Fintechzoom.com Bitcoin Halving 2024: Ultimate Guide

Why Bitcoin Halving Coverage Matters for Crypto Enthusiasts

Comprehensive coverage of the Bitcoin halving has become essential reading for anyone trying to understand one of cryptocurrency’s most important recurring events. This pre-programmed event occurs approximately every four years and cuts the reward for Bitcoin miners in half, creating a supply shock that historically drives significant price movements.

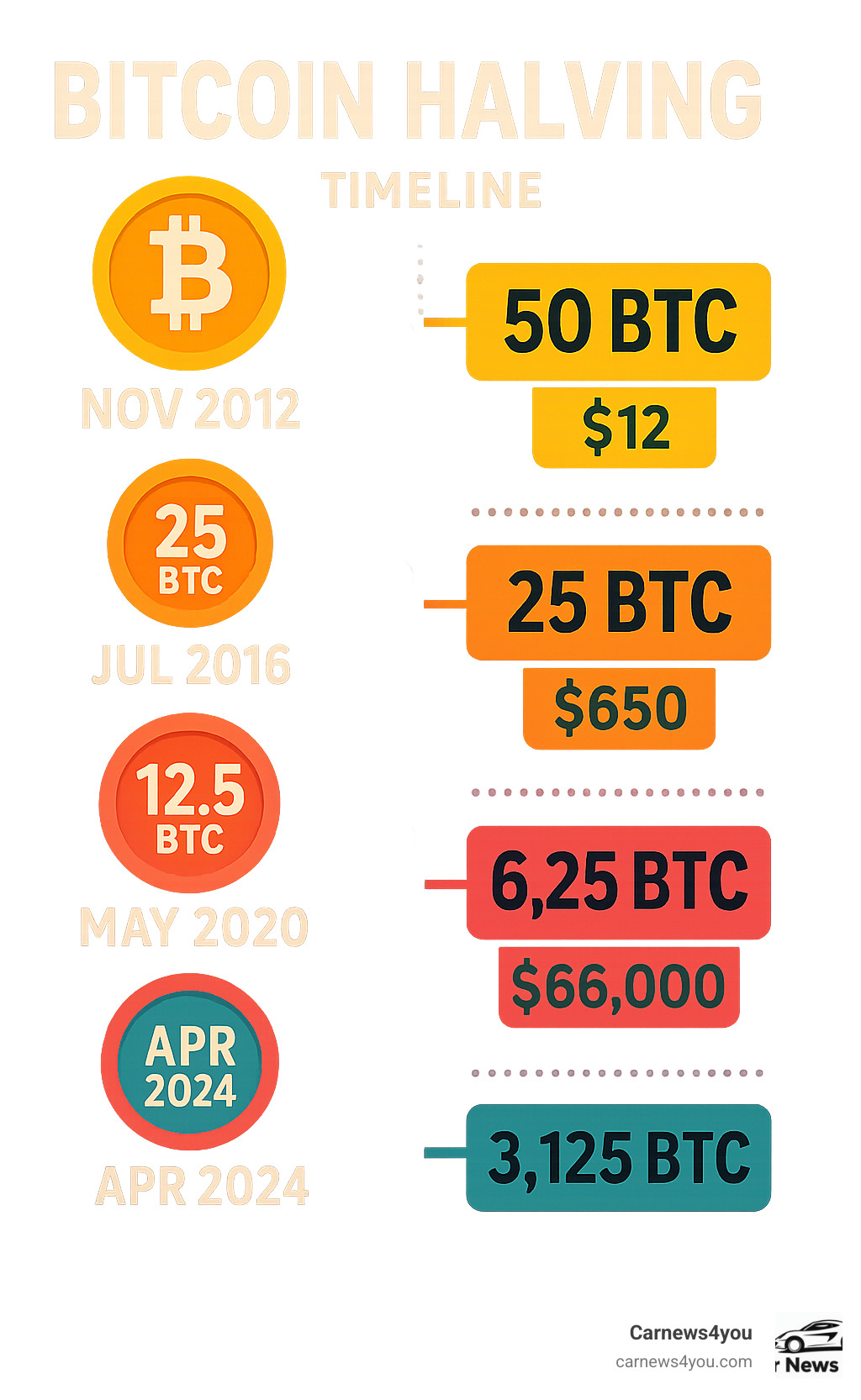

Key Facts About Bitcoin Halving:

- Frequency: Every 210,000 blocks (roughly 4 years)

- Purpose: Controls Bitcoin supply and reduces inflation

- Historical Impact: Previous halvings led to major price increases

- Next Event: Occurred in 2024, reducing rewards from 6.25 to 3.125 BTC

- Market Effect: Creates scarcity that often triggers bull markets

The halving mechanism is built into Bitcoin’s code and serves as a digital version of gold’s natural scarcity. Unlike traditional currencies that governments can print endlessly, Bitcoin has a fixed supply of 21 million coins. Each halving slows the rate at which new bitcoins enter circulation.

Detailed market analysis and Bitcoin forecasts have gained attention from both new and experienced investors. Many traders and enthusiasts seek out in-depth, trustworthy analysis of halving events and their market implications.

Historical data shows remarkable patterns: The first halving in 2012 saw Bitcoin surge from $12.35 to over $127 within 150 days. The 2020 halving preceded Bitcoin’s climb to nearly $70,000. However, past performance doesn’t guarantee future results.

Understanding these events helps explain why Bitcoin often experiences dramatic price swings and why institutional investors increasingly view it as “digital gold.” The halving creates predictable supply constraints that, combined with growing demand, can lead to significant market movements.

Related terms at a glance:

What is Bitcoin Halving and Why Does It Matter?

Think of Bitcoin halving as a built-in economic event that happens like clockwork every four years. It’s not just a technical update – it’s the heart of what makes Bitcoin so fascinating as a digital asset.

Here’s what happens: Bitcoin miners (people who use powerful computers to verify transactions) are rewarded with new Bitcoin for their work. During a halving, that reward gets cut in half. It’s like telling gold miners they can only extract half as much gold as before, making what’s already mined more valuable.

This matters because it creates genuine digital scarcity. Unlike regular money that governments can print at will, Bitcoin has rules baked into its code. Only 21 million Bitcoin will ever exist, and halvings ensure new ones become harder to create.

Market analysis often highlights how this creates a fascinating economic dynamic. When something becomes scarcer but demand remains high, the price typically goes up. It’s basic supply and demand applied to digital money.

The Mechanics of Bitcoin Halving Explained

Let’s break down how this works. Bitcoin miners are the security guards of the Bitcoin network. They solve complex math problems to verify transactions and keep everything running smoothly. As a thank-you, they receive newly created Bitcoin.

The system started with miners getting 50 Bitcoin per block. But Bitcoin’s creator built in a clever twist: every 210,000 blocks (roughly four years), this reward is sliced in half.

Here’s how it played out: 2012 brought the first halving (50 to 25 BTC), 2016 saw the second (25 to 12.5 BTC), 2020 delivered the third (12.5 to 6.25 BTC), and 2024 gave us the most recent (6.25 to 3.125 BTC).

This creates a deflationary model. Instead of more money flooding the system, less new Bitcoin enters circulation over time. It’s coded scarcity at its finest.

How Halving Reinforces Bitcoin’s Value

The beauty of Bitcoin halving lies in how it reinforces the “digital gold” concept. Just like physical gold maintains value because there’s a finite amount, Bitcoin’s programmed scarcity creates similar dynamics.

When a halving occurs, it creates a supply shock. Suddenly, half as much new Bitcoin enters the market, while demand often stays the same or increases due to the attention these events generate.

This makes Bitcoin attractive as a store of value, especially when traditional currencies face inflation. While central banks can print more money, potentially devaluing what you own, Bitcoin’s supply schedule is predictable and cannot be changed by any government or institution.

