High risk merchant account at HighRiskPay.com: 99% Secure

Navigating the World of High-Risk Payment Processing

A high risk merchant account at highriskpay.com serves businesses that traditional payment processors often reject due to industry type, chargeback potential, or regulatory concerns. Here’s what you need to know:

Key Facts About HighRiskPay.com:

- 99% approval rate for high-risk businesses

- 24-48 hour approval timeline

- A+ BBB rating maintained since 2014

- 4.8/5 stars on Trustpilot from 52 users

- No setup fees or application costs

- Next-day funding available

If you’re running a business in industries like CBD, travel, tech support, or e-commerce and can’t get approved elsewhere, you’re not alone. Traditional processors like PayPal, Square, and Stripe typically don’t work with high-risk businesses due to their restrictive policies.

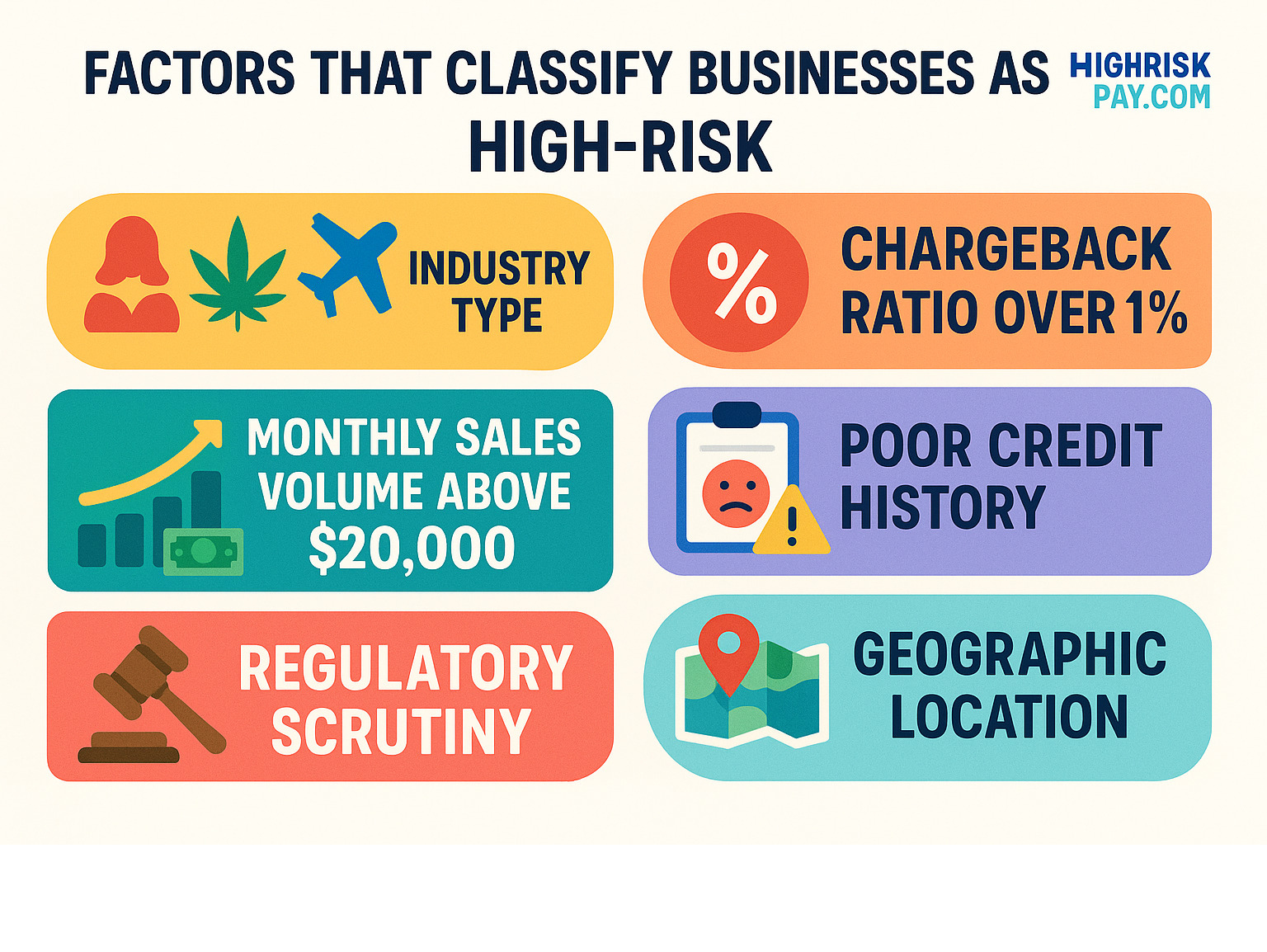

What makes a business “high-risk”? Payment processors flag businesses based on several factors: industry type, chargeback rates over 1%, high transaction volumes ($20,000+ monthly), bad credit history, or operating in heavily regulated sectors.

The reality is simple – high-risk doesn’t mean bad business. It just means you need specialized payment processing that understands your industry’s unique challenges.

HighRiskPay.com positions itself as a solution for these underserved businesses, offering merchant accounts when others say no. But like any financial decision, it’s important to understand both the benefits and potential drawbacks before applying.

Explore more about high risk merchant account at highriskpay.com:

Exploring a High Risk Merchant Account at HighRiskPay.com: Services and Industries

Getting turned down by banks and payment processors can feel like hitting a brick wall. That’s where HighRiskPay.com comes in – they specialize in helping businesses that others won’t touch.

Think of a high risk merchant account at highriskpay.com as your financial lifeline when traditional processors slam the door shut. Whether you’re selling CBD products, running a tech support company, or operating in the travel industry, these folks understand that “high-risk” doesn’t mean “bad business.”

What makes HighRiskPay.com stand out? Their 99% approval rate is pretty impressive – even if your credit looks like it went through a blender. Most merchants get approved within 24 to 48 hours, which means you’re not sitting around twiddling your thumbs while your business bleeds money.

