Auto Industry Update: 7 Powerful Trends Shaping 2025 Success

Why This Auto Industry Update Matters Right Now

The auto industry update landscape in 2025 is shifting faster than ever, with trade wars, electric vehicle mandates, and supply chain disruptions creating unprecedented challenges for manufacturers and consumers alike.

Key Auto Industry Developments:

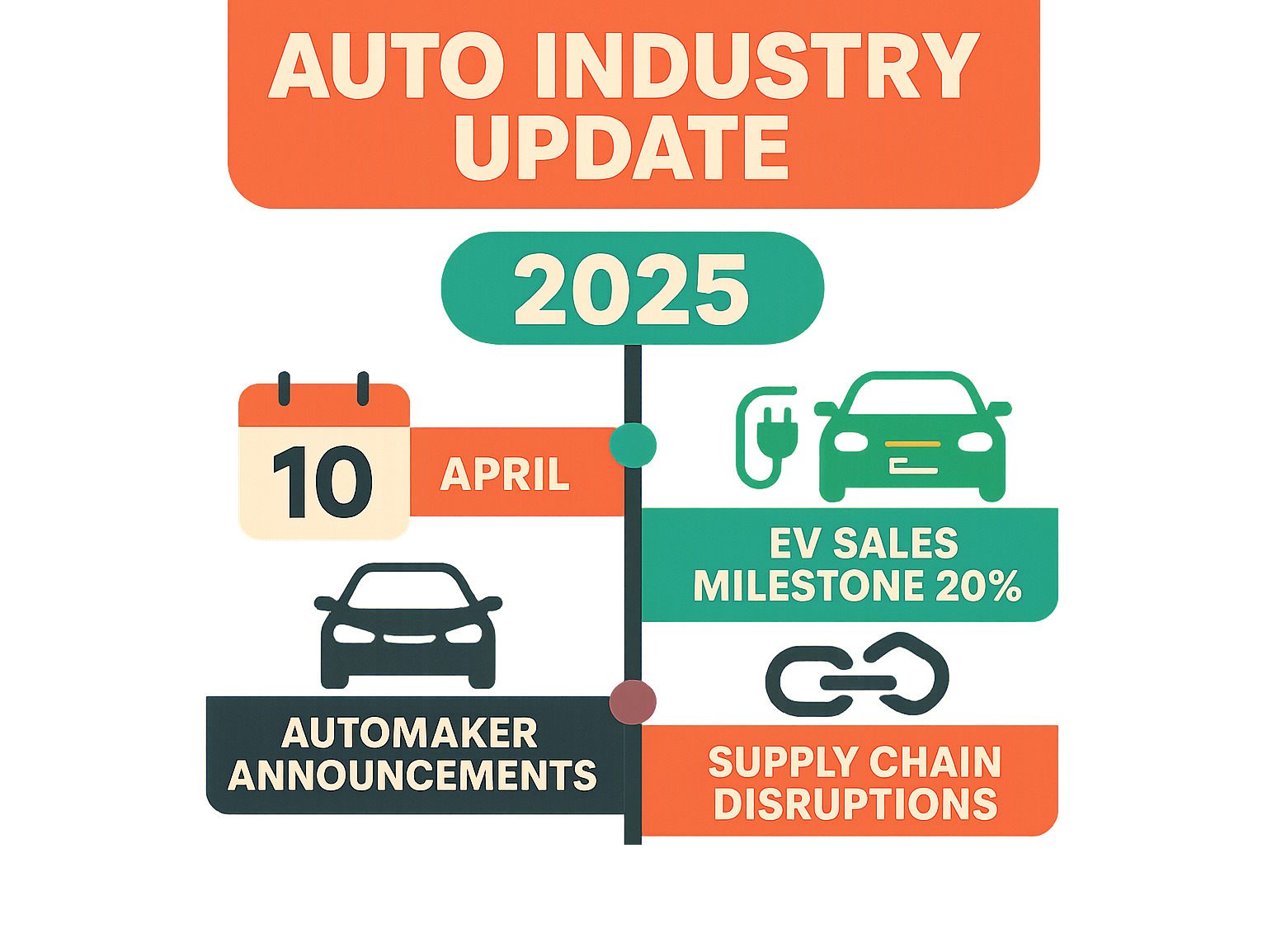

- Tariff Wars: U.S. imposes 25% tariffs on non-USMCA vehicles; Canada matches; China retaliates with 34% duties

