When Will Mortgage Rates Go Down: 2025 Relief

Why Understanding Mortgage Rate Trends Matters for Canadian Homeowners

When will mortgage rates go down is the question keeping millions of Canadians awake at night. Whether you’re a first-time buyer priced out of the market or a homeowner facing renewal anxiety, the answer affects your biggest financial decision.

Here’s what experts predict for Canadian mortgage rates:

- 2025: Rates expected to drop gradually, with the Bank of Canada policy rate falling to around 2.25%

- Variable rates: Could hit 4.0% by late 2025, offering potential savings over fixed rates

- Fixed rates: May decline to 3.85%-4.50% range but won’t return to pandemic lows

- Timeline: Most cuts expected by end of 2025, with rates stabilizing in 2026-2027

The Bank of Canada has already cut its policy rate from 5% to 2.75%, but mortgage rates haven’t fallen as dramatically as many hoped. That’s because fixed rates follow bond markets, not just the central bank’s decisions.

Current economic forces are pulling in opposite directions. Cooling inflation and rising unemployment suggest more rate cuts ahead. But trade disputes with the US and sticky core inflation above 3% could keep rates higher than expected.

For the 60% of Canadian mortgages renewing in the next two years, this matters enormously. Many borrowers who locked in rates below 1% during the pandemic face payment increases of 25-40% when they renew.

The good news? Experts from major banks and mortgage companies agree that the worst of the rate increases is behind us. The challenge now is timing your financial decisions around a gradual descent rather than a dramatic drop.

Handy when will mortgage rates go down terms:

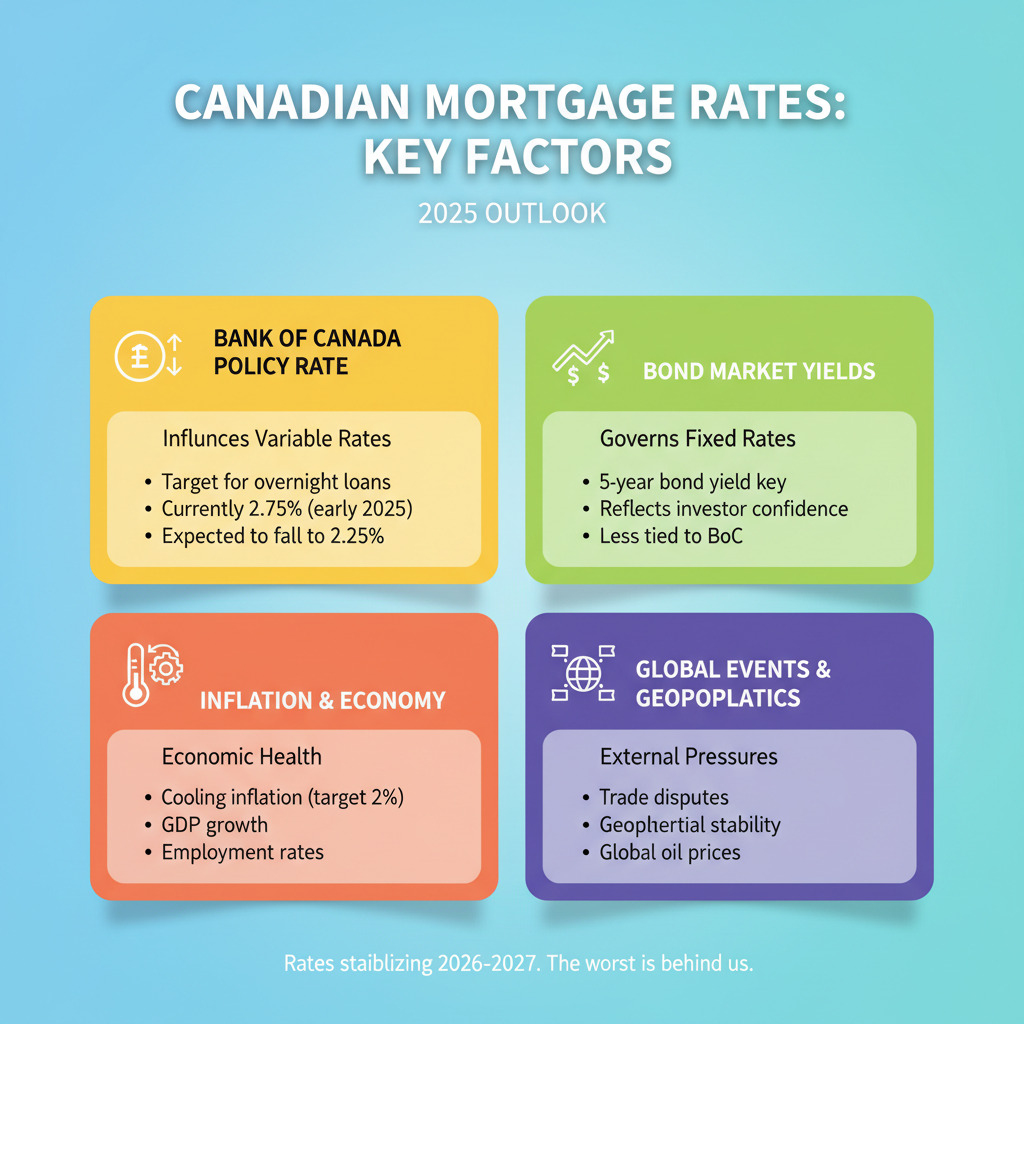

The Key Drivers: What Makes Mortgage Rates Rise and Fall?

If you’ve ever wondered when will mortgage rates go down, you need to understand the puppet masters pulling the strings behind Canada’s borrowing costs. It’s like a complex dance with several key players, and the Bank of Canada (BoC) is leading the choreography.

The BoC holds the most powerful tool in Canadian finance: the policy rate (also called the overnight rate). Think of it as the master switch that controls how much it costs banks to borrow money from each other overnight. When the BoC moves this rate up or down, your mortgage rate typically follows along like a loyal dog.

But here’s the thing – the Bank of Canada doesn’t just flip a coin to make these decisions. They have one main job: keep inflation hovering around 2%. Not too hot, not too cold, but just right. This sweet spot helps keep your grocery bills from skyrocketing while ensuring the economy doesn’t fall asleep.

The BoC watches a parade of economic indicators like a hawk. Employment data tells them if Canadians are working and earning. GDP growth shows whether our economy is expanding or shrinking. And the Consumer Price Index (CPI) – that’s the big kahuna that measures how much more expensive things are getting.

The latest inflation data from StatsCan shows Canada’s headline inflation rose to 1.9% in August from 1.7% in July. The BoC studies these numbers like tea leaves, looking for clues about where to steer interest rates next.

Global economic forces also crash the party uninvited. What happens in other countries – especially with major central banks and trade relationships – can shake up our mortgage rates even when Canada’s economy looks perfectly fine.

Then there’s the mysterious world of bond yields and something called the “neutral rate.” Government of Canada bond yields are like the compass for fixed mortgage rates. When bond investors get nervous about inflation or economic uncertainty, yields rise, and fixed mortgage rates tag along. The neutral rate, currently sitting around 2.75%, is the Bank of Canada’s estimate of where interest rates should naturally settle when the economy is running smoothly.

For a deeper look at how all this works, check out The BoC’s role in monetary policy.

How Inflation and Employment Steer the Bank of Canada’s Decisions

Here’s where things get really interesting. Inflation isn’t just important to the Bank of Canada – it’s everything. Their entire mandate revolves around keeping prices stable, which means hitting that magic 2% inflation target.

But the BoC doesn’t just look at headline inflation (the number you see in the news). They dig deeper into core inflation, which strips away the wild price swings in things like gas and groceries to reveal the underlying trend. While headline inflation hit 1.9% in August, core inflation was still running around 3.05% – a sign that price pressures are stickier than they appear on the surface.

