fintechzoom.com bitcoin mining: Ultimate Guide 2025

Why Understanding Bitcoin Mining Matters More Than Ever

FintechZoom.com bitcoin mining coverage has become essential reading for anyone looking to understand this complex but rewarding process. Whether you’re a complete beginner or someone looking to optimize your mining strategy, knowing how bitcoin mining works can help you make smarter decisions about this digital gold rush.

Quick Answer for FintechZoom.com Bitcoin Mining:

- What it covers: Real-time bitcoin mining news, profitability analysis, and hardware updates

- Best for: Beginners seeking educational content and market insights

- Key features: Price tracking, mining difficulty updates, and expert analysis

- Important note: FintechZoom is an information platform, not a mining service provider

- How to use: Cross-reference their analysis with other sources for complete market understanding

Bitcoin mining is the backbone of the entire Bitcoin network. It’s how new bitcoins enter circulation and how transactions get verified on the blockchain. More than 70% of mining happens in China, and the rewards have dropped dramatically – from 50 Bitcoin per block in 2009 to just 6.25 coins today.

But here’s what makes this topic so important right now: Bitcoin has reached a market capitalization of over $1.2 trillion as of 2025. This massive growth has made mining both more competitive and potentially more profitable than ever before.

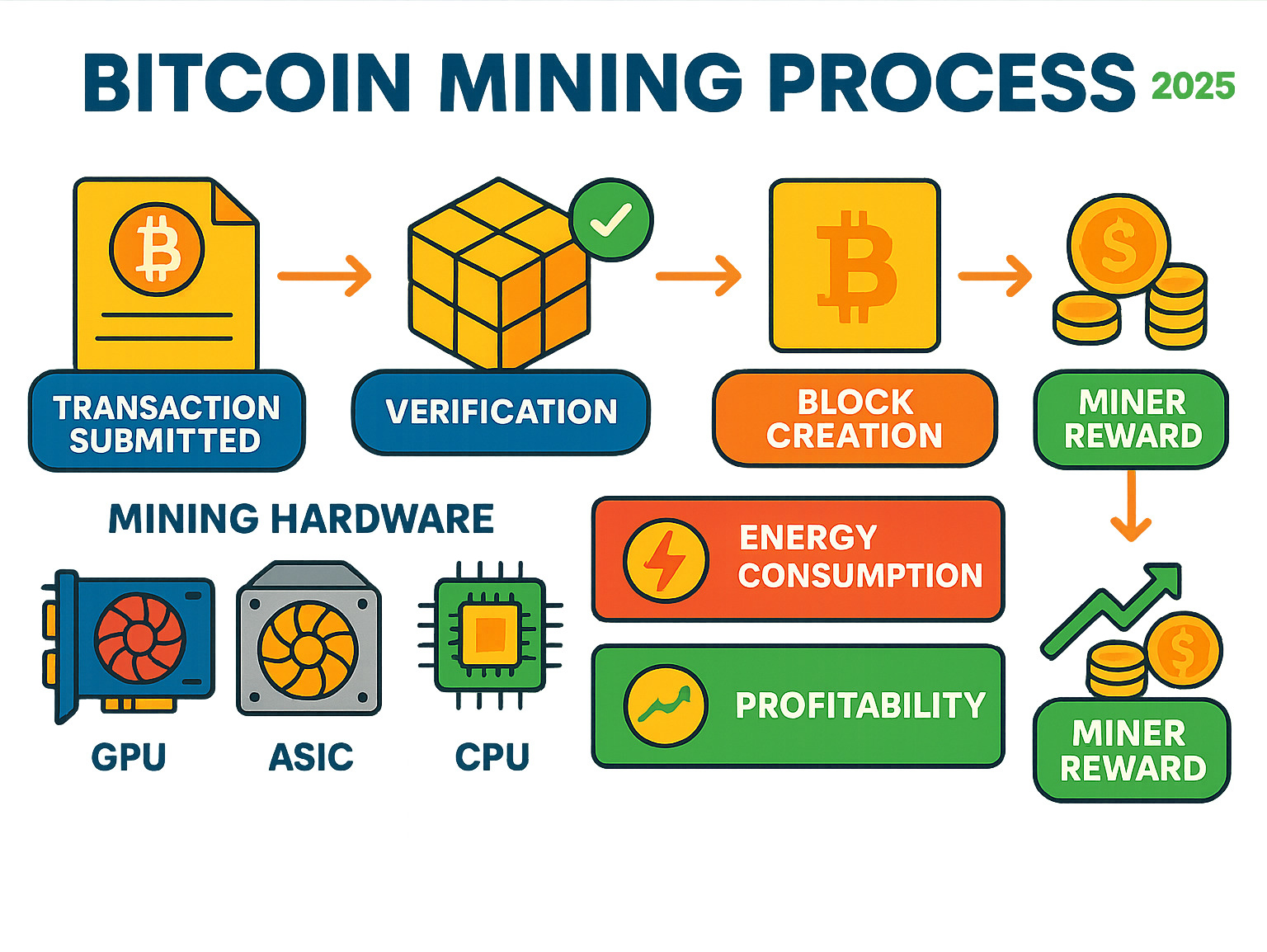

The mining process involves powerful computers solving complex mathematical problems to verify transactions and add them to the blockchain. Miners get rewarded with new bitcoins and transaction fees for this work. It’s like being a digital accountant who gets paid in the currency they’re helping to manage.

FintechZoom has emerged as a go-to resource for mining information because it breaks down complex market data into digestible insights. Their coverage includes everything from new mining hardware releases to changes in mining profitability and developments in mining pools.

Glossary for fintechzoom.com bitcoin mining:

What is Bitcoin Mining and How Does It Work?

Picture this: Bitcoin mining is like being part of a massive, worldwide accounting team. But instead of boring spreadsheets, you’re using powerful computers to solve incredibly complex puzzles. Every time you solve one, you help verify Bitcoin transactions and keep the blockchain ledger running smoothly.