- EV Market Surge: Record 20% of U.S. vehicle sales were electric or hybrid in 2024

- Production Shifts: Nissan halts Mexican-built SUV orders; GM expects $5B China restructuring impact

- Sales Recovery: Ford and GM report best annual U.S. sales since 2019

- Policy Pressure: Canadian automakers push to repeal federal EV mandate amid falling demand

Ford CEO Jim Farley captured the industry mood perfectly, saying Trump’s tariffs are causing “chaos” in the auto industry. This chaos is reshaping everything from vehicle pricing to manufacturing locations.

Major automakers are scrambling to adjust their strategies. GM is restructuring its China operations at a massive cost, while Stellantis is offering employee buyouts across multiple plants. Meanwhile, Tesla reported its first annual decline in deliveries, showing even EV leaders aren’t immune to market pressures.

The ripple effects touch every corner of the industry. Used vehicle prices are stabilizing after pandemic volatility, but new car shoppers face limited choices as manufacturers pull certain models from markets hit by tariffs.

Your Mid-Year Auto Industry Update: Tariffs, Tech & Trends

The auto industry update we’re all watching unfold feels like watching a high-stakes chess match where every move changes the entire game. Right now, we’re seeing the most dramatic shake-up in automotive trade that any of us have witnessed in our lifetimes.