The inflation hedge aspect becomes compelling during uncertain economic times. Investors often look for assets that maintain purchasing power, and Bitcoin’s halving mechanism provides that kind of protection.

For more insights into how these economic principles play out in broader markets, Economic Analysis offers valuable context.

A Historical Look at Bitcoin Halving Events and Price Trends

Looking back at Bitcoin’s journey through its halving events is like watching an economic experiment unfold in real time. Each halving has told a unique story, yet they all share a common thread: dramatic price movements that have captured the attention of investors worldwide.

What makes these historical patterns so compelling is their consistency. Time and again, we’ve witnessed Bitcoin’s price surge following each halving. While past performance never guarantees future results, the four-year cycle has become legendary among crypto enthusiasts.

The beauty of studying these patterns lies in understanding how market sentiment evolved with Bitcoin’s growing maturity. Each halving wasn’t just a technical event; it was a moment that shaped how the world viewed digital currency. Expert analysis often highlights this evolution from a curious experiment to a legitimate asset class.

While correlation isn’t causation, the consistent upward price movements following halvings suggest a powerful dynamic is at work. The combination of programmed scarcity, growing awareness, and increased adoption creates a perfect storm for price appreciation.

The 2012 Halving: The First Proof of Concept

November 28, 2012, was a pivotal moment in crypto history. This was the day Bitcoin’s reward dropped from 50 to 25 BTC per block. At the time, Bitcoin was trading at a humble $12.35, and most people had never heard of cryptocurrency.

What happened next surprised even the most optimistic believers. Within 150 days, Bitcoin’s price skyrocketed to $127, representing incredible 900% growth. This wasn’t just a price increase; it was a validation of a new economic model.

The 2012 halving proved that coded scarcity could work in practice. It showed that reducing the supply of a desired asset tends to increase its price—simple economics in the digital world.

This early market reaction laid the foundation for everything that followed, showing Bitcoin was an asset with real economic properties.

The 2016 & 2020 Halvings: A Maturing Market Cycle

By the 2016 halving on July 9th, Bitcoin had gained more credibility. The block reward dropped to 12.5 BTC, with Bitcoin trading at $650. The initial price movement was modest, but what came next was spectacular.

Following a familiar pattern, Bitcoin reached $758 after 150 days. The real fireworks began later, as Bitcoin climbed to nearly $20,000 by the end of 2017, capturing global headlines.

The 2020 halving on May 11th told an even more impressive story. Starting from $8,821, Bitcoin rose to $10,943 after 150 days. This time, institutional adoption was accelerating, with major corporations and investment funds taking Bitcoin seriously.

What followed was Bitcoin’s most spectacular run yet, climbing to nearly $69,000 in 2021. This period saw unprecedented media attention and mainstream acceptance, showing that Bitcoin had matured from a niche asset to a recognized store of value.

Each halving has built upon the last, creating larger price movements and attracting more participants, highlighting Bitcoin’s growing role in the global financial system.