The company has maintained an A+ BBB rating since 2014 and scores 4.8 out of 5 stars on Trustpilot from real customers. That’s the kind of track record that gives you confidence when you’re trusting someone with your business payments.

Here’s what really caught our attention: no setup fees, no application costs, and no long-term contracts. Plus, they offer next-day funding, so you’re not waiting weeks to access your own money.

For more insights on navigating today’s financial landscape, check out our fintech guides.

Key Services and Features Offered

HighRiskPay.com isn’t just about saying “yes” when others say “no” – they actually deliver the tools you need to run your business smoothly.

Their payment gateway integration works with most e-commerce platforms. It might not be as simple as clicking one button, but it gets the job done reliably. For online stores, their e-commerce processing handles transactions without the headaches you’d face elsewhere.

Beyond credit cards, they offer ACH and eCheck processing. These options often come with lower fees, which can add up to real savings over time. Smart business owners love having multiple payment options for their customers.

Chargeback prevention tools are where things get serious. High-risk businesses face more disputes, and HighRiskPay.com provides essential tools to fight back. Their fraud protection measures help catch suspicious transactions before they become expensive problems.

Need flexibility? Their mobile processing capabilities let you take payments anywhere, while virtual terminals handle phone and mail orders like a champ. Perfect if you’re running a call center or taking orders over the phone.

For businesses serving customers worldwide, international support opens up global markets. And when something goes wrong (because it always does), their live customer support via email and phone means you talk to real humans, not chatbots.

Industries Catered to by HighRiskPay.com

The beauty of HighRiskPay.com lies in their willingness to work with businesses that make traditional banks nervous. They’ve built their reputation serving industries that others avoid.

E-cigarettes and vaping companies find a welcome home here, as do businesses in the pharmaceuticals and health supplements space – including those operating in worldwide marketplaces for health supplements. Tech support companies, which often face scrutiny due to industry reputation issues, get the processing solutions they need.

