Fintechzoom.com Bitcoin Mining: Maximize Profit 2024

What is Bitcoin Mining and Why is Everyone Talking About It?

Bitcoin mining has become one of the hottest topics in digital finance, and for good reason. Bitcoin just hit another milestone that caught Wall Street off guard, with its market cap exceeding $1.2 trillion and trading volumes reaching $7.65 billion.

Quick Answer: What You Need to Know About Bitcoin Mining:

- Mining Basics: Bitcoin mining validates transactions on the blockchain using powerful computers to solve complex mathematical problems

- Equipment Needed: Specialized ASIC miners costing $3,000-$20,000, plus electricity (500-1500 watts per rig)

- Profitability: Depends on electricity costs (ideally under $0.05/kWh), Bitcoin price, and mining difficulty

- Getting Started: Join mining pools, use mining calculators, and stay informed about market trends

- 2024 Reality: Solo mining is nearly impossible – most miners join pools for consistent rewards

Bitcoin mining is the backbone of the Bitcoin network. It’s how new bitcoins are created and transactions get verified. Think of miners as digital gold prospectors using high-powered computers instead of pickaxes.

Here’s what makes this so interesting right now: Bitcoin’s market dominance has hit a 2-year high, and institutional investors are paying attention. The U.S. alone contributes 38% of the global hash rate, making it a hotbed for mining activity.

But here’s the reality check – mining isn’t free money. As one industry expert noted, “while software can be free, mining requires investment in hardware and electricity.” The days of mining Bitcoin on your laptop are long gone.

The good news? Platforms are making it easier to understand this complex world. From real-time profitability calculators to beginner-friendly guides, the resources available today help newcomers steer everything from hardware selection to pool fees.

Relevant articles related to Bitcoin mining:

Understanding the Fundamentals of Crypto Mining

Let’s pull back the curtain on Bitcoin mining and see what’s really happening behind all those flashing lights and humming machines.

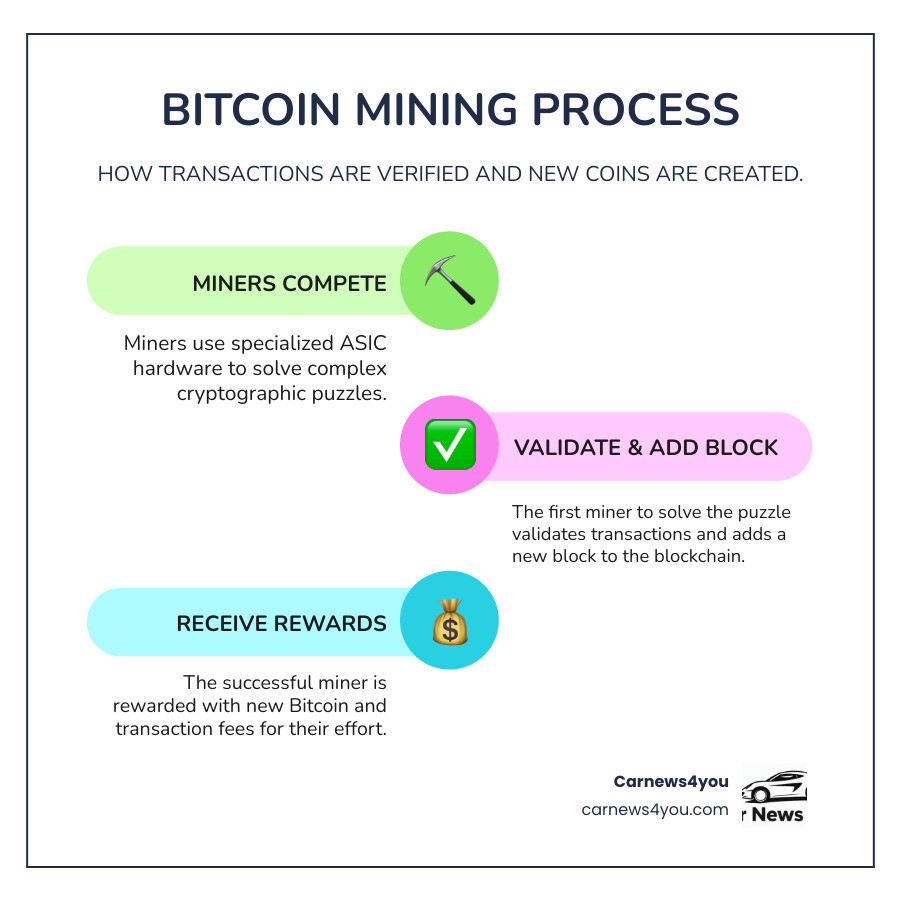

Think of crypto mining like a global treasure hunt that never ends. Every 10 minutes, thousands of powerful computers around the world compete to solve an incredibly complex math puzzle. The winner gets to do two important jobs: validate a batch of Bitcoin transactions and add them to the blockchain – that permanent digital ledger we keep hearing about.