Bitcoin mining serves two crucial purposes that keep the entire network humming along. First, it’s how new bitcoins are born and enter circulation. Second, it maintains a rock-solid record of every Bitcoin transaction that’s ever happened. Think of miners as digital detectives who make sure every transaction is legitimate before it gets permanently recorded.

The magic happens through something called Proof-of-Work consensus. This fancy term simply means miners have to prove they’ve done the computational “work” by solving complex math problems. It’s like a digital lottery where the winner gets to add the next page to Bitcoin’s permanent record book.

When a miner successfully cracks the puzzle, they’re rewarded in two sweet ways: block rewards (brand new bitcoins) and transaction fees from all the transactions they verified. Currently, miners earn 6.25 new bitcoins per block, plus whatever fees people paid to get their transactions processed faster.

This entire process relies on cryptography – the same technology that keeps your online banking secure. Without miners dedicating their computing power to verifying transactions and creating new coins, Bitcoin would simply stop working. It’s a brilliant system that keeps everything decentralized and secure.

For a deeper dive into how all this cryptocurrency magic works, check out our Car News 4 You Crypto Resource Guide.

The Evolution of Mining

Bitcoin mining has come a long way since Satoshi Nakamoto first introduced it to the world. Back in the early days – we’re talking 2009 here – mining was refreshingly simple. You could literally mine Bitcoin using just your regular computer’s processor during the CPU mining era. Your everyday desktop could churn out bitcoins while you slept!

Those peaceful days didn’t last long, though. As Bitcoin gained popularity and more people jumped on the mining bandwagon, the competition heated up fast. This led to the GPU mining rise, where clever miners finded that graphics cards (originally built for gaming) were way better at the parallel processing that mining requires.

Suddenly, gaming rigs everywhere were pulling double duty as Bitcoin factories. But even GPUs couldn’t keep up with the relentless pace of innovation and competition.

Enter the era of ASIC miner dominance. These Application-Specific Integrated Circuits are like Formula 1 race cars compared to the family sedans of CPUs and GPUs. ASICs are built for one thing only: mining Bitcoin, and they do it with incredible efficiency.

