Trump Tariffs 101: Unlawful Ruling

Why Trump Tariffs Matter for Every American

Trump tariffs have become one of the most hotly debated economic policies in recent years. Here’s what you need to know:

Key Facts:

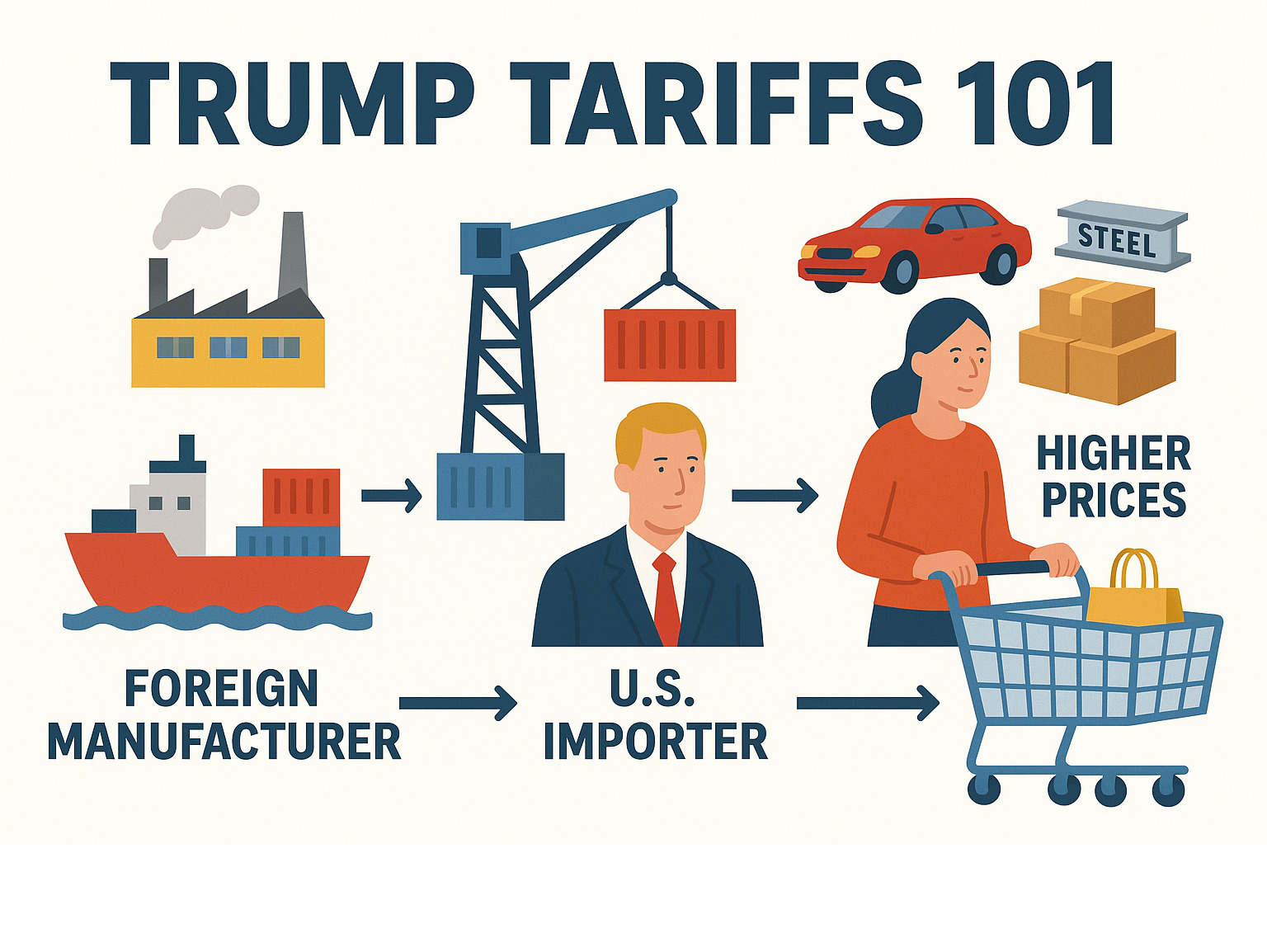

- What they are: Taxes on imported goods that U.S. companies pay at the border

- Who really pays: U.S. importers (not foreign countries), who often pass costs to consumers

