fintechzoom.com natural gas: Ultimate Guide 2025

Why FintechZoom Natural Gas Analysis Matters for Today’s Investors

FintechZoom.com natural gas analysis provides investors with essential tools to track one of the world’s most important energy commodities. Here’s what you need to know:

- Live Price Data: Real-time natural gas prices and market movements

- Technical Analysis: RSI, MACD, and proprietary indicators for market timing

- Expert Commentary: Insights on weather patterns, storage reports, and geopolitical factors

- Alert System: Custom notifications for price changes and market events

- Historical Trends: Multi-year patterns and seasonal cycles

- ESG Integration: Methane emissions and carbon intensity tracking

Natural gas remains a critical energy source powering homes, industries, and serving as a “bridge fuel” during the transition to renewable energy. With global demand growing and markets influenced by everything from winter weather to international trade policies, having access to quality analysis has never been more important.

FintechZoom democratizes this complex market data by offering user-friendly tools that were once only available to institutional traders. The platform combines live market feeds with technical analysis tools, making it easier for retail investors to understand price movements and market dynamics.

Whether you’re a beginner trying to understand commodity markets or an experienced trader looking for additional insights, FintechZoom’s natural gas section provides the foundation you need to make informed decisions in this volatile but essential market.

Basic * fintechzoom.com natural gas* vocab:

What is FintechZoom and Why Does it Cover Natural Gas?

Think of FintechZoom.com as your friendly neighborhood financial expert who happens to be really good with technology. It’s not just another website throwing numbers at you – it’s a comprehensive platform that takes complex financial data and makes it actually understandable for regular people like us.

What makes FintechZoom special is how it democratizes financial information. You know how fancy Wall Street firms have access to all the best market data and analysis tools? Well, FintechZoom brings that same level of insight to everyday investors. Whether you’re a complete beginner or someone who’s been trading for years, the platform speaks your language.

The site covers everything from cryptocurrency to stock markets, but here’s where it gets interesting for energy investors: FintechZoom.com natural gas analysis is particularly robust. They don’t just cover it as an afterthought – natural gas gets the full treatment with real-time data, expert commentary, and user-friendly tools.

But why focus so much attention on natural gas? Simple – it’s one of the most important commodities on the planet. Natural gas literally keeps the lights on in millions of homes and powers countless industries. As we steer the tricky transition from dirty fossil fuels to clean energy, natural gas serves as what experts call a “bridge fuel” – it’s much cleaner than coal or oil while still being reliable and abundant.

The Significance of Natural Gas in Today’s Economy

Natural gas isn’t going anywhere – in fact, it’s becoming more important every day. Global demand keeps growing as more countries recognize its benefits for both economic development and environmental goals.

One of the biggest game-changers has been the rise of Liquefied Natural Gas (LNG) and Compressed Natural Gas (CNG). These technologies transform natural gas into forms that can travel across oceans in ships or across continents in trucks. What this means for investors is that natural gas has become a truly global commodity – events in Russia can affect prices in Japan, and a cold snap in Europe can impact markets in the United States.

Here’s something many people don’t realize: natural gas is absolutely critical for energy grid stability. Solar and wind power are fantastic, but they’re not always available when we need them. The sun sets, the wind stops blowing, and suddenly we need backup power. Natural gas plants can fire up quickly to fill these gaps, making them essential partners to renewable energy sources.

This reliability creates consistent investment opportunities in the energy sector. Unlike some commodities that face uncertain futures, natural gas has a clear role in both today’s energy mix and tomorrow’s cleaner grid.

FintechZoom’s Unique Approach to Commodity Analysis

What sets FintechZoom.com natural gas coverage apart from other platforms is how they combine sophisticated analysis with genuine accessibility. They understand that most of us don’t have economics degrees or years of trading experience.

The platform provides real-time data that updates as market conditions change. This isn’t just important – it’s essential in fast-moving commodity markets where prices can swing dramatically based on weather reports, storage announcements, or geopolitical events.

But raw data is only half the story. FintechZoom’s expert opinions and in-depth analysis help explain the “why” behind price movements. These aren’t random predictions – they’re insights from professionals who understand how weather patterns, supply disruptions, and policy changes affect natural gas markets.

The user-friendly interface deserves special mention. Instead of overwhelming you with complex charts and confusing terminology, FintechZoom presents information in a way that actually makes sense. You can quickly find what you need without feeling like you need a PhD in finance.

