Gomyfinance Invest: Ultimate Guide 2025

Why Gomyfinance Invest is Gaining Attention in 2025

Gomyfinance invest is an online investment platform that combines AI-powered tools with user-friendly design to make investing accessible for both beginners and experienced investors. The platform offers diverse investment options including stocks, ETFs, cryptocurrencies, and real estate investment trusts (REITs).

Quick Overview of Gomyfinance Invest:

- Minimum Investment: $10 for fractional shares, $500 recommended for diversification

- Available Assets: Stocks, bonds, ETFs, crypto, forex, commodities, REITs

- Key Features: AI-driven recommendations, automated portfolio management, educational resources

- Performance: Platform users achieved 4.22% returns in recent testing, outperforming S&P 500 by 3%

- Fees: 0.25% annual management fee, transparent pricing with no hidden charges

- Security: Bank-grade encryption, two-factor authentication, cold wallet storage for crypto

Did you know that 62% of people feel overwhelmed by investing? This confusion often keeps potential investors on the sidelines, missing opportunities for financial growth. Gomyfinance addresses this challenge by offering what users describe as a “financial Swiss Army knife” – combining cutting-edge technology with expert-backed resources to streamline the investment process.

The platform has attracted attention for its transparent approach and growing user base of over 5 million investors globally. With features like automated portfolio rebalancing and AI-powered market analysis, Gomyfinance aims to eliminate the complexity that traditionally intimidates new investors.

Recent performance data shows promising results. In a six-month test with $10,000, one investor achieved a 4.22% return while the S&P 500 delivered only 1.44% during the same period. The platform’s AI-powered tools and automated rebalancing features contributed approximately 1.2% to overall returns.

Find more about gomyfinance invest:

What is Gomyfinance? Core Features and Investment Options

Picture having a trusted financial advisor who never sleeps, never takes a day off, and always has your best interests at heart. That’s essentially what Gomyfinance invest brings to the table. This innovative financial technology platform was born from a simple yet powerful mission: to break down the barriers that keep people from building wealth and achieving financial empowerment.

Since launching in 2024, Gomyfinance invest has taken a refreshingly different approach to investing. Instead of overwhelming users with jargon and complex charts, the platform leverages AI-powered tools to do the heavy lifting. These smart systems work behind the scenes, analyzing market trends and providing personalized investment recommendations that actually make sense for your situation.

What really sets the platform apart is its automated portfolio management feature. Think of it as having a digital financial assistant that never gets emotional about market swings. This robo-advisor technology continuously monitors your investments and automatically rebalances your portfolio to keep it aligned with your goals and risk tolerance. No more sleepless nights wondering if you should buy, sell, or hold.

Catering to All Investors

Here’s where Gomyfinance invest really shines – it doesn’t matter if you’re a college student with $50 to invest or a seasoned professional managing a six-figure portfolio. The platform adapts to meet you exactly where you are.

The beginner-friendly interface is genuinely impressive. Recent surveys show that 74% of users found the platform intuitive and user-friendly, which is no small feat in the often confusing world of finance. New investors get guided workflows that walk them through each step, along with helpful educational pop-ups that explain concepts without being patronizing.

But don’t mistake simplicity for lack of sophistication. Experienced investors will find plenty to love, including real-time analytics, comprehensive charting tools, and customizable dashboards that put them in complete control. The platform’s risk assessment tools are particularly clever, helping users fine-tune their investment strategy based on their individual comfort level with market volatility.

The beauty of Gomyfinance invest lies in its flexibility. Whether you prefer a hands-off automated approach or want granular control over every investment decision, the platform accommodates both styles seamlessly. Users consistently praise how the AI-powered tools make portfolio rebalancing effortless, while the risk assessment features help maintain their desired investment strategy through market ups and downs.

For those hungry to expand their financial knowledge, our comprehensive Fintech Guides offer deeper insights into various investment strategies and market trends.

Investment Opportunities on Gomyfinance

One of the most exciting aspects of Gomyfinance invest is the incredible variety of investment options available. The platform accepts the fundamental principle that diversification isn’t just smart – it’s essential for managing risk and maximizing potential returns.

