usd to inr: Master 3 Easy Steps 2025

Why Converting USD to INR Matters for Your Financial Decisions

The USD to INR exchange rate is a critical financial metric for millions. Whether you’re sending remittances to India, conducting business, or shopping online from Indian retailers, knowing how to convert dollars to rupees can save you significant money on fees and poor rates.

Quick USD to INR Facts:

- Current Rate: 1 USD = approximately 85.06 INR (rates fluctuate daily)

- Best Conversion Method: Online money transfer services typically offer better rates than banks

- Typical Fees: Range from 0.5% to 4% depending on your chosen method

- Processing Time: Instant to 3 business days depending on the service

From large international earnings to everyday family remittances, getting the best exchange rate makes a tangible difference to your finances.

The USD to INR rate is volatile. In 2024, it fluctuated from 82.695 to 85.787 INR per dollar. On a $10,000 transfer, poor timing could cost you over $300.

This guide simplifies the process into three steps, helping you avoid hidden fees and maximize your conversion.

Understanding the Current USD to INR Exchange Rate

Before converting dollars to rupees, it’s crucial to understand the difference between the rate you see online and the rate you actually get. This knowledge can save you hundreds on large transfers.

The USD to INR exchange rate includes hidden fees and markups. Let’s break down how it works.

What is the Mid-Market Rate vs. the Transactional Rate?

The rate you find online is the mid-market rate—the wholesale price banks use to trade with each other. It’s the real exchange rate without any added fees or markups.

However, you’ll almost never get this rate. Instead, you’ll receive a transactional rate from your provider. This rate includes their profit margin, known as the “spread”—the difference between the wholesale mid-market rate and the retail rate offered to you.

For example, if the mid-market rate is 1 USD = 85.05 INR, a bank might offer you 84.50 INR. That 0.55 INR difference is their hidden fee, costing you about $6.50 on a $1,000 transfer.

The buy rate is what you get when selling dollars for rupees, while the sell rate is what you’d pay to buy dollars back with rupees. The mid-market rate is your benchmark for comparison.

Checking the real mid-market rate is crucial to see how much markup a service is charging.

Where to Find Reliable USD to INR Rate Information

Not all rate information is reliable; some sites show outdated or promotional rates. The USD to INR rate changes constantly, so you need real-time sources.

- Financial news websites offer live, constantly refreshed currency data and market analysis.

- Central bank data from the US Federal Reserve and India’s Reserve Bank provides official reference rates.

- Reputable online currency converters are your best bet for quick, accurate information, pulling data directly from financial markets.

- Rate tracking apps can send you alerts when your target rate is reached, so you don’t have to monitor the market constantly.

Always use multiple fresh sources, as yesterday’s rate can be very different from today’s.

What are the fees associated with converting USD to INR?

Even with a good exchange rate, fees can make currency conversion expensive.

- Transaction fees are upfront charges, either a flat fee (e.g., $10) or a percentage of the transfer amount (e.g., 2%).

- Exchange rate markup is a hidden fee. It’s the difference between the mid-market rate and the less favorable rate a service gives you. A 1% markup on a $5,000 transfer costs you $50.

- Receiving bank fees may be charged by the recipient’s bank in India to process an international transfer.

- Payment method fees vary. Credit cards often incur cash advance fees, while bank transfers are typically cheapest.

The best approach is to calculate the total cost by adding all fees to the exchange rate markup. Compare the final amount of rupees the recipient gets, not just the advertised rate, to find the best value.