This approach to democratizing financial data means that high-quality market insights are no longer exclusive to big investment firms. Individual investors can now access the same type of analysis that was once available only to institutional players. If you’re interested in exploring more financial technology topics, our comprehensive Fintech Guides offer additional insights into this rapidly evolving field.

A Step-by-Step Guide to Accessing FintechZoom Natural Gas Analysis

Getting started with natural gas analysis on FintechZoom doesn’t have to feel overwhelming. Think of it like learning to drive – once you know the basics, everything else becomes second nature. Let’s walk through this together, step by step.

Step 1: Navigating to the Natural Gas Hub

Starting your journey is easier than you might think. When you land on the FintechZoom homepage, you’ll want to look for either the ‘Commodities’ or ‘Markets’ section – it’s usually pretty prominent on the main navigation.

Once you click into the commodities area, you’ll see a list of different raw materials that power our world. Simply click on ‘Natural Gas’ and boom – you’re in!

Welcome to the fintechzoom.com natural gas hub. This is where the magic happens. You’ll immediately see live price feeds showing you exactly where natural gas is trading right now, plus daily changes that tell you whether it’s been a good or rough day for the market. The market overview gives you that crucial first impression – think of it as your market mood ring.

Step 2: Interpreting Charts and Historical Data

Now comes the fun part – reading the story that charts tell us. Don’t worry if you’ve never done this before; charts are just visual stories of what buyers and sellers have been up to.

Candlestick charts are your best friend here. Each “candle” shows you the opening price, closing price, and the highest and lowest points for a specific time period. Green candles usually mean prices went up, red means they went down.

Pay attention to price trends first. Are prices generally climbing upward, sliding downward, or just bouncing around sideways? This gives you the big picture of market sentiment. Trading volume is equally important – it’s like measuring how excited people are about buying or selling. High volume during a price move means traders really believe in that direction.

Here’s where natural gas gets interesting: seasonality matters huge. Winter means more heating demand, summer means more air conditioning (which needs electricity, often from natural gas plants). FintechZoom’s historical data lets you see these patterns play out year after year.

Storage cycles are another crucial piece of the puzzle. Natural gas gets stored in massive underground facilities, and these inventory levels get reported weekly. When storage is low, prices tend to rise. When it’s high, prices often fall. It’s basic supply and demand in action.

Watch for these key chart features: support and resistance levels act like invisible floors and ceilings for prices. Volume spikes can signal big news or shifts in trader thinking. Trend lines help you see the overall direction, while moving averages smooth out the noise to show cleaner trends.

Step 3: Applying Technical Analysis Tools for fintechzoom.com natural gas

Technical analysis tools help you peek into market psychology and spot potential opportunities before they become obvious to everyone else.

The Relative Strength Index (RSI) is like a market thermometer. When it’s running hot (above 70), natural gas might be overbought and due for a cooldown. When it’s cold (below 30), it might be oversold and ready to bounce back. It’s not perfect, but it’s a helpful guide.

MACD (Moving Average Convergence Divergence) sounds complicated, but it’s really just comparing fast-moving and slow-moving price averages. When the fast line crosses above the slow line, it often signals upward momentum. When it crosses below, downward momentum might be building.

FintechZoom also offers proprietary indicators – these are their special sauce, developed by their own experts. Think of them as secret weapons that aren’t available everywhere else. They’re worth exploring to see if they fit your analysis style.

Setting up your analysis dashboard is like arranging your workspace. You can customize which charts and indicators you see, creating a personalized command center for tracking fintechzoom.com natural gas movements. If you enjoy this kind of detailed analysis, you might also find our Fintechzoom.com Bitcoin Price Guide 2025 helpful for understanding similar analytical approaches in other markets.

Step 4: Leveraging Expert Commentary and Setting Alerts

Numbers and charts tell part of the story, but expert commentary fills in the missing pieces. FintechZoom’s analysts help connect the dots between world events and market movements. They might explain how a cold snap in Texas could spike prices, or how new LNG export facilities might affect long-term supply.

ESG commentary is becoming increasingly important too. This covers environmental factors like methane emissions tracking and carbon intensity – topics that matter more and more as the world focuses on cleaner energy. Policy shift analysis helps you understand how government decisions might ripple through the market.

But here’s the real game-changer: price alerts and headline notifications. Instead of constantly watching your screen, you can set custom alerts for specific price levels or breaking news. Imagine getting a gentle ping when natural gas hits your target price, or when major storage data gets released.

This alert system lets you integrate signals into your strategy without becoming glued to your computer. It’s like having a smart assistant that taps you on the shoulder when something important happens. You can react quickly when opportunities arise, or simply stay informed about market movements that matter to your investments.

