Fintechzoom.com bitcoin halving: Unlock 2025 Gains

Why Bitcoin Halving Matters for Crypto Investors

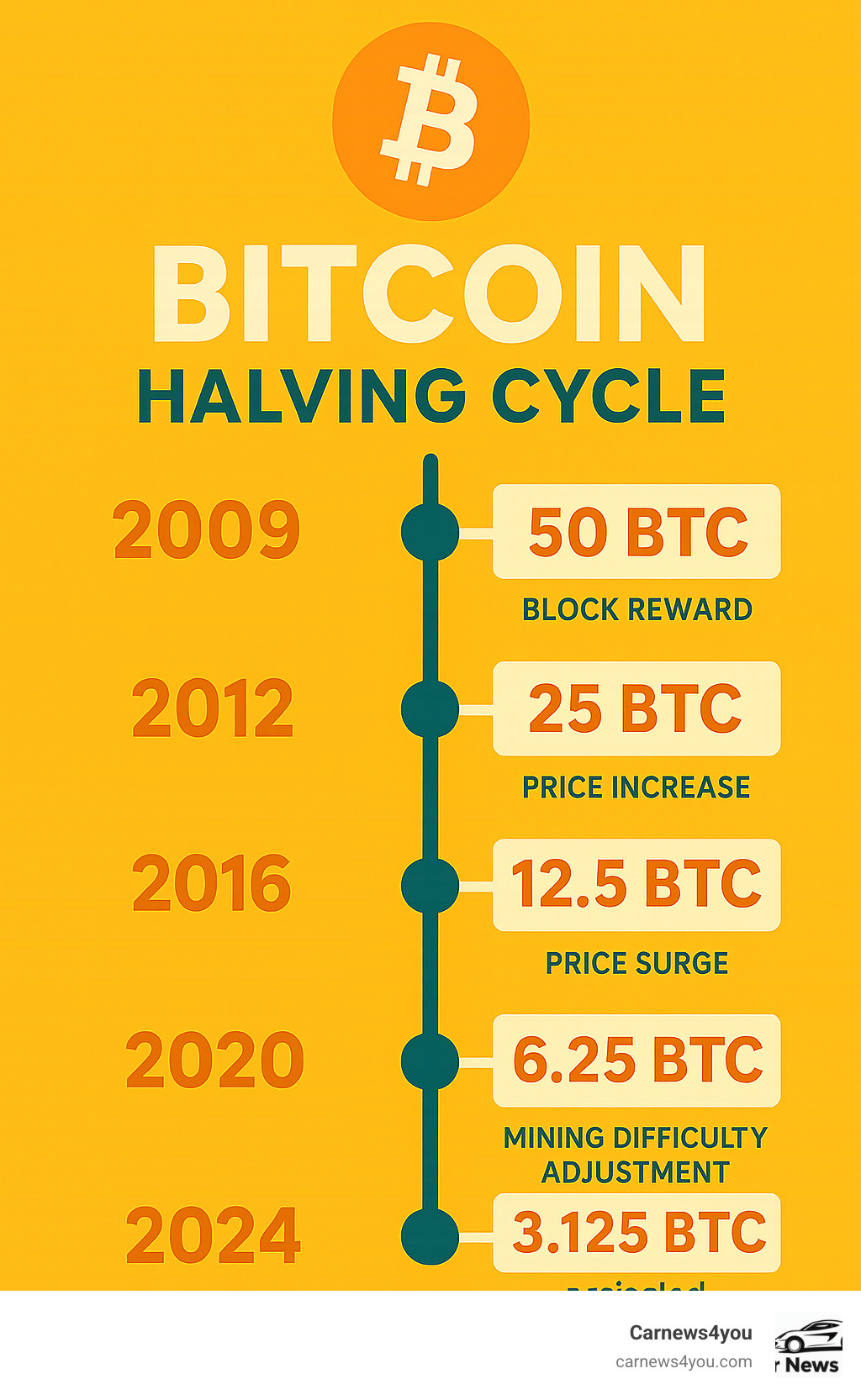

Coverage of the Bitcoin halving has become essential reading for investors trying to understand one of cryptocurrency’s most significant events. Bitcoin halving occurs approximately every four years when the reward for mining new Bitcoin blocks gets cut in half, creating digital scarcity that has historically influenced price movements.