The Impact of Halving on the Bitcoin Ecosystem

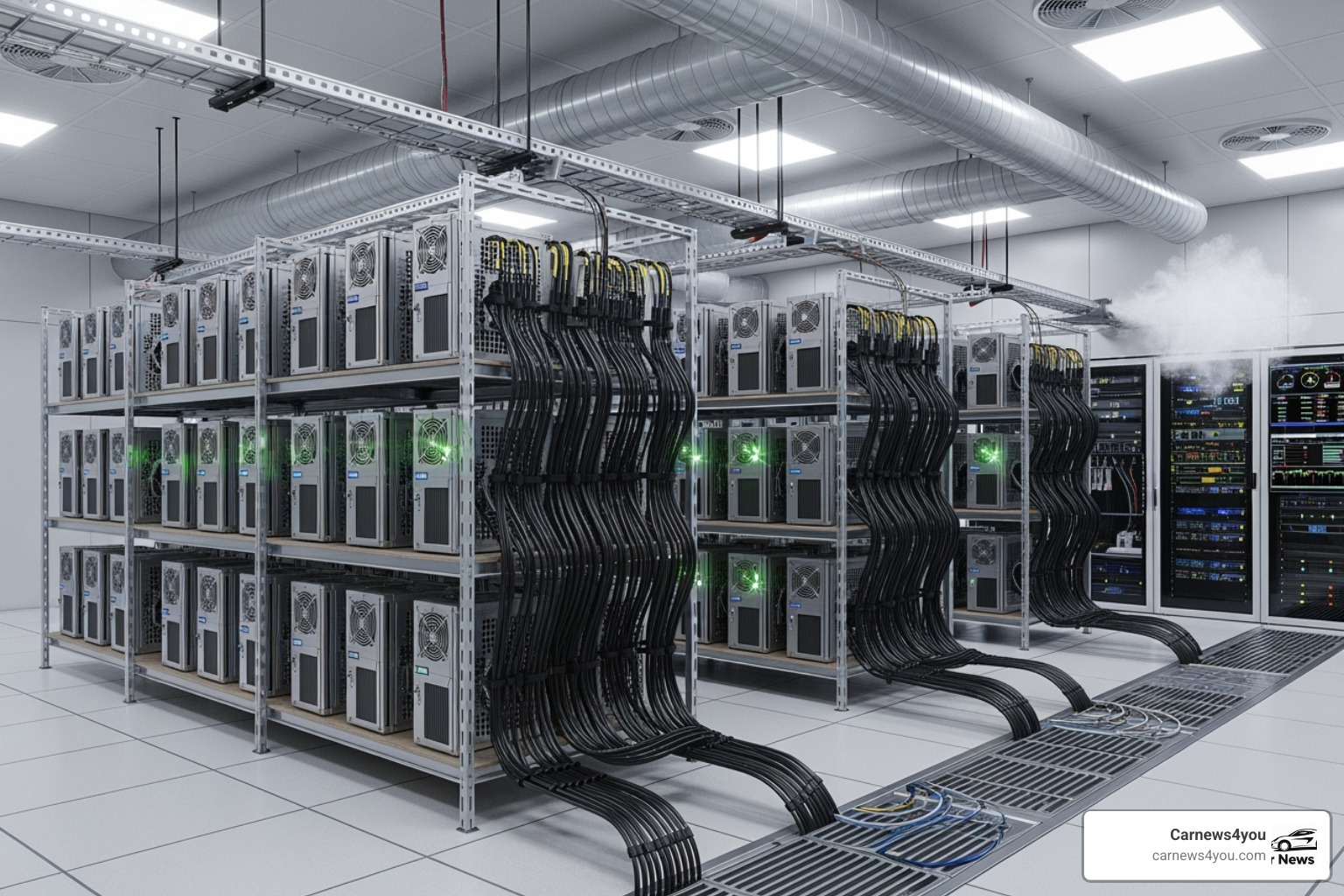

The Bitcoin halving creates ripple effects far beyond price charts. While the media focuses on price movements, the real story unfolds in mining facilities, where the economics of securing Bitcoin’s network undergo fundamental shifts every four years.

Market analysis consistently highlights how these events reshape the mining landscape. When block rewards are slashed in half, it’s like telling every miner their primary income just took a 50% cut. This forces rapid adaptation across the industry.

This system has a natural selection mechanism. Bitcoin halvings strengthen the network by forcing out inefficient operations. This is happening now as miners adapt to the 2024 halving that reduced rewards from 6.25 to 3.125 BTC per block.

Challenges and Opportunities for Bitcoin Miners

Imagine a business where your main revenue source is cut in half overnight, but your costs remain the same. That’s the reality for Bitcoin miners after a halving. Mining costs can soar, creating a profitability squeeze that separates winners from losers.

Miners with older, less efficient equipment or high electricity rates face a stark choice: upgrade or shut down. This harsh reality forces rapid decision-making.

