fintechzoom.com russell 2000: Essential 2025 Insights

Why the Russell 2000 Index Matters for Smart Investors

Russell 2000 analysis has become essential for investors seeking to understand America’s small-cap market landscape. This comprehensive index tracks 2,000 of the smallest publicly traded companies in the United States, serving as a crucial barometer for economic health and investment opportunities.

Quick Answer: What You Need to Know About Russell 2000 Analysis

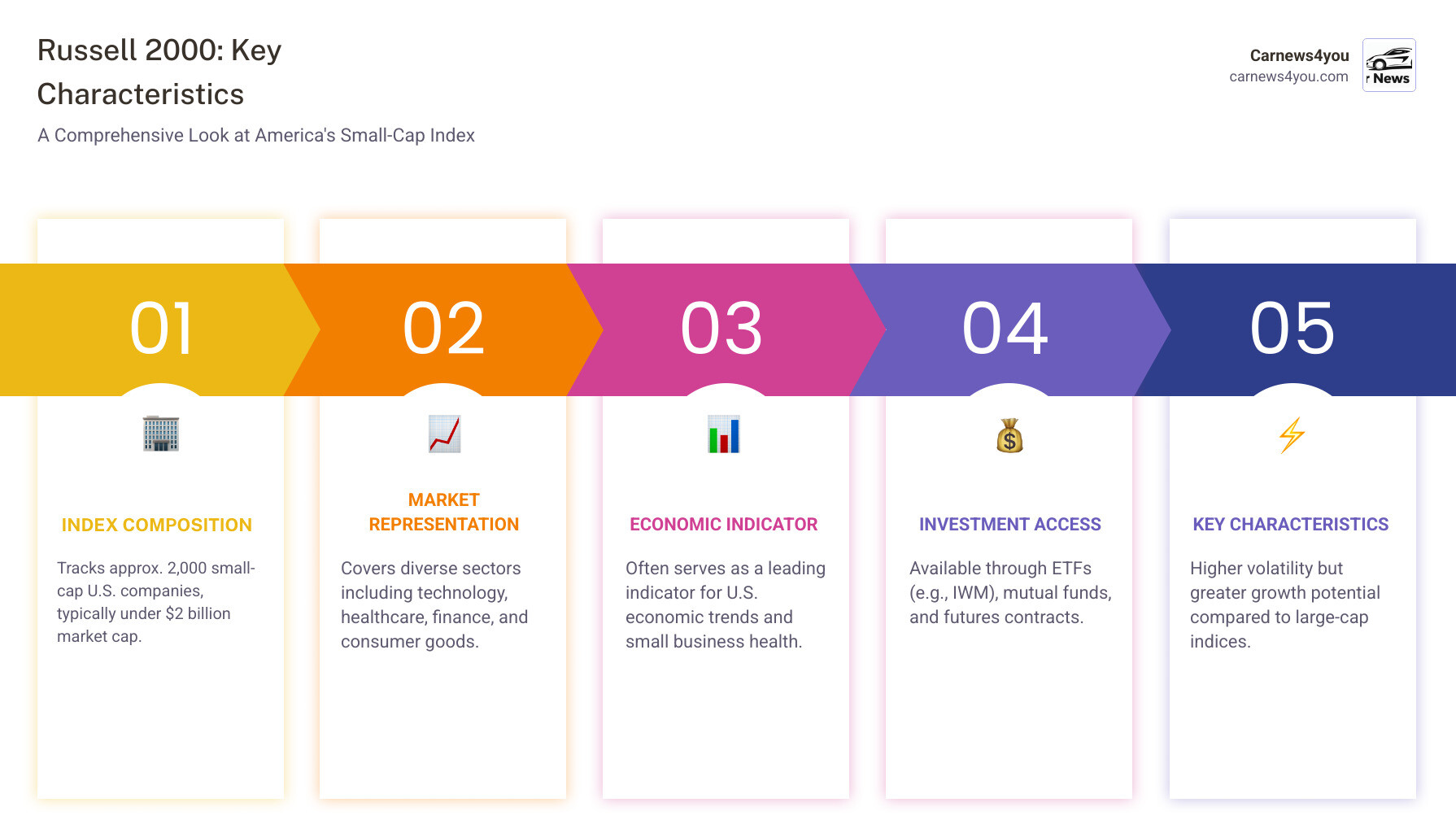

- Index Composition: Tracks approximately 2,000 small-cap U.S. companies with market caps typically under $2 billion

- Market Representation: Covers diverse sectors including technology, healthcare, finance, and consumer goods

- Economic Indicator: Often serves as a leading indicator for U.S. economic trends and small business health

- Investment Access: Available through ETFs like IWM, mutual funds, and futures contracts

- Key Characteristics: Higher volatility but greater growth potential compared to large-cap indices

The Russell 2000 represents the heartbeat of American small business, encompassing companies that are often more sensitive to domestic economic conditions than their large-cap counterparts. These smaller firms typically have market capitalizations between $300 million and $2 billion, making them uniquely positioned to benefit from economic growth periods.