This constant technological arms race has led to increasing mining difficulty as the Bitcoin network automatically adjusts to maintain consistent block times. What started as a hobby you could do on your laptop has evolved into an industrial operation. But here’s the silver lining: all this competition and innovation has made Bitcoin’s network security stronger than ever.

The Impact of the Bitcoin Halving

Here’s where Bitcoin gets really interesting from an economic perspective. Every four years, like clockwork, Bitcoin goes through something called a “halving.” It’s exactly what it sounds like – the reward miners get for successfully mining a block gets cut in half.

When Bitcoin launched, miners earned 50 bitcoins per block. By 2020, that reward had shrunk to just 6.25 coins. The next halving will slice it down to 3.125 bitcoins. It’s Bitcoin’s built-in way of controlling supply and demand.

This four-year cycle creates artificial scarcity that often drives up Bitcoin’s price over time. Think of it like a rare collectible – the fewer new ones that get made, the more valuable the existing ones become.

But here’s the catch for miners: their direct income from reduced block rewards gets slashed overnight. This can seriously impact profitability, especially for miners dealing with high electricity costs or outdated equipment.

The halving forces miners to become more efficient, upgrade their gear, or find cheaper energy sources. It’s like a survival test that weeds out the less competitive operations. Historically, Bitcoin’s price has tended to rise after halvings, often making up for the reduced rewards, but there are never any guarantees in this volatile market.

Understanding this cycle is crucial for anyone interested in fintechzoom.com bitcoin mining or the broader cryptocurrency landscape. For more detailed insights into this fascinating economic mechanism, explore our Car News 4 You Bitcoin Halving Overview.

A Beginner’s Guide to Bitcoin Mining Methods

Ready to dip your toes into the fintechzoom.com bitcoin mining world? That’s exciting! The good news is you have several paths to choose from, each with its own personality and requirements. Think of it like choosing between buying a car, leasing one, or just using ride-sharing – they’ll all get you where you want to go, but the experience and costs are quite different.

The mining landscape has three main approaches: running your own hardware at home, using specialized mining equipment, or going the remote route where someone else handles the heavy lifting. Your choice really depends on how hands-on you want to get, your budget, and whether you’re okay with your basement sounding like a jet engine.

Hardware-Based Mining: CPU, GPU, and ASIC

Let’s talk about the three generations of mining hardware – it’s like looking at the evolution from horse-drawn carriages to sports cars.

CPU mining is where it all began, back when Bitcoin was just Satoshi Nakamoto’s fascinating experiment. Your regular computer processor could actually mine Bitcoin and make money doing it! Those days are long gone, though. Today, trying to mine Bitcoin with your CPU is like trying to dig a swimming pool with a teaspoon – technically possible, but you’ll spend more on electricity than you’ll ever earn back.

GPU mining brought the first real power boost to the mining world. These graphics cards, originally designed to make your video games look amazing, turned out to be fantastic at the mathematical heavy lifting that mining requires. While they’ve been largely outpaced for Bitcoin mining, GPUs still shine when it comes to versatility. You can switch between different cryptocurrencies depending on what’s most profitable, making them a more flexible investment.

ASIC miners are the current champions of the Bitcoin mining world. These specialized machines are built for one thing only: solving Bitcoin’s specific mathematical puzzles as efficiently as possible. They’re incredibly fast and energy-efficient for their job, but they come with a hefty price tag and can only mine Bitcoin (or coins using the same algorithm).

When you own your hardware, you’re in complete control of your mining operation. You decide when to run it, how to cool it, and when to upgrade. The downside? You’re also responsible for the initial investment (which can be thousands of dollars), the ongoing electricity costs, and dealing with machines that can get quite loud and hot. It’s definitely a more hands-on approach that requires some technical comfort.

Remote Mining: The Hands-Off Approach

If the idea of turning your home into a mini data center doesn’t appeal to you, remote mining might be your perfect match. Also known as cloud mining, this approach lets you rent computing power from large-scale mining operations. You pay them, they do the mining, and you get your share of the rewards delivered to your wallet.

