Fintechzoom.com dax40: Master DAX 40 Data

Why the DAX 40 Matters for Modern Investors

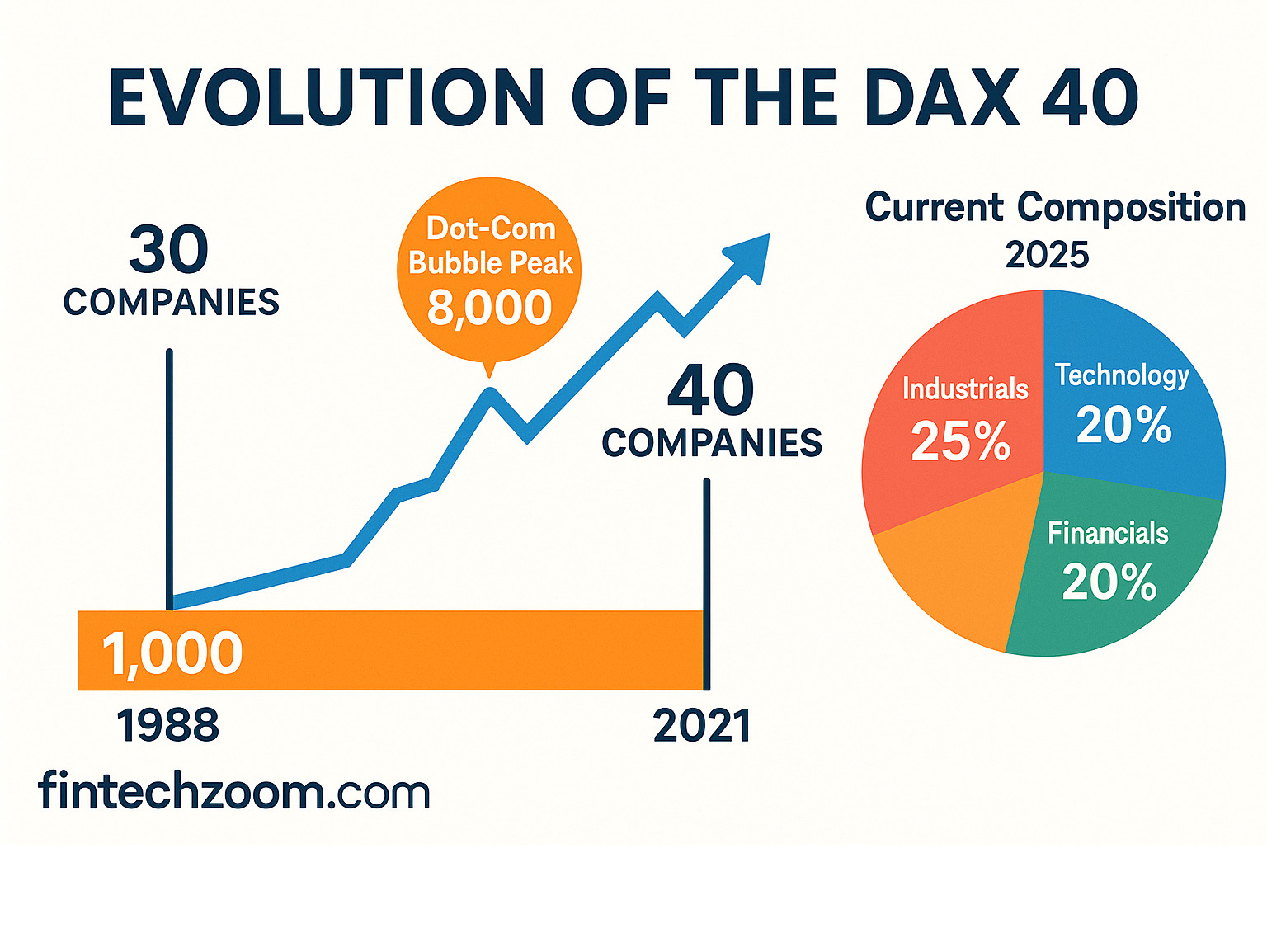

fintechzoom.com dax40 represents one of the most important financial benchmarks in Europe, tracking Germany’s 40 largest and most liquid companies on the Frankfurt Stock Exchange. This performance-based index serves as a barometer of Germany’s economic health and represents about 80% of the market capitalization of all German-listed companies.