- Recent ruling: Federal appeals court ruled many Trump tariffs illegal in a 7-4 decision

- Current status: Tariffs remain in place until mid-October while administration appeals

Donald Trump famously called “tariff” his “favorite word” and “the most beautiful word in the dictionary.” But a federal appeals court just dealt a major blow to his trade agenda, ruling that the president exceeded his authority when imposing sweeping import taxes using emergency powers.

The court found that Trump’s use of the International Emergency Economic Powers Act (IEEPA) to justify broad tariffs was an overreach. These “reciprocal tariffs” affected nearly every U.S. trading partner and were designed to address what Trump called America’s trade deficits.

This ruling creates massive uncertainty for businesses, consumers, and global markets. While some tariffs remain unaffected – like those on steel and aluminum – the decision could force the government to refund billions in collected import taxes.

The economic stakes are enormous. Analysts estimate these tariffs could cost American households between $1,700 and $6,000 per year through higher prices on everything from cars to clothing.

Similar topics to trump tariffs:

Appeals Court Rules Against Key Trump Tariffs

Sometimes even presidents find there are limits to their power. A federal appeals court just handed the Trump administration a major legal setback, ruling that many trump tariffs were flat-out illegal.

The U.S. Court of Appeals for the Federal Circuit delivered a decisive 7-4 ruling that struck down what Trump called his “reciprocal tariffs.” These were sweeping import taxes the president tried to slap on nearly every country America trades with.

The court’s message was crystal clear: Trump had overstepped his presidential authority when using the International Emergency Economic Powers Act (IEEPA). The judges declared these tariffs “invalid as contrary to law” – legal language that packs a serious punch.

Trump’s legal team had argued that the 1977 emergency powers law gave him broad authority to impose tariffs. But the court wasn’t buying it. While four judges disagreed with the majority decision, the ruling represents a significant check on how presidents can use emergency powers for trade policy.

The International Emergency Economic Powers Act was designed to let presidents respond to genuine national emergencies that threaten America’s security or economy. The 1977 law explained shows how this legislation gives presidents tools to deal with “unusual and extraordinary threats” from outside the U.S.

However, the appeals court drew a firm line in the sand. Just because you’re president doesn’t mean you can declare trade deficits a national emergency and start taxing imports left and right.

On What Grounds Were the Tariffs Found Unlawful?

The court’s reasoning comes down to one of America’s most fundamental principles: separation of powers. The Constitution gives Congress – not the president – the power to impose taxes, including tariffs.

Think of it like this: Congress writes the rules, and presidents have to follow them. While Congress sometimes lets presidents make certain decisions about trade, the court found that IEEPA didn’t give Trump the sweeping tariff powers he claimed.

The judges looked closely at the actual language of the emergency powers law. Here’s what they noticed: IEEPA never actually uses the words “tariff” or “duty” anywhere in the text. That’s a pretty big red flag when you’re trying to justify broad tariff authority.

This wasn’t just legal nitpicking. The court argued that if Congress had wanted to give presidents unlimited power to impose tariffs during emergencies, they would have said so explicitly. The absence of tariff-specific language showed Congress intended to limit presidential power in this area.

The ruling reinforced an earlier decision by the U.S. Court of International Trade, which had also found Trump lacked authority for some of his emergency tariff declarations. The appeals court essentially said: “Even during declared emergencies, presidents must stick to the powers Congress actually gave them.”

Which Tariffs Are Affected and Which Remain?

Here’s where things get complicated. The court ruling didn’t wipe out all trump tariffs – just specific ones imposed under emergency powers.

The “reciprocal tariffs” took the biggest hit. These included the patchwork of different tax rates Trump imposed on countries around the world, including additional duties on China, Mexico, and Canada. All of these were justified by declaring trade deficits a national emergency under IEEPA.