Understanding Market Dynamics with fintechzoom.com natural gas

Think of the natural gas market as a giant, interconnected puzzle where every piece matters. Fintechzoom.com natural gas analysis helps you see how all these pieces fit together, creating a complete picture of this fascinating and complex market.

Natural gas isn’t just another commodity trading on exchanges. It’s deeply woven into the fabric of global economics, weather patterns, and international relations. When you’re tracking natural gas through FintechZoom, you’re essentially watching a real-time drama unfold with multiple storylines happening at once.

Weather patterns play perhaps the most dramatic role in this market story. Picture this: a particularly harsh winter hits the northeastern United States, and suddenly millions of homes need extra heating. Demand spikes, inventories drop, and prices can surge within days. On the flip side, a mild winter leaves storage facilities fuller than expected, often pushing prices down as supply outweighs demand.

Geopolitical factors add another layer of complexity that makes natural gas markets so intriguing. International tensions, trade disputes, or diplomatic shifts can send ripples across global energy flows. When major producing regions face political instability, or when key pipeline routes become uncertain, markets react swiftly. FintechZoom helps you track these developments and understand their potential impact on prices.

The fundamental forces of supply and demand create the backbone of price movements, but they’re influenced by technological breakthroughs, regulatory changes, and economic growth patterns. The shale gas revolution, for instance, dramatically increased production capabilities in North America, reshaping global market dynamics in ways that are still playing out today.

Storage reports might sound boring, but they’re actually market-moving events. Every week, when organizations like the Energy Information Administration release inventory data, traders worldwide hold their breath. Higher-than-expected storage levels often signal oversupply, while lower levels can indicate strong demand or supply disruptions.

FintechZoom’s global perspective helps you connect regional trends with worldwide implications. A production disruption in one country can affect prices on the other side of the world, especially as LNG trade continues expanding global market interconnectedness.