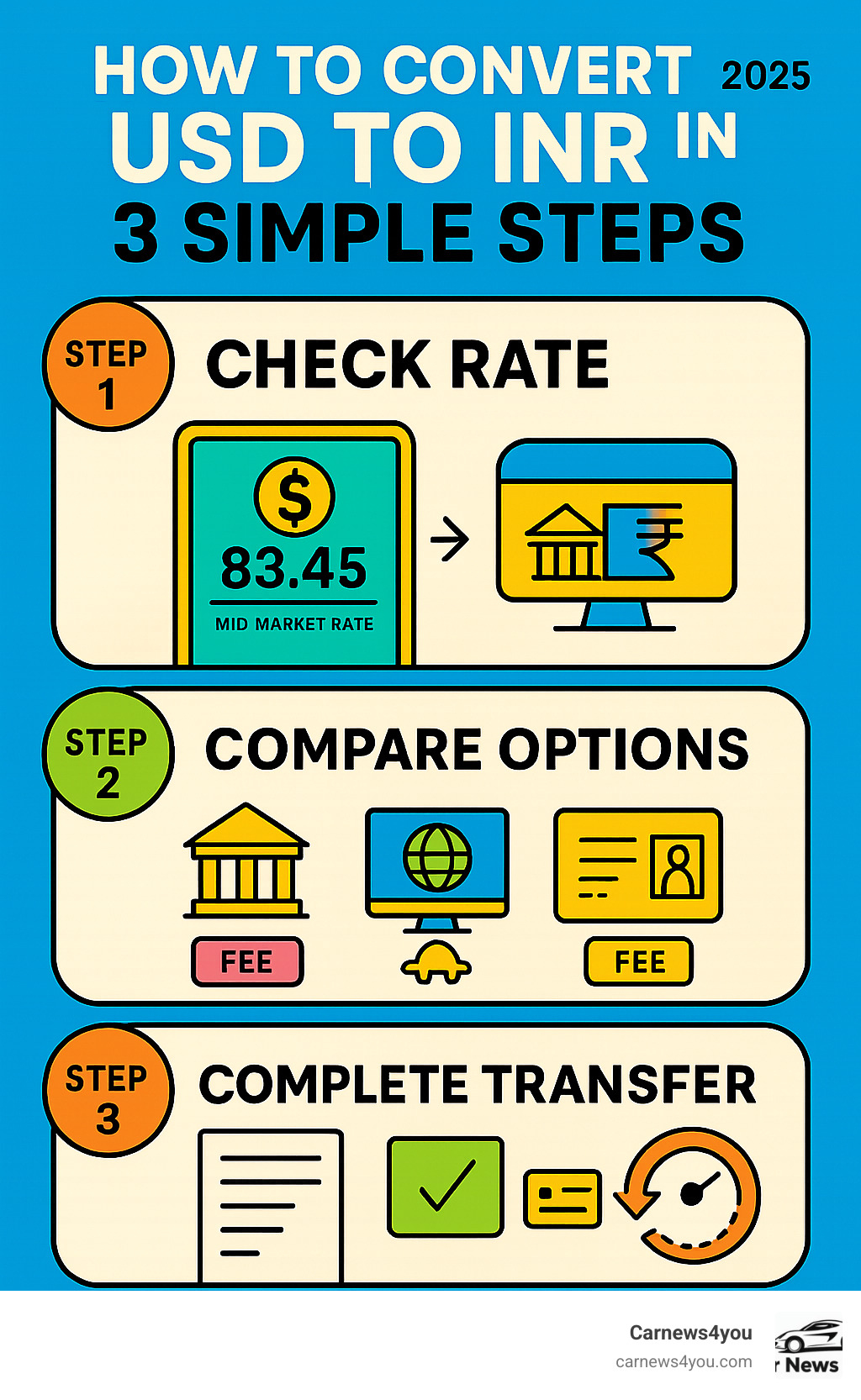

How to Convert USD to INR in 3 Simple Steps

Now let’s cover the practical steps to convert your USD to INR. This is your guide to maximizing your rupees while avoiding common pitfalls.

Whether you’re sending money to family, paying for an online purchase, or planning a trip to India, these three steps will guide you through the process.

Step 1: Check the Real-Time Mid-Market Rate

The golden rule of currency conversion is to always start with the real-time mid-market rate. This is the true value of USD to INR and your benchmark for comparing offers.

Timing matters because the USD to INR rate fluctuates constantly due to market conditions, economic news, and political events. The 2024 swing from 82.695 to 85.787 INR per dollar illustrates this; on a $10,000 transfer, that difference is over $300.

Use a reliable currency converter to see the current mid-market rate and historical data. This can help you decide whether to convert now or wait. If you’re not in a hurry, set up rate alerts to be notified when the USD to INR rate hits your target.

Step 2: Compare Your Conversion Options

With the mid-market rate as your benchmark, it’s time to shop around. Compare providers carefully, as the differences in value can be substantial.

- Traditional banks may seem convenient, but they often have less competitive rates and higher fees.

- Online money transfer services specialize in cross-border payments and typically offer better rates, lower fees, and faster service.

- Physical currency exchange bureaus, especially at airports, are convenient for cash but usually offer the least favorable rates and highest fees.

- Digital wallet and fintech platforms are a newer option, often providing multi-currency accounts that let you convert money when rates are good.

When comparing, focus on the total INR the recipient will get after all fees and the exchange rate are applied. Also, consider transfer speed—instant transfers may cost more, while slower options can sometimes offer better rates.

Step 3: Securely Complete Your Transfer

Once you’ve chosen a service, the final step is completing the transfer. Attention to detail is critical here to avoid delays or errors.

- Provide correct details: You’ll need the recipient’s full name (as on their bank account), bank name, account number, and IFSC code. Double-check everything to prevent errors.

- Verify your identity: Reputable services require identity verification (e.g., driver’s license, passport) to comply with regulations and prevent fraud. This is a necessary security step.

- Choose a payment method: Bank transfers are often cheapest, while debit cards offer a balance of speed and cost. Credit cards are fast but may have high cash advance fees.

- Review and confirm: Before confirming, review the summary screen showing the amount sent, exchange rate, fees, and the final amount in INR.

- Track your transfer: Use the provider’s tracking system to monitor the progress of your USD to INR conversion. You’ll get updates as it moves through the system.

Finally, save your confirmation receipt as proof of the transaction. The entire process typically takes just a few minutes, making modern USD to INR conversions quick, secure, and cost-effective.