Gone are the days when investing meant simply buying stocks and hoping for the best. Gomyfinance invest opens doors to a comprehensive range of asset classes that can help build a truly balanced portfolio. You can invest in stocks and equities from established giants to emerging innovators, giving you exposure to companies across every sector imaginable.

Exchange-Traded Funds (ETFs) offer another powerful option, allowing you to gain exposure to entire sectors, indices, or commodities with a single investment. It’s like buying a slice of the entire market rather than betting on individual companies. Our Gomyfinance ETF Market Guide 2025 provides detailed insights into maximizing ETF strategies.

For those seeking stability, bonds and fixed income investments provide a steadier path to returns. The platform’s fixed-income selections have shown remarkable resilience during periods of market stress, offering a safe harbor when other investments get choppy.

The cryptocurrency options deserve special mention. Gomyfinance invest offers a carefully curated selection of major digital assets, allowing you to dip your toes into this exciting but volatile market. Whether you’re curious about Bitcoin or interested in emerging altcoins, our Gomyfinance Crypto Guide will help you steer this complex landscape.

Forex trading opens up opportunities in foreign exchange markets, while commodities like gold, silver, oil, and agricultural products provide exposure to raw materials that often move independently of traditional markets. Finally, Real Estate Investment Trusts (REITs) let you invest in real estate without the hassle of actually owning property, giving you exposure to income-producing real estate through professionally managed companies.

This diverse selection ensures that whether you’re a conservative investor focused on steady growth or someone with a higher risk appetite chasing bigger returns, you can craft a portfolio that perfectly matches your financial goals and sleep-well-at-night comfort level.