Here’s where it gets interesting. The winner doesn’t just get bragging rights. They earn freshly minted Bitcoin as a reward – currently 3.125 BTC per block after the April 2024 halving event. At today’s prices, that’s a pretty nice payday for solving a math problem!

This whole process is called Proof of Work, and it’s absolutely brilliant in its simplicity. By making these puzzles computationally expensive to solve, Bitcoin creates an unbreakable security system. Think about it – if someone wanted to cheat the system, they’d need more computing power than the rest of the world combined. That’s practically impossible.

The network is smart too. If more miners join the party and puzzles start getting solved too quickly, the mining difficulty automatically adjusts to keep that 10-minute schedule. It’s like having a thermostat for the entire Bitcoin network.

But here’s the reality check: this security comes at a cost. The hardware requirements are serious, and the electricity consumption is substantial. As we always say, there’s no such thing as a free lunch in crypto mining. Understanding Bitcoin explained gives you the full picture, and for broader economic context, check out More info about the economy.

Key Hardware and Software

When you’re ready to dive into Bitcoin mining, you’ll quickly find this isn’t your typical computer setup. We’re talking about specialized equipment that’s built for one thing: mining Bitcoin as efficiently as possible.

Mining devices are where the magic happens. For Bitcoin, you’ll need ASIC miners – that stands for Application-Specific Integrated Circuits. These aren’t your everyday computers; they’re purpose-built machines that eat, sleep, and breathe Bitcoin mining. While GPU mining (using graphics cards) works great for other cryptocurrencies, it simply can’t compete with ASICs for Bitcoin anymore. As for CPU mining using your regular computer processor? Those days are long gone.

Once you’ve got your hardware, you’ll need mining software to make it all work together. Programs like CGMiner or BFGMiner act as the bridge between your ASIC miner, the Bitcoin network, and your chosen mining pool. This software keeps track of everything – your performance, your earnings, and your connection to the network.

Here’s something many newcomers overlook: cooling systems. These mining rigs generate serious heat – imagine running a small space heater 24/7. Without proper cooling, whether that’s industrial fans, special cooling liquids, or just really good ventilation, your expensive equipment will overheat and fail.

Finally, you’ll need a crypto wallet – your digital bank account for storing those hard-earned Bitcoin rewards. Security here is absolutely critical.

| Mining Device Type | Description | Bitcoin Mining Suitability | Common Use Cases |

|---|---|---|---|

| ASIC | Application-Specific Integrated Circuit; highly specialized for one algorithm | Excellent (most efficient) | Bitcoin, Litecoin, other specific PoW coins |

| GPU | Graphics Processing Unit; versatile, less specialized than ASICs | Poor (not competitive) | Ethereum (before PoS), Monero, Ravencoin, other altcoins |

| CPU | Central Processing Unit; general-purpose computer processor | Obsolete | Very early Bitcoin mining, some obscure, low-difficulty coins |

The Costs Involved: More Than Just a Computer

Let’s talk money – because Bitcoin mining requires a serious financial commitment that goes way beyond buying a computer.

Your biggest upfront cost is hardware investment. A single quality ASIC miner runs anywhere from $3,000 to $20,000, and most serious miners need multiple units. Some enterprise setups can cost over $100,000. This isn’t pocket change we’re talking about.

Then comes the ongoing reality of electricity consumption. Bitcoin mining is incredibly energy-hungry. A typical mining rig uses 500-1500 watts continuously – that’s like running multiple refrigerators 24/7. To stay profitable, you ideally need electricity costs under $0.05 per kWh. This is why location matters so much in mining success.

Don’t forget about pool fees either. Most miners join mining pools to get consistent payouts, and these pools charge 1-3% of your earnings. It’s worth it for the steady income, but it’s still a cost to factor in.

Maintenance costs are another reality. High-performance equipment breaks down, parts wear out, and technology becomes obsolete. You’ll need budget for repairs and eventual upgrades to stay competitive.