The job market is the other half of this equation. The BoC wants something called “maximum sustainable employment” – basically, as many Canadians working as possible without the economy overheating like a car engine on a summer road trip.

Recent employment data paints a concerning picture. Canada lost 66,000 jobs in August, pushing the unemployment rate up to 7.1%. Average wage growth has also cooled to 3.2% in July, down from much higher levels earlier in the year.

This weakening job market is actually music to the BoC’s ears when it comes to when will mortgage rates go down. Fewer jobs and slower wage growth typically mean less consumer spending, which helps cool inflation naturally. It’s like taking your foot off the economic gas pedal.

External Pressures: The US Economy and Global Trade

Canada might be the second-largest country in the world, but when it comes to economics, we’re still heavily influenced by our neighbors to the south. US economic conditions and Federal Reserve decisions pack a serious punch when it comes to Canadian mortgage rates.

Why does this matter? When the US Federal Reserve raises or lowers rates, it affects the value of the Canadian dollar. If Canadian rates fall too far below US rates, our dollar weakens, making everything we import more expensive – and that fuels inflation right back up again.

The US Consumer Price Index jumped 0.4% in August, pushing their overall inflation rate to 2.9%. If the Fed needs to keep rates higher to fight this inflation, it puts pressure on the BoC to do the same, regardless of what’s happening in Canada.

Trade disputes add another layer of complexity. Bank of Canada Governor Macklem has warned that “US tariffs have already hurt employment in the sectors most dependent on trade.” About 36% of Canadian businesses report being affected by trade conflicts, dealing with higher prices, demand changes, or supply chain headaches.

This creates a tricky situation for anyone wondering when will mortgage rates go down. Trade tariffs could push inflation higher (a reason to keep rates up), while the resulting economic slowdown (like Canada’s 0.2% GDP contraction in Q2 2025, partly from falling US exports) suggests rates should come down.

It’s like trying to drive while looking in two different directions at once. The BoC has to balance domestic economic conditions with these powerful external forces, making their job – and predicting rate movements – much more complicated than it appears on the surface.

When Will Mortgage Rates Go Down? The 2025-2027 Forecast

Here’s the moment you’ve been waiting for: when will mortgage rates go down? The good news is that economists across Canada are feeling cautiously optimistic about the next few years. While we won’t see those rock-bottom pandemic rates again, meaningful relief is on the horizon.

The Bank of Canada’s latest Market Participant Survey paints a promising picture for the rest of 2025. Most experts expect two more 25-basis-point cuts before the year ends, likely in September and December. This would bring the policy rate down to a much more manageable 2.25% by year-end.

Major banks are singing the same tune. Economists from National Bank, TD Economics, Scotiabank, and RBC all forecast the Bank of Canada rate dropping to that same 2.25% target. It’s rare to see such consensus in the forecasting world, which makes this prediction feel particularly solid.

What’s really exciting is the psychological barrier these cuts could break. Mortgage expert Penelope Graham from Ratehub.ca explains it perfectly: “Having a three handle on mortgage rates is an important psychological hurdle for buyers.” Many Canadians have been sitting on the sidelines, waiting for rates to drop into that magical 3% range.

Mortgage agent Shaunese Lawrence believes this could be the spark the housing market needs: “People will come back into the market” once we hit those levels. After years of volatility and uncertainty, buyers and sellers are ready to make moves when rates become more reasonable.

The housing market impact could be significant. We’re already seeing some buyers and sellers coming off the sidelines, perhaps out of necessity or simply because better deals are becoming available. A gradual descent in rates over the next few years could create the stable environment everyone’s been craving.

The Outlook for Variable-Rate Mortgages

If you’re holding a variable-rate mortgage, you’re in the driver’s seat for these upcoming cuts. Variable rates follow the Bank of Canada’s policy rate directly, which means every cut flows straight through to your payment.

Here’s where things get interesting. With those expected cuts of 0.25% to 0.75% from current levels, variable mortgage holders could see their rates drop to around 4.0% by late 2025. Most bank prime rates are forecast to settle around 4.70% before any lender discounts.