Key Factors That Influence the USD to INR Rate

The USD to INR exchange rate is influenced by forces that strengthen either the dollar or the rupee. Understanding these factors helps you make smarter decisions about when to convert your money.

The rate is not random; it’s driven by economic reports, political events, and global money flows. Let’s break down the key drivers of the USD to INR rate.

How Economic Performance Affects the Rate

The economic health of the United States and India is a primary driver of the USD to INR exchange rate. A strong economy typically leads to a strong currency.

- GDP growth: If India’s economy grows faster than the US, it can attract investors who need to buy rupees, strengthening the INR.

- Inflation rates: Higher inflation in one country can weaken its currency’s purchasing power relative to the other.

- Interest rates: The US Federal Reserve and the Reserve Bank of India set interest rates. Higher rates in one country attract foreign capital, strengthening its currency. For instance, when the Fed raised rates in 2023, the dollar strengthened as investors sought better returns on US assets, pushing the USD to INR rate higher.

The Impact of Political Stability and Trade

Currencies are sensitive to uncertainty. Geopolitical events and government stability can cause significant volatility in the USD to INR rate. Investors often move to the US dollar as a “safe haven” currency during times of global turmoil.

- Trade balance: When India imports more from the US, it creates demand for USD. When the US buys more from India, it creates demand for INR.

- Foreign investment: Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI) into India require converting foreign currency to rupees, which supports the INR’s value.

- Remittances: Money sent home by Indians working abroad creates a steady demand for rupees, providing underlying support for the currency.

Historical Trends and Future Outlook for usd to inr

Historically, the rupee has generally weakened against the dollar over the long term, though with significant fluctuations.

In 2024, the USD to INR rate averaged 83.682, swinging from a low of 82.695 to a high of 85.787. This volatility highlights how timing can impact your conversion. The dollar gained strength throughout the year, with the rate climbing 2.83%.

Long-term patterns show rupee depreciation due to factors like India’s higher inflation and the dollar’s status as the world’s reserve currency. However, periods of strong economic reform can boost the rupee.

Predicting the future of USD to INR is difficult. Key factors to watch include comparative economic growth, central bank interest rate policies, investor sentiment toward emerging markets, and US-India trade relations.

For those converting currency, this means timing can be important, especially for large amounts. While you shouldn’t try to perfectly time the market, understanding trends helps you make informed decisions.

Frequently Asked Questions about USD to INR Conversion

Here are answers to some of the most common questions about converting dollars to rupees.

How can I track USD to INR exchange rate changes?

Tracking USD to INR exchange rate changes is easy with modern technology. The key is to find tools that suit your needs.

- Rate alert tools are ideal if you’re not in a rush. Set your desired USD to INR rate, and the platform will notify you when it’s reached.

- Financial news apps allow you to add USD to INR to a watchlist for regular updates.

- Monitoring trends using historical charts on currency platforms can help you spot patterns and decide on a good time to convert.

Staying informed puts you in control, allowing you to time your conversion strategically.

Why is the rate I get different from the one I see online?

This common question relates to the difference between mid-market rates and transactional rates.

The rate you see online is the mid-market rate—the wholesale rate banks use to trade with each other. It’s the pure exchange rate without any retail markup.

However, service providers offer you a transactional rate, which includes a spread or markup. This is their profit margin for the service. So, if the mid-market rate is 85.00 INR, a provider might offer you 84.70 INR. That 0.30 INR difference is their fee.

This is why you should always compare the total amount of INR you’ll receive to find the best deal.

Are there limits on how much USD I can convert to INR?

Yes, there are limits on how much you can convert, which exist for regulatory and security reasons. Understanding them helps you plan large transfers.

- Regulatory limits: Both the US and India have rules to prevent money laundering, setting maximum amounts that can be transferred in certain periods.

- Service provider limits: Each transfer service has its own internal caps based on risk. These are often tiered.

- Verification levels: Your transfer limits usually increase as you provide more identity verification documents. A basic account may have a low daily limit, while a fully verified account can transfer much larger sums.

Check your provider’s policies before making a large USD to INR conversion. Complete any required verification in advance to avoid delays.

Conclusion

Converting USD to INR is straightforward when you follow three key steps: check the real-time mid-market rate, compare providers to avoid markups, and complete your transfer with attention to detail.

The exchange rate is driven by economic indicators, political stability, and trade. Understanding these forces allows you to make informed decisions instead of just hoping for a good rate.

Remember the key takeaways:

- Always start with the mid-market rate to know what you should be getting

- Look beyond advertised fees to see the total INR you’ll actually receive

- Consider factors like transfer speed and security, not just the cheapest option

- Use rate alerts and tracking tools to time your conversions strategically

Doing your homework is the key to a smart, cost-effective conversion. These principles apply whether you’re sending money to family, paying for business, or planning a trip to India.

At Carnews4you, we break down complex financial topics into simple, actionable advice to help you make better money decisions.

If you’re planning a trip, explore our other practical guides. Plan your next trip with our guide to the best cars for camping, because great experiences are a worthwhile investment.