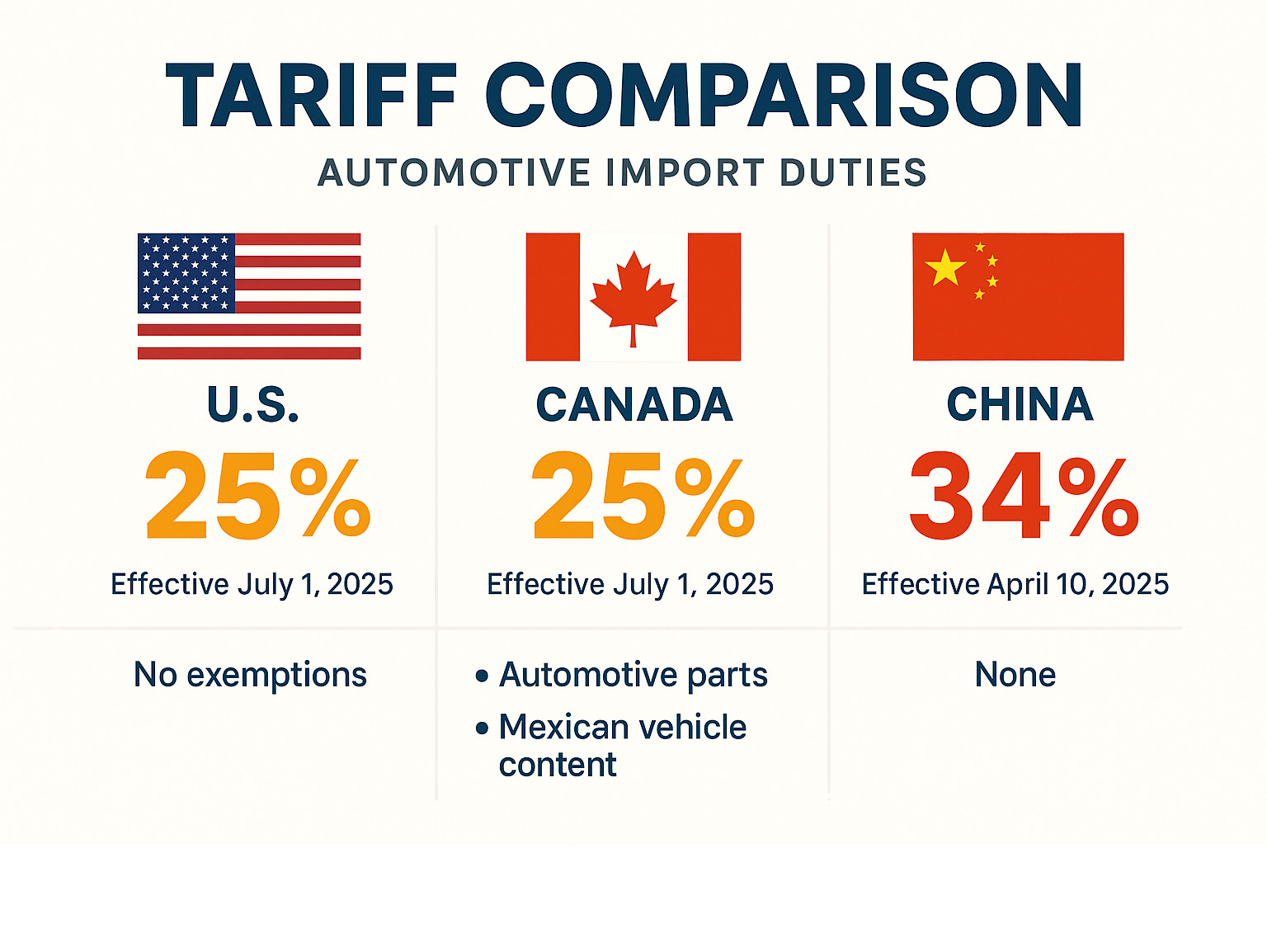

Here’s what’s happening: The U.S. just dropped a 25% tariff hammer on vehicles that don’t meet USMCA requirements. Canada immediately matched these duties, though they’re being smart about it – they’re exempting automotive parts and anything with Mexican vehicle content. Meanwhile, China isn’t taking this lying down. They’ve fired back with a crushing 34% retaliatory tariff on U.S. imports starting April 10, 2025.

This trade war is hitting electric vehicles especially hard. The Biden administration raises tariffs on electric cars from China, which is creating a perfect storm for EV supply chains that were already stretched thin.

But here’s the thing – this isn’t just about big numbers and political posturing. These tariffs are fundamentally changing how your next car gets priced, where it gets built, and what choices you’ll have on the dealer lot. The baseline 10% tariff creates a new reality for import costs, while country-specific duties add layers of complexity that even seasoned manufacturers are scrambling to figure out.

Auto industry update—Immediate price shock

The tariff impact isn’t some future worry – it’s hitting consumers right now. Walk into any dealership and you’ll see MSRP hikes already showing up on window stickers. Some manufacturers are trying to soften the blow by cutting back on dealer incentives instead of shocking customers with higher prices, but that’s like putting a band-aid on a broken dam.

The used car market, which had finally started to cool down after those crazy pandemic price swings, is now seeing renewed upward pressure. When new cars get more expensive, people naturally turn to used vehicles, and that drives those prices up too. Industry experts expect used vehicle prices to continue stabilizing throughout 2025, but these tariffs are definitely slowing that process down.

Auto industry update—Global diplomatic chess

These tariffs represent something much bigger than simple trade policy – they’re reshaping the entire global automotive landscape. Countries are filing WTO challenges left and right, and we’re watching new trade alliances form as nations try to minimize their tariff exposure.

The smartest manufacturers are playing a new game called supply diversification. Instead of putting all their eggs in one basket, they’re spreading production across multiple continents to hedge against future trade wars. It’s like having backup plans for your backup plans – because in today’s world, you never know when the next trade bomb might drop.

Automaker Playbooks: How Ford, GM & Rivals Are Pivoting

The auto industry update wouldn’t be complete without looking at how the big players are scrambling to adapt. Ford’s CEO didn’t hold back when he called the current tariff situation “chaos” – and honestly, that’s exactly what it feels like watching these companies pivot in real time.

GM is facing the biggest financial hit with a jaw-dropping $5 billion impact from restructuring its China operations. That’s not pocket change, even for a giant like GM. The company is essentially rebuilding its entire Asian strategy from scratch, which shows just how dramatically the trade landscape has shifted.