What makes this index particularly valuable is its role as both a performance benchmark and economic forecasting tool. Small-cap stocks historically rally approximately 60% following bear market lows, and the index often signals broader market shifts before they appear in large-cap indices.

For investors, understanding Russell 2000 dynamics means gaining insight into sectors where innovation and rapid growth intersect with higher risk profiles. The index undergoes annual rebalancing to ensure it accurately reflects the current small-cap market landscape.

Explore more:

What is the Russell 2000 and Why Does It Matter?

Picture the stock market as a busy city. While many focus on the towering skyscrapers (large-cap companies), there’s an entire neighborhood of smaller buildings that’s equally important to the city’s growth. That’s what the Russell 2000 Index represents – it’s your window into approximately 2,000 small-cap companies that form the backbone of American business.

Think of the Russell 2000 as America’s small business report card. These companies are often the innovators and future giants, typically worth between $300 million and $2 billion – substantial businesses, but still small enough to have room for explosive growth.

This index is a subset of the Russell 3000 Index. While it represents about 8% of the total market value, it captures the entrepreneurial spirit and growth potential that drives our economy forward.

The index uses market capitalization weighting, meaning larger companies within the 2,000 have more influence on its daily moves. The Russell 2000 also undergoes annual rebalancing every June. Companies that have grown too big are promoted to larger indices, while new small-cap companies join the ranks. This keeps the index fresh and truly representative of the current small-cap landscape.

For investors, analysis of the Russell 2000 reveals why this index matters so much. Small-cap companies are incredibly sensitive to domestic economic conditions. When the American economy struggles, these companies feel it first. But when the economy is thriving, they often lead the charge upward.

This sensitivity makes the Russell 2000 an excellent economic health indicator. It’s like a thermometer for American business confidence. When small businesses are doing well, it usually means consumers are spending, banks are lending, and optimism is high.

You can find more info about market trends to understand how these dynamics play out in real-time. The index is widely recognized as a vital benchmark for small-cap stocks by investment professionals worldwide.

Key Components and Sector Diversity

One of the most exciting things about the Russell 2000 is its incredible diversity. It’s a genuine cross-section of American enterprise, spanning virtually every corner of our economy and creating natural portfolio diversification.

- Technology: This sector leads the charge with innovative software companies, cybersecurity specialists, and hardware developers creating the tools that larger corporations will eventually adopt.

- Healthcare: This is another major component, featuring biotech pioneers, medical device innovators, and healthcare service providers at the cutting edge of medical research.

- Financials: This sector brings regional banks, specialized lenders, and fintech innovators into the mix, often serving local communities and niche markets.

- Consumer Goods: These companies include retailers, food and beverage producers, and businesses creating products we use every day, keeping a finger on the pulse of consumer preferences.

- Industrials: These companies provide the infrastructure and manufacturing capabilities that keep America running, from construction firms to transportation services.

This sector diversity helps to stabilize overall performance, as strength in one area can offset challenges in another.

The Russell 2000 vs. Large-Cap Indices

Understanding how the Russell 2000 differs from large-cap indices like the S&P 500 is crucial for smart investing. They offer very different risk-reward profiles.

| Metric | Russell 2000 | Large-Cap Indices (e.g., S&P 500) |

|---|---|---|

| Number of companies | Approximately 2,000 | Typically 30 (Dow Jones) or 500 (S&P 500) |

| Market cap focus | Small-cap (typically $300M – $2B) | Large-cap (billions to trillions of dollars) |

| Volatility | Higher (more susceptible to market swings) | Lower (more stable, less dramatic price movements) |

| Growth potential | Higher (more room for expansion) | Moderate (established companies, slower growth rates) |

| Economic sensitivity | Higher (more sensitive to domestic economy) | Moderate (more diversified revenue streams, global reach) |

The volatility difference is perhaps the most noticeable. Small-cap stocks can swing dramatically, but this is also where the potential for rapid growth lies.

Economic sensitivity is another key differentiator. Most Russell 2000 companies generate their revenue primarily within the United States. When the American economy is booming, these companies often see outsized benefits, but they also feel the pain more acutely during downturns.

