Tariff News: Critical 2025 Impact Guide

Why Tariff News Matters More Than Ever

Tariff news has become one of the most important economic stories of our time, affecting everything from your grocery bill to global financial markets. Recent developments have created unprecedented uncertainty in international trade.

Key Tariff News Updates:

- Federal Appeals Court Ruling: U.S. Court ruled 7-4 that most Trump tariffs are illegal

- Financial Impact: Tariff revenue hit record $142 billion by July 2025

- Legal Status: Tariffs remain in place until mid-October pending Supreme Court appeal

- Global Effects: Countries like Switzerland, Canada, and Southeast Asia face significant trade disruptions

- Next Steps: Case likely heading to U.S. Supreme Court for final decision

A federal appeals court recently delivered a bombshell ruling that most of Donald Trump’s tariffs are illegal. The court found that the president exceeded his authority when imposing sweeping import taxes using national emergency powers.

This decision affects billions of dollars in trade. Switzerland alone exported $61.5 billion worth of gold to the U.S. in the first half of 2025. At the new 39% tariff rate, that volume would face an additional $24 billion in duties.

The ruling has created massive uncertainty for businesses worldwide. Some Swiss gold refineries have already stopped shipping to America. Meanwhile, the U.S. Justice Department warns that revoking these tariffs could mean “financial ruin” for the United States.

The stakes couldn’t be higher. This case questions fundamental presidential powers over trade and taxation – powers that belong to Congress under the Constitution.

Related content about tariff news:

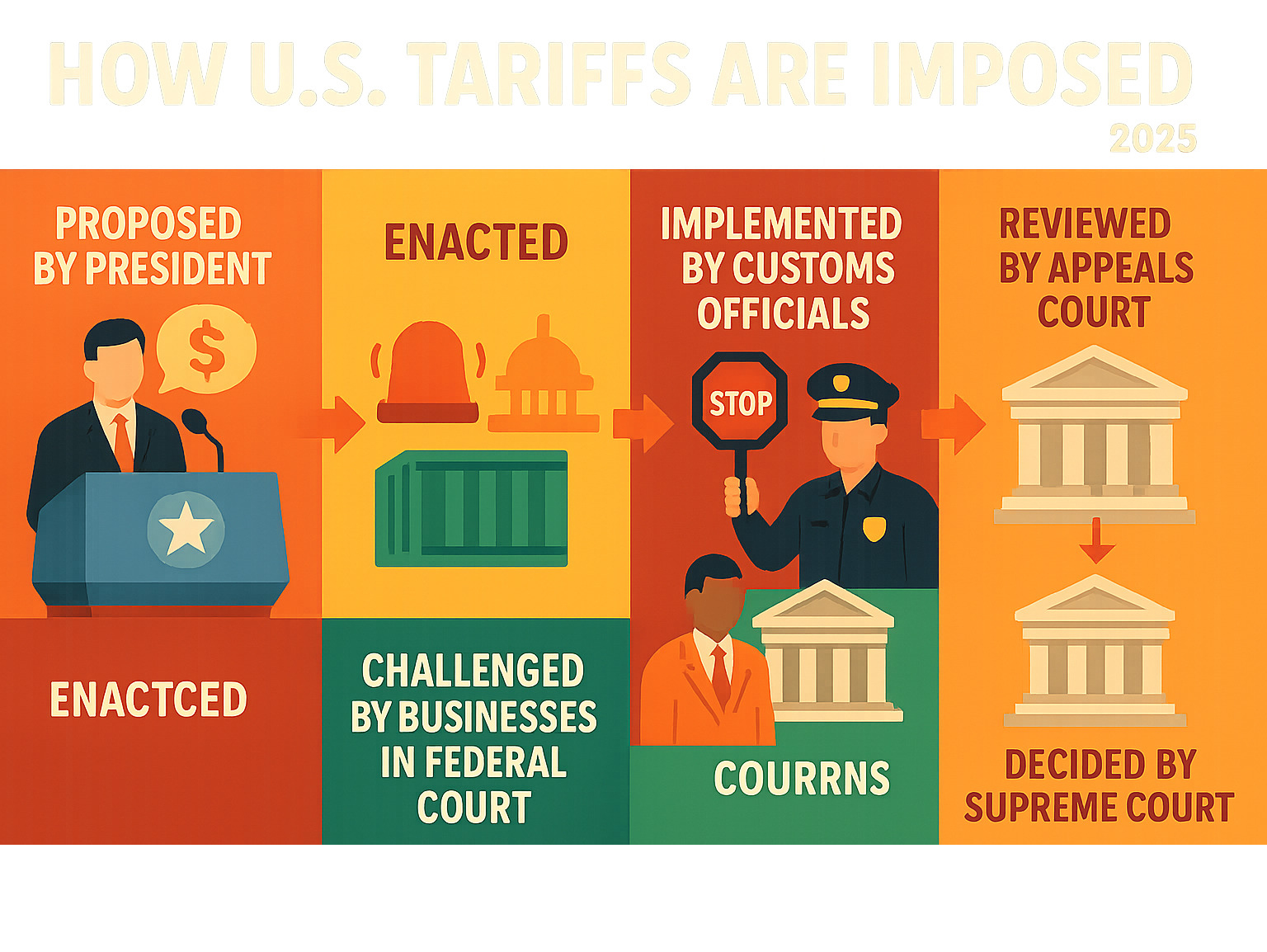

Understanding Tariffs and Presidential Powers

Think of tariffs as taxes on stuff coming from other countries. When you buy something made overseas, these extra fees make foreign products cost more. The idea is simple: if imported goods are pricier, people might choose American-made products instead.

But here’s where things get interesting – and where most tariff news gets complicated. The U.S. Constitution says Congress controls the “power of the purse.” That means lawmakers, not presidents, are supposed to decide on taxes and duties.

Over the years though, Congress has handed presidents some special powers to impose trade measures during emergencies or national security threats. This creates a fascinating tug-of-war between presidential authority and congressional power that’s at the heart of today’s biggest trade disputes.

The 1977 law states that a president can use economic tools “to deal with any unusual and extraordinary threat, which has its source in whole or substantial part outside the United States, to the national security, foreign policy or economy.” The million-dollar question? Just how far does this authority actually stretch.

The recent court ruling has thrown this debate wide open, questioning whether presidents can use emergency powers to slap tariffs on everything from Swiss gold to Vietnamese textiles. For broader context on how these policies ripple through the economy, check out our Fintechzoom Economy: A Complete Guide.

The International Economic Emergency Powers Act (IEEPA)

The International Economic Emergency Powers Act – or IEEPA for short – became law in 1977. It’s basically the president’s emergency toolkit for dealing with foreign economic threats. When things get serious, this law lets presidents freeze assets, block transactions, and impose sanctions on countries or companies causing trouble.

Presidents have used IEEPA plenty of times over the decades. Barack Obama used it to sanction Russia after they grabbed Crimea. Joe Biden ramped up those same powers when Russia invaded Ukraine. But here’s the key difference: these were targeted sanctions, not broad taxes on imports.

The recent federal appeals court ruling zeroed in on this distinction. The judges argued that while IEEPA gives presidents power over economic transactions, it never actually mentions tariffs or taxes. The court essentially said Congress didn’t intend for this emergency law to become a backdoor for imposing widespread import duties.

This interpretation is huge for anyone following tariff news. It suggests there are real limits to what presidents can do, even during declared emergencies. The court’s reading of the 1977 law states that emergency powers don’t equal unlimited tariff authority.

Alternative Legal Avenues for Imposing Tariffs

IEEPA isn’t the only way presidents can impose tariffs – Congress has created other legal paths, each with its own rules and restrictions. Understanding these alternatives helps explain why the recent court ruling was so specific and narrow.

The Trade Act of 1974 lets presidents respond to unfair trade practices by other countries. But it comes with strings attached – tariffs usually can’t exceed 15% and typically last only 150 days. This law requires investigations and proof that U.S. industries are being harmed by unfair trade practices.

Then there’s Section 232 of the Trade Expansion Act of 1962. This one’s all about national security. If the Commerce Department finds that imports threaten America’s defense capabilities, the president can impose tariffs to protect critical industries.

Trump used Section 232 for his steel and aluminum tariffs – and those remain completely unaffected by the recent court ruling. Why? Because they were imposed under different legal authority than the “reciprocal tariffs” that got struck down.

The court’s decision specifically targeted tariffs imposed under IEEPA, including the so-called “Liberation Day” tariffs and fentanyl-related duties. Other trade measures using different legal foundations remain intact for now.

For a complete breakdown of various tariff policies and their current status, the BBC provides helpful context on what tariffs has Trump announced and why.

Breaking Down the Latest Tariff News: The Trump Tariff Ruling

The recent federal appeals court ruling has created a seismic shift in tariff news and international trade policy. This wasn’t just another routine court decision – it was a direct challenge to how much power a president really has when it comes to imposing taxes on foreign goods.

The U.S. Court of Appeals for the Federal Circuit made a bold statement when they ruled that many of Trump’s tariffs were simply illegal. These weren’t small, targeted taxes either. We’re talking about the sweeping “reciprocal tariffs” that affected dozens of countries and billions of dollars in trade.

The court also struck down what were called “Liberation Day” tariffs and special duties on goods related to the fentanyl crisis. The judges found these levies to be “invalid as contrary to law” – legal language that essentially means the administration went way beyond what it was allowed to do.