But many other Trump-era tariffs remain completely untouched. The Section 232 tariffs on steel and aluminum are still in place because they were imposed under different legal authority – the Trade Expansion Act of 1962, which allows tariffs for national security reasons.

Copper tariffs also survived the court ruling, along with various duties on foreign-made cars and parts. These were all imposed under separate legal frameworks that the court didn’t challenge.

This creates a confusing landscape for businesses and consumers. Some tariffs face immediate legal uncertainty, while others continue as if nothing happened. It’s like having half your taxes declared illegal while the other half remain perfectly valid.

The distinction matters enormously for companies trying to plan their supply chains and pricing. While the court placed significant limits on presidential emergency powers, it didn’t dismantle Trump’s entire trade policy approach.

The Economic Fallout: What the Ruling Means for Markets and Consumers

When the appeals court ruling hit the news, financial markets felt the tremors immediately. Even though these trump tariffs remain active for now, the uncertainty alone was enough to shake investor confidence.

Remember April 9, 2025? That’s when tariff concerns sent the S&P 500 tumbling over 274 points – a brutal 4.88% drop. The Nasdaq took an even harder hit, plummeting more than 1,050 points or 5.97% in a single day. Markets often bounce back, but these sharp drops show just how nervous global trade uncertainty makes everyone.

The economic ripple effects go far beyond Wall Street. These tariffs have been quietly pushing up the U.S. inflation rate as businesses pass higher costs onto consumers. By June, prices had climbed 2.7% year-over-year – up from 2.4% the month before. You’ve probably noticed it yourself: clothing costs more, coffee prices are up, toys are pricier, and appliances hit the wallet harder.

What makes this court ruling so significant is the uncertainty it creates. If these tariffs eventually get struck down, we might see some relief from inflation and lower household costs. But here’s the catch – businesses hate uncertainty even more than they hate tariffs. Companies need predictability to make smart investment decisions, and this ongoing legal battle creates exactly the opposite.

The human cost is staggering. Economists estimate these tariffs could drain $25 billion from household budgets and eliminate over 64,000 jobs in California alone. That’s just one state, albeit a massive economy. The Congressional Budget Office warns that tariffs can push unemployment to recession-level territory.

If you’re wondering how this affects car buyers specifically, check out our detailed analysis of how tariffs affect car prices for the full picture.

Economic Impact of the Trump Tariffs on Consumers

Let’s get real about who actually pays for tariffs. Despite political claims that foreign countries foot the bill, it’s U.S. importers who write the checks at customs. And guess what? They almost always pass those costs straight to us through higher prices.

Major brands aren’t shy about admitting this reality. Adidas has already announced price increases for American customers because nearly half their products come from Vietnam and Indonesia – countries facing 20% and 19% tariffs respectively. Nike issued similar warnings, estimating the tariffs could add $1 billion to their costs. Even Barbie maker Mattel plans to charge Americans more.

The pain doesn’t stop with finished products. Cars are a perfect example of how complex this gets. Car parts typically cross U.S., Mexican, and Canadian borders multiple times before a vehicle rolls off the assembly line. Each border crossing means another tariff hit, and all those costs add up in your final price.

The numbers are genuinely scary for family budgets. A 10% tariff on all imports could cost households between $1,700 and $2,350 annually. Add a 60% tariff on Chinese goods, and you’re looking at another $1,950 per year. Middle-income families might face $2,500 more annually, potentially jumping to $3,900 with a 20% basic tariff.

The most aggressive estimates are truly eye-watering: over $6,000 per household with comprehensive tariffs. These aren’t just theoretical numbers – the Trump administration’s 2018-2019 tariffs already cost Americans nearly $80 billion in new taxes, making it one of the largest tax increases in decades.

Global Trade and Diplomatic Consequences

The trump tariffs have created a global game of economic chess, and not everyone’s playing nice. When America imposes tariffs, other countries often fire back with their own duties on American goods. This tit-for-tat approach throws existing trade deals into question and makes new negotiations incredibly complicated.