The appeal is obvious – much lower entry barriers and zero equipment headaches. You don’t need to research the best hardware, worry about cooling solutions, or deal with noise complaints from your neighbors. It’s mining made simple, which is why many beginners find it attractive.

But here’s where we need to pump the brakes a bit. Remote mining comes with some serious considerations that you absolutely must understand before jumping in. The contract terms can be tricky, with various fees and payout structures that might not be immediately obvious. Some providers charge maintenance fees that can eat into your profits, while others might have minimum withdrawal amounts or long contract periods.

The biggest challenge is provider reliability. Unfortunately, the cloud mining space has attracted its fair share of questionable operators. Some have turned out to be outright scams, while others simply weren’t transparent about their true costs and capabilities. You’re essentially trusting someone else with your investment, and you have no control over the actual mining equipment or operations.

Before considering any remote mining service, do your homework thoroughly. Look for providers with transparent operations, clear fee structures, and positive track records. Be especially wary of anyone promising guaranteed returns – Bitcoin’s volatility makes such promises impossible to keep legitimately.

If something sounds too good to be true in the mining world, it probably is. The most successful miners, whether they use their own hardware or remote services, approach it as a serious business venture that requires careful planning and realistic expectations.

Your Guide to Car News 4 You Bitcoin Mining Resources

Here at Car News 4 You, we’ve made it our mission to be your friendly guide through the sometimes overwhelming world of fintechzoom.com bitcoin mining. We know that diving into cryptocurrency can feel like learning a completely new language, which is why we’ve dedicated ourselves to breaking down complex topics into bite-sized, digestible pieces.

Think of us as that tech-savvy friend who’s always happy to explain things without making you feel silly for asking questions. We’re a dedicated informational platform that specializes in news aggregation – meaning we gather the most important mining developments from across the industry and present them in one convenient place. Our market analysis goes beyond just reporting what happened; we help you understand why it matters and what it could mean for your potential mining journey.

What really sets us apart is our beginner-friendly interface. We’ve designed our content to welcome newcomers while still providing valuable insights for more experienced miners. Whether you’re trying to figure out what a hash rate is or you’re comparing the latest ASIC models, we’ve got you covered with educational content that actually makes sense.

For a comprehensive look at everything we offer in the crypto space, check out our Car News 4 You Crypto Guides.

Analyzing Profitability with Car News 4 You Bitcoin Mining Tools

Let’s be honest – nobody gets into Bitcoin mining just for the fun of it (though it can be pretty exciting!). You want to know if you can actually make money, and that’s exactly where our resources shine.

While we don’t run mining operations ourselves, we provide something arguably more valuable: the knowledge you need to make smart decisions. We’re constantly tracking hardware news because when a new, more efficient ASIC hits the market, it can completely change the profitability landscape overnight. That old mining rig that was profitable last month? It might suddenly be eating more electricity than it’s producing in Bitcoin.

We also keep a close eye on mining pool developments. These aren’t just technical updates – they directly impact how much of the mining rewards you’ll actually receive. When a major pool changes its fee structure or a new pool gains significant hash rate, we make sure you know about it.

Our approach to using price charts for analysis goes beyond just showing you whether Bitcoin is up or down. We help you understand the relationship between Bitcoin’s price, mining difficulty, and your potential profits. Bitcoin’s price drives your revenue, but mining difficulty determines how hard you have to work for it. Hardware efficiency affects your costs, while electricity expenses often make or break profitability. Don’t forget about pool fees either – those small percentages add up over time.

For detailed price tracking and historical trends that can inform your mining decisions, our Car News 4 You Bitcoin Price Guide is an invaluable resource.

How Car News 4 You Bitcoin Mining Content Stands Out

What makes our fintechzoom.com bitcoin mining coverage different? We like to think it’s our commitment to keeping things real and practical.

Our accessible analysis means you won’t need a computer science degree to understand our articles. When we talk about hash rates, we explain what they actually mean for your bottom line. When we discuss mining difficulty adjustments, we break down how they’ll affect your daily earnings. No confusing jargon, no assuming you already know everything.