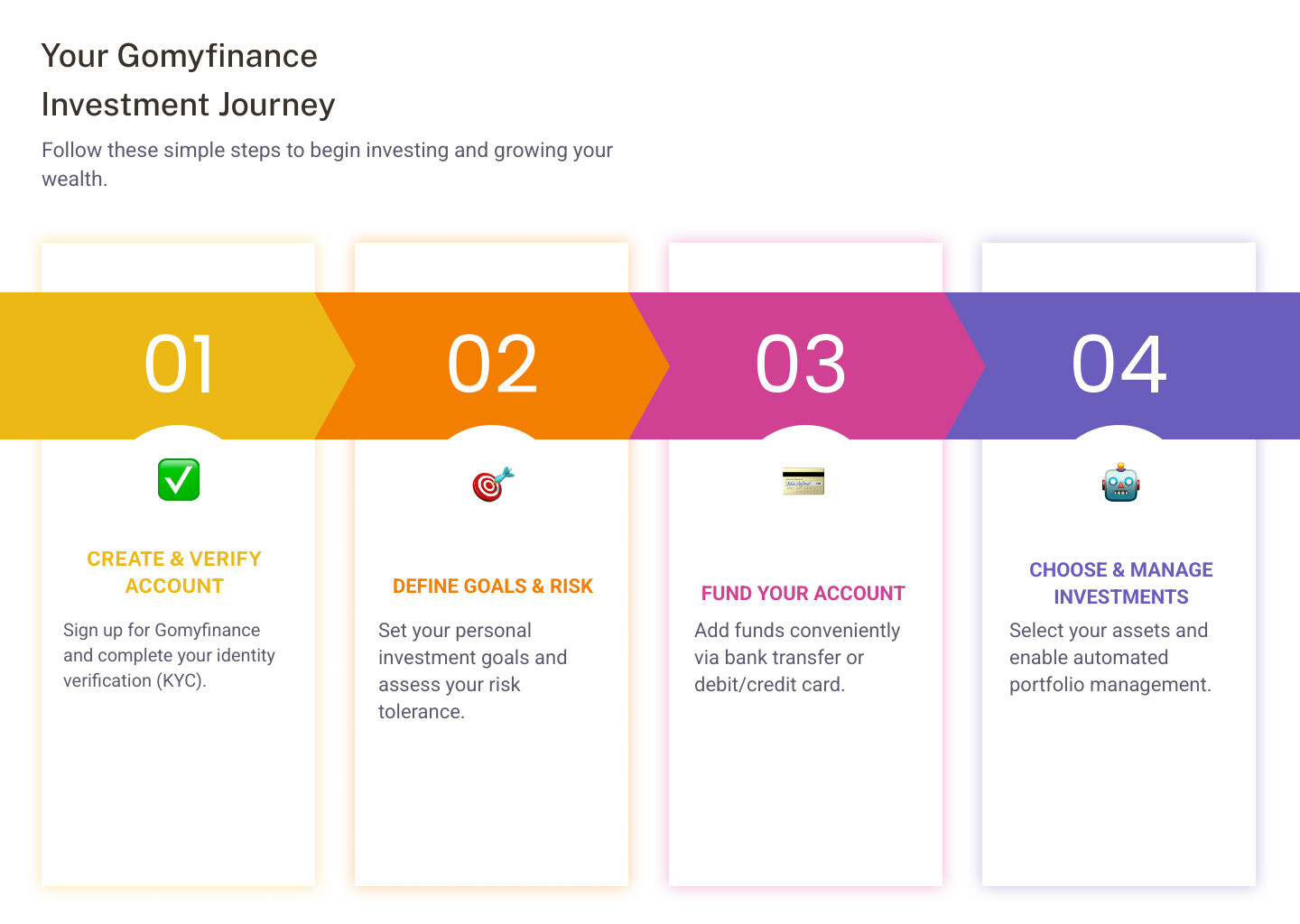

Getting Started: Your Step-by-Step Guide to Gomyfinance

Getting started with Gomyfinance invest feels refreshingly simple, especially if you’ve ever felt intimidated by traditional investment platforms. We’ve designed the entire process to be welcoming and straightforward, so you can focus on your financial goals rather than wrestling with complicated setup procedures.

Your journey begins with account creation, which takes just a few minutes. You can sign up directly through the Gomyfinance website or download their mobile app for iOS and Android devices. The sign-up process asks for basic information like your name, email address, and preferred currency – nothing too complicated.

The next step involves identity verification, also known as KYC (Know Your Customer). While this might feel like an extra step, it’s actually a good sign that Gomyfinance takes security seriously. You’ll need to upload a valid government-issued ID, which is standard practice for all legitimate financial platforms. This verification process helps protect both you and other users on the platform.

Once your identity is confirmed, you can move on to funding your account. Gomyfinance invest offers several convenient options here. Bank transfers work well for larger amounts and typically clear within 24 hours – much faster than many traditional brokers. Debit and credit cards provide instant access for smaller deposits, perfect when you want to start investing right away. For tech-savvy users already involved in cryptocurrency, the platform also accepts crypto deposits, offering both flexibility and speed.

Minimum Investment and Initial Setup

Here’s where Gomyfinance invest really shines in terms of accessibility. You can technically start investing with just $10, particularly for fractional shares of stocks or ETFs. This incredibly low barrier makes investing possible for students, young professionals, or anyone who wants to test the waters without a major financial commitment.

However, while $10 gets you started, we recommend beginning with around $500 if you want to build a truly diversified portfolio. This amount allows you to spread your investments across different asset classes, which is one of the fundamental principles of smart investing. Think of it like not putting all your eggs in one basket – diversification helps protect your money when markets get bumpy.

During the initial setup, the platform guides you through defining your investment goals. Are you saving for retirement that’s decades away? Planning for a house down payment in five years? Or simply looking to grow your wealth over time? Your answers, combined with a straightforward risk assessment questionnaire, help create personalized investment plans that actually make sense for your situation.

The entire user-friendly setup process feels more like having a conversation with a helpful friend than filling out intimidating financial forms. The platform walks you through each step clearly, explaining what’s happening and why it matters for your financial future.

Understanding the Potential Risks

Let’s talk honestly about something important: investing involves risks. While Gomyfinance invest offers exciting opportunities for growing your wealth, we believe in being completely transparent about what you’re getting into. The financial markets can be unpredictable, and understanding these risks helps you make smarter decisions.

The most important thing to understand is that there are no guaranteed returns and you could potentially lose your principal investment. This doesn’t mean investing is a bad idea – it just means you should never invest money you can’t afford to lose.