Even your internet connection matters. You need stable, fast internet to keep your miners connected to the network. Any downtime means lost earning potential.

So when people ask “is crypto mining free?” – the answer is definitely no. While some software might be free to download, the investment in hardware and electricity is substantial. This is a capital-intensive business that requires careful planning and realistic expectations about costs and returns.

Getting Started with Bitcoin Mining: A Step-by-Step Guide

The world of Bitcoin mining doesn’t have to feel overwhelming. It’s complex, but with the right approach and reliable resources, you can steer this exciting landscape with confidence. Think of it like learning to drive – intimidating at first, but totally manageable once you understand the basics.

What you really need is a clear platform overview, easy-to-follow guides, real-time data, and solid market analysis. These aren’t just nice-to-haves – they’re your lifeline in a world where Bitcoin’s price can swing dramatically overnight. The key is finding resources that break down complex concepts into digestible pieces, helping you make informed decisions rather than educated guesses.

Speaking of market insights, understanding the broader financial landscape is crucial for any mining venture. That’s why we recommend checking out More info about markets to get a fuller picture of what you’re stepping into.

Why Use Carnews4you for Bitcoin Mining Insights?

Here’s the thing – the crypto world is full of noise. Everyone’s got an opinion, and not all of them are worth your time. At Carnews4you, we cut through that noise to bring you expert analysis that actually matters. We’re not just throwing around technical jargon to sound smart; we’re focused on giving you the practical knowledge you need to succeed.

Our comprehensive guides take complex mining concepts and make them accessible. Whether you’re trying to understand hash rates or figuring out which mining pool to join, we’ve got your back. We also provide mining profitability calculators and hardware reviews that help you make smart financial decisions – because let’s face it, nobody wants to spend $15,000 on equipment only to find out it won’t pay for itself.

But here’s what really sets us apart: we keep you updated on news and trends that directly impact your mining operation. When Bitcoin’s mining difficulty adjusts or when new regulations emerge, you’ll know about it. And for those thinking long-term, understanding market predictions can help you plan your mining strategy more effectively.

We believe in bridging the gap between complex financial data and real-world action. After all, what good is information if you can’t use it?

A Beginner’s Walkthrough

Ready to get your hands dirty? Here’s your roadmap to starting your Bitcoin mining journey. Don’t worry – we’ll walk through this together, step by step.

First, do your homework by researching thoroughly. Before you spend a dime, dive deep into understanding what you’re getting into. Use reliable guides and articles to grasp the basics, costs, risks, and potential rewards. This isn’t the time to rush – think of it as building your foundation. The more you understand upfront, the fewer expensive mistakes you’ll make later.

Next, focus on choosing the right hardware. For Bitcoin mining, you’re looking at ASIC miners – those specialized machines we talked about earlier. Compare different models by looking at their hash rates, power consumption, and price points. The most expensive option isn’t always the most profitable, especially if your local electricity rates are high. Do the math before you buy.

Then, set up a secure wallet. You’ll need somewhere safe to receive and store your mined Bitcoin. Hardware wallets offer the best security, though software wallets work fine for smaller amounts. Here’s a crucial tip: back up your wallet properly and keep your private keys safe. Lose those, and you lose your Bitcoin forever – no customer service can help you there.

Consider joining a mining pool next. Unless you’re planning to invest hundreds of thousands in equipment, solo mining Bitcoin is like buying lottery tickets – technically possible to win big, but not a reliable strategy. Mining pools let you combine your computing power with other miners, giving you more consistent (though smaller) payouts. Look for pools with reasonable fees and good reputations.

Finally, monitor your profitability religiously. Mining isn’t passive income – it requires active management. Bitcoin’s price fluctuates, mining difficulty adjusts, and electricity costs can change. Use profitability calculators to track whether your operation is making money, and be prepared to adjust your strategy when market conditions shift.

The key to success in Bitcoin mining isn’t just having the right equipment – it’s staying informed and adapting to an ever-changing landscape.

Strategies, Profitability, and Risks in 2024

The landscape of Bitcoin mining in 2024 is like navigating a thrilling rollercoaster – exciting potential rewards paired with real challenges that require your full attention. Let’s be honest about what you’re facing this year.

Market volatility continues to be the elephant in the room. Bitcoin’s price swings can turn your profitable mining operation into a money pit overnight. One day you’re celebrating record-high Bitcoin prices, and the next day you’re watching a 20% correction eat into your margins. This isn’t just theoretical – it directly impacts your bottom line every single day.