Stellantis chose a different path, offering employee buyouts across Michigan, Ohio, and Illinois plants. It’s a tough but practical approach – right-sizing operations to match demand patterns that have been completely scrambled by new trade policies. These aren’t easy decisions, but they reflect the reality that manufacturers can’t keep running plants that no longer make financial sense.

Nissan moved fast and decisively, immediately pausing U.S. orders for two Mexican-built Infiniti SUVs after the tariffs hit. This kind of rapid-fire model availability change is becoming the new normal. If a vehicle can’t be sold profitably, it gets pulled from the market – simple as that.

Hyundai took a more consumer-friendly approach, promising to keep prices steady until June despite all the tariff uncertainty. It’s a smart move that builds customer loyalty, but realistically, they can’t absorb those costs forever.

The bigger picture here is that on-shoring is happening at breakneck speed. Automotive Tech Innovations are making domestic production more viable than ever, but the transition isn’t smooth. We’re seeing supplier layoffs in communities that built their economies around automotive manufacturing as supply chains get completely reorganized.

Supply-Chain Reinvention

Remember the semiconductor shortage that had everyone scrambling for chips? Well, tariffs are forcing an even bigger supply chain makeover. Chip sourcing is being spread across multiple continents instead of relying heavily on Asia. New facilities are being planned in North America and Europe, though building that expertise takes time.

Critical minerals for batteries have become geopolitical chess pieces. Countries are racing to secure domestic sources of lithium, cobalt, and other essential materials. Nobody wants to be caught dependent on imports when the next trade war hits.

AI logistics are helping manufacturers steer these incredibly complex new supply chains. The technology is getting better at optimizing routes and predicting disruptions, but we’re still in the messy transition period. Near-shoring plants are being built at record pace, but you can’t replace decades of Asian manufacturing know-how overnight.

Labor & Union Perspectives

Here’s where things get interesting from a worker’s perspective. The UAW has actually supported some tariff measures because they see them as protection for American jobs. But union leaders aren’t naive – they know that on-shoring often comes with increased automation.

Canadian unions are watching nervously as their members’ jobs depend on keeping manufacturing costs competitive. If tariffs make Canadian production too expensive compared to U.S. facilities, those jobs could disappear quickly.

The central tension in labor negotiations has become job security versus automation. Tariffs might protect some jobs in the short term, but the long-term trend toward automated production continues regardless of trade policy. It’s a delicate balance that unions and manufacturers are still figuring out together.

Electric Vehicle Market Pulse

The auto industry update wouldn’t be complete without diving into the electric vehicle revolution that’s reshaping everything we thought we knew about car buying. Here’s a stunning fact: electric and hybrid vehicles hit 20% of U.S. vehicle sales in 2024. That’s a milestone nobody saw coming this fast.

But here’s where it gets interesting – this success story comes with some serious plot twists. Tesla reported its first annual decline in deliveries, which sent ripples through the entire industry. When the EV king stumbles, everyone pays attention. It turns out that even Tesla isn’t bulletproof against market saturation and the growing crowd of competitors nipping at their heels.

The charging infrastructure story is like watching a race between a tortoise and a hare. The build-out continues with federal funding protected by court orders, but it’s still not keeping pace with the demand for mass adoption. Range anxiety is real, and until we see charging stations as common as gas stations, some buyers will keep hesitating.

Canada’s EV mandate debate has become a real nail-biter. Automakers are pushing hard to repeal the federal ZEV mandate, arguing that hitting 20% by 2026 is basically impossible. The numbers back them up – EV sales dropped to just 7.53% in April 2025 from a peak of 18.29% in December 2024. That’s not exactly trending in the right direction.

The ZEV credits market has turned into something like a complex trading game. Manufacturers earn credits by beating sales targets or investing in charging infrastructure. It adds flexibility but also creates another layer of complexity in an already challenging transition.

Our detailed coverage of Electric Vehicles explores these trends further, and this 04:44 video on smart car shopping offers practical advice for navigating today’s complicated market.