The real magic happens with those lender discounts off prime. Depending on your term and creditworthiness, you might qualify for discounts ranging from 0.15% to 1.50%. These discounts can push your effective rate even lower, creating meaningful savings on your monthly payments.

For variable-rate holders, this translates to real money back in your pocket. Lower payments mean more breathing room in your budget, or you could use the savings to pay down your principal faster. Either way, the next couple of years look much brighter than what we’ve experienced recently.

The Forecast for Fixed-Rate Mortgages

Fixed rates march to a different drummer. Instead of following the Bank of Canada directly, they dance with Government of Canada bond yields. These bonds reflect market sentiment, inflation expectations, and overall economic confidence.

The encouraging news? Five-year fixed rates have already dropped roughly 2% since their peak in November 2023. The Canadian 5-year bond yield is currently sitting around 2.7%, which economists describe as “unthreatening” – a refreshing change from the volatility we’ve seen.

Looking ahead, the forecast for fixed rates shows steady improvement. Five-year fixed rates could decline to 4.2% by the end of 2025, with some optimistic projections seeing rates as low as 3.85%. That’s a significant drop from where we’ve been.

The longer-term outlook for 2025-2027 suggests fixed rates will settle into these ranges: 3.75% to 4.60%. However, there’s a catch. Fixed rates are expected to start climbing again in 2026 and will likely stay above 4% for the foreseeable future.

This creates an interesting timing consideration. If you’re looking at fixed rates, the sweet spot might be in late 2025 or early 2026. After that, rates could start their gradual climb back up as the economy stabilizes and inflation concerns resurface.

The path isn’t perfectly smooth, though. If we see more recessionary data pile up, fixed rates might fall even further as markets price in more aggressive rate cuts. On the flip side, if inflation proves stubborn, bond yields could rise and push fixed rates higher than expected.

Fixed vs. Variable: Choosing Your Strategy in the Current Climate

Choosing between a fixed and variable-rate mortgage right now feels like standing at a financial crossroads. One path offers certainty but might cost you more, while the other promises potential savings with a side of uncertainty. Your risk tolerance and financial stability will ultimately guide this crucial decision.

Let’s be honest about what experts are saying: variable rates are expected to fall below fixed rates in the coming months, potentially offering more savings for borrowers willing to ride the wave. Many mortgage professionals believe that borrowers who choose variable rates will come out ahead, especially if the Bank of Canada continues cutting rates as forecasted.

But here’s where it gets interesting. Not all variable mortgages work the same way. Adjustable-Rate Mortgages (ARMs) give you immediate relief when rates drop – your payment goes down right away. Variable Rate Mortgages (VRMs) might keep your payment the same but apply more money toward your principal, shortening your loan term. In a falling rate environment, ARMs can be particularly beneficial for your monthly cash flow.

Fixed rates, on the other hand, offer something precious in uncertain times: predictability. You’ll know exactly what your mortgage payment will be for the entire term, making budgeting a breeze. No surprises, no sleepless nights wondering when will mortgage rates go down enough to help your situation.

The challenge? Fixed-rate borrowers will likely pay more than variable-rate holders if current forecasts prove accurate. This is especially true if you lock in now and variable rates continue their expected decline through 2025.

Here’s a strategy worth considering: a 3-year fixed term. This approach lets you bridge the current uncertainty while positioning yourself to potentially switch to variable rates in 2026 when they might be even lower. It’s like buying yourself time to see how the market evolves.