Regulatory risks are becoming increasingly complex. While Bitcoin mining remains legal in most regions including the U.S., the rules keep changing. Some countries have completely banned mining operations, while others are rolling out new tax requirements or environmental regulations. Even within the U.S., different states have varying approaches to mining operations.

Then there’s hardware obsolescence – the silent profit killer. The mining hardware you buy today might be outdated faster than you think. New, more efficient ASIC miners hit the market regularly, and if you’re not keeping up, your older equipment becomes less competitive. It’s like trying to race a Formula 1 car with last year’s model.

For context on how major events shape the mining landscape, understanding More info about the Bitcoin Halving is crucial for any serious miner.

Maximizing Your Mining Profits

Smart miners don’t just plug in their rigs and hope for the best. They develop strategies that work even when market conditions get tough.

Choosing the right crypto to mine starts with understanding your equipment capabilities. For Bitcoin, ASIC miners are your only viable option. But here’s something many newcomers miss – you need to research which specific Bitcoin mining pools are most profitable based on your hash rate and location.

Joining mining pools isn’t optional anymore; it’s essential. Solo mining Bitcoin today is like buying a single lottery ticket and expecting to win. Mining pools like Foundry USA, AntPool, and F2Pool combine your computational power with thousands of other miners. You’ll pay a 1-3% fee, but you’ll receive steady, predictable payouts instead of waiting potentially years for a solo block reward.

Energy efficiency strategies can make or break your operation. Location matters tremendously – if you’re paying more than $0.10 per kilowatt-hour for electricity, you’re already at a significant disadvantage. Many successful miners relocate their operations to regions with cheap power, sometimes as low as $0.03-0.05 per kWh.

Renewable energy is becoming increasingly popular, not just for environmental reasons but for cost savings. Solar panels, wind power, and hydroelectric setups can dramatically reduce your ongoing costs. Some miners even take advantage of off-peak electricity rates, running their most power-hungry operations during cheaper nighttime hours.

Staying informed with market news is your competitive advantage. Bitcoin’s price, network difficulty adjustments, and regulatory changes all impact your profitability. The miners who succeed are those who adapt quickly to changing conditions rather than just hoping things will work out.

Is Crypto Mining Worth It with Carnews4you Bitcoin Mining Insights?

This is the million-dollar question, and honestly, the answer depends entirely on your specific situation. At Carnews4you, we believe in giving you the complete picture so you can make informed decisions.

Profitability factors are interconnected in ways that might surprise you. Bitcoin’s price gets all the attention, but mining difficulty adjustments can be equally important. When Bitcoin’s price rises, more miners join the network, increasing difficulty and reducing everyone’s individual rewards. It’s a delicate balance that requires constant monitoring.

Your break-even analysis should include more than just hardware and electricity costs. Factor in cooling systems, internet connectivity, potential repairs, and the eventual need to upgrade your equipment. Most miners find their break-even point somewhere between 8-18 months, depending on these variables.

The long-term potential is where things get interesting. Bitcoin’s halving events historically create supply shocks that benefit existing miners, even though block rewards decrease. The most recent halving in April 2024 reduced rewards to 3.125 BTC per block, but many miners view this as bullish for Bitcoin’s long-term price.

Bitcoin halving impact extends beyond just reward reductions. These events often trigger increased institutional interest and media attention, potentially driving up Bitcoin’s price enough to offset the reduced mining rewards.

Our stance at Carnews4you on profitability is straightforward: Bitcoin mining can be profitable, but it requires careful planning, ongoing attention, and realistic expectations. It’s not passive income – it’s an active investment that demands your time and energy. We provide you with the tools and insights to evaluate whether mining fits your financial goals, but the final decision is always yours to make.

The miners who succeed in 2024 are those who treat it as a business, not a hobby. They monitor their operations daily, adapt to changing conditions, and always have an exit strategy if profitability disappears.

Frequently Asked Questions about Bitcoin Mining

When people look into Bitcoin mining, they naturally have questions. We’ve noticed the same inquiries coming up again and again, so let’s tackle the most common ones head-on. Think of this as your quick reference guide to clear up any confusion.

Is crypto mining free?

This is probably the biggest misconception out there. No, crypto mining is definitely not free. While you can download some mining software without paying a dime, that’s where the “free” part ends pretty quickly.

The reality is that Bitcoin mining requires serious upfront investment. You’re looking at thousands of dollars just for the specialized ASIC miners. Then comes the real kicker – electricity bills that can make your eyes water. These machines are power-hungry beasts, consuming anywhere from 500 to 1500 watts around the clock.