Incentives, Tariffs & Battery Costs

Federal EV tax credits are like a political football – constantly under pressure and subject to change. This uncertainty makes it tough for consumers to plan their purchases, especially when you add tariffs into the mix.

Chinese battery cell duties are hitting where it hurts most – the core component of every EV. These tariffs are pushing back the timeline for cost-parity between EVs and gas cars, which was supposed to be the tipping point for mass adoption.

The interaction between incentives and tariffs creates a confusing web of costs and benefits that changes depending on which vehicle you’re looking at and who makes it. It’s enough to make your head spin.

EV Supply-Chain Hotspots

The Nissan-SK On $661 million battery supply deal shows how manufacturers are scrambling to lock in their EV component supplies. These strategic partnerships are becoming essential for survival in the EV game.

But not every project is moving forward. EcoPro’s pause of its battery plant construction demonstrates how quickly market conditions can flip investment priorities upside down. One day you’re building the future, the next day you’re hitting the pause button.

Battery recycling breakthroughs are becoming the unsung heroes of the EV story. As the first generation of EV batteries reaches end-of-life, this circular economy approach could help reduce our dependence on critical mineral imports. It’s not glamorous, but it might be the key to making EVs truly sustainable.

Sales Trends, Consumer Sentiment & Economic Risks

Here’s something that might surprise you: despite all the chaos we’ve been talking about, Ford and GM just posted their best annual U.S. sales since 2019. That’s right – record sales in the middle of tariff wars, supply chain nightmares, and economic uncertainty.

It’s a testament to how resilient both manufacturers and consumers have become. People still need cars, and they’re finding ways to make purchases work even when the market feels unpredictable.

Used vehicle prices are finally catching a break after years of pandemic-driven madness. Remember when a three-year-old sedan cost almost as much as a new one? Those days are fading, giving budget-conscious buyers some much-needed relief.

The minivan segment continues its long goodbye, which honestly isn’t shocking. Modern families are choosing SUVs over sliding doors, and changing lifestyles mean fewer people need that classic family hauler. It’s the end of an era, but the market has spoken.

What’s not giving consumers a break is insurance costs, which are spiking across all vehicle categories. It’s adding another layer of expense that people have to factor into their car-buying decisions. Between higher vehicle prices and rising insurance premiums, the total cost of ownership is becoming a real consideration for many families.

The broader economic picture brings both risks and opportunities. Macro risks like potential recession concerns are making consumers more cautious about major purchases. But there’s an upside too – domestic steel production is seeing benefits as tariffs make imported steel less competitive, potentially strengthening the domestic supply chain.

Technology is also reshaping what consumers expect from their vehicles. Connected Car Technology Trends are creating new value beyond just getting from point A to point B. Cars are becoming mobile offices, entertainment centers, and communication hubs.

Hybrid & Plug-In Adoption

Policy drivers are pushing hybrid adoption as the perfect middle ground between gas engines and full EVs. It’s smart positioning – hybrids give consumers the fuel efficiency they want without the range anxiety that still comes with pure electric vehicles.

Toyota’s leadership in hybrid technology is really paying off right now. While other manufacturers scramble to figure out their EV strategies, Toyota’s decades of hybrid expertise makes them the go-to choice for consumers who want to go greener without going all-electric.

The credits market for hybrids isn’t as developed as it is for full EVs, but that’s changing. Policy makers are starting to recognize that hybrids play a crucial role in emissions reduction, and we’re likely to see expanded incentive programs that acknowledge this reality.

Consumer Choice Under Pressure

Model availability has become a genuine concern as manufacturers juggle tariff impacts and regulatory requirements. Some models are disappearing from certain markets entirely, leaving consumers with fewer options than they’re used to.

Rental fleets are shifting their purchasing patterns too, which creates ripple effects throughout the market. When rental companies change what they buy, it affects both new car demand and the used car supply chain down the road.

Subscription models are emerging as an interesting alternative to traditional ownership. In an uncertain market, some consumers appreciate the flexibility of essentially renting a car long-term rather than committing to a purchase.