This decision matters more than ever because 60% of all outstanding mortgages are due for renewal within the next two years. Many of these borrowers locked in rates below 2% during the pandemic and are facing the reality of payment shock – increases of 25-40% when they renew.

| Mortgage Type | Best For | Key Benefits | Main Risks |

|---|---|---|---|

| Fixed Rate | Risk-averse borrowers who value predictability | Stable payments, easy budgeting, protection from rate increases | May miss out on savings if rates fall, higher penalties to break |

| Variable Rate | Risk-tolerant borrowers expecting rate cuts | Potential for significant savings, lower break penalties, flexibility | Payment uncertainty, risk of trigger rates, budget challenges |

| 3-Year Fixed | Those wanting to bridge uncertainty | Shorter commitment, ability to reassess when rates stabilize | Still higher than current variable rates |

Understanding Fixed Rates and Bond Yields

Think of fixed mortgage rates as having a complicated relationship with the bond market – specifically with Government of Canada bond yields. When you apply for a fixed-rate mortgage, your lender essentially looks at what it costs them to borrow money in the bond market, adds their profit margin, and voilà – that’s your rate.

This connection means your fixed rate dances to a different tune than the Bank of Canada’s policy rate. Bond yields respond to investor confidence, inflation expectations, and economic outlook. If investors worry about future inflation, they demand higher yields to compensate for money losing purchasing power over time. If the economy looks shaky, yields might fall as investors seek the safety of government bonds.

Here’s where it gets tricky: even if the Bank of Canada cuts rates, your fixed mortgage rate might not drop as much if bond investors remain nervous about long-term inflation or government debt levels. It’s like two different orchestras playing in the same concert hall – they’re related, but not perfectly synchronized.

The stability versus cost trade-off is real. You’re essentially paying a premium for the peace of mind that comes with knowing your exact payment for years to come. Whether that premium is worth it depends on your personal financial situation and sleep-at-night factor.

Understanding Variable Rates and the Policy Rate

Variable-rate mortgages have a much more straightforward relationship with the Bank of Canada’s policy rate. When the BoC moves its overnight rate, banks typically adjust their prime rates in lockstep, and your variable mortgage rate moves right along with it.

Your variable rate is usually expressed as prime plus or minus a percentage. So if prime is 4.70% and you have prime minus 0.50%, your rate is 4.20%. When the BoC cuts rates by 0.25%, prime typically drops by the same amount, and your rate becomes 3.95%.

But here’s where the payment structure gets interesting. Some variable mortgages keep your monthly payment the same when rates change. If rates rise, more of your payment goes to interest and your amortization period extends. If rates fall, more goes to principal and you pay off your mortgage faster.

Other variable products – those Adjustable-Rate Mortgages – change your payment immediately when rates move. This gives you instant relief when rates drop but also means immediate payment increases when rates rise.

The flexibility is appealing. Variable mortgages typically have lower penalties if you need to break your mortgage early, usually just three months’ interest compared to the potentially hefty Interest Rate Differential (IRD) penalties on fixed mortgages.

There’s one risk worth understanding: trigger rates. If rates rise enough that your payment no longer covers the interest portion, your lender might require higher payments or extend your amortization. It’s not common, but it’s something to keep in mind.

The potential for savings in the current environment makes variable rates attractive for many borrowers, especially those comfortable with some uncertainty in exchange for the possibility of benefiting from the expected rate cuts ahead.

Preparing Your Finances for Rate Changes

Navigating a fluctuating interest rate environment can feel like walking a tightrope, but with the right preparation, you can keep your balance. The key is financial preparedness, whether you’re a homebuyer, a home seller, or facing a mortgage renewal.

One of the best pieces of advice we can offer is to focus on what you can control. This means working on improving your credit score, putting away any extra cash for your down payment, and automating your savings. These actions strengthen your financial position regardless of market shifts.

For homeowners, stress-testing your finances is crucial. Use a hypothetical interest rate that is higher than your current one to assess what your payments would look like and if you could comfortably afford them. This foresight can prevent unwelcome surprises. When it comes to shopping for rates, don’t just take the first offer. Contact a mortgage professional or broker as early as possible – up to 120 days before closing on a home purchase or your mortgage renewal – to lock in a rate. Expert brokers can help you steer the myriad of options and potentially secure a better deal than going directly to your bank.

