Fintechzoom.com Nickel: Critical Analysis 2025

Why Nickel Has Become Essential for Modern Investors

Nickel has gained significant attention as this critical metal powers everything from your smartphone battery to the electric vehicle revolution. Understanding its market dynamics is crucial for anyone interested in commodities, green technology, or sustainable finance.

Quick Answer for Nickel Analysis:

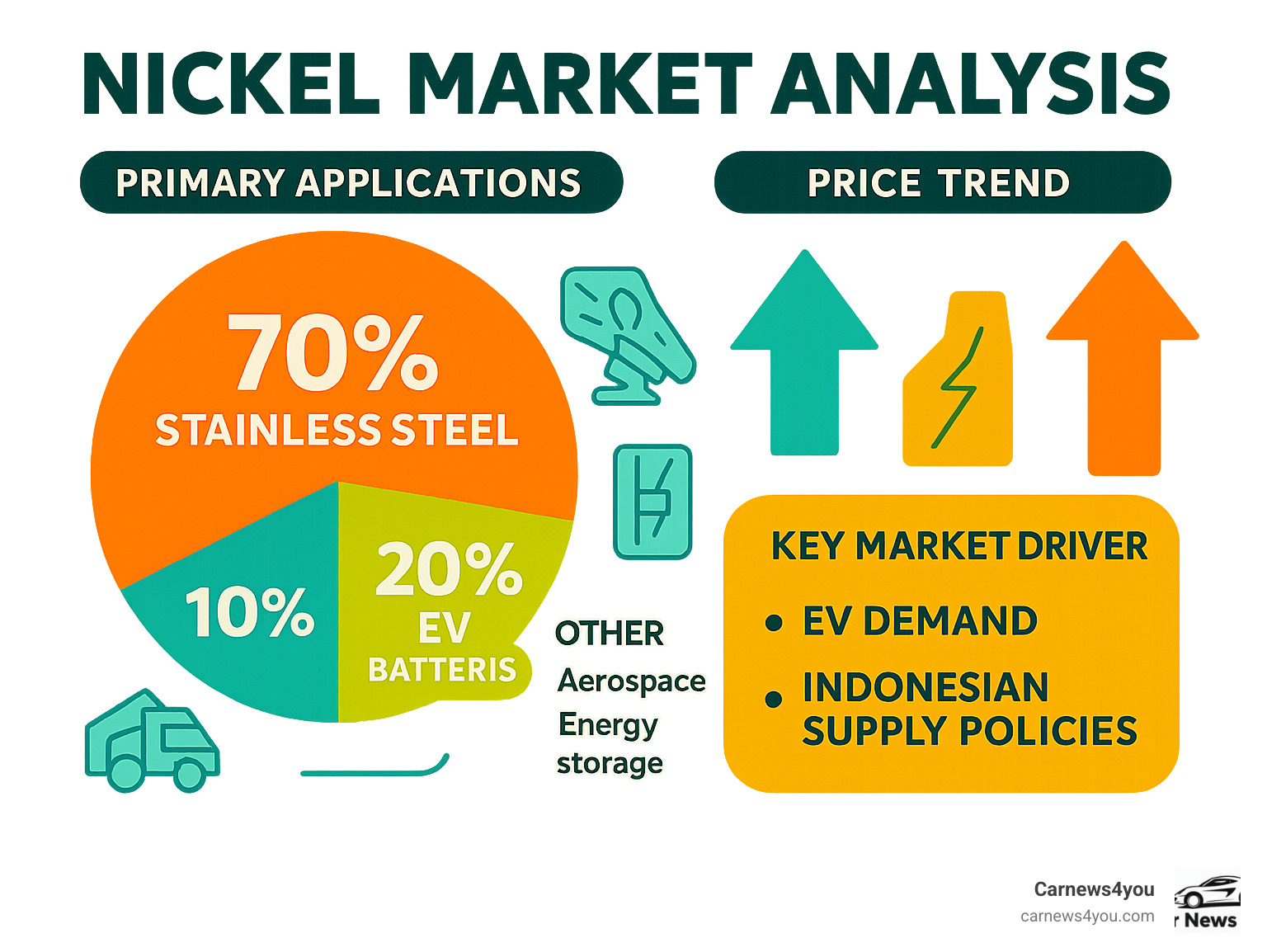

- Primary Uses: 70% stainless steel, 30% batteries and green tech

- Key Price Drivers: EV demand, Indonesian supply policies, geopolitical tensions

- Investment Options: Mining stocks, ETFs, futures contracts

- Major Producers: Indonesia (largest), Philippines, Russia, Canada

- 2025 Outlook: Continued growth driven by electric vehicle adoption

Nickel has transformed from an industrial metal into a strategic commodity at the heart of the clean energy transition. Its importance has skyrocketed because it’s essential for high-energy density batteries used in electric vehicles and renewable energy storage. Simultaneously, about 70% of global nickel supply still goes into stainless steel, making it a dual-purpose commodity with diverse market drivers.

