Payday loans eloanwarehouse: 3 Easy Steps

Why eLoanWarehouse Offers a Different Approach to Quick Cash Solutions

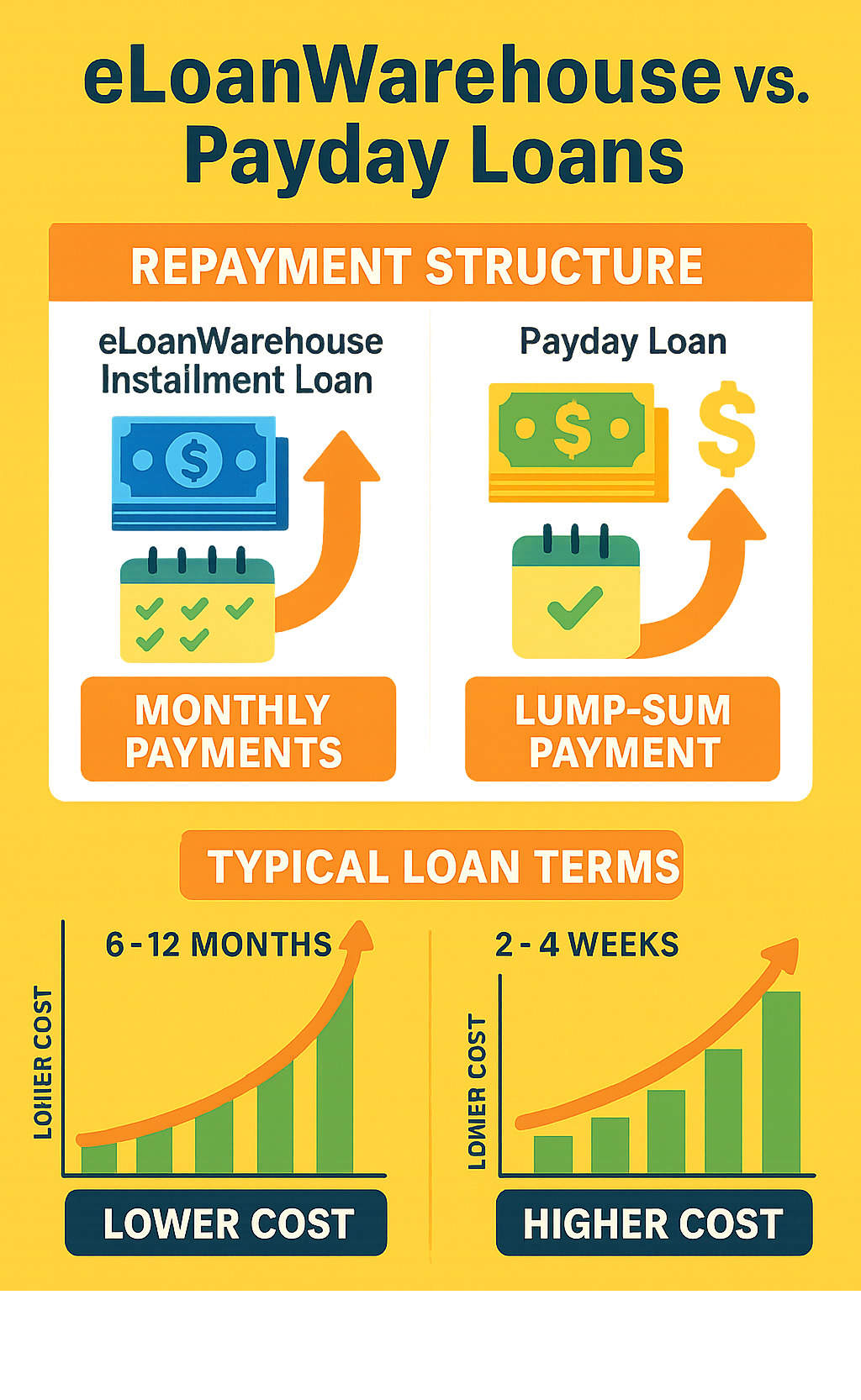

Payday loans eloanwarehouse marks a shift from traditional single-payment payday loans to installment-based borrowing. When unexpected expenses like car repairs or medical bills hit, many need fast cash but find the typical payday loan model, which demands full repayment on the next payday, unmanageable.