Quick DAX 40 Overview:

- What it is: Germany’s premier stock market index of 40 blue-chip companies

- Key feature: Performance-based index that includes dividend reinvestment

- Market weight: Represents 80% of Frankfurt Stock Exchange market cap

- Top sectors: Industrials (25%), Technology (20%), Financial services (20%)

- Largest company: SAP with over €220 billion market capitalization

- Recent change: Expanded from 30 to 40 companies in September 2021

The DAX 40 stands out from other major indices because it’s a performance index rather than a price index. This means it automatically reinvests all dividends and capital gains from its constituent companies, giving investors a complete picture of total returns.

For investors seeking exposure to Europe’s largest economy, understanding the DAX 40 is essential. The index includes industrial giants like Siemens and Rheinmetall, technology leaders like SAP, and luxury brands that highlight Germany’s diverse economic strength.

The expansion from DAX 30 to DAX 40 in 2021 came partly as a response to the Wirecard scandal, with stricter inclusion criteria now requiring companies to maintain positive EBITDA for two fiscal years and a minimum 10% free float.

Find more about fintechzoom.com dax40:

The Anatomy of the DAX 40: Composition and Calculation

Let’s explore what makes the fintechzoom.com dax40 tick. Think of it as Germany’s economic all-star team – but instead of athletes, we’re talking about the country’s most powerful companies. This isn’t just a random collection of businesses thrown together. Every company in this index has earned its place through strict criteria and represents the beating heart of Europe’s largest economy.

What makes the DAX 40 special is how it’s calculated. Unlike some indices that only track stock prices, the DAX 40 is a performance-based index. This means when companies pay dividends, those payments get reinvested back into the calculation. It’s like getting compound interest on your investment tracking.

The index uses a free-float methodology, which sounds fancy but simply means it only counts shares that regular investors can actually buy and sell. Shares locked away by governments or controlling shareholders don’t count. This gives you a clearer picture of what’s really available in the market. For more detailed analysis and insights, check out our Car News 4 You Markets Insights.

History and Evolution of the DAX

The DAX started small but dreamed big. Back in 1988, it launched with a base value of 1,000 points and tracked just 30 companies. For over 30 years, these 30 companies were Germany’s corporate champions.

But times change, and so do markets. In September 2021, something big happened – the index expanded from 30 to 40 stocks. This wasn’t just about adding more companies for the sake of it. The expansion came partly because of the Wirecard scandal, which shook investor confidence and highlighted the need for better oversight.

Adding those extra 10 companies made the index stronger and more diverse. It’s like expanding your investment net to catch more opportunities while spreading out the risk.

Inclusion Criteria and Composition

Getting into the DAX 40 club isn’t easy – think of it as the VIP section of German business. Companies need to jump through several hoops to earn their spot.

First, they must be listed on Frankfurt Stock Exchange’s Prime Standard segment. This is where the big players hang out, with stricter reporting requirements and better transparency. Companies also need a minimum free float of 10%, ensuring there are enough shares floating around for investors to trade.

Here’s where it gets interesting – companies must show positive EBITDA for two straight years. EBITDA measures earnings before all the accounting adjustments, so it’s a good way to see if a company is actually making money from its core business.

The DAX 40 isn’t set in stone either. Every quarter, experts review the lineup to make sure it still represents the best of German business. When the index welcomed its ten new members, it marked a new chapter in how Germany measures its corporate success.

Top Companies and Sector Weighting

Now for the headliners – the companies that really move the needle when it comes to fintechzoom.com dax40 performance. Leading the pack is SAP, the software giant that’s become Germany’s most valuable company with a market cap of USD 267.24 billion.

Right behind SAP, you’ll find Siemens, the industrial powerhouse that’s been engineering solutions for over 170 years. Then there’s Allianz, one of the world’s largest insurance companies, and Airbus, which builds the planes that connect our world.

The beauty of the DAX 40 lies in its diversity. The industrials sector dominates with about 25% of the index weight – no surprise given Germany’s reputation for manufacturing excellence. The technology sector and financial services sector each claim around 20%, showing how Germany has evolved beyond just making things to also powering the digital economy.

| Company | Sector | Market Cap (Approx.) |

|---|---|---|

| SAP | Technology | €220+ billion |

| Siemens | Industrials | €120+ billion |

| Deutsche Telekom | Telecommunications | €120+ billion |

| Allianz | Financial Services | Varies |

| Airbus | Industrials | Varies |

This mix gives investors exposure to everything from cutting-edge software to traditional manufacturing, from financial services to telecommunications. It’s like owning a slice of Germany’s entire economic success story in one neat package.