Key Topics in Bitcoin Halving Coverage:

- Up-to-date halving timing – Know when key milestones occur

- Historical analysis – Review price patterns from 2012, 2016, and 2020 halvings

- Expert insights – Understand market narratives and key drivers

- Mining impact reports – Learn how halvings affect the mining industry

- Educational guides – Explore the economics behind Bitcoin’s scarcity model

- Investment considerations – See how investors position around halving cycles

The most recent Bitcoin halving occurred in April 2024, when mining rewards dropped from 6.25 BTC to 3.125 BTC per block. This reduction in new Bitcoin supply has historically preceded significant bull runs, with some analysts predicting Bitcoin could break the $100,000 barrier.

Many readers value detailed market analysis and Bitcoin outlooks. At Carnews4you, we break down complex information into digestible insights, explaining how halving events control Bitcoin’s inflation rate and contribute to its “digital gold” narrative.

Understanding Bitcoin halving helps investors grasp why this cryptocurrency operates differently from traditional assets and why scarcity can drive long-term value.

Related Topics:

The Mechanics and History of Bitcoin Halving

Welcome, fellow crypto enthusiasts! If you’re diving into Bitcoin, you’ve likely heard the term “halving” thrown around with a mix of excitement and anticipation. But what exactly is it, and why does it send ripples through the entire cryptocurrency market? Let’s peel back the layers and understand the core mechanics and fascinating history behind Bitcoin’s pivotal event.

How Halving Works: At its heart, Bitcoin halving is a pre-programmed event embedded directly into Bitcoin’s code. It’s designed to control the supply of new bitcoins entering circulation. Approximately every four years, or more precisely, after every 210,000 blocks are mined on the Bitcoin blockchain, the reward given to miners for validating transactions is cut in half. This is known as the “Block Reward” and it’s how new bitcoins are introduced into the system. This consistent reduction in new supply is what makes Bitcoin a truly deflationary asset, unlike traditional fiat currencies which can be printed endlessly.

The economic principles behind this mechanism are simple yet profound: scarcity. Just like gold, Bitcoin’s value is underpinned by its limited supply. There will only ever be 21 million Bitcoins. By periodically reducing the rate at which new bitcoins are created, the halving events ensure that Bitcoin remains scarce, which, in turn, can drive up its value if demand remains constant or increases.

Historical Price Trends: When we look at past halvings, we see a compelling pattern. While no one can guarantee future results, history has shown us that these events often precede significant bull runs. It’s a classic case of supply and demand: when the supply of new bitcoins shrinks, and demand either holds steady or grows, the price tends to follow suit.

However, it’s crucial to remember the difference between Correlation vs. Causation. While Bitcoin has historically experienced substantial price increases following halvings, these periods also coincided with broader market trends, technological advancements, and growing institutional interest. So, while the halving is a powerful catalyst, it’s part of a larger, complex ecosystem.

Historical Halving Events

To truly appreciate the impact of a halving, let’s take a quick stroll down memory lane and look at the previous events:

-

The First Halving (November 28, 2012): This inaugural event saw the mining reward reduced from 50 to 25 bitcoins per block. At the time, Bitcoin was trading at a modest $12.35. Within 150 days post-halving, its price surged to $127, an astonishing over 900% growth! This event truly set the stage for understanding the potential market cycles.

-

The Second Halving (July 9, 2016): The block reward was further reduced to 12.5 bitcoins per block. Bitcoin was trading around $650. While the immediate jump wasn’t as dramatic as the first, reaching $758 within 150 days, this halving set the stage for the monumental bull run of 2017, where Bitcoin soared to nearly $20,000 by December.

-

The Third Halving (May 11, 2020): This most recent halving brought the reward down to 6.25 bitcoins per block. Despite the global economic uncertainty caused by the pandemic, Bitcoin was trading at about $8,821. Within 150 days, it reached $10,943, eventually surging past $60,000 within a year.

These Price Surges illustrate the power of reduced supply in a growing market. Each halving has been a significant milestone, marking a new phase in Bitcoin’s journey and contributing to its long-term value proposition.

Understanding Bitcoin Halving: A Deep Dive

Now that we’ve covered the basics, let’s dive deeper into the fascinating world of Bitcoin halving and explore the intricate economic principles that underpin this phenomenon.

Economic Principles: As we mentioned, scarcity is king in Bitcoin. The halving events are pivotal in establishing Bitcoin as “digital gold.” This narrative gains traction because, much like precious metals, Bitcoin’s supply is finite and predictable. In an era of increasing national debts and fiat currency devaluation, Bitcoin’s appeal as a hedge against inflation is growing. It’s a borderless, censorship-resistant store of value that many institutional investors, pension funds, and corporations are now adding to their balance sheets. For more on how economic factors play a role, you can explore More info about the economy.