However, this pressure also creates opportunities for innovation. Companies are doubling down, expanding their fleets with cutting-edge, energy-efficient miners. It’s a bet that better technology and lower operating costs will compensate for reduced block rewards.

The push toward sustainable energy has accelerated. The Bitcoin Mining Council reports its members now use electricity with a 63.1% sustainable power mix. This is smart economics, as renewable energy is often cheaper.

Industry consolidation is inevitable as larger operations acquire smaller players. The halving often accelerates merger and acquisition activity across the mining sector.

The Future of Network Security: From Block Rewards to Transaction Fees

As block rewards shrink, transaction fees must become the primary incentive for miners. This transition is already beginning.

On April 20, 2024, transaction fees peaked at 1,257.71 BTC, accounting for over 75% of total miner revenue that day. This was driven by network activity from new protocols like Runes and Ordinals, which created congestion and higher fee competition.

This shift proves users will pay for block space when demand is high. It’s a preview of Bitcoin’s future, where miners will compete for transaction fees, ensuring long-term network security after all 21 million Bitcoins are mined around 2140.

The transition also demonstrates Bitcoin’s adaptive resilience. The network evolves under pressure. Surviving miners become more efficient and sustainable, strengthening the network.

Understanding this evolution is crucial. The halving isn’t just about price; it’s about the economics that keep Bitcoin secure and decentralized.

For those curious about Bitcoin’s ultimate destination, many educational resources explain what happens after all 21 million BTC are mined.

Navigating the 2024 Halving with Expert Insights

The 2024 Bitcoin halving was a pivotal moment for investors, miners, and analysts. Understanding its portfolio impact required solid market analysis, smart investment strategies, and reliable data.

This is where quality market coverage really shines. Reliable resources are essential for investors trying to make sense of market noise and plan their next move. Access to quality insights makes all the difference.

Investment Strategies for the Halving Event

There’s no one-size-fits-all approach to halving events. Your strategy should match your risk tolerance and long-term goals.

Long-term hodling is a core strategy for many Bitcoin believers. It involves buying and holding for years, betting that built-in scarcity will drive prices higher. Data shows long-term holders increased their Bitcoin stash by roughly 73% in the year after the first halving.

Many hodlers use dollar-cost averaging, investing a fixed amount regularly regardless of price. This can help smooth out the volatility.

Short-term trading around halvings can be profitable but is not for the faint of heart. Volatility creates opportunities for quick gains and losses. Setting stop-loss orders and taking profits is essential for protecting capital.

Portfolio diversification remains crucial. Spreading investments across different cryptocurrencies and traditional assets can cushion against unexpected outcomes. The 2024 halving showed that different assets don’t always move in lockstep.

Expert Predictions and Analysis

The 2024 halving prompted many predictions, and solid analysis helped cut through the noise.

Some analysts suggested Bitcoin could exceed six figures in the post-halving cycle, while others projected even higher potential peaks.

These forecasts were based on the supply shock theory: when new supply is cut while demand remains strong, prices tend to climb. Historical patterns provided a roadmap.

However, some argued the 2024 halving was already “priced in.” The approval of spot Bitcoin ETFs in the US brought in institutional money, potentially reducing the halving’s impact compared to previous cycles.

Market sentiment analysis was crucial. Investor mood often moved prices more than fundamentals. Understanding this psychological element helped separate signal from noise.

For deeper market insights, Market Insights offers comprehensive coverage.

Understanding the Data

Making sense of data during a halving can be overwhelming. Quality coverage focuses on what matters for investment decisions.

Real-time tracking keeps investors updated on price movements. Current information helps in making timely decisions when markets are moving fast.

Market sentiment indicators proved valuable. By analyzing news, social media, and trading patterns, these tools help investors understand the psychological forces driving prices.

News aggregation is a lifesaver during busy periods. A single source curating key developments saves investors from information overload.

The strength of good analysis lies in making data-driven decisions accessible. Complex concepts are broken down, helping all investors understand what’s happening and why it matters.