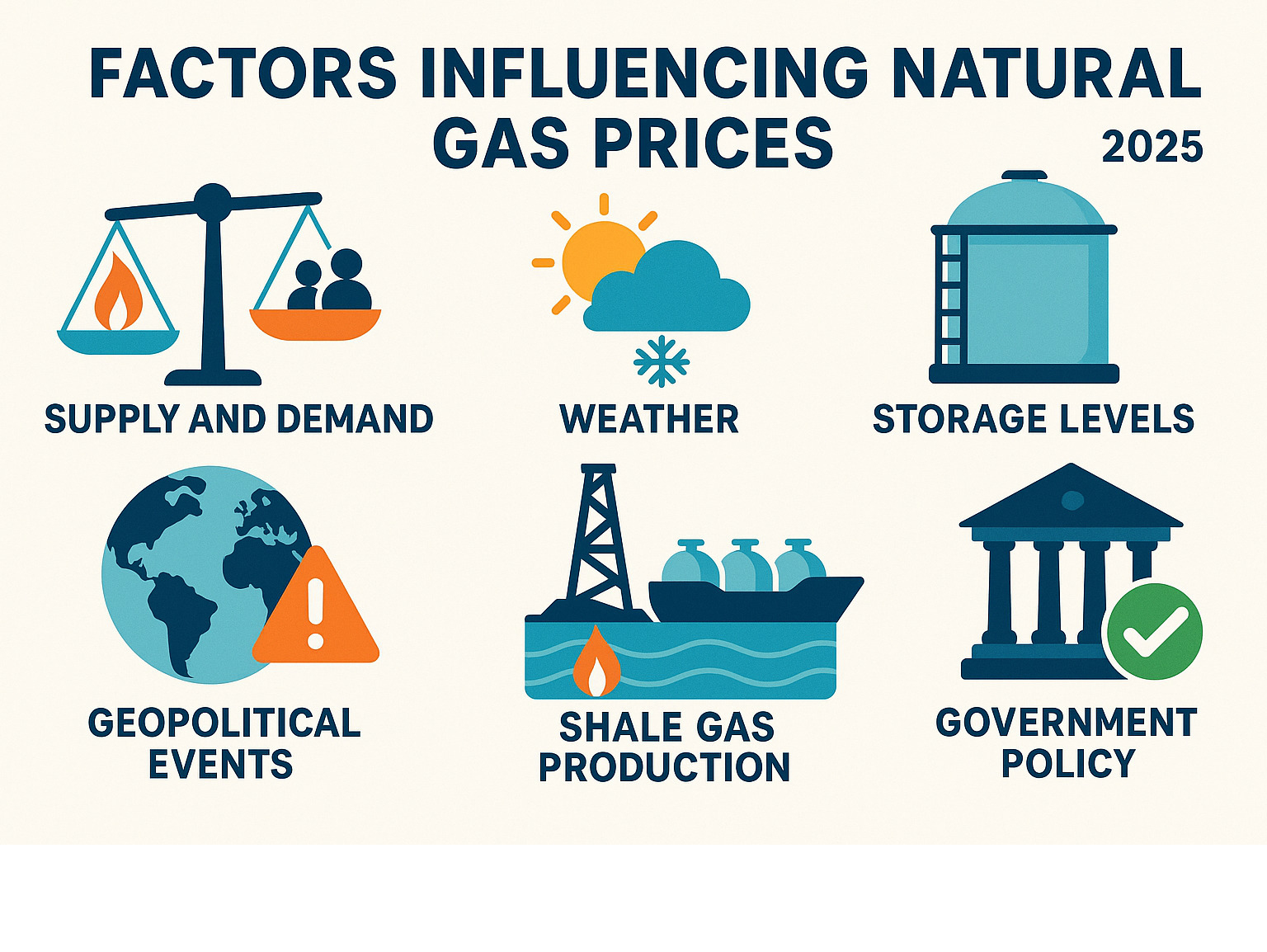

Key Factors Influencing Natural Gas Prices

Let’s dive deeper into the specific factors that constantly push and pull natural gas prices. Understanding these forces is like learning the language of the market – once you know it, price movements start making much more sense.

Production levels form the foundation of supply dynamics. When drilling activity increases in major producing regions, it typically signals growing supply, which can put downward pressure on prices. Conversely, when production declines due to well depletion, regulatory restrictions, or economic factors, supply tightens and prices often respond accordingly.

Weather extremes create some of the most dramatic price movements in natural gas markets. Cold winters drive heating demand through the roof, especially in densely populated northern regions. Meanwhile, hot summers boost electricity demand for air conditioning, since many power plants burn natural gas to generate electricity. Mild weather in either season typically leads to weaker demand and softer prices.

Transportation bottlenecks can create fascinating regional price differences. Natural gas might be abundant in producing areas but expensive in consuming regions if pipeline capacity is limited. These infrastructure constraints create opportunities and challenges that FintechZoom helps you track and understand.

International trade dynamics have become increasingly important as LNG technology makes natural gas a truly global commodity. Export capacity expansions, new import terminals, and changing trade relationships all influence how gas flows around the world and where prices find equilibrium.

Regulatory changes can reshape entire market segments. Environmental regulations affecting methane emissions, drilling permits, or pipeline approvals can significantly impact both supply and demand fundamentals. FintechZoom’s coverage helps you stay ahead of these policy shifts and understand their market implications.

The interplay between these factors creates the complex price patterns you see in fintechzoom.com natural gas charts. Sometimes multiple factors align – like a cold winter coinciding with supply disruptions – creating powerful price movements. Other times, competing forces balance each other out, leading to sideways trading patterns.

The Role of Technology and Future Trends

The natural gas market is experiencing a technological revolution that’s changing how we analyze, trade, and even think about this essential commodity. FintechZoom is at the forefront of covering these exciting developments.

AI-powered forecasting is changing how market participants predict price movements and demand patterns. These sophisticated algorithms can process vast amounts of weather data, economic indicators, and historical patterns to generate insights that would be impossible for human analysts to identify manually. FintechZoom integrates these technological advances into their analysis, giving you access to cutting-edge market intelligence.

Blockchain technology is starting to make inroads into energy trading, potentially revolutionizing how natural gas futures and contracts are executed. This technology promises greater transparency, reduced settlement times, and lower transaction costs – developments that could democratize access to these markets even further.

The growing focus on environmental responsibility is driving demand for “green gas” data and methane emissions tracking. Investors and consumers increasingly want to know not just the price of natural gas, but also its environmental impact. This trend is creating new data streams and analysis requirements that platforms like FintechZoom are beginning to incorporate.

Looking ahead, the future of energy trading will likely be shaped by the continued integration of renewable sources with traditional fuels like natural gas. As wind and solar become more prevalent, natural gas’s role as a backup power source becomes even more critical, creating new demand patterns and trading opportunities.

These technological and environmental trends are reshaping the natural gas landscape in real-time. FintechZoom’s commitment to covering these developments ensures you’re not just tracking current market conditions, but also preparing for the future of energy markets. Understanding these trends helps position you ahead of market shifts rather than simply reacting to them.