Impact on the Mining Industry

While halvings are exciting for investors, they present unique challenges for the Bitcoin mining industry.

Miner Profitability: When the block reward is cut in half, miners suddenly earn half the bitcoins for the same amount of work (and energy expenditure!). This directly impacts their profitability. Wall Street experts predict that mining costs could soar post-halving, potentially reaching as high as $40,000 per Bitcoin to remain profitable. This pressure can lead to profitability challenges for less efficient operations.

Industry Consolidation: The increased pressure on profitability often leads to Industry Consolidation. Smaller, less efficient mining farms may struggle to compete, leading to larger, more well-capitalized entities acquiring them or expanding their operations. We’ve seen examples of this, such as Riot Platforms’ attempted takeover of Bitfarms, indicating a strategic shift towards larger-scale, more efficient mining.

Energy Efficiency and Sustainable Mining: To counter the reduced rewards and rising costs, miners are constantly seeking technological advancements. This includes investing in more energy-efficient mining hardware, like Bit Digital’s plan to double its fleet with more efficient miners. There’s also a significant push towards Sustainable Mining. The Bitcoin Mining Council reported that its members use electricity with a sustainable power mix of 63.1%, contributing to a global mining industry’s sustainable electricity mix of 59.9%. This focus on green energy is crucial for the long-term viability and public perception of the industry.

Beyond block rewards, transaction fees are becoming increasingly important for miners. As block rewards diminish, transaction fees are expected to become the primary revenue source, ensuring the network remains secure and incentivized. This shift is already evident, with transaction fees peaking at 1,257.71 BTC on April 20, 2024, accounting for over 75% of miner revenue on that day, partly due to new protocols like Runes and Ordinals boosting network activity. For a deeper dive into how financial markets operate, check out More info about financial markets.

How Carnews4you Provides Clarity

In a market as dynamic and sometimes bewildering as cryptocurrency, our editorial team focuses on clear, useful coverage that helps readers make sense of fast-moving events like the Bitcoin halving.

- Timely coverage: We publish updates on Bitcoin prices, network activity, and key milestones to keep readers informed without promising trading tools or alerts.

- Expert analysis: Our writers translate complex topics into plain-English explainers for both beginners and experienced investors.

- Market sentiment: We highlight notable on-chain trends and sentiment indicators, such as long-term holder behavior and accumulation patterns, to provide context.

- Educational guides: From blockchain basics to halving mechanics, our guides break down concepts into digestible, human-friendly articles.

- Scenario-based outlooks: Rather than issuing trading signals, we present balanced bull, bear, and neutral scenarios grounded in historical patterns and widely cited on-chain metrics.

- Clear sourcing: We verify information and avoid sensationalism, aiming for transparency and reader-first context in a frequently hyped space.

Investor Strategies and Future Outlook

Alright, future-focused investors! Navigating Bitcoin halving events is more than just watching the price go up and down. It’s about having a smart plan. The crypto market can be a bit of a rollercoaster, especially around these big halving moments. So, having a clear Investment Strategy is super important to help you Navigating Volatility and manage your Risk Management.

Common Approaches for Investors

So, what are some of the popular ways people approach investing in Bitcoin, especially with halvings in mind?

First up, there’s the classic strategy known as Long-Term Hodling. This is where you buy Bitcoin and hold onto it for a long, long time, no matter what short-term price swings happen. Think of it like planting a tree and waiting for it to grow – you believe in Bitcoin’s long-term value because it’s so scarce and more and more people are using it. After the very first halving, the amount of Bitcoin held by these long-term investors grew by about 73% in just one year! This approach definitely takes patience and a strong belief in Bitcoin’s future.

Then, for those who like a bit more action and understand how markets move, there’s Short-Term Trading. This involves trying to make quicker gains by buying and selling Bitcoin around halving events. You’d look for key price levels and make moves when the price shifts. But beware! This strategy needs careful Risk Management. This means you should always set Stop-Loss Orders to limit how much you might lose, and also set “take-profit” levels to lock in your gains. It’s like playing chess; you need to think a few moves ahead!