Quick Facts About eLoanWarehouse:

- Loan Type: Installment loans (not traditional payday loans)

- Loan Amounts: Up to $3,000 based on loyalty tier

- Repayment Terms: 6-12 months with fixed monthly payments

- Funding Speed: Within 1 business day if approved

- APR Range: Higher than banks but potentially lower than traditional payday loans

- Mobile App: Available for iOS and Android devices

eLoanWarehouse is operated by Lac Courte Oreilles Financial Services II, LLC and functions as a tribal lender. Unlike traditional payday loans that can trap borrowers in debt cycles with lump-sum repayments, their installment model spreads payments over several months.

The company offers a loyalty tier system where repeat borrowers can access higher loan amounts and longer repayment terms. New borrowers start with up to $1,000 for 9 months, while Platinum tier borrowers (after 24 payments) can access up to $3,000 for 12 months.

However, these loans carry high interest rates, with APRs that can range from 400% to 700%. While the mobile app makes applying convenient, borrowers should understand the total cost and explore alternatives before committing.

What is eLoanWarehouse and What Does It Offer?

eLoanWarehouse is a financial service provider offering a different approach to quick cash. For those with unexpected expenses and less-than-perfect credit, eLoanWarehouse specializes in installment loans.

Here’s what makes them unique: eLoanWarehouse operates as a tribal lender under Lac Courte Oreilles Financial Services II, LLC. This company is wholly owned by the Lac Courte Oreilles Band of Lake Superior Chippewa Indians, which means they operate under tribal law rather than state regulations.

The company focuses on installment loans up to $3,000, depending on your status in their loyalty program. Unlike single-payment loans, these loans allow you to spread payments over 6 to 12 months with fixed monthly amounts, making budgeting more manageable.

As a member of the Online Lenders Alliance (OLA), eLoanWarehouse commits to responsible lending practices. While their APRs are higher than a credit union’s, they are positioned as an alternative to traditional payday loans. These loans are intended for emergencies, not long-term financial problems, emphasizing responsible borrowing.

Understanding the Loyalty Tiers

One of the key features eLoanWarehouse offers is its loyalty tier system. This system rewards responsible repayment with better benefits.

- New borrowers start at the basic tier, with access to loans up to $1,000 for 9 months.

- After 7 successful payments, you reach Silver Tier, increasing your borrowing limit to $1,750 for the same 9-month period.

- At 15 payments, you hit Gold Tier, which increases the maximum loan amount to $2,000 over 9 months.

- The top level is Platinum Tier, reached after 24 payments. Here, you can borrow up to $3,000 and have a full 12 months to repay it.

This system rewards customers who pay on time and use the service responsibly.

Key Differences from Traditional Payday Loans

Although people search for “payday loans eloanwarehouse,” these are not traditional payday loans.

Traditional payday loans require you to borrow a small amount and pay back the entire sum plus fees on your next payday. If you can’t pay it all back, you risk rolling the loan over and incurring more fees.

eLoanWarehouse installment loans spread your payments over several months. Instead of a single large payment, you get manageable, fixed monthly payments.

The repayment structure is the main difference. While both loan types have high costs, installment payments provide breathing room. You have months to pay the loan back gradually.

This extended repayment period of 6-12 months helps you avoid the debt trap common with payday loans. You pay down the principal each month, which can help you move toward a stronger financial future. The total cost may still be high due to interest rates, but the payment structure is more realistic for complete repayment.

Your 3-Step Guide to Applying for Payday Loans eLoanWarehouse via the App

When facing a financial emergency, the eLoanWarehouse mobile app is designed for a quick and smooth application process.

The first thing you’ll need to do is download the app from Google Play for Android or the Apple App Store for iPhone. Once installed, you’re three steps from potentially getting the cash you need. Let’s walk through each step.

Step 1: Confirm Your Eligibility

Before applying, ensure you meet the basic requirements. The eligibility checklist is straightforward. You must be 18 years or older, have verifiable income, and an active checking account for fund transfers and payments.

US residency is required, but eLoanWarehouse does not operate in New York, Pennsylvania, Virginia, or Connecticut. It’s worth checking this before you start.