The growth potential aspect is where small-caps really shine. A small company with a breakthrough product can see its stock price multiply several times over, a rate of growth that massive companies cannot match.

For investors, this means the Russell 2000 is higher risk, higher potential reward, and more closely tied to domestic economic conditions. Adding it to a portfolio can provide valuable diversification and growth opportunities.

How to Leverage carnews4you.com Russell 2000 Insights for Market Analysis

In today’s financial world, having access to accurate, timely data is a significant advantage. When it comes to understanding the small-cap market, Russell 2000 analysis can transform what seems like market chaos into clear opportunities.

Modern market analysis tools act as a financial toolkit. Real-time data keeps you connected to the pulse of the market, allowing you to make today’s decisions with current information. Expert analysis turns raw numbers into meaningful insights, explaining what market movements mean for your investment strategy.

Combining comprehensive charts with custom alerts helps you understand important market events as they happen. News aggregation brings together information from multiple sources, so you don’t miss crucial pieces of the puzzle. The real power lies in making data-driven decisions rather than emotional ones. With solid information and clear analysis, you can approach the volatile small-cap market with confidence.

Tracking Influential Economic Factors

The Russell 2000 doesn’t exist in a bubble; it moves in rhythm with the broader economy. Understanding these economic factors helps you anticipate the index’s next moves.

- Interest rates are highly influential. Small companies often borrow to grow, so when borrowing gets expensive, their growth can slow. Lower rates can accelerate expansion.

- GDP growth tells us how healthy the overall economy is. A growing economy means more spending, which often flows directly to the small businesses in the Russell 2000.

- Employment data matters because jobs equal spending power. When unemployment is low and wages are rising, consumers have more money to spend.

- Inflation creates a complex picture. A little can signal healthy growth, but too much is a burden, as small companies often struggle to pass rising costs to customers.

- Government policy changes can reshape industries. New regulations might create costs, while tax cuts could boost profitability. Small businesses feel these shifts acutely.

For a more comprehensive look at these economic dynamics, you can explore deeper economic analysis to see how these factors interconnect.

Understanding Historical Performance with carnews4you.com Russell 2000 Insights

History doesn’t repeat, but it often rhymes, especially in the stock market. Looking at the Russell 2000’s past performance offers insight into the resilience of American small businesses.

- Long-term trends tell a compelling story. Following major market downturns, small-cap stocks have historically shown remarkable recovery power.

- Key milestones in the index’s journey often coincide with major economic shifts, like the dot-com boom or the housing crisis, creating a roadmap of how these companies respond.

- Post-recession recovery periods have been particularly telling. Small companies, with their agility, often lead market recoveries.

- The pandemic impact provided a real-time case study in small-cap resilience, showcasing the adaptability and innovation that characterizes many Russell 2000 companies.

- Bull and bear cycles affect the Russell 2000 differently than large-cap indices. During bull markets, small caps often outperform. During bear markets, they may fall harder but also position themselves for stronger recoveries.

Performance charts reveal patterns that help investors understand typical behavior. The Russell 2000’s recent surge of 19% over three months suggests we might be witnessing another small-cap revival, following historical patterns where these stocks rally approximately 60% from bear market lows.

Investing in the Russell 2000: Strategies, Risks, and Rewards

Stepping into the Russell 2000 investment arena is compelling due to its energy and opportunity, despite its unpredictability. Analysis shows this index represents one of the most dynamic segments of the American stock market.

Investing in the Russell 2000 is a bet on America’s entrepreneurial spirit. These smaller companies often represent the next generation of business leaders, and getting in early can be rewarding, though it requires patience and strategy.

- Taking a long-term perspective is perhaps the most crucial approach. Small-cap stocks can be volatile month-to-month, but over several years, the best performers often deliver significant returns.

- Diversification remains your best friend. Even within the Russell 2000’s diverse mix, spreading investments across different sectors helps cushion the blow when one industry hits a rough patch.

- For most investors, index-tracking ETFs and mutual funds offer the smartest entry point. These vehicles give you instant access to all 2,000 companies without having to research each one individually.

- Some investors prefer active trading strategies, using the index’s natural volatility to their advantage. This approach requires more time, attention, and a stronger tolerance for risk.

- Sector rotation is another sophisticated strategy, where investors shift their focus to the hottest-performing industries within the index. This requires staying on top of economic trends.

Assessing Risks and Rewards with carnews4you.com Russell 2000 Insights

The Russell 2000 is a thrilling ride that can be rewarding but also challenging. Understanding the balance of risk and reward is key.