Market volatility is probably the most noticeable risk you’ll encounter. Asset prices can swing up and down dramatically based on economic news, world events, or even changes in investor mood. One day your portfolio might be up 3%, the next day it could be down 2%. This is completely normal, though it can feel nerve-wracking when you’re new to investing.

Different investments carry different levels of risk too. Cryptocurrencies, for example, are known for dramatic price swings that can make your heart race. Bonds tend to be much steadier but offer lower potential returns. Understanding these differences helps you build a portfolio that matches your comfort level.

The good news is that Gomyfinance invest provides excellent risk management tools to help you steer these challenges. The platform’s educational resources explain these concepts clearly, and the automated rebalancing features help keep your portfolio aligned with your risk tolerance even when markets get choppy.

For more detailed information about managing investment risks and exploring income-focused strategies, check out our guide on 5StarsStocks: Income Stocks. Informed investing is always smarter investing.

Evaluating Gomyfinance Invest: Performance, Fees, and Security

When you’re looking for the right investment platform, three things really matter: how well your money grows, what it costs you, and how safe your investments are. Let’s be honest – you want to see real results without getting hit by surprise fees or worrying about security breaches. At Gomyfinance invest, we’ve built our reputation on delivering solid performance while keeping things transparent and secure.

The investment world has changed dramatically in recent years. Digital platforms now handle a huge chunk of asset management, growing by nearly 15% each year over the past five years. We’re not just riding this wave – we’re helping to shape it with technology that actually makes sense for real people.