This creates both opportunities and challenges for investors. Recent data shows nickel prices at $15,732 per metric ton as of April 2025, up 5.09% from the previous month but down 7.87% year-over-year. This volatility reflects the complex interplay of supply constraints, geopolitical tensions, and shifting demand.

Why Nickel is a Critical Commodity in Today’s Economy

Nickel is an unassuming metal that quietly powers our daily lives, from the stainless steel in your kitchen to the battery in an electric car. Its story is a tale of two markets: the traditional industrial backbone and the cutting-edge technology of the future.

While the electric vehicle (EV) revolution gets the headlines, the truth is that 70% of global nickel still goes into stainless steel production. This makes it a foundational material for construction and manufacturing. The remaining 30% of demand, however, is driving some of today’s most exciting technological advances. EVs depend on nickel-rich battery chemistries to achieve the high energy density and range that consumers demand.

The global push toward a green energy transition has transformed nickel into a strategic resource. Beyond EVs, it plays a crucial role in renewable energy storage systems and high-strength aerospace alloys. This versatility means that when nickel prices fluctuate, they reflect everything from global construction activity to the latest EV production numbers.

The Dual Role of Nickel: Industrial Staple and Tech Metal

Nickel leads a fascinating double life. On one side, it’s the industrial workhorse for stainless steel, essential for everything from skyscrapers to medical equipment due to its strength and corrosion resistance.

On the other side, nickel is a star in the tech world. High-energy density batteries, like Nickel-Cobalt-Manganese (NCM), rely on nickel to pack more power into smaller spaces, making EVs practical. This technology also extends to renewable energy storage, where nickel-based batteries store power from solar and wind. Furthermore, its use in aerospace alloys and chemical processing highlights its ability to withstand extreme conditions. This versatility makes nickel strategically important for both current infrastructure and a sustainable future.

Key Market Movers: Supply, Demand, and Geopolitics

The nickel market is influenced by a complex interplay of supply, demand, and geopolitics, creating volatility and opportunity.

- Supply Dynamics: Indonesia’s production surge is a major factor. As the world’s largest producer, its policies, such as export bans to encourage domestic processing, have an immediate global impact.

- Demand Growth: The accelerating adoption of EVs is reshaping demand. Government targets for phasing out gasoline engines create a strong long-term outlook for battery-grade nickel.

- Geopolitical Factors: Geopolitical tensions and sanctions affecting major producers like Russia can disrupt supply chains and cause dramatic price swings.

- Sustainability Concerns: Sustainable mining practices and ESG investing are increasingly important. The focus on responsibly sourced nickel can affect production costs and supply, becoming essential for market participation.

Analyzing the nickel market requires monitoring everything from Indonesian policy to European EV sales, as these interconnected factors create a dynamic investment landscape.

A Deep Dive into Nickel Market Analysis Tools

In today’s fast-moving financial world, the right tools for tracking commodities like nickel are essential. Modern financial technology platforms have revolutionized how we access and analyze commodity data, turning what was once exclusive institutional information into accessible insights for any investor.

These platforms act as digital command centers, pulling together data from exchanges, news, and analysts to create a comprehensive market picture. They are particularly valuable for capturing market sentiment by tracking social media, news, and retail investor activity. This democratization of data means you no longer need a professional terminal to understand what’s driving nickel prices.

How to Effectively Analyze the Nickel Market

Successfully tracking nickel requires a multi-layered approach. Here are key features and strategies to use when analyzing nickel trends:

-

Real-Time and Historical Data: Start with live price feeds, but use historical price charts to identify long-term patterns and separate market noise from significant moves. Understanding past price points, like the drop from $17,438 in April 2024 to $15,732 a year later, provides crucial context.

-

News Aggregation and Alerts: Use platforms that pull together relevant headlines from trusted sources. Setting up alerts for market-moving events—like supply disruptions, geopolitical news, or new battery technologies—helps you react quickly to changing conditions.

-

Technical and Sentiment Analysis: Go beyond raw price data with technical indicators. Moving Averages can reveal underlying trends, while the RSI (Relative Strength Index) can indicate if nickel is overbought or oversold. Combine this with sentiment analysis tools that monitor social media and news to gauge the market’s mood.

-

Expert Commentary and Forecasts: Supplement your analysis with insights from industry specialists. Many platforms provide price forecasts from multiple sources, offering a range of expert opinions to inform your own decision-making.