Investing and Navigating the DAX 40: Methods and Strategies

So you understand what the DAX 40 is, but how do you actually invest in it? That’s where things get exciting. Whether you’re planning for retirement or looking for shorter-term opportunities, the fintechzoom.com dax40 offers several pathways to match your investment style and risk tolerance. Let’s walk through your options and explore some proven strategies that can help you steer this dynamic market. For comprehensive financial insights, remember to consult our Car News 4 You Financial Guides.

How to Gain Exposure to the DAX 40

Getting started with DAX 40 investing doesn’t have to be complicated. Think of it like choosing how to experience a city – you can take a guided tour that covers all the highlights, explore specific neighborhoods on your own, or try more adventurous approaches.

The “guided tour” approach involves Exchange-Traded Funds (ETFs) and mutual funds that track the entire DAX 40. This is probably the most beginner-friendly option because you instantly own a tiny piece of all 40 companies without having to research each one individually. It’s like buying a sampler platter instead of ordering individual dishes – you get to taste everything German business has to offer. These funds handle all the complicated stuff like rebalancing and dividend collection for you.

For those who prefer direct stock research and want to handpick their investments, buying individual DAX 40 companies is another route. Maybe you love BMW’s cars and believe in their electric vehicle future, or perhaps you think SAP’s software dominance will continue growing. This approach requires more homework but gives you complete control over your portfolio diversification. You can focus on sectors you understand or companies whose products you use daily.

More experienced investors might explore derivatives like CFDs, futures, or options. These tools let you amplify your exposure or bet on short-term price movements, but they’re definitely not for beginners. Think of them as the extreme sports of investing – thrilling but requiring serious skill and preparation.

Before diving deeper into any of these approaches, check out our Car News 4 You DAX 40 Resources for detailed guidance custom to your experience level.

Popular DAX 40 Market Approaches

Once you’ve decided how to invest, you’ll need a game plan. The most successful DAX 40 investors combine market analysis with solid risk management principles.

Understanding market patterns forms the foundation of most successful strategies. Many investors start with trend following – essentially going with the flow of the market. When the DAX 40 is climbing steadily, you ride the wave up. When it’s declining, you either step aside or look for opportunities at lower prices. This approach works particularly well with German stocks because they often follow clear, sustained trends.

Breakout analysis offers another popular approach. Picture the DAX 40 as a ball bouncing between a floor and ceiling. When it finally breaks through either barrier with strong volume, it often continues in that direction for a while. Savvy investors position themselves to profit from these breakthrough moments.

Position sizing might be the most crucial skill you’ll develop. Never put all your eggs in one basket, even if that basket is as solid as German engineering. Most professionals risk no more than 2-3% of their total portfolio on any single trade. This way, even if you’re wrong several times in a row, you’ll still have plenty of capital left to recover.

Smart investors always consider their reward-to-risk ratio before making any move. If you’re risking €100 to potentially make €300, that’s a 3:1 ratio – much better than risking €100 to make €50. This simple calculation can save you from many costly mistakes and keep your portfolio growing over time.

The key is finding an approach that matches your personality and schedule. Some people thrive on daily market action, while others prefer to check their investments monthly. Both can work with the DAX 40 – just pick the style that you can stick with consistently.

Mastering the Market with Car News 4 You DAX40 Insights

In today’s fast-moving financial world, having access to real-time data and insightful analysis can make all the difference between success and frustration. Think of it like having a GPS for your investment journey – you wouldn’t drive across Europe without one, so why steer the fintechzoom.com dax40 without proper tools and insights?

At Car News 4 You, we understand that the financial markets can feel overwhelming, especially when you’re trying to keep up with Germany’s premier stock index. That’s why we’re committed to giving you the resources and knowledge you need to confidently steer these waters. For a comprehensive understanding of how broader economic factors impact your investments, our Car News 4 You Economy Complete Guide provides invaluable context.

Accessing Live Data and Analysis

Getting your hands on live DAX 40 data has never been easier, thanks to the wealth of platforms available today. Major financial websites like Yahoo Finance, Google Finance, and the official Frankfurt Stock Exchange offer real-time quotes that update throughout the trading day. Many brokerage platforms go a step further, providing sophisticated charting tools and live data feeds right within their trading interfaces.