A really smart way to build up your Bitcoin stash over time, without worrying too much about daily price changes, is Understanding Dollar-Cost Averaging (DCA). With DCA, you invest a fixed amount of money into Bitcoin regularly, say every week or month. This helps average out your purchase price over time and reduces the risk of buying all your Bitcoin at a super high price. It’s a disciplined and often less stressful way to invest for the long run. You can learn more about this strategy right here: Understanding Dollar-Cost Averaging.

Finally, it’s always a good idea to spread your eggs into different baskets! This is called Portfolio Diversification. While Bitcoin is a big deal, it’s wise to have other investments too. This could mean buying other cryptocurrencies (we often call them altcoins), or even traditional assets outside of crypto. Diversifying helps reduce your overall risk. If one investment isn’t doing so well, your whole portfolio isn’t in trouble. We might even see some altcoins start to move differently from Bitcoin as the crypto world gets more advanced.

Now, for the exciting part: Future Predictions and Market Forecasts! What’s next after a halving? Well, no one has a crystal ball, but smart folks who watch the market closely have some ideas. Some analysts think Bitcoin could easily break the $100,000 mark. Other forecasts see a potential peak above $170,000 by August 2025, and some believe post-halving prices could even zoom past $250,000! Looking further out, ARK Invest has shared optimistic scenarios suggesting Bitcoin could reach $300,000 by 2026 and even a whopping $1.5 million by 2030. Imagine that!

Many experts say the 2024 halving is “actually different” from past ones. Why? Because of big changes in the market, like the approval of spot Bitcoin ETFs in the U.S. These new investment products mean huge institutions can now easily buy Bitcoin, creating a steady stream of demand. It’s like opening the floodgates for big money! Plus, new activities like “ordinal inscriptions” on the Bitcoin network have boosted transaction fees for miners, showing Bitcoin is evolving beyond just a store of value.

The Halving’s Effect on the Broader Crypto Market

The Bitcoin halving isn’t just about Bitcoin itself; it sends ripples across the entire crypto ocean!

First, let’s talk about Altcoin Reactions. Historically, when Bitcoin makes a big move, the rest of the crypto market tends to follow. After a Bitcoin halving, and if Bitcoin’s price starts to climb, investors often take some of their profits and put them into other cryptocurrencies. This can kick off what’s known as an “altcoin season,” where many altcoins see significant price increases. Some altcoins, like Litecoin, even have their own halving events built into their systems, adding their own unique price boosts.

Next, there’s a massive trend called Institutional Adoption. The approval of spot Bitcoin ETFs in the US has been a game-changer. It means big players like pension funds, insurance companies, and corporations can now easily get into Bitcoin without actually owning the digital currency directly. This surge in institutional interest brings huge amounts of demand and makes Bitcoin seem even more legitimate in traditional finance. We’ve already seen record inflows into these ETFs, which boosts confidence in the crypto market overall.

Each halving event also brings Mainstream Awareness. Every time Bitcoin goes through this big event, it grabs headlines and gets people talking. This increased attention helps more and more people learn about cryptocurrencies, which can attract new investors and users to the entire crypto ecosystem. It’s like a big public service announcement for Bitcoin!

Finally, the halving mechanism plays a huge role in Bitcoin’s Long-Term Sustainability. By steadily reducing the supply of new bitcoins, it truly makes Bitcoin a “deflationary asset.” This means it’s designed to become more scarce over time, unlike regular money that governments can print endlessly. As the rewards for mining new blocks shrink, the network’s security will rely more and more on transaction fees, which are expected to become the main way miners earn money. This ensures the network stays strong and decentralized. Plus, the growing use of renewable energy in Bitcoin mining makes it more environmentally friendly, helping its long-term future. All these things together mean Bitcoin is set to adapt and thrive in the ever-changing financial world, with a design that ensures the network’s long-term sustainability even after the last coin is mined.

Frequently Asked Questions about Bitcoin Halving

We know this is a lot to take in, so let’s address some of the most common questions we hear about bitcoin halving to solidify your understanding and clear up any lingering confusion.

How often does a Bitcoin halving occur?

Here’s the beautiful thing about Bitcoin – it’s completely predictable! A Bitcoin halving happens approximately every four years, but to be more precise, it occurs after every 210,000 blocks are mined on the Bitcoin blockchain.

This timing isn’t left to chance or human decision-making. It’s programmed directly into Bitcoin’s code by its mysterious creator, Satoshi Nakamoto. Think of it like a digital alarm clock that’s been set since Bitcoin’s birth in 2009, ticking away with mathematical precision.