Major economies are scrambling to adapt. The United Kingdom managed to negotiate a relatively friendly 10% tariff rate with specific quotas for vehicles. Japan and South Korea found themselves navigating much trickier waters, while some countries even suspended parcel deliveries to the U.S. just to figure out the new rules.

The European Union faces 15% tariffs on many goods under some agreements, leading to retaliatory duties and constant threats of escalation. This back-and-forth damages foreign investment, disrupts supply chains, and makes the entire global trading system less stable.

If this court ruling stands, it could fundamentally reshape Trump’s “America First” trade approach. The administration has relied heavily on unilateral tariff threats as negotiating tools. Without that broad presidential authority, future trade policy might require more cooperation and less confrontation.

Foreign governments are watching this legal battle closely. If presidential tariff powers get significantly curtailed, it could embolden other countries to resist future demands or push for better terms in existing agreements. The days of “tariff diplomacy” might be numbered.

The Bigger Picture of the Trump Tariffs Policy

Understanding trump tariffs means looking beyond individual trade disputes to see the bigger strategy at work. These weren’t just random taxes slapped on imports – they were the cornerstone of an “America First” economic policy that aimed to flip decades of trade relationships on their head.

The grand plan was ambitious: use tariffs as a bargaining chip to renegotiate trade deals, shrink America’s trade deficits, and bring manufacturing jobs back home. Think of it as economic hardball – impose tariffs first, negotiate later. But as we’ve seen with this recent court ruling, the strategy faced serious legal roadblocks.

This appeals court decision isn’t the first time Trump’s trade policies have landed in court. During his first presidency, various industry groups and businesses filed lawsuits challenging different aspects of his tariff programs. While many early challenges didn’t succeed, this latest ruling shows that courts are becoming more willing to push back against expansive presidential powers in trade matters.

One policy change that flew under many people’s radar was the elimination of the de minimis exemption. This exemption used to let goods worth $800 or less enter the U.S. duty-free – basically, your small online purchases from overseas didn’t get hit with tariffs. Trump’s team first removed this break for Chinese and Hong Kong products (think purchases from sites like Shein and Temu), then eliminated it globally. Now even your $50 gadget from abroad might come with extra fees.

The scope and complexity of these policies can be overwhelming. For a comprehensive breakdown of the strategy and its real-world implications, An analysis of Trump’s tariff agenda offers detailed insights into what was proposed and what actually happened.

Understanding the ‘Reciprocal’ Trump Tariffs

The “reciprocal tariffs” that just got struck down by the appeals court were perhaps the most ambitious part of Trump’s trade strategy. The name tells you everything – if another country charged high tariffs on American goods, the U.S. would charge them right back.

But calling them “reciprocal” was a bit misleading. In practice, these tariffs created a complex web of different rates for different countries, often based more on political relationships than actual reciprocity. Indian goods faced 50% tariffs, partly because India kept buying Russian oil despite U.S. pressure. Brazilian products also got hit with 50% rates, sometimes tied to political disputes. South African goods saw 30% tariffs, while countries like Vietnam (20%), Indonesia (19%), and the Philippines (19%) all faced significant duties.

Even allies weren’t spared. Japanese and South Korean goods faced 15% tariffs, as did products from the European Union. The situation with neighbors was particularly messy – Canada faced 35% tariffs on top of existing duties, though many goods under the USMCA trade deal got exemptions. Mexico faced similar threats, though implementation was often delayed during border security negotiations.

The most dramatic rates were reserved for China, which faced total tariffs reaching 145% on some goods. China retaliated with 125% tariffs on American products, creating a full-blown trade war that hurt businesses and consumers on both sides.

What made this system particularly unpredictable was how Trump used tariff threats as negotiating tools. Deadlines would be announced, then postponed. Rates would be threatened, then reduced if countries made concessions. It was economic diplomacy through uncertainty.