The CBD and hemp industry gets special attention here. HighRiskPay.com offers non-aggregated accounts, giving you full control over your finances without worrying about sudden closures or frozen funds. That’s huge in an industry where processors disappear overnight.

Adult entertainment and online gaming businesses find reliable processing here, as do travel agencies dealing with the constant threat of chargebacks from cancelled bookings. Subscription services with recurring billing get the specialized handling they require.

Even trickier industries like credit repair, debt collection, and firearms dealers (FFL) get custom solutions. Multi-level marketing companies, dropshipping operations, and sellers of glassware and tobacco products all find processing options.

Don’t forget about nonprofits, startups, and high-volume businesses – even these can be considered high-risk depending on their specific situations. And if you’re dealing with bad credit, HighRiskPay.com’s 99% approval rate means there’s light at the end of the tunnel.

This wide range shows that HighRiskPay.com isn’t just picking and choosing easy accounts – they’re genuinely committed to serving businesses that traditional financial institutions ignore.

The Application and Approval Journey with HighRiskPay.com

Getting approved for a high risk merchant account at highriskpay.com might seem daunting, but their process is actually more straightforward than you’d expect. Think of it like applying for a loan – they need to understand your business before they can help you.

The underwriting team looks at several key areas when reviewing your application. First, they’ll examine your financial stability by reviewing your bank statements and cash flow patterns. They want to see that your business can handle the ups and downs of payment processing.

Next comes your processing history evaluation. If you’ve worked with other payment processors before, they’ll want to know how that went. High chargeback rates or account terminations are red flags, but don’t worry – they’re more understanding than traditional processors.

Finally, there’s the fraud management assessment. They’ll look at your business model, website, and industry to determine what fraud prevention tools you’ll need. This isn’t about judging your business – it’s about protecting both you and them from potential problems.

You can learn more about their approach at HighRiskPay.com’s underwriting process.

The Application Process for a high risk merchant account at highriskpay.com

The journey to getting your merchant account starts with filling out their online form. This isn’t your typical two-minute signup – expect to spend about 15-20 minutes providing detailed information about your business, products, and expected processing volumes.

Once you hit submit, the real work begins with submitting your documents. This is where many applications get delayed, so having everything ready beforehand makes a huge difference. The underwriting team needs these documents to verify everything you’ve told them about your business.

The risk assessment by underwriters happens next. Real people (not just algorithms) review your application and documents. They’re looking for red flags, but they’re also trying to understand your business model and find ways to make the partnership work.

During the follow-up and communication phase, don’t be surprised if someone calls or emails with questions. This is actually a good sign – it means they’re taking your application seriously. Being responsive and honest during these conversations can make or break your approval.

After approval comes the post-approval setup phase. You’ll work with their technical team to integrate the payment gateway with your website or point-of-sale system. They’ll also help you set up fraud prevention tools and chargeback management systems.

Finally, you’ll go live and start processing payments. Most merchants see their first funds within 24-48 hours of their first transaction, though this can vary based on your risk level and account terms.

Required Documentation for a Smooth Approval

Having the right paperwork ready can turn a week-long approval process into a 24-hour one. Start with a government-issued ID for all business owners – driver’s license or passport works fine.

You’ll need proof that your business is legitimate through a business license or registration. If you’re a sole proprietor, your DBA filing usually suffices.

Banking verification comes through either a voided business check or bank letter. This confirms where you want your funds deposited and helps prevent fraud.

Your 3-6 months of bank statements tell the story of your business’s financial health. They’re looking for consistent deposits, reasonable expenses, and overall stability. Don’t worry if you have some rough months – they understand that businesses have ups and downs.

If you’ve processed payments before, your prior processing statements are incredibly valuable. These show your chargeback ratios, processing volumes, and account history. Even if your previous processor terminated your account, being upfront about it is better than trying to hide it.

A solid business plan helps, especially for newer businesses. You don’t need a 50-page document – just something that clearly explains what you do, who your customers are, and how you plan to grow.