To put this in perspective, running a single mining rig is like having a small refrigerator that never turns off. Now imagine having several of them humming away in your garage 24/7. Your electricity meter will be spinning like a carnival ride, and your utility company will probably send you a thank-you card.

How long does it take to mine one Bitcoin?

Here’s where things get interesting – and a bit sobering. For someone mining solo with a single rig, it’s virtually impossible to mine a complete Bitcoin in any reasonable timeframe. We’re talking potentially thousands of years, and that’s not an exaggeration.

The mining difficulty has skyrocketed by an incredible 500,000% since Bitcoin’s early days in 2009. Back then, you could mine Bitcoin on your laptop while watching Netflix. Those days are long gone, my friend.

This is precisely why miners join pools instead of going it alone. When you contribute your hash power to a mining pool, you’re essentially joining forces with thousands of other miners. When the pool successfully mines a block, everyone gets a slice of the pie based on how much computing power they contributed.

Think of it like a lottery pool at work – instead of buying one ticket and hoping for the jackpot, everyone chips in to buy hundreds of tickets and shares any winnings. You get smaller but much more frequent payouts, which makes the whole venture far more predictable and manageable.

Is Bitcoin mining legal?

Yes, Bitcoin mining is perfectly legal in most places, including throughout the United States. However, the legal landscape isn’t exactly uniform everywhere, so it’s worth doing your homework.

Different states and countries have their own approaches to cryptocurrency mining. Some places roll out the red carpet for miners, especially those using renewable energy sources. Others have imposed strict regulations or even outright bans – China being the most notable example of the latter.

What you really need to pay attention to are the local regulations around energy consumption, environmental impact, and tax implications. Some jurisdictions have specific rules about how much power you can draw or require special permits for commercial mining operations.

The tax side is particularly important. Mining rewards are typically considered taxable income, and the rules around depreciation of mining equipment can get complex. We always recommend chatting with a local tax professional who understands cryptocurrency regulations in your area.

The bottom line? While mining is generally legal, the devil is in the details of your specific location’s rules and regulations.

Conclusion: The Future of Mining and Your Next Steps

As we wrap up our journey through Bitcoin mining, it’s amazing to think about how far this industry has come. What started as a hobby for tech enthusiasts has evolved into a multi-billion dollar industry that’s reshaping how we think about money and technology.

We’ve learned that mining isn’t just about making money – it’s the security backbone of the entire Bitcoin network. Every transaction you make, every Bitcoin that changes hands, relies on miners working around the clock to keep everything safe and verified. It’s pretty incredible when you think about it.

But let’s be honest about what we’ve found. This isn’t a get-rich-quick scheme. Successful mining requires serious planning, from choosing the right hardware to finding affordable electricity. The days of mining Bitcoin on your laptop are long gone, replaced by specialized machines that can cost more than a car.

The future looks fascinating though. Renewable energy is becoming a game-changer in the mining world. More operations are turning to solar farms, wind power, and hydroelectric sources – not just to cut costs, but to address environmental concerns. It’s exciting to see an industry that was once criticized for its energy use now leading the charge toward sustainable practices.

Artificial Intelligence is also making its mark. Smart systems are now helping miners optimize their operations, predict the best times to mine, and even manage equipment maintenance. Some experts predict that by 2030, these technological advances will favor larger, more sophisticated operations, but there’s still room for smaller players who stay informed and adapt quickly.

Here’s what really matters for your next steps: continuous learning is everything. The crypto space moves fast, and what’s profitable today might not be tomorrow. Bitcoin halving events, regulatory changes, and technological breakthroughs can all shift the landscape overnight.

That’s where we come in. At Carnews4you, we’re committed to being your trusted guide through these exciting but sometimes turbulent waters. We’ll keep bringing you the latest insights, market analysis, and practical advice to help you make smart decisions about Bitcoin mining.

Whether you’re just starting to research your first mining rig or you’re looking to expand your existing operation, knowledge is your most valuable asset. Stay curious, stay informed, and don’t be afraid to ask questions.

And hey, while you’re planning your mining investments and thinking about the future, don’t forget to enjoy the journey. When you’re ready to take a break from watching hash rates and checking Bitcoin prices, maybe it’s time for a camping trip. You can always Find the best vehicles for your next trip when you need a change of scenery.

The future of digital finance is unfolding right before our eyes, and you’re part of it. We’re here to help you steer every step of the way.