What really sets successful investors apart is how they filter and use this information. Rather than drowning in data, smart investors customize their news feeds to focus on what matters most. You can set up alerts for specific DAX 40 companies, adjust your news settings to prioritize the most relevant updates, and follow trusted financial sources that consistently deliver quality insights.

The key is finding the right balance between staying informed and avoiding information overload. Our Car News 4 You DAX40 stock news provides carefully curated updates that help you stay on top of market movements without getting lost in the noise.

Beyond raw numbers, the real magic happens when you combine technical analysis tools with fundamental analysis. Technical analysis uses charts and indicators to spot trends and patterns in price movements, while fundamental analysis digs deeper into economic data and company financials to understand true value. Many modern platforms seamlessly blend both approaches, giving you a complete picture of market conditions.

Understanding Market Influences on the DAX40

Here’s something fascinating about the DAX 40 – it’s not just a collection of German companies trading in isolation. This index serves as a genuine barometer of Germany’s economic health, and its movements ripple across global markets in ways that might surprise you.

Global economic trends have an outsized impact on the DAX 40 because Germany runs an export-driven economy. When global trade flows smoothly, German companies thrive. When trade tensions arise or international demand weakens, you’ll often see this reflected in the index’s performance.

The European Central Bank’s policies deserve special attention when you’re tracking the fintechzoom.com dax40. Interest rate decisions, quantitative easing measures, and other monetary policy changes from the European Central Bank (ECB) can send shockwaves through the index. It’s like watching a carefully choreographed dance between monetary policy and market reactions.

Currency movements add another layer of complexity. The Euro exchange rate often moves in the opposite direction of the DAX 40. When the Euro weakens, German exports become more competitive globally, potentially boosting the performance of DAX companies and lifting the index.

Perhaps most interesting is the DAX 40’s relationship with American markets. Research shows a remarkable 90% correlation to major U.S. stock indices, meaning that movements in the S&P 500 or Dow Jones often predict or accompany similar shifts in the DAX. This connection highlights how interconnected global markets have become.

Geopolitical events round out the major influences. Everything from energy price fluctuations to political developments across Europe can introduce volatility and shift investor sentiment. The key is learning to recognize which events truly matter and which are just market noise.

Common Mistakes to Avoid with DAX40 Analysis

Even with excellent data and analysis tools, traders can still stumble into costly mistakes. We’ve seen these patterns repeatedly, and avoiding them can dramatically improve your success rate with the DAX 40.

Overtrading and overleveraging top our list of concerns. The excitement of active markets can be intoxicating, leading to excessive trading activity often amplified by high leverage. While leverage can multiply your profits, it equally multiplies your losses. The smartest approach is trading with purpose, not just for the thrill of it.

Emotional decision-making destroys more trading accounts than any technical factor. Fear, greed, hope, and frustration are powerful forces that can derail even the best-laid plans. Research reveals that 90% of retail traders lose money mainly due to poor emotional control. Successful traders develop systems and stick to them, even when emotions run high.

Poor money management kills trading careers before they begin. This includes failing to use stop-loss orders to limit potential losses, allowing losing positions to grow unchecked, or desperately adding to losing trades hoping for a miraculous turnaround. Smart traders define their risk per trade upfront and never deviate from that plan.

Lack of a comprehensive trading plan leaves you vulnerable to impulsive decisions. Think of your trading plan as your personal constitution – it defines your entry and exit rules, risk management strategies, daily goals, and even your trading schedule. Without this framework, you’re essentially gambling rather than investing strategically.

The foundation of all successful trading rests on having reliable information, understanding market dynamics, and maintaining disciplined execution. Master these elements, and the fintechzoom.com dax40 becomes not just an investment opportunity, but a pathway to building long-term wealth.

Frequently Asked Questions about the DAX 40

We know that jumping into Germany’s premier stock index can feel overwhelming at first. That’s completely normal! Over the years, we’ve heard the same questions pop up again and again from investors just starting their journey with fintechzoom.com dax40. Let’s tackle these head-on so you can feel more confident about understanding this powerful market indicator.

What does the DAX 40 represent?

Think of the DAX 40 as Germany’s financial hall of fame. It’s the country’s blue-chip stock market index that tracks the 40 largest and most liquid companies trading on the Frankfurt Stock Exchange. When you look at the DAX 40, you’re essentially getting a front-row seat to watch Germany’s corporate giants in action.