Other Major Tariffs Under the Trump Administration

While the reciprocal tariffs grabbed headlines, other trump tariffs imposed under different legal authorities remain untouched by the recent court ruling. These were justified under Section 232 of the Trade Expansion Act, which lets presidents impose tariffs for national security reasons.

Steel got hit with 50% tariffs under the argument that America needed a strong domestic steel industry for national defense. Since the U.S. imports massive amounts of steel (we’re the world’s second-largest steel importer after the EU), these tariffs had huge ripple effects throughout the economy.

Aluminum faced the same 50% rate, which was particularly awkward since Canada supplies more than half of America’s aluminum imports. Imagine telling your biggest aluminum supplier that their metal is a national security threat – it created some tense conversations with our northern neighbors.

Copper imports also got slapped with 50% tariffs, despite the fact that America consumes about 1.6 million tons of refined copper annually but only produces 1.1 million tons domestically. That math doesn’t add up without imports, making these tariffs particularly painful for industries that depend on copper.

Perhaps the most controversial were the 25% tariffs on foreign-made cars and auto parts. This hit the automotive industry like a sledgehammer because modern car manufacturing is incredibly interconnected. A single vehicle might have parts that cross the U.S.-Mexico-Canada borders multiple times during production. Industry leaders warned these tariffs could “blow a hole in the U.S. industry” and drive up car prices for everyone.

The key difference is that these Section 232 tariffs were based on national security arguments rather than emergency economic powers. That’s why they survived the recent court challenge while the reciprocal tariffs got struck down. It’s a complex legal landscape that leaves some tariffs standing while others face elimination.

What’s Next? The Legal and Political Battle Ahead

The appeals court’s ruling has set the stage for a dramatic legal and political showdown. Unsurprisingly, the Trump administration has immediately rejected the judgment. President Trump took to Truth Social, his social media platform, in the hours after the ruling landed to call the appeals court “highly partisan” and predicted a reversal with the help of the Supreme Court. This reaction signals that the administration is far from accepting this legal defeat.

The next legal steps are clear: the Trump administration is expected to file an appeal with the U.S. Supreme Court. This is why the appeals court delayed the ruling’s effect until October. This delay is significant; it gives the administration time to prepare and submit its appeal, ensuring that the tariffs remain in place while the highest court in the land considers the case. Without this delay, the tariffs would have immediately become unenforceable, potentially leading to chaos in customs and trade.