Advice for Homebuyers and Sellers

For homebuyers, the question of when will mortgage rates go down profoundly impacts their decisions. Many who were hesitant due to higher rates may now be motivated to enter the market. As Shaunese Lawrence noted, “If rates come down, people will come back into the market.” However, market timing is notoriously difficult. While prices are expected to rebound as interest rates decline, waiting too long might mean facing higher home prices, even if rates are slightly lower. Our advice is to assess your personal circumstances, needs, and long-term goals rather than trying to perfectly time the market. Affordability remains a challenge in many areas, but some buyers are finding more deals available in higher-priced or formerly ‘hot’ markets like Calgary.

For sellers, the current environment presents a nuanced picture. Historically, the first half of the year typically favors sellers, while the period between now and January tends to favor buyers. If you’re in a market where prices are already falling, these declines could accelerate in the second half of the year. While waiting until Spring might bring more potential buyers to your open house, by then, the value of your home might have dropped anywhere from 2% to 10% in weaker markets. More economic factors are currently putting downward pressure on home prices than upward pressure. This suggests that now might be a prudent time to sell if you’re considering it, rather than waiting for an uncertain rebound. For more detailed insights, you can find expert advice for navigating the market.

Navigating Your Mortgage Renewal

Mortgage renewal is a critical juncture for many Canadian homeowners, especially with an estimated 60% of all outstanding mortgages due to renew within the next two years. Many of these borrowers took out their mortgages when interest rates were at historic lows in 2020 or 2021. This means they are likely to experience “payment shock,” with potential payment increases of 25% (for 2021 bookings) to 40% (for 2020 bookings).

Our best advice for navigating your mortgage renewal is to be proactive and shop around. Don’t simply accept the renewal rate offered by your current lender. Use a mortgage offer comparison tool to calculate the dollar difference between offers and potential fees. Contact other lenders and brokers to see what they can offer. You can lock in a rate up to 120 days before your renewal date, giving you a buffer to compare options and secure the best possible terms.

Consider your mortgage term carefully. While a 5-year fixed term offers stability, a 3-year fixed term might be a better strategy to bridge current uncertainty, positioning you to potentially benefit from further rate dips expected in 2026. Also, be aware of the penalties for breaking a mortgage. Fixed-rate mortgages often come with higher interest rate differential (IRD) penalties compared to variable rates, which can be a significant cost if your plans change.

Frequently Asked Questions about Canadian Mortgage Rates

We’ve covered a lot of ground, but there are always more questions swirling around the topic of when will mortgage rates go down. Let’s tackle some of the most common ones that keep homeowners up at night.

How will my mortgage payment be affected if it comes up for renewal in 2025?

If your mortgage is coming up for renewal in 2025, brace yourself for what could be a significant financial adjustment. You’re not alone in this situation – approximately 60% of all outstanding mortgages are due to renew within the next two years, creating what experts are calling a “renewal cliff.”

Here’s the reality: many of these mortgages were secured during the golden period of ultra-low rates when the Bank of Canada’s policy rate sat at or below 1%. With the policy rate currently at 2.75% and prime rates hovering around 4.95% (before any lender discounts), your renewal rate will almost certainly be higher than what you’re paying now.

The numbers can be sobering. If you locked in your mortgage rate in 2021, you could see your monthly payment increase by up to 25%. For the truly fortunate folks who secured their rates in 2020, the payment shock could be even more dramatic – up to 40% higher than your current payment.

This isn’t just about numbers on a spreadsheet. For a typical homeowner with a $400,000 mortgage, this could mean an extra $400 to $800 per month. That’s why budgeting for higher payments and exploring all your renewal strategies well in advance isn’t just smart – it’s absolutely critical for your financial wellbeing.

Will mortgage rates ever return to the ultra-low 1-2% levels?

This question tugs at the heartstrings of every Canadian who experienced those dreamy pandemic-era rates. The short answer? Don’t hold your breath for a return to those ultra-low 1-2% mortgage rates anytime soon.

Those pandemic rates were truly exceptional – a perfect storm of economic uncertainty, aggressive monetary policy, and unprecedented government stimulus. Before COVID-19, the average five-year fixed mortgage rate typically sat in the 3% range from 2009 to 2020, which was considered the “new normal” after the 2008 financial crisis.