What makes this really impressive is the sheer scale we’re talking about. These 40 companies aren’t just random picks – they represent about 80% of the market capitalization of all German-listed companies. That means when the DAX 40 moves up or down, it’s giving you a pretty accurate picture of how Germany’s entire stock market is performing.

From software powerhouse SAP to industrial giant Siemens, these companies are the backbone of Europe’s largest economy. When investors want to understand how Germany is doing economically, they often look to the DAX 40 first.

How is the DAX 40 different from other indices?

Here’s where things get interesting, and honestly, it’s one of the coolest features of the DAX 40. Unlike many other major stock indices around the world, the DAX 40 is what we call a performance index.

What does that mean in plain English? Well, when you’re tracking the DAX 40, you’re not just seeing price movements of the stocks. The index automatically reinvests all dividends and capital gains from its constituent companies back into the calculation. It’s like getting the full picture of what your returns would actually be if you owned these stocks.

Compare that to price indices that only track price movements without considering dividends, and you can see why the DAX 40 gives investors a more complete view. It’s essentially showing you the total return story, not just the headline price changes.

What are the main benefits of tracking the DAX 40?

There are several compelling reasons why keeping an eye on the DAX 40 makes sense, whether you’re an active investor or just someone interested in understanding global markets.

First, it provides a clear snapshot of the health of the German economy. Since Germany is such a major player in the global economy and the driving force behind much of Europe’s economic activity, the DAX 40 serves as an excellent barometer for broader European economic trends.

Second, it serves as a benchmark for European investments. Many fund managers and institutional investors use the DAX 40 as a measuring stick for their European investment strategies. If you’re thinking about investing in European markets, understanding how the DAX 40 performs can give you valuable context.

Finally, it offers exposure to leading global companies across diverse sectors. We’re talking about world-class companies in industrials, technology, automotive, and financial services. Many of these firms aren’t just German success stories – they’re global leaders that influence markets worldwide. By following the DAX 40, you get insight into how some of the world’s most innovative and established companies are performing.

Conclusion: Your Next Steps in Navigating the DAX 40

Our journey through the fintechzoom.com dax40 has taken us from understanding its role as Germany’s premier blue-chip index to exploring practical investment strategies and common pitfalls to avoid. We’ve finded how this performance-based index serves as more than just numbers on a screen—it’s a living, breathing reflection of Europe’s largest economy and a gateway to some of the world’s most influential companies.

The significance of the DAX 40 extends far beyond Germany’s borders. As we’ve seen, this index represents about 80% of the Frankfurt Stock Exchange’s market capitalization and maintains a striking 90% correlation with major U.S. stock indices. This interconnectedness means that understanding the DAX 40 gives you insights into global market dynamics, not just European ones.

What sets successful DAX 40 investors apart is their commitment to informed decision-making. This means staying current with European Central Bank policies, monitoring global economic trends, and understanding how geopolitical events can ripple through German markets. The data and analysis we’ve explored—from technical indicators to fundamental company research—form the foundation of smart investing.

Continuous learning remains your most valuable asset in this dynamic market. The financial world never stands still, and neither should your education. Whether you’re tracking individual DAX 40 companies like SAP and Siemens or using ETFs for broader exposure, staying informed about market influences and regulatory changes will serve you well.

At Car News 4 You, we’re here to support your financial journey with practical insights that cut through the complexity. Our comprehensive coverage extends beyond the DAX 40 to help you understand interconnected markets. Explore our guides on FintechZoom.com Russell 2000 and FintechZoom.com Ftse 100 to broaden your index knowledge, or dive into commodities with our FintechZoom.com Natural Gas and FintechZoom.com Nickel resources.

For those interested in the digital currency revolution, our FintechZoom Bitcoin Price Guide 2025 and FintechZoom Ultimate Bitcoin Mining Guide offer valuable insights into cryptocurrency markets. You can find all our market analysis in our FintechZoom.com Markets section.

Every expert was once a beginner. The key is taking that first step with confidence, armed with knowledge, and maintaining the discipline to stick to your investment plan. The DAX 40 offers tremendous opportunities for those willing to do their homework and approach it with respect for both its potential and its risks.

Your financial future starts with the decisions you make today. Whether you’re just beginning to explore the DAX 40 or looking to refine your existing strategy, the foundation we’ve built together in this guide will serve you well. Keep learning, stay curious, and most importantly—make informed decisions based on solid research rather than emotions or market hype.