We pride ourselves on our real-time news focus. The crypto world moves incredibly fast, and yesterday’s information can be outdated by morning. We stay on top of breaking developments, from regulatory changes that could impact mining operations to technological breakthroughs that might revolutionize the industry.

Here’s something important to understand: we’re not a trading platform or mining service provider. We don’t sell mining equipment, run cloud mining operations, or facilitate Bitcoin transactions. What we do is provide you with comprehensive, unbiased information so you can make your own informed decisions.

We actively encourage cross-referencing data from multiple sources. While we work hard to ensure accuracy, the crypto space is complex and constantly evolving. The more sources you consult, the better picture you’ll have of any situation.

Perhaps most importantly, we focus on educational value for new investors. Getting started in Bitcoin mining shouldn’t require years of study, but it does require understanding the basics. We make sure our content builds your knowledge progressively, from fundamental concepts to advanced strategies, always with practical applications in mind.

Getting Started: Your First Steps in Bitcoin Mining

Ready to dive into fintechzoom.com bitcoin mining? We get it – the excitement is real! But before you start dreaming of digital gold flowing into your wallet, let’s walk through this together with a clear, step-by-step approach that’ll set you up for success.

Your mining journey begins with choosing the right method for your situation. Think about your budget, how comfortable you are with technology, and what your electricity costs look like. Are you leaning toward investing in your own ASIC hardware, trying GPU mining for altcoins, or exploring cloud mining options? Each path has its own personality, and the right choice depends entirely on your circumstances.

Once you’ve made that decision, it’s time to set up your digital wallet – this is where your hard-earned Bitcoin will live. Think of it as opening a bank account, but for cryptocurrency. You’ll want this ready before you mine your first satoshi.

Here’s where things get interesting: joining a mining pool. Unless you’ve got the budget of a small country and can afford warehouse-sized mining operations, going solo isn’t realistic. Mining pools combine everyone’s computing power, making it much more likely you’ll see consistent rewards. You’ll share the profits, but you’ll actually have profits to share.

If you’re going the hardware route, you’ll need to install the right mining software. This acts as the translator between your equipment and the mining pool. Finally, once everything’s connected and humming along, you’ll want to monitor your operation regularly. Mining isn’t a “set it and forget it” deal – it requires attention and occasional tweaking.

For those just getting their feet wet in the Bitcoin world, our comprehensive guide on How to get started with Bitcoin is a fantastic starting point.

Essential Hardware and Software

Setting up a Bitcoin mining operation is like building your own mini power plant – and honestly, it’s pretty exciting once you get into it! Let’s break down what you’ll actually need to get your operation humming.

Your mining hardware is obviously the star of the show. Whether you choose ASIC miners or GPUs, these are your workhorses that’ll be crunching numbers 24/7. But here’s what many beginners don’t realize – the supporting equipment is just as crucial.

Power Supply Units (PSUs) are absolutely critical. Your miners are going to be hungry for electricity, and a inadequate or unstable power supply can damage expensive equipment faster than you can say “blockchain.” Make sure your PSUs can handle the power requirements with some headroom to spare.

Cooling solutions might not sound glamorous, but they’re essential for keeping your investment running smoothly. Mining generates serious heat – we’re talking about enough warmth to heat a small room in winter! Proper ventilation, fans, or even advanced cooling systems will keep your hardware from overheating and extend its lifespan significantly.

Don’t forget about your internet connection – it needs to be stable and reasonably fast. Your miners need to communicate constantly with the network and your mining pool. A spotty connection means lost opportunities and reduced earnings.

Mining software acts as the bridge between all your hardware and the mining pool. Popular options like CGMiner, BFGMiner, and EasyMiner each have their strengths, so you’ll want to research which works best with your specific setup.

Most importantly, you’ll need a secure Bitcoin wallet for receiving your mining rewards. We can’t stress this enough: for any significant amounts of Bitcoin, consider investing in Hardware wallets, also called cold wallets. These physical devices keep your Bitcoin completely offline, making them virtually immune to online threats. Think of them as a digital safe that hackers can’t even find, let alone crack.

For a deep dive into wallet security, check out our Car News 4 You Bitcoin Wallet Guide.