Finally, your website needs clear refund and privacy policies. This isn’t just paperwork – it’s your first line of defense against chargebacks and disputes.

Approval Timelines and the “Instant Approval” Promise

HighRiskPay.com advertises approval within 24-48 hours, and our research shows they generally deliver on this promise. This speed is impressive in the high-risk processing world, where some providers take weeks to make decisions.

However, several factors can affect your timeline. Incomplete documentation is the biggest delay culprit. Missing a bank statement or having an unclear business license can add days to your approval.

Complex business models also take longer to review. If you’re doing something unique or operating in multiple industries, expect additional questions and potentially longer review times.

Here’s something important to understand about “instant approval” – there’s a difference between real underwriting and conditional approval. Some companies offer instant approval without actually reviewing your documents or understanding your business. This might sound great, but it often leads to problems later.

HighRiskPay.com’s approach involves actual human review, which takes time but provides more stability. They’re not just rubber-stamping applications – they’re building long-term partnerships.

Be cautious of un-vetted “instant” approvals from any processor. If someone approves you in minutes without asking questions or reviewing documents, they probably haven’t done proper risk assessment. This can lead to account holds, fund freezes, or sudden terminations when they finally review your account activity.

The best approach is to be patient with the process. A thorough 48-hour review is much better than a 5-minute approval that causes problems later.

Weighing the Pros, Cons, and Costs

Let’s be honest – getting a high risk merchant account at HighRiskPay.com isn’t a decision you should make lightly. Like any business choice, it comes with both exciting advantages and important considerations you need to think through.

The good news? HighRiskPay.com really does deliver on some impressive promises. That 99% approval rate isn’t just marketing fluff – they genuinely help businesses that have been turned down everywhere else. If you’ve been struggling to find payment processing because of bad credit or your industry type, this could be your lifeline.

The fast funding is another major win. Getting your money the next day instead of waiting weeks can make a huge difference for cash flow, especially when you’re trying to grow your business. And those no setup fees and no contract claims? That’s real money saved upfront and flexibility you won’t get with many other providers.

But here’s where things get a bit tricky. HighRiskPay.com doesn’t publish their pricing openly on their website, which means you’ll need to call or email to get the full picture. This isn’t necessarily a red flag – many high-risk processors do this because pricing varies so much by industry – but it does mean you can’t comparison shop as easily.

There’s also the reality of rolling reserves. This is where they hold back a percentage of your sales for a period to protect against chargebacks. It’s standard in high-risk processing, but it can impact your cash flow. Finally, their analytics and reporting tools might feel more basic compared to some of the flashier fintech platforms out there.

Understanding the Fees for a high risk merchant account at highriskpay.com

Here’s where the rubber meets the road – understanding exactly what you’ll pay for your high risk merchant account at HighRiskPay.com. The pricing structure isn’t one-size-fits-all, and that’s actually a good thing because it means they’re tailoring rates to your specific situation.

Transaction fees start at what they advertise as 1.79% plus $0.25 per transaction. But here’s the catch – that’s typically for lower-risk retail businesses with good credit. If you’re in a higher-risk industry like CBD, adult entertainment, or travel, you’re looking at rates that can start around 2.95% plus $0.25 and potentially climb to 4% to 6% depending on your specific risk profile.

The monthly minimum fee starts at just $9.95, which is pretty reasonable. But remember, if you’re not processing enough volume to hit that minimum in transaction fees, you’ll pay the difference.

Chargeback fees are where things can get expensive quickly. Expect to pay anywhere from $20 to $100 per chargeback, depending on your agreement. This is why having solid customer service and clear return policies is so important.

The rolling reserve is probably the biggest surprise for new merchants. HighRiskPay.com typically holds back 5% to 10% of your sales for 90 to 180 days. Think of it as a security deposit that protects them (and ultimately you) from potential chargebacks and disputes.

Before you sign anything, absolutely request a complete fee schedule. Don’t just ask for the highlights – get every fee, every percentage, and every condition in writing. This isn’t being difficult; it’s being smart.