There’s also a restriction for military families. Active Duty Military personnel, their spouses, and dependents are not eligible for these loans.

Step 2: Complete the Application for payday loans eloanwarehouse

Once you’ve confirmed your eligibility, it’s time to fill out the application in the app.

You’ll enter your personal details, banking information, and choose your desired loan amount. Your loyalty tier determines your maximum loan amount, with new users typically capped at $1,000.

After submission, expect a verification call from their customer service team. This is a standard security measure to confirm your identity and information. Be ready to answer questions about your application.

Step 3: E-Sign Your Agreement and Get Funded

If your application is approved, the final step is to e-sign your loan documents digitally through the app.

Before you sign, read the entire loan agreement carefully. It’s crucial to understand what you’re agreeing to. Pay close attention to the loan amount, total repayment amount, APR, payment schedule, and any late payment fees.

Once you’ve reviewed and e-signed the agreement, eLoanWarehouse typically deposits approved funds into your bank account within 1 business day. This is one of their biggest selling points for urgent situations.

You can use the app to manage your loan throughout the repayment period. Check your payment schedule, track due dates, and monitor your progress to stay on top of your payments.

Costs, Terms, and Potential Risks of eLoanWarehouse Loans

While eLoanWarehouse positions itself as an alternative to traditional payday loans, these loans still come with significant costs that can affect your financial health.

The most significant factor is the Annual Percentage Rate (APR), which typically ranges from 400% to 700%. To put this in perspective, a typical bank loan might have an APR of 6-12%. Even though eLoanWarehouse claims their loans are “usually less costly than payday loans,” these rates are substantially higher than most other forms of credit.

Your repayment schedule will be clearly laid out in your loan agreement. New borrowers usually get 9 months to repay, while Platinum tier members can extend payments over 12 months. These fixed monthly payments are more manageable than a lump-sum repayment, but you’re still paying high interest rates over the entire loan period.

Regarding credit reporting: eLoanWarehouse doesn’t typically report to the three major credit bureaus (Experian, TransUnion, Equifax). They use alternative credit repositories to evaluate applications and report payment history. This means on-time payments might not build your traditional credit score, but defaults can still harm your ability to get credit elsewhere.

Implications of Late or Non-Payment

If you cannot make a monthly payment, you will face consequences. Missing payments triggers additional fees and penalties as detailed in your loan contract. These can significantly increase your total debt and make it harder to catch up.

If you anticipate trouble, contact eLoanWarehouse customer support immediately. Having an honest conversation about your situation might lead to alternative payment arrangements. Proactive communication is key, as lenders prefer working with borrowers who reach out rather than those who simply stop paying.

Customer Reviews and Common Complaints

Customer feedback on eLoanWarehouse provides important insights.

The eLoanWarehouse app currently holds a 2.9 out of 5 star rating on app stores. On the positive side, customers praise the speed and convenience of getting cash for emergencies. The app is straightforward, and funding is quick.

However, the negative feedback raises red flags. Customer service issues are a top complaint, with users reporting unhelpful representatives. Payment processing problems are another serious concern, with some borrowers reporting unexpected withdrawals or difficulties getting refunds for errors.

Data privacy concerns also appear in reviews, despite the company’s privacy policy. Some users report issues with their personal information. While eLoanWarehouse has a privacy policy, these experiences suggest potential gaps between policy and practice.

These reviews highlight the importance of reading your loan agreement, keeping detailed records, and having a solid repayment plan before borrowing.

Safer Alternatives and Responsible Borrowing

Before taking a high-cost loan like those from payday loans eloanwarehouse, it’s wise to explore safer alternatives. Understanding all your choices and building solid financial habits can save you stress and money.

Financial planning is a powerful tool. Start by creating a simple budget to track your monthly spending. Learning to distinguish between needs and wants can significantly improve your spending habits.

Building an emergency fund is also critical. Setting aside even a small amount each month creates a safety net over time, which can help you avoid high-interest loans when unexpected expenses arise.

Exploring Alternatives to payday loans eloanwarehouse

When money is tight, several places offer help before you turn to high-APR loans.

- Non-profit credit counseling agencies can offer free advice and budgeting help. They are trained to help you find options you may not have considered.