Price elasticity is being tested like never before. Consumers are weighing the costs of new vehicles against keeping their current car longer, buying used, or even exploring alternative transportation options. The auto industry update shows that people are becoming more creative and strategic about their transportation choices when traditional options become too expensive.

Looking Ahead: Key Challenges & Opportunities for 2025

The auto industry update for 2025 reveals a landscape where opportunity and challenge walk hand in hand. While tariffs and supply chain disruptions dominate headlines, the real story is how these pressures are accelerating innovation in unexpected ways.

Regulatory problems are multiplying faster than solutions. Zero-emission mandates are creating a compliance nightmare for manufacturers who must balance environmental goals with market realities. The Canadian experience shows how quickly these mandates can become political flashpoints when consumer demand doesn’t match regulatory timelines.

Autonomous vehicle rules remain frustratingly vague, leaving companies to invest billions in technology without clear regulatory frameworks. This uncertainty is particularly challenging for smaller innovators who can’t afford to build multiple versions of their systems for different regulatory scenarios.

But here’s where it gets interesting: 3D-printed parts are quietly revolutionizing how the industry thinks about manufacturing. What started as a prototyping tool is becoming a viable production method, especially for low-volume specialty parts. This technology could help manufacturers respond more quickly to supply chain disruptions by producing components locally rather than shipping them across oceans.

Bidirectional charging represents perhaps the most exciting opportunity on the horizon. Imagine your EV not just consuming electricity, but actually powering your home during outages or selling energy back to the grid during peak demand. This technology could transform vehicles from cost centers into revenue generators for their owners.

The robotaxis story is still being written, with some companies expanding to new markets while others face significant setbacks. The technology is advancing steadily, but consumer acceptance and regulatory problems remain substantial. Success will likely come to companies that can steer both the technical and social challenges of autonomous transportation.

Automotive 3D Printing Applications explores how this manufacturing revolution is creating new possibilities for customization and rapid prototyping, potentially reshaping entire supply chains.

Opportunity Watchlist

Truck-as-a-service models are emerging as fleet operators seek flexibility in an uncertain market. Instead of buying vehicles outright, companies are subscribing to transportation services that include maintenance, insurance, and technology updates. This shift could fundamentally change commercial vehicle financing and create new revenue streams for manufacturers.

Sports-centric car experiences are becoming increasingly important as automakers seek to differentiate beyond basic transportation. Whether it’s track-focused performance packages or racing-inspired interior designs, manufacturers are tapping into the emotional connection between cars and competition. This trend aligns perfectly with the growing intersection of automotive technology and sports culture.

Digital retail is no longer experimental – it’s essential. Online car buying accelerated during the pandemic and shows no signs of slowing. This change is changing dealer relationships and creating new opportunities for customer engagement throughout the ownership lifecycle. The companies that master digital retail will have significant advantages in reaching younger consumers who expect seamless online experiences.

These opportunities won’t materialize automatically. Success will require manufacturers to balance innovation with practical market realities, especially as tariffs and regulatory pressures continue reshaping the competitive landscape.

Frequently Asked Questions about Auto Industry Shifts

How will new U.S. tariffs affect car prices in 2025?

The 25% tariff on non-USMCA vehicles is already hitting consumers where it hurts most – their wallets. Some manufacturers are playing the hero temporarily, absorbing these costs to avoid sticker shock. But let’s be honest, this generous approach won’t last forever.

Price increases of $2,000-$5,000 are becoming the new reality for affected models. Luxury vehicles are getting hit the hardest, which makes sense when you think about it – these high-end imports were already expensive, and now they’re even pricier.

The 10% baseline tariff creates what economists call a “new floor” for import costs. Think of it as a permanent tax on bringing cars into the country. When you add country-specific duties on top of that, you get a pricing puzzle that even manufacturers are still figuring out.

The unpredictability is what’s really challenging. One month a car might cost one price, the next month tariffs change and suddenly that same vehicle is thousands more expensive. It’s making car shopping feel like gambling.