Chargeback and Fraud Management

Chargebacks are like the boogeyman of high-risk processing – they’re scary, but understanding how HighRiskPay.com handles them can help you sleep better at night.

HighRiskPay.com offers chargeback prevention tools, but let’s be clear about what this means. They’re not miracle workers who can eliminate all chargebacks. Instead, they provide monitoring services that can alert you to potential issues before they become full disputes.

Here’s how their account monitoring works: They’re constantly watching your chargeback ratio. If it starts climbing above 1% to 2% of your total transactions, you’re entering dangerous territory. At this point, they might freeze your funds temporarily, increase your rolling reserve, or in worst-case scenarios, terminate your account entirely.

The impact of high chargeback rates can’t be overstated. It’s not just about the individual chargeback fees – it’s about the risk of losing your ability to process payments altogether. This is why HighRiskPay.com takes this so seriously.

But here’s the reality check: merchant responsibility is huge here. HighRiskPay.com can provide tools and monitoring, but you’re the one who needs to have crystal-clear refund policies, responsive customer service, and accurate billing descriptors. The best chargeback prevention tool is a happy customer who doesn’t dispute their charge in the first place.

Is HighRiskPay.com a Legitimate and Reliable Choice?

This is probably the question keeping you up at night, and it’s a fair one. The high-risk processing world has its share of questionable operators, so let’s look at the facts.

HighRiskPay.com has been around for over a decade, which in the fast-moving world of payment processing is actually quite impressive. They’ve maintained an A+ rating with the Better Business Bureau since 2014 – that’s not something you can fake or buy your way into.

Their 4.8-star rating on Trustpilot from 52 users tells a consistent story of satisfied customers. While 52 reviews isn’t massive, the consistency of positive feedback is encouraging.

As an Independent Sales Organization (ISO), HighRiskPay.com operates within the standard structure of the payment processing industry. They’re not trying to reinvent the wheel – they’re working within established partnerships with acquiring banks to get your business approved where others won’t.

The fact that they can offer next-day funding and serve such a wide range of high-risk industries suggests they have solid relationships with reputable acquiring banks. This isn’t something fly-by-night operators can pull off.

Source: StockCake

The bottom line? While no payment processor is perfect, HighRiskPay.com appears to be a legitimate, reliable option for businesses that need a high risk merchant account at highriskpay.com. Their track record suggests they’re in this for the long haul, not looking to make a quick buck and disappear.

Key Factors for Choosing Any High-Risk Processor

When you’re shopping for a high risk merchant account at highriskpay.com or any other processor, it’s easy to get caught up in flashy promises and quick approvals. But here’s the thing – choosing the wrong processor can be more expensive than not processing payments at all.

Think of it like buying a car. You wouldn’t just look at the sticker price, right? You’d want to know about reliability, hidden fees, and what happens when something breaks down. The same logic applies to high-risk payment processing.

Industry experience should be your first checkpoint. Does the processor actually understand your business? A company that’s helped hundreds of CBD retailers will know the regulatory landscape better than one that’s only worked with tech support companies. This expertise can mean the difference between smooth sailing and constant account headaches.

Fee transparency is where many merchants get burned. If a processor won’t give you a complete fee breakdown upfront, that’s a red flag waving in the wind. You need to know about transaction fees, monthly minimums, chargeback costs, and any reserve requirements. Hidden fees have a nasty habit of showing up on your first statement.

Chargeback support can make or break your business. High-risk industries face more disputes – that’s just reality. Look for processors that offer robust fraud prevention tools, chargeback alerts, and dispute management services. Some even provide representment services to fight unfair chargebacks on your behalf.

Integration flexibility matters more than you might think. Your payment processor needs to play nicely with your existing systems. Whether you’re running Shopify, WooCommerce, or a custom platform, seamless integration saves you time and reduces technical headaches.