Frequently Asked Questions about Bitcoin Halving

Let’s address the most common questions people have about Bitcoin halving. Understanding the answers helps you steer this fascinating cryptocurrency event with confidence.

How does the halving affect Bitcoin’s price?

Historically, halvings have been followed by significant price increases due to reduced new supply. However, past performance doesn’t guarantee future results.

Think of it this way: if gold miners could suddenly only produce half as much gold, but demand remained the same, the price would likely go up. That’s essentially what happens with Bitcoin.

The numbers tell a powerful story. After the 2020 halving, Bitcoin’s price rocketed from around $8,821 to nearly $70,000 in the following year. In-depth analysis often highlights how this scarcity mechanism creates upward pressure on prices.

However, Bitcoin’s price isn’t controlled by halving alone. Macroeconomic conditions, regulatory news, institutional adoption, and market sentiment all play crucial roles and can overshadow the halving’s impact.

How does the halving impact Bitcoin miners?

For miners, a halving is like a 50% pay cut overnight. The halving directly cuts the block reward miners receive for validating transactions by half, creating immediate business challenges.

When rewards dropped from 6.25 BTC to 3.125 BTC in 2024, miners began earning much less for the same work. Those with older equipment or high electricity costs may find mining unprofitable.

This pressure forces tough decisions. Less efficient miners may shut down, creating a natural selection process for the industry.

This challenge also drives innovation. Miners invest in more advanced, energy-efficient hardware and seek cheaper, often renewable, energy sources. This process ultimately strengthens the network’s security and efficiency.

Industry consolidation often follows, with larger operations acquiring smaller players.

Is the halving a guaranteed catalyst for a price increase?

No, it is not guaranteed. While the supply reduction creates bullish fundamentals and history shows post-halving surges, the crypto market is complex.

The halving’s impact might be “priced in” by investors before the event. This means some expected price increase could happen months before, leading to less dramatic immediate surges.

Around the 2024 halving, significant price movements occurred beforehand, partly due to the approval of Bitcoin ETFs and institutional interest. These factors can amplify or overshadow the halving’s direct impact.

Broader market conditions also play a huge role. Global economic stability, regulations, and geopolitical events can all influence Bitcoin’s price.

The key takeaway is that while the halving creates a strong fundamental tailwind, it’s not the sole determinant of price. Smart investors use it as one factor among many and always manage their risks.

Conclusion

The Bitcoin halving is one of cryptocurrency’s most influential events. It’s a built-in economic timer that reminds us of Bitcoin’s brilliant original design. Every four years, this pre-programmed scarcity mechanism cuts the mining reward in half, reinforcing Bitcoin’s position as digital gold.

We’ve seen how this system creates predictable supply shocks that have historically triggered remarkable price movements. From the 900% surge in 2012 to the climb toward $70,000 after the 2020 halving, the pattern has been consistent. Yet, it’s not just about price; the halving drives mining innovation, pushes the industry toward sustainable energy, and shifts the network’s security model from block rewards to transaction fees.

The 2024 halving has set the stage for another transformative period. With institutional adoption growing and quality analysis providing deeper insights into market dynamics, we’re witnessing Bitcoin’s evolution from a niche experiment to a recognized store of value.

What makes this exciting is that each halving occurs in a different market environment. The 2024 event happened alongside the approval of Bitcoin ETFs and increased institutional interest, creating a unique backdrop for the supply reduction.

For anyone in the crypto space, understanding these four-year cycles is essential. The halving affects everything from mining profitability to investment strategies. Staying informed helps you make better decisions.

Remember, while history offers valuable lessons, the future isn’t guaranteed to mirror the past. The halving creates powerful economic incentives but operates within a complex web of global financial conditions, regulations, and market sentiment.

As Bitcoin matures, the halving will continue to play its crucial role in maintaining its scarcity and value. It’s a reminder that the most powerful innovations can also be the simplest.

Ready to explore more fascinating topics beyond crypto? We’ve got you covered with insights across finance, technology, and much more.