The Path to the Supreme Court

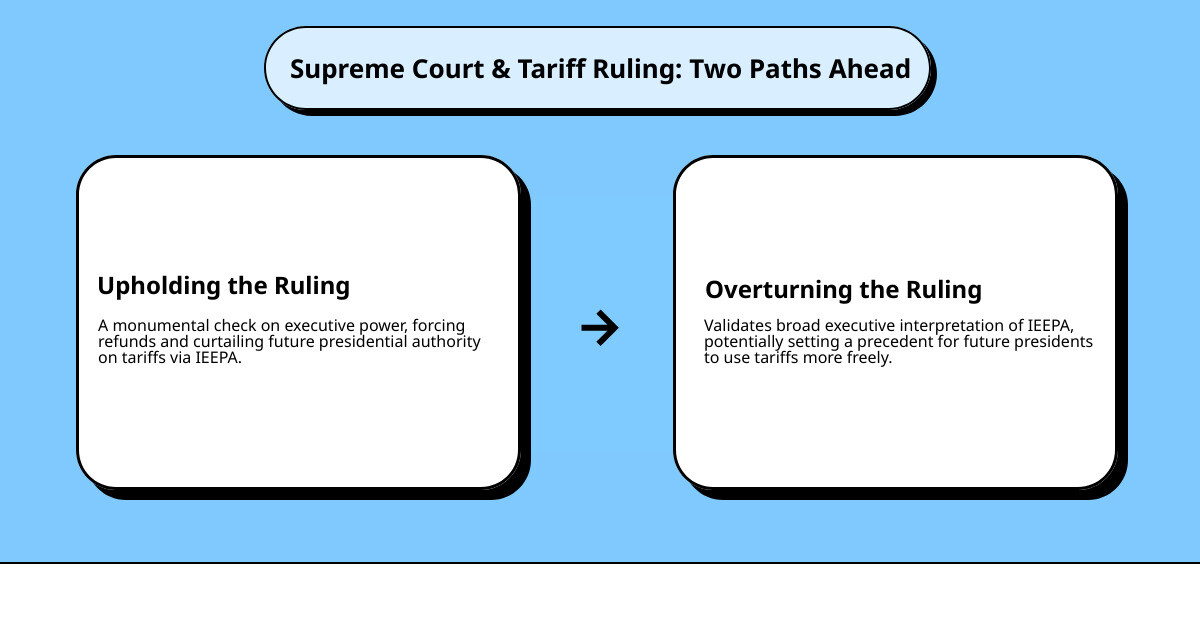

The journey to the Supreme Court is the ultimate appeals process in the U.S. legal system. If the Supreme Court decides to take the case (which it is likely to do given the constitutional implications and economic impact), there are two main outcomes:

- Upholding the ruling: If the Supreme Court upholds the appeals court’s decision, it would be a monumental check on presidential power. It would affirm that the International Emergency Economic Powers Act (IEEPA) does not grant the President the authority to impose broad tariffs. This could force the U.S. government to refund billions of dollars in collected import taxes, potentially dealing a financial blow to the U.S. Treasury, which had collected $159 billion in tariff revenue by July. More importantly, it would severely curtail the executive branch’s ability to use tariffs as a unilateral trade policy tool in the future.

- Overturning the ruling: If the Supreme Court overturns the ruling, it would validate the President’s expansive interpretation of IEEPA and his emergency powers to impose tariffs. This would be a significant victory for the Trump administration, allowing the continuation of its current trade policy and potentially setting a precedent for future presidents to use tariffs more freely. However, it would also raise significant questions about the balance of power between the executive and legislative branches, particularly concerning taxation.

The implications for presidential power are immense. This case tests the boundaries of executive authority, especially in areas traditionally reserved for Congress. The outcome will shape not only future trade policy but also the broader interpretation of emergency powers and the separation of powers in U.S. law. Dissenting judges in the appeals court decision had argued that IEEPA’s language was indeed broad enough to grant the President the power to regulate imports through tariffs, emphasizing the executive’s role in responding to national emergencies. This is the argument the Supreme Court would likely dig into.

Regardless of the outcome, the legal battle highlights the contentious nature of trump tariffs and their profound impact on American governance and the economy.

Frequently Asked Questions about the Trump Tariffs

Let’s be honest – tariffs can be confusing. You’ve probably heard a lot about trump tariffs in the news, but what does it all actually mean for you? We’ve gathered the most common questions people are asking and broken down the answers in simple terms.

Which of Trump’s tariffs did the court rule illegal?

The appeals court took aim at what President Trump called his “reciprocal tariffs” – those sweeping import taxes he slapped on goods from countries around the world. These weren’t your typical, carefully crafted trade measures. Instead, they were broad tariffs imposed using the International Emergency Economic Powers Act (IEEPA), which is supposed to be for genuine national emergencies.

The court found that Trump had overstepped his presidential authority when he used this emergency law to justify tariffs on everything from Vietnamese goods to European cars. Essentially, the judges said “hold on a minute – you can’t just declare trade deficits a national emergency and start taxing imports left and right.”

What made these tariffs particularly problematic in the court’s eyes was their scope. We’re talking about tariffs affecting nearly every major U.S. trading partner, all justified under a single emergency declaration. The court saw this as going way beyond what Congress intended when it gave presidents emergency economic powers.

How do these tariffs affect me as a consumer?

Here’s where the rubber meets the road for your wallet. Despite what you might have heard, tariffs aren’t paid by foreign countries – they’re taxes that U.S. importers pay at the border. And guess what happens next? Those companies almost always pass those extra costs right on to you and me through higher prices.