Customer service quality becomes crucial when things go sideways. And in high-risk processing, things do go sideways sometimes. You want real humans answering phones, not endless chatbots or ticket systems that take days to respond.

| Essential Feature | What to Look For | Why It Matters |

|---|---|---|

| Industry Experience | 5+ years serving your specific vertical | Understands unique challenges and regulations |

| Fee Transparency | Complete pricing disclosed upfront | No surprise costs on monthly statements |

| Chargeback Support | Prevention tools and dispute management | Keeps your account in good standing |

| Integration Flexibility | Works with your current platform | Smooth operations without technical issues |

| Customer Service | Live phone and email support | Quick resolution when problems arise |

Scalability is something many merchants overlook initially. You might be processing $10,000 monthly now, but what happens when you hit $100,000? Some processors impose volume caps or require lengthy reviews for growth. Others accept scaling businesses and adjust terms accordingly.

The reality is that high risk merchant account at highriskpay.com options should be evaluated against these same criteria. While HighRiskPay.com checks many of these boxes with their industry experience and customer support, every business has unique needs.

What to Do if Your Application is Denied

Getting denied for a merchant account feels like a punch to the gut, especially when you’re eager to start processing payments. But don’t panic – denials happen more often than you’d think, and they’re rarely permanent roadblocks.

Common denial reasons usually fall into predictable categories. Your business model might be unclear to underwriters, or there could be mismatched information between your application and supporting documents. Sometimes you’re simply in an industry the processor doesn’t support, even if they claim to work with “all high-risk businesses.”

Unclear business models trip up many applicants. If underwriters can’t quickly understand how you make money, where your customers come from, or what exactly you’re selling, they’ll often choose the safe route and deny the application. This is especially common with newer business models or complex revenue streams.

Mismatched information is another frequent culprit. Maybe your business name on the bank account doesn’t exactly match your legal entity, or your website shows different contact information than your application. These inconsistencies raise red flags about legitimacy.

Unsupported industries can catch merchants off guard. A processor might advertise high-risk acceptance but still have internal restrictions on certain verticals. Adult entertainment, cryptocurrency, and some MLM models face this challenge regularly.

When denial happens, how to pivot becomes your next priority. Start by requesting specific feedback about why you were rejected. Most processors will provide general reasons, though they might not give detailed explanations for security purposes.

Correcting documentation often solves the problem. Update any inconsistent information, gather missing documents, or clarify confusing aspects of your business model. Sometimes it’s as simple as rewriting your business description to be clearer.

Reapplying after addressing issues usually works better than immediately jumping to another processor. If you fix the underlying problems, the same company that denied you might approve you on the second try. This shows you’re responsive to feedback and serious about compliance.

Seeking expert advice can be worthwhile if you’re facing repeated denials. Payment processing consultants understand what underwriters look for and can help position your application more effectively. Sometimes an outside perspective reveals blind spots you’ve been missing.

Every denial teaches you something about how processors evaluate risk. Use that knowledge to strengthen your next application, whether it’s with the same company or a different provider.

Frequently Asked Questions about HighRiskPay.com

Getting a high risk merchant account at HighRiskPay.com can feel overwhelming, especially when you’re dealing with rejection after rejection from other processors. Let’s tackle the most common questions we hear from business owners just like you.

Can I get an account at HighRiskPay.com with bad credit or no processing history?

Here’s some good news – yes, you absolutely can! HighRiskPay.com built their entire business around helping merchants that others won’t touch. Their 99% approval rate isn’t just marketing speak; they genuinely work with businesses that have severe credit issues.

Bad credit doesn’t automatically disqualify you. In fact, HighRiskPay.com specifically advertises “Bad Credit OK” as one of their key features. This is a refreshing change from traditional banks that slam the door shut the moment they see a less-than-perfect credit score.

If you’re a brand-new business without any processing history, don’t worry – you can still apply. However, expect the underwriters to be a bit more cautious with your account initially. They might start you with lower monthly processing limits or require a slightly higher rolling reserve until you prove you can manage transactions responsibly.