Understanding the Costs, Risks, and Rewards

Let’s have an honest conversation about what you’re really getting into with fintechzoom.com bitcoin mining. This isn’t a get-rich-quick scheme, and anyone who tells you otherwise is probably trying to sell you something. But with the right approach and realistic expectations, it can be a fascinating and potentially profitable venture.

The costs hit you in waves. First comes that initial sticker shock – quality ASIC miners can cost several thousand dollars each. Even if you go the GPU route, building a decent-sized rig adds up quickly. But that’s just the beginning.

Electricity costs are often the make-or-break factor for mining operations. Your equipment will be running constantly, consuming power like a small factory. The difference between cheap and expensive electricity can literally determine whether you’re profitable or just heating your house with very expensive space heaters. Many successful miners relocate to areas with lower electricity rates.

Hardware depreciation is another reality check. The mining world moves fast, and today’s cutting-edge equipment becomes tomorrow’s paperweight as newer, more efficient models hit the market. Factor this into your calculations – your initial investment will lose value over time.

Don’t forget about maintenance and cooling costs. Keeping industrial-grade equipment running smoothly requires ongoing investment in repairs, upgrades, and climate control.

The risks are real and varied. Bitcoin’s price can swing dramatically – what’s profitable today might not be tomorrow. Market volatility affects every aspect of your operation’s economics. Regulatory uncertainty adds another layer of complexity, as governments worldwide are still figuring out how to handle cryptocurrency mining. The UK’s FCA has published GC23/1: Guidance on cryptoasset financial promotions highlighting the high-risk nature of crypto investments.

Mining difficulty spikes can suddenly reduce your earnings as more powerful miners join the network. Hardware failures happen, often at the worst possible times. And if you’re considering cloud mining, the risk of scams and fraudulent operations is unfortunately high.

But the potential rewards make it interesting. Beyond the Bitcoin block rewards and transaction fees you earn directly, there’s the possibility of capital appreciation if Bitcoin’s value increases after you’ve mined it. Many miners also find satisfaction in supporting the Bitcoin network’s security and decentralization.

The key is approaching mining with clear eyes and realistic expectations. Only invest what you can afford to lose, do your homework on costs and profitability, and remember that success in mining often comes down to patience, persistence, and smart business decisions rather than luck.

Frequently Asked Questions about Bitcoin Mining

We get tons of questions about Bitcoin mining, and honestly, we love answering them! The world of fintechzoom.com bitcoin mining can feel overwhelming at first, but once you break it down, it becomes much clearer. Let’s explore the questions that pop up most often in our inbox.

How profitable is Bitcoin mining today?

Here’s the million-dollar question – literally, in some cases! The truth is, Bitcoin mining profitability today looks completely different from the early days when miners were earning 50 BTC per block. Now we’re down to 6.25 BTC, and that number keeps shrinking with each halving event.

Bitcoin’s current price plays the starring role in your profitability story. When Bitcoin soars, those mining rewards become much more valuable. But when it dips? Well, that’s when some miners start sweating over their electricity bills.

Speaking of electricity, this is often your biggest ongoing expense. Miners in places like Iceland or regions with abundant hydroelectric power have a huge advantage over someone mining in an area with expensive grid electricity. Hardware efficiency matters tremendously too – newer ASIC miners can deliver higher hash rates while sipping less power, making them far more profitable than older models.

Mining difficulty adjusts roughly every two weeks based on how many miners are competing. More miners joining means higher difficulty, which translates to smaller slices of the reward pie for everyone. And don’t forget about mining pool fees – most pools take a small percentage of your earnings.

The best way to get a realistic picture? Use online mining calculators. Plug in your hardware specs, electricity costs, and pool fees to see potential daily or monthly earnings. Just remember, these are estimates that can change faster than Bitcoin’s price on a volatile day!

Can I start Bitcoin mining with no money?

We wish we had better news here, but starting Bitcoin mining with absolutely zero money is like trying to drive a car without gas – technically possible to sit in the driver’s seat, but you’re not going anywhere.