But here’s what makes today different from previous decades: Canadians are carrying much more debt. Back in the 1980s, when interest rates were sky-high, households weren’t nearly as leveraged as they are today. Currently, Canadians owe $1.65 for every $1 of disposable income. This massive debt load means that even modest rate increases pack a much bigger punch than they used to.

The Bank of Canada is acutely aware of this debt burden. It’s why they’re cautious about aggressive rate moves in either direction. While they can’t let inflation run wild, they also know that dramatic rate changes could destabilize household finances across the country.

Expert consensus suggests that while rates will likely decline from their recent peaks, a return to those pandemic lows simply isn’t realistic given our current economic fundamentals and debt levels.

What is the single most important indicator for future mortgage rates?

If you’re trying to predict when will mortgage rates go down, there’s one indicator that trumps all others: inflation, specifically the Consumer Price Index (CPI).

Think of the Bank of Canada as having one primary job – keeping inflation near that sweet spot of 2% annually. Everything else they do revolves around this mandate. When inflation runs hot and stays persistently above target (especially core inflation, which strips out volatile items like gas and food), the BoC feels pressure to keep rates higher to cool down the economy.

On the flip side, when inflation consistently sits below target or when economic weakness threatens to push it even lower, the Bank has more room to cut rates and stimulate economic activity.

Now, other indicators like employment data, GDP growth, and wage increases certainly matter, but they’re important primarily because they influence the path of inflation. A red-hot job market with rapidly rising wages? That could fuel inflation. A weakening economy with rising unemployment? That typically helps cool price pressures.

So if you’re watching for signals about future rate cuts, keep your eyes glued to those monthly CPI releases from Statistics Canada. Inflation is the ultimate signal the Bank of Canada uses to guide their interest rate decisions, making it your best crystal ball for predicting mortgage rate movements.

Conclusion

So, when will mortgage rates go down? After diving deep into the economic forces at play, the answer brings a welcome dose of cautious optimism to Canadian homeowners and buyers who’ve been holding their breath.

The consensus is clear: we’re past the worst of the rate increases. While those ultra-low pandemic rates of 1-2% aren’t making a comeback anytime soon, experts across major banks agree that we’re entering a period of gradual relief. The Bank of Canada’s policy rate is expected to settle around 2.25% by the end of 2025, bringing mortgage rates into that psychologically important 3% range that could finally coax hesitant buyers back into the market.

What we’ve learned is that mortgage rates don’t move in isolation. They’re shaped by a fascinating web of forces: inflation’s stubborn dance around the Bank of Canada’s 2% target, the health of our job market, our neighbor’s economic moves south of the border, and those ongoing trade tensions that keep everyone on their toes. Fixed rates will keep following the bond market’s lead, while variable rates march to the Bank of Canada’s drum.

The forecasts paint a picture of steady, measured decline rather than dramatic drops. Variable rates could hit 4.0% by late 2025, while fixed rates may settle into the 3.85% to 4.50% range. For the 60% of Canadian mortgages renewing in the next two years, this gradual descent offers hope, even if it means adjusting to payments that are still significantly higher than those rock-bottom pandemic levels.

Here’s the thing about trying to time the market perfectly: it’s nearly impossible. The smartest approach is focusing on what you can actually control. Build up that credit score, save what you can, and stress-test your budget against higher payments. If you’re buying, don’t wait for the “perfect” rate – assess your needs and move when it makes sense for your life. If you’re renewing, start shopping around early and don’t just accept your lender’s first offer.

The road ahead looks more stable than the roller coaster we’ve been on. While we can’t predict every twist and turn, the direction is promising. Long-term planning beats market timing every time, whether you’re securing your dream home or planning your financial future.

At Car News 4 You, we know that solid financial planning opens doors to all kinds of adventures. Whether you’re mapping out homeownership or dreaming about exploring your next big adventure, having your finances in order makes everything possible.