This extra scrutiny isn’t personal – it’s just smart business. Once you demonstrate consistent, low-risk performance over a few months, these restrictions typically get relaxed or removed entirely.

What happens if my chargeback rate gets too high after approval?

This is probably the most important question you can ask, because chargebacks are the biggest threat to any high risk merchant account at HighRiskPay.com. Even after you’re approved and processing payments, the monitoring never stops.

HighRiskPay.com watches your chargeback ratio like a hawk. If it climbs above acceptable levels – usually somewhere between 1% to 2% of your total transactions – they’ll take action quickly. The consequences can be serious.

You might wake up to find your funds frozen temporarily while they investigate. Or they could increase your rolling reserve percentage, meaning they hold back more of your money for longer periods. In the worst-case scenario, persistent high chargeback rates can lead to account termination.

The key takeaway? Chargeback management isn’t something you deal with later – it’s something you need to focus on from day one. Clear billing descriptors, excellent customer service, and transparent refund policies are your best defense against chargebacks.

Are there any long-term contracts or cancellation fees?

One of HighRiskPay.com’s biggest selling points is their “No Contract” promise. This means you shouldn’t be locked into a multi-year agreement that’s impossible to escape. They also advertise “No Application Fee” and “No Setup Fee,” which eliminates those annoying upfront costs.

But here’s our honest advice – always read the fine print. While HighRiskPay.com promotes contract-free service, merchant agreements can be complex documents with various terms and conditions. Some processors use creative language where technically there’s “no contract,” but other fees or conditions might apply.

Before you sign anything, take the time to read through the entire merchant agreement. Look specifically for any mention of early termination fees, account closure procedures, or other costs that might not be obvious upfront. It’s better to ask awkward questions now than deal with surprises later.

The “no contract” feature is genuinely valuable in the high-risk space, where business needs can change quickly. Just make sure you understand exactly what it means for your specific situation.

Final Thoughts on Securing Your High-Risk Merchant Account

If you’ve made it this far, you’re well on your way to understanding the complex world of high-risk payment processing. The reality is that securing a high risk merchant account at HighRiskPay.com can be a game-changer for businesses operating in challenging industries.

HighRiskPay.com’s value proposition is compelling – their 99% approval rate, next-day funding, and willingness to work with businesses that others reject makes them stand out in a crowded field. The A+ BBB rating they’ve maintained since 2014 and their solid 4.8-star Trustpilot rating suggest they’re doing something right for their customers.

But here’s the thing – getting approved is just the beginning of your journey. The real work starts after you’re live and processing payments. We can’t stress enough how important it is to do your homework upfront. Know your fees, understand any rolling reserve requirements, and get everything in writing before you sign on the dotted line.

Managing chargebacks proactively isn’t just good business practice – it’s essential for keeping your merchant account healthy. High chargeback rates can quickly turn your payment processing dreams into a nightmare of frozen funds and account termination. Excellent customer service, clear billing descriptors, and transparent refund policies aren’t optional extras – they’re your lifeline.

The balance between fast approval and long-term stability is delicate. While HighRiskPay.com’s quick turnaround times are attractive, make sure that speed doesn’t come at the cost of proper underwriting. A thorough review process, though it might take a bit longer, often leads to more stable, long-term relationships.

The high-risk payment processing world moves fast, and staying informed is crucial. Regulations change, industry standards evolve, and what works today might not work tomorrow. That’s why we’re committed to keeping you updated with the latest insights and trends.

At Carnews4you.com, we believe in empowering you with clear, practical information that helps you make smart financial decisions. Whether you’re navigating cryptocurrency markets, exploring fintech solutions, or securing payment processing for your high-risk business, we’re here to guide you through the complexity with straightforward, actionable advice.

Your business deserves payment processing that works as hard as you do. With the right preparation and the right partner, that high risk merchant account at HighRiskPay.com could be exactly what you need to take your business to the next level.

Ready to explore beyond payments? Explore our guides on adventure vehicles and find what other exciting topics we cover.