Mining hardware costs are unavoidable. Even entry-level ASIC miners cost hundreds or thousands of dollars. Those free mining apps you might see advertised? They’re either scams or generate such tiny amounts that you’d earn more money looking for loose change in your couch cushions.

Electricity bills don’t care about your budget constraints. Mining rigs consume serious power, and utility companies expect payment regardless of whether your mining operation is profitable.

Some cloud mining services offer small free trials, but these are typically marketing gimmicks that generate pennies at best. The mining software itself might be free and open-source, but without powerful hardware to run it, it’s like having a Ferrari engine with no car to put it in.

The reality is that Bitcoin mining has evolved into a serious investment opportunity that requires capital. You need money for hardware, electricity, cooling, and maintenance. While we understand the appeal of turning spare computing power into digital gold, today’s competitive mining landscape demands real financial commitment.

Is Car News 4 You a reliable source for mining information?

We’re glad you asked! We work hard to earn your trust every day, and transparency is a big part of that effort.

As an informational platform, our mission is crystal clear: provide you with well-researched, accessible content that helps you understand fintechzoom.com bitcoin mining and the broader cryptocurrency world. We’re not trying to sell you mining equipment or get you to sign up for cloud mining contracts – we’re here to educate.

Our news aggregation and analysis approach means we gather insights from various industry sources and expert opinions, then break them down into language that actually makes sense. Whether you’re a complete beginner or someone looking to deepen your mining knowledge, our content is designed to meet you where you are.

We take a beginner-friendly approach seriously. Complex topics get simplified without losing their essential meaning. We answer common questions and guide newcomers through the basics of Bitcoin mining step by step.

Here’s something we always emphasize: cross-reference everything. We encourage our readers to verify information from multiple reputable sources. This isn’t because we lack confidence in our content – it’s because smart investors and enthusiasts always do their homework.

We’re honest about what we are and aren’t. While we report on market trends and mining developments, we’re not a primary source of raw blockchain data. Our strength lies in interpreting these trends and explaining what they mean for you in practical terms.

Our goal is simple: empower you with the knowledge needed to steer the exciting world of Bitcoin mining confidently and safely.

Conclusion

What a journey we’ve taken together through the fascinating world of fintechzoom.com bitcoin mining! From understanding the basic mechanics of how miners verify transactions and secure the blockchain, to exploring the dramatic evolution from simple CPU mining in Satoshi Nakamoto’s early days to today’s sophisticated ASIC operations. We’ve seen how the four-year halving cycles create both challenges and opportunities, cutting rewards in half while potentially driving up Bitcoin’s value through increased scarcity.

We’ve walked through your mining options too – whether you’re drawn to the hands-on approach of managing your own hardware with its higher potential returns and full control, or you prefer the simpler entry point of cloud mining despite its risks and limitations. Each path has its place, and the right choice depends entirely on your situation, budget, and comfort level with technology.

The numbers don’t lie though. With Bitcoin’s market cap soaring past $1.2 trillion and mining difficulty constantly adjusting upward, this isn’t the casual hobby it once was. Today’s mining landscape demands serious research, careful cost analysis, and realistic expectations about profitability. Electricity costs, hardware depreciation, and market volatility all play crucial roles in determining whether your mining venture succeeds or struggles.

Looking ahead, we’re excited about the innovations coming to mining technology and the industry’s growing focus on sustainable practices. The regulatory environment will continue evolving, and successful miners will be those who stay informed and adapt quickly to changes. This isn’t just about earning cryptocurrency anymore – miners are the guardians of a decentralized financial system that’s reshaping how we think about money.

At Car News 4 You, we’re here to help you steer these complex waters with confidence. Our commitment is providing you with clear, practical insights that cut through the noise and help you make smart decisions. Whether you’re just starting to explore mining or looking to optimize an existing operation, staying informed is your best strategy.

The digital gold rush continues, but it rewards the prepared and the patient. Ready to dive deeper into cryptocurrency and digital finance? Explore more in-depth resource guides to expand your knowledge and stay ahead of the curve. Here’s to your success in the exciting world of Bitcoin mining!