What strategies are automakers using to secure battery supply?

Smart manufacturers aren’t putting all their eggs in one basket anymore. Diversifying suppliers beyond China has become job number one, especially after seeing how quickly trade relationships can sour.

Investing in North American battery plants is the hot trend right now. The Nissan-SK On $661 million deal shows how seriously companies are taking supply security. These partnerships aren’t just about money – they’re about survival in an uncertain trade environment.

Recycling technology is becoming surprisingly important. When the first generation of EV batteries reaches the end of their life, recycling creates a circular supply chain that doesn’t depend on imports. It’s like creating your own battery supply from old batteries.

The goal is simple: reduce dependence on any single country or supplier. But this diversification comes with higher costs and complexity. Building new supply chains from scratch isn’t cheap, and those costs eventually find their way to consumers.

Is now the right time for consumers to switch to an EV?

This question doesn’t have a one-size-fits-all answer, and anyone who tells you otherwise is probably trying to sell you something.

Federal tax credits remain available for many models, which helps offset the higher purchase prices. Used EV prices are finally becoming more reasonable after years of being sky-high. That’s good news for budget-conscious buyers.

But here’s the reality check: charging infrastructure gaps still exist, especially in rural areas. And with all the political uncertainty around EVs, policies could change faster than you can say “tax credit.”

For consumers with home charging capability and predictable driving patterns, the switch makes perfect sense. You wake up every morning with a “full tank,” and your fuel costs drop dramatically. But if you’re someone who takes frequent long road trips or lives in an apartment without charging options, you might benefit from waiting.

Hybrid alternatives are worth considering too. They give you some of the fuel efficiency benefits without the range anxiety or charging concerns. Sometimes the middle ground is the smartest choice.

The bottom line? Do your homework, consider your specific situation, and don’t let anyone pressure you into a decision that doesn’t fit your lifestyle.

Conclusion

This auto industry update tells the story of an industry caught between two worlds – the traditional automotive landscape we’ve known for decades and the high-tech, policy-driven future that’s rushing toward us faster than anyone expected.

The changes we’re seeing aren’t just numbers on a spreadsheet. They’re real shifts that affect everyone from the factory worker in Detroit to the family shopping for their next car. Tariff wars are forcing manufacturers to completely rethink where they build vehicles, while the push toward electrification is creating winners and losers almost overnight.

What strikes us most is how quickly everything is moving. Companies that seemed unshakeable just a few years ago are now scrambling to adapt. Tesla’s first annual delivery decline shows that even the EV pioneers aren’t immune to market forces. Meanwhile, traditional automakers like Ford and GM are posting record sales while simultaneously warning about chaos in their planning processes.

The intersection of car culture and automotive innovation has never been more fascinating. We’re watching luxury sports experiences evolve as manufacturers figure out how to make electric vehicles exciting for enthusiasts. Racing leagues are adapting to new technologies, and the whole definition of what makes a car special is being rewritten.

For our readers at Car News 4 You, these changes create incredible opportunities to witness automotive history in the making. The sports-centric car experiences we love aren’t disappearing – they’re evolving into something entirely new. Digital retail is changing how we buy cars, while subscription models are offering new ways to access the vehicles we want.

The companies that will thrive in this new landscape are those that understand something important: technology alone isn’t enough. The emotional connection between people and their cars remains as strong as ever. Whether it’s the rumble of a V8 engine or the instant torque of an electric motor, cars still need to make us feel something special.

Looking ahead to the rest of 2025, we expect the pace of change to accelerate even more. Supply chains will continue adapting, new technologies will emerge, and consumer preferences will keep evolving. The industry’s focus on maintaining that special connection while embracing innovation aligns perfectly with what we cover here.

We’re committed to helping you steer every twist and turn in this exciting journey. For deeper dives into the technologies shaping tomorrow’s vehicles, explore our More info about Car Tech Updates section.

The auto industry update story is far from over. In fact, we’re probably still in the opening chapters of this change. But one thing remains constant – the passion that drives car culture will find new ways to express itself, no matter what changes come our way.