This predictable schedule is one of Bitcoin’s greatest strengths. Unlike traditional monetary policy where central banks can change interest rates or print money on a whim, Bitcoin’s monetary policy is transparent, unchangeable, and known by everyone. No surprises, no sudden policy shifts – just pure, mathematical certainty.

Does the halving guarantee a Bitcoin price increase?

Ah, the million-dollar question! Here’s where we need to be honest with you – the halving doesn’t guarantee anything when it comes to price.

Yes, there’s a historical correlation between halvings and significant price increases. We’ve seen this pattern play out three times now, with impressive bull runs following each event. But correlation isn’t causation, and past performance doesn’t guarantee future results.

The reality is that Bitcoin’s price is influenced by a complex web of factors beyond just the halving. Market sentiment plays a huge role – are people feeling optimistic or fearful? Macroeconomic factors matter too, like inflation rates, global economic uncertainty, and government policies.

The increased scarcity from halving does create upward pressure on price, but markets are incredibly complex beasts. Some experts argue that the halving’s impact might already be “priced in” by the time it actually happens, since everyone knows it’s coming.

The bottom line? While halvings create favorable conditions for price appreciation, they’re not magic price-boosting events. Always do your homework and understand the risks!

How does the halving contribute to Bitcoin’s long-term value?

Now this is where things get really interesting! The halving is like the secret sauce in Bitcoin’s long-term value recipe, and it works in several powerful ways.

First, it controls inflation in a way that’s completely different from traditional money. While governments can print more dollars or euros whenever they want, Bitcoin’s halving ensures that new coins enter circulation at an ever-decreasing rate. This makes Bitcoin a deflationary asset, meaning its purchasing power tends to increase over time rather than decrease.

The halving also creates scarcity in the truest sense. With only 21 million bitcoins that will ever exist, each halving makes new bitcoins harder to come by. It’s like having a gold mine that produces less and less gold every four years – the existing gold becomes more precious.

Here’s something many people don’t realize: the halving actually strengthens network security over time. As block rewards shrink, miners become increasingly dependent on transaction fees for their income. This creates a powerful incentive for them to keep the network running smoothly and securely, because their livelihood depends on people actually using Bitcoin.

Finally, the increased reliance on transaction fees ensures Bitcoin’s long-term sustainability. Even after all 21 million bitcoins are mined sometime around 2140, miners will still be incentivized to secure the network through transaction fees. It’s a brilliant economic design that ensures Bitcoin can thrive for generations to come.

The halving isn’t just a technical event – it’s the beating heart of Bitcoin’s economic model, pumping scarcity and value through the entire system with mathematical precision.

Conclusion

As we wrap up our journey through Bitcoin halving, it’s clear that this fascinating mechanism sits at the very heart of what makes Bitcoin special. We’ve explored how these predictable events create digital scarcity, diving deep into the mechanics that reduce mining rewards every four years and the ripple effects that follow.

The halving’s significance extends far beyond just numbers on a chart. It’s about understanding how Bitcoin’s built-in scarcity model challenges traditional thinking about money and value. We’ve seen how past halvings in 2012, 2016, and 2020 each brought their own unique market dynamics, from dramatic price surges to evolving mining landscapes.

What struck me most while researching this topic is how informed decision-making becomes absolutely crucial during these periods. The crypto market doesn’t hand out guarantees, and while history shows promising patterns, each halving occurs in a completely different economic environment. That’s why staying educated and understanding the underlying principles matters so much more than chasing quick profits.

The importance of research cannot be overstated in this space. Whether you’re considering long-term holding, exploring dollar-cost averaging, or simply trying to understand how Bitcoin fits into the broader financial picture, knowledge truly is power. The mining industry’s evolution toward greater efficiency and sustainability, the growing institutional adoption, and the increasing reliance on transaction fees all paint a picture of a maturing ecosystem.

As your trusted source for trending topics and financial planning insights, we at Carnews4you believe in empowering you with diverse, up-to-date information across all the subjects that matter to your daily life. Bitcoin halving might seem complex at first, but breaking it down into digestible pieces helps us all make better decisions about our financial futures.

The crypto world moves fast, but smart investing moves thoughtfully. Take time to understand what you’re investing in, never put in more than you can afford to lose, and always align your decisions with your personal financial goals. And hey, while you’re making smart financial choices, don’t forget that saving money comes in many forms – including finding the best high-mileage cars to save on gas for your daily commute!