What makes this ruling particularly significant is that it challenges the use of the International Economic Emergency Powers Act (IEEPA) as a tool for imposing widespread tariffs. The court argued that while this 1977 law gives presidents emergency powers, it doesn’t actually give them the right to impose taxes – that’s Congress’s job.

The Specifics of the Court’s Decision

The 7-4 ruling wasn’t even close – a clear majority of judges agreed that the Trump administration had overstepped its bounds. The court’s reasoning was pretty straightforward: the Constitution gives Congress the “power of the purse,” which includes the authority to tax imports.

The majority opinion made it clear that Congress did not grant unlimited tariff authority through the IEEPA. The judges pointed out that the law lacks the kind of procedural safeguards and clear limits you’d expect if Congress really intended to hand over such massive tax powers to the president.

But it wasn’t unanimous. Four judges disagreed, arguing that the IEEPA should be interpreted more broadly. These dissenting opinions pointed to historical examples, like how President Carter used similar emergency powers during the Iran hostage crisis in 1979. They believed the president should have more flexibility during genuine emergencies.

This split decision shows just how complex these legal questions really are. The dissenting judges weren’t necessarily wrong – they just saw the law differently. This disagreement actually strengthens the case for taking it to the Supreme Court, where these fundamental questions about executive authority and congressional intent can be settled once and for all.

Trump’s Reaction and the Path Forward

Former President Trump didn’t hold back when he heard about the ruling. Within hours, he posted on Truth Social, calling the appeals court “highly partisan” and declaring that “ALL TARIFFS ARE STILL IN EFFECT!”

His reaction was vintage Trump – defiant and dramatic. He warned that removing the tariffs would lead to a “GREAT DEPRESSION” and promised that America would “win in the end.” While his language was colorful, he wasn’t wrong about one thing: the tariffs do remain in place for now.

The court gave the administration a temporary lifeline. The tariffs remain in place until mid-October, giving Trump’s legal team time to file a Supreme Court appeal. This isn’t just a courtesy – it recognizes that suddenly removing billions of dollars in tariffs could create chaos in global markets.

The legal timeline now points toward what could be a landmark Supreme Court case. This would be huge – we’re talking about a decision that could reshape presidential power over trade policy for generations. For businesses trying to steer this uncertainty, understanding market reactions becomes crucial, which is why resources like our Fintechzoom.com Markets guide can be so valuable.

Understanding the Latest Tariff News from a Legal Perspective

This ruling brings up some fascinating legal concepts that go way beyond just tariffs. The major questions doctrine is at the heart of this case – it’s a legal principle that says the government can’t claim vast new powers without clear permission from Congress, especially on issues that affect millions of people and billions of dollars.

The court essentially said that imposing widespread tariffs falls under this doctrine. You can’t just declare an emergency and start taxing imports without Congress explicitly saying that’s okay. It’s a significant check on executive power.

The Liberty Justice Center, representing businesses that challenged the tariffs, argued that “the president cannot impose tariffs on his own.” They contended that the IEEPA simply doesn’t grant unlimited authority to bypass Congress when it comes to taxation.

The White House spokesperson’s defense took a different approach. Kush Desai argued that “President Trump lawfully exercised the tariff powers granted to him by Congress to defend our national and economic security from foreign threats.” This defense highlights the core disagreement – what powers did Congress actually grant?

This case fundamentally questions the president’s power to bypass Congress on taxes. The separation of powers is one of the most basic principles in American government, and this ruling reinforces that some powers – like taxation – belong firmly with the legislative branch.

What makes the upcoming Supreme Court decision even more interesting is the court’s composition. With six Republican-appointed justices, including three appointed by Trump himself, the ideological makeup could play a role. But constitutional law isn’t always predictable, and these justices have sometimes surprised observers with their interpretations of presidential power and congressional authority.

The outcome will set a crucial precedent for executive authority that goes far beyond just trade policy. Future presidents will be watching closely to see how much emergency power they really have when it comes to economic policy.

Global Economic Ripple Effects of Tariff Policies

The recent tariff news isn’t just about legal battles; it has tangible economic consequences that ripple across the global economy. U.S. tariffs, whether legal or not, have a direct impact on trade flows, supply chains, and financial markets worldwide. The U.S. Justice Department’s stark warning that revoking these tariffs could mean ‘financial ruin’ for the United States underscores the immense financial stakes involved. This reflects the significant revenue generated by these duties, which totaled a record US$142 billion by July, more than double the previous year.

The uncertainty created by legal challenges to these tariffs can deter investment, disrupt existing trade deals, and force businesses to re-evaluate their global strategies. This can lead to slower economic growth and increased volatility in various sectors.

Impact on Specific Countries and Industries

The effects of these tariffs are felt acutely in specific countries and industries. Here’s a look at some of the most notable impacts:

| Country/Region | Tariff Rate (MFN + %) | Specific Impact/Notes | Relevant Link |

|---|