- Local community assistance programs, such as food banks and utility assistance programs, can provide emergency aid to free up money for other essential bills.

- Negotiating with creditors is often possible. Most companies prefer working with you on a payment plan rather than dealing with unpaid bills.

- Paycheck advances from employers are often cheaper than loans. Some companies offer programs to access earned wages early, and various apps provide similar services, often requesting optional tips instead of high interest.

- Credit unions are member-owned institutions that often offer Payday Alternative Loans with much lower rates and are more likely to work with you personally.

- Peer-to-peer lending platforms connect you with individual investors and may offer significantly lower rates, though they might require better credit.

Privacy and Contact Information

Understanding how a company handles your data is crucial. The app developer claims it doesn’t collect user data, but it’s always best to read the complete Privacy Policy to understand their practices across all services.

If you need to reach eLoanWarehouse, they offer several customer support options. You can call them at 855-650-661 (Monday through Friday, 8:00 am to 5:00 pm CST). They also have a fax line at 715-255-442 and a mailing address at PO Box 1753, Hayward, WI 54843.

Their website includes a Contact Us section, and their app has a chat feature for quicker assistance.

Frequently Asked Questions about eLoanWarehouse

It’s smart to have questions about any financial product. Here are answers to common concerns people have about payday loans eloanwarehouse services.

What is the difference between an eLoanWarehouse installment loan and a traditional payday loan?

This is the most important distinction. eLoanWarehouse offers installment loans, not traditional payday loans.

A traditional payday loan is a short-term loan where the entire amount plus fees is due on your next payday. This means repaying the full amount plus fees in a single payment within a few weeks. If you can’t make the payment, you may have to roll the loan over, incurring more fees.

eLoanWarehouse’s installment loans spread payments over 6 to 12 months with fixed monthly amounts. Instead of a single large payment, you make smaller, predictable payments over time, which is more manageable.

What happens if I miss a payment on my eLoanWarehouse loan?

If you miss a payment on your eLoanWarehouse loan, you will face additional fees and penalties as outlined in your loan agreement.

Our biggest piece of advice is to not hide from the problem. The moment you realize you might have trouble making a payment, call eLoanWarehouse customer support at 855-650-661. Having an honest conversation might open up options, like an alternative payment arrangement.

Missed payments can lead to escalating fees and negative marks with alternative credit reporting agencies, making it harder to get financial help in the future.

Does applying for an eLoanWarehouse loan affect my credit score?

eLoanWarehouse doesn’t typically report to the three major credit bureaus (Experian, Transunion, and Equifax). Instead, they use “alternative credit information repositories.”

This means applying for the loan might not immediately impact your traditional credit score. However, any loan application can potentially impact your credit.

The bigger concern is your payment history. If you are late with payments or default, that information will likely be reported to those alternative credit agencies. Other lenders use these same alternative systems, so your payment history can affect future borrowing.

We always recommend monitoring your credit. Applying for multiple loans in a short period can be a red flag to lenders, regardless of the credit reporting system they use.

Bottom line: While an eLoanWarehouse loan might not directly impact your traditional credit score, your payment behavior is critical for your overall financial reputation.

Conclusion

For a financial emergency, payday loans eloanwarehouse can seem like a solution. The mobile app offers a straightforward application process with the potential for funding within one business day, which is convenient when you need cash fast.

However, while eLoanWarehouse offers installment loans that are more manageable than single-payment payday loans, they remain a high-cost borrowing option. The high APRs, from 400% to 700%, represent a significant cost over the life of the loan.

The loyalty tier system offers perks for repeat borrowers, but the fundamental cost of borrowing remains steep. The mixed customer reviews, especially regarding customer service and payment handling, are worth considering.

Understanding the full picture before signing is crucial. Take time to read your loan agreement, including the APR, total repayment amount, payment schedule, and late payment penalties.

We can’t stress this enough: explore every alternative first. Reaching out to credit counseling agencies, checking community assistance programs, negotiating with creditors, or using paycheck advances are often safer financial paths. Often, the best financial decision avoids high-interest debt entirely.

At Carnews4you.com, we’re committed to helping you make informed decisions that protect your financial future. Every choice you make today shapes your tomorrow, so choose wisely.