On the risk side, high volatility is a primary concern. Small-cap stocks can move dramatically on news that might barely affect a large corporation. Economic sensitivity means these companies feel every economic hiccup more intensely, as they often lack the deep pockets of larger firms. Liquidity concerns can also occasionally surface with some of the smaller companies in the index, making it harder to trade shares quickly without affecting the price.

Now for the exciting part: the rewards. The significant growth potential is what draws so many investors. Small companies have room to grow in ways that massive corporations cannot. A breakthrough product or smart expansion can multiply a company’s value. Adding Russell 2000 exposure to a portfolio also provides diversification benefits, creating balance against large-cap stocks. Finally, the index serves as a leading economic indicator, which savvy investors can use to position themselves ahead of major market moves.

Platforms providing Russell 2000 insights help investors steer these waters by offering real-time data and expert analysis, turning complexity into actionable information.

For additional investment guidance custom to your specific situation, consider exploring commerce advice for investors.

The key is understanding that with the Russell 2000, you trade stability for opportunity. It’s not suitable for everyone, but for those willing to accept the risks, it can be a valuable addition to a well-rounded investment strategy.

Frequently Asked Questions about the Russell 2000

Here are answers to some of the most common questions investors have about this important small-cap index.

How are companies selected for the Russell 2000?

Companies are selected for the Russell 2000 through a methodical process. First, they must fall within a specific market capitalization range, typically $300 million to $2 billion. They also need to meet liquidity requirements to ensure their shares can be traded easily without causing major price swings. A key criterion is a strong U.S. company focus, meaning most of their revenue is generated domestically.

The selection culminates in the annual reconstitution process each June. FTSE Russell ranks all eligible U.S. companies by market cap and selects the smallest 2,000 companies from the broader Russell 3000 Index. This reshuffling ensures the index remains a fresh and representative snapshot of the current small-cap landscape.

Is the Russell 2000 a good indicator for the entire economy?

The Russell 2000 serves as an excellent barometer for small businesses and the domestic American economy. Because its constituent companies are typically more focused on domestic operations, the index is incredibly sensitive to what’s happening at home. For this reason, it often acts as a leading indicator for broader economic trends, feeling the effects of changes before they are reflected in large-cap indices.

However, the Russell 2000 works best when it complements large-cap indices rather than standing alone. While it provides insight into domestic business health, indices like the S&P 500 show how the biggest, most established multinational companies are performing. For the most complete picture of economic health, smart investors look at both.

What is the easiest way for a beginner to gain exposure to the Russell 2000?

For beginners who want a straightforward way to invest in the Russell 2000, the easiest path is through index-tracking investment vehicles.

Exchange-Traded Funds (ETFs) are an excellent choice. By buying a single share of a Russell 2000 ETF (like the popular IWM), you are instantly invested in all 2,000 companies in the index. Mutual funds work similarly, offering the same diversified exposure.

Both options provide automatic diversification across the entire small-cap universe and offer a low-cost entry into the market. This approach removes the complexity of individual stock selection, making it perfect for beginners who are just getting started with small-cap investing.

Conclusion

As we wrap up our deep dive, it’s clear the Russell 2000 Index is more than just numbers on a screen. Our analysis reveals it’s a window into the entrepreneurial soul of America, where small businesses with big dreams create the foundation for tomorrow’s economic growth.

Informed investing is crucial in today’s rapidly shifting markets. The Russell 2000, with its characteristic volatility and growth potential, demands comprehensive analysis and real-time insights to make decisions with confidence.

Fortunately, small-cap market navigation is more accessible than ever. Modern tools and platforms provide data and analysis that was once reserved for Wall Street professionals, democratizing financial information for all investors.

Strategic decision-making in this space means understanding the broader economic currents that lift these smaller companies. Recognizing that small-cap stocks often serve as leading indicators for economic recovery can help investors position themselves ahead of market movements.

Looking toward the future of financial analysis, technology like AI and blockchain will continue to transform how we interact with markets, improving the quality and accessibility of insights for investors focused on indices like the Russell 2000.

Comprehensive market analysis connects individual company performance with broader economic trends. Understanding these connections means participating in the growth story of American innovation.

The journey through Russell 2000 analysis is about recognizing opportunity where others might see complexity. The small-cap market is where new ideas become established businesses and where patient investors can potentially capture significant value over time.

Thank you for joining us on this exploration. The Russell 2000 continues to offer both challenges and rewards. For those interested in exploring beyond financial topics, we invite you to explore more diverse topics from our experts.