Think about it this way: if a company importing sneakers from Vietnam suddenly has to pay a 20% tariff, they’re not just going to absorb that cost out of the goodness of their hearts. They’re going to add it to the price tag. We’ve already seen this happening with major brands like Adidas and Nike, both of which have announced price increases for American customers specifically because of these tariffs.

The numbers are pretty eye-opening. Various economic analyses suggest that these trump tariffs could cost the average American household between $1,700 and $6,000 per year. That’s real money coming out of your budget for everything from clothes and toys to car parts and appliances.

It’s not just imported goods either. Even products made in America can become more expensive when they rely on imported components. Your car, for example, might have parts that cross between the U.S., Mexico, and Canada multiple times during manufacturing. Tariffs at each step add up, making the final product pricier for you.

Are all of Trump’s tariffs canceled because of this ruling?

Not by a long shot. This is where things get a bit complicated, but it’s important to understand. The court ruling only targeted those “reciprocal tariffs” imposed under the emergency powers law. Plenty of other Trump-era tariffs are still standing strong.

The Section 232 tariffs on steel, aluminum, and copper are completely unaffected by this ruling. These were imposed under a different law that lets presidents put tariffs on imports for national security reasons. Same goes for the hefty tariffs on foreign-made cars and car parts – they’re based on separate legal authority.

Even some of the China tariffs remain in place, depending on which specific legal justification was used to impose them. It’s honestly a bit of a maze, with different tariffs having different legal foundations.

What this means is that while the court ruling is significant, it doesn’t wipe the slate clean. Many businesses and consumers will continue feeling the pinch from tariffs that weren’t touched by this decision. The legal landscape around trade policy remains as complex as ever, with some tariffs facing potential elimination while others march on unchanged.

The bottom line? This ruling is a big deal, but it’s just one piece of a much larger puzzle when it comes to America’s trade policy and what you’ll pay for goods.

Conclusion

The federal appeals court’s decision against key trump tariffs represents more than just another legal ruling – it’s a defining moment that could reshape how America approaches trade for generations to come. By declaring the broad “reciprocal tariffs” unlawful, the court sent a clear message that even presidents have limits when it comes to imposing taxes on American families.

This isn’t just about legal technicalities. The court’s finding that President Trump overstepped his authority under the International Emergency Economic Powers Act reinforces a fundamental principle: Congress, not the President, holds the power to tax. It’s a reminder that our system of checks and balances still works, even when billions of dollars and global trade relationships hang in the balance.

But let’s be honest – the uncertainty isn’t going away anytime soon. While this ruling provides some hope for relief from higher prices, the ongoing legal battle creates its own problems. Businesses hate uncertainty, and that’s exactly what we’re getting. Companies are left wondering whether to adjust their pricing, consumers don’t know if their grocery bills will go up or down, and global trading partners are watching nervously from the sidelines.

The human cost of this uncertainty is real. We’re talking about potential job losses, higher household expenses, and market volatility that affects everyone’s retirement accounts and savings. The fact that these tariffs could cost families thousands of dollars per year isn’t just a statistic – it’s money that could have gone toward car payments, college funds, or that vacation you’ve been planning.

Now all eyes turn to the Supreme Court. Will they uphold the appeals court’s decision and limit presidential power, or will they give future presidents even broader authority to impose tariffs? The stakes couldn’t be higher. This decision will influence not just trade policy, but the very balance of power in our government.

At Car News 4 You, we know that economic policies don’t exist in a vacuum – they affect real people making real financial decisions every day. Whether you’re buying a car, planning your budget, or just trying to understand why prices keep changing, these trump tariffs and the legal battles surrounding them matter to your wallet.

The road ahead remains uncertain, but one thing is clear: this story is far from over. As the case moves toward the Supreme Court, we’ll continue tracking how these developments impact your financial well-being and the broader economy.

Understanding complex economic issues like tariffs doesn’t have to be overwhelming. For more insights into how policies and market changes affect your personal finances, explore our in-depth financial guides – because when it comes to your money, knowledge really is power.