Strategically Using Nickel Insights for Your Portfolio

Changing market data into smart investment decisions is the ultimate goal. Nickel’s unique position at the crossroads of industry and green technology makes it an interesting diversification play, but its volatility requires a careful approach.

A holistic strategy is key. Beyond direct investments in mining stocks or ETFs, consider companies that depend on nickel, such as EV manufacturers or stainless steel producers. This allows you to capture different angles of the nickel story. However, risk management is crucial. Nickel’s price swings can be dramatic, so treat market insights as one piece of a larger investment puzzle, not the whole picture. Always cross-reference data from multiple sources before making major moves.

Advantages and Limitations of Online Analysis Tools

Online financial platforms have democratized access to market intelligence, offering significant advantages in accessibility, cost, and user experience. They are excellent for getting a quick pulse on the market, tracking news flow, and gauging market sentiment.

However, understand their limitations. The primary concern is data accuracy and depth. These platforms are best used as a starting point, not a definitive source for trade execution.

| Platform Focus | Online Financial News Platforms | Institutional Sources |

|---|---|---|

| Best for | Sentiment tracking, news aggregation | Precise pricing, trade execution |

| Data depth | Broad overview, narrative-focused | Granular, exchange-backed detail |

| Cost | Often free or low-cost | Expensive, professional-grade |

| User experience | Simple, accessible | Complex, feature-rich |

Use online platforms to understand the market narrative, but always verify critical data with primary sources like the International Nickel Study Group.

Managing Key Investment Risks

Nickel investing comes with specific risks that go beyond data limitations:

- Price Volatility: Prices can swing dramatically based on news, policy changes, or rumors.

- Supply Chain Vulnerabilities: Production is concentrated in a few countries, making the supply chain susceptible to political or environmental disruptions.

- Technological Risks: Research into alternative battery chemistries could potentially reduce future nickel dependency.

- Environmental and Regulatory Pressures: Stricter mining regulations or ESG trends could affect production costs and investor appetite.

To manage these risks, diversify your portfolio, stay informed on geopolitical events, and focus on the fundamental drivers of supply and demand.

Frequently Asked Questions about Nickel Investing

Nickel’s growing importance in green technology has sparked many questions from investors. Here are answers to some of the most common inquiries.

How reliable is nickel data from online financial news platforms?

This is a critical question. Data from online platforms is generally reliable for its intended purpose: tracking market sentiment, news trends, and overall price direction. Think of it as a weather forecast—it gives you a good sense of the conditions and helps you prepare.

However, for precise, trade-level data, these platforms may not match the accuracy of institutional sources like the London Metal Exchange. The data is often aggregated and serves best as a signal for retail sentiment rather than a basis for high-frequency trading. For most investors looking at broader trends, this is sufficient. For large trades, it’s wise to cross-reference with primary exchange sources.

What are the biggest risks when investing in nickel?

Nickel investing is not for the faint of heart. The primary risks include:

- High price volatility: Prices can swing dramatically on a single news event.

- Supply chain disruptions: Geopolitical events or policy changes in key producing countries like Indonesia can have an immediate impact on global supply.

- Regulatory changes: Governments can impose export bans, new taxes, or stricter environmental rules, altering the market overnight.

- Technological shifts: The development of new battery technologies that use less or no nickel could fundamentally change long-term demand.

Can I trade nickel directly through a news or analysis platform?

Generally, no. Most financial news and analysis platforms are informational tools, not brokerage platforms. They provide the intelligence you need to make informed decisions, but you cannot execute trades on them.

Think of them as research hubs. You use their data and analysis to form a strategy, then take that strategy to a dedicated brokerage platform to buy or sell investments. This separation is beneficial, as it allows analysis platforms to focus on providing unbiased information. To invest, you would use a broker to trade assets like mining company stocks, commodity ETFs, or futures contracts.

Conclusion

As we’ve seen, nickel has evolved from a simple industrial material into a critical commodity at the heart of two massive global trends: everyday manufacturing and the clean energy transition.

From the stainless steel in our kitchens to the batteries in electric vehicles, nickel’s dual personality makes it a fascinating investment story. Its strategic importance is set to grow as the EV revolution continues and the need for renewable energy storage expands.

Online platforms have made nickel market analysis more accessible than ever, empowering investors to track trends and make informed decisions. While these tools are excellent starting points, the key to success is a balanced approach. By using analytical tools, cross-referencing information, and understanding both the opportunities and the significant risks, you can make smarter choices in this dynamic market.

The nickel story is far from over. By staying informed and curious, you can better steer the changes ahead in this compelling tale of industrial evolution and green technology.