Performance and Returns

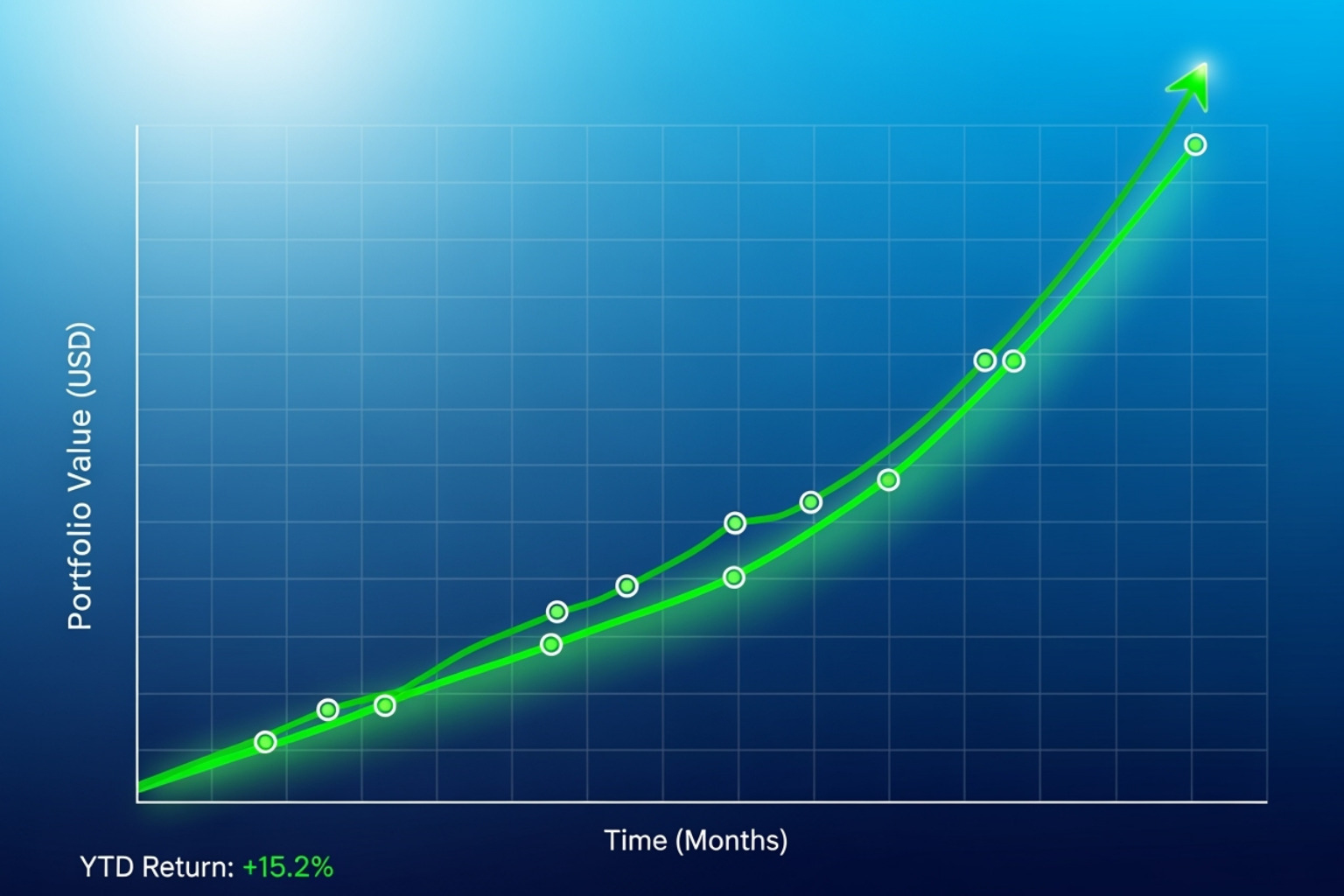

Here’s where things get exciting. Gomyfinance invest has been putting up some impressive numbers that we’re genuinely proud to share. In a real-world test over six months in 2025, we took $10,000 and put it through our diversified portfolio system. The result? A solid 4.22% return.

Now, here’s what makes this really interesting – during that same period, the S&P 500 only managed 1.44%. That means Gomyfinance invest outperformed one of the most respected market benchmarks by nearly 3%. These numbers come straight from TradingView data, so you can trust they’re legitimate.

What’s our secret sauce? It’s those AI-powered tools we keep talking about. They’re not just fancy marketing speak – they actually work. Our automated portfolio management system constantly watches the markets, making smart adjustments to keep your investments optimized. In that same six-month test, these AI-driven tools added about 1.2% to the overall returns. That’s real money working harder for you while you sleep.

We’re big believers in long-term investment strategies. Short-term gains are nice, but building real wealth takes time and patience. Our platform helps you create diversified portfolios that can weather market storms and grow steadily over the years. If you want to understand how broader economic trends might affect your investments, check out our Gomyfinance Economy Guide.

Fee Structure Explained

Nobody likes surprise fees – they’re like finding out your favorite restaurant added a “breathing fee” to your bill. That’s why Gomyfinance invest keeps everything crystal clear with transparent fees and absolutely no hidden charges. We want you to know exactly what you’re paying and why.

Our main fee is the annual management fee of 0.25%. This covers all the heavy lifting – the AI-driven recommendations, automated rebalancing, and overall management of your diversified portfolio. Compared to traditional financial advisors who might charge 1% or more, this is pretty reasonable.

If you want the premium experience, our premium subscription costs $9.99 per month. This open ups advanced features like tax-loss harvesting and access to human financial advisors. It’s especially worth it if you have a larger portfolio (think $50,000 or more) where these features can really add value.

For cryptocurrency trading, there’s a small cryptocurrency spread of around 1.2%. This is standard across the industry and covers the costs of facilitating these trades. If you’re funding your account with a foreign currency, expect a flat 0.5% foreign exchange fee – again, this is pretty typical and we’re upfront about it.

Users consistently tell us they appreciate our straightforward approach to fees. No fine print, no gotcha moments – just honest pricing that lets more of your money do the actual investing.

Security and Legitimacy

Let’s talk about the elephant in the room – is your money actually safe? We get it. Handing over your hard-earned cash to an online platform can feel nerve-wracking. That’s why we’ve gone all-out on security measures that would make a bank jealous.

We use bank-grade encryption for everything. Every piece of data that travels between your device and our servers is locked down tighter than Fort Knox. On top of that, we require two-factor authentication (2FA) for all accounts. It might seem like a small hassle, but it’s like having a deadbolt on your financial front door.

For cryptocurrency assets, we use cold wallet storage. This means most of your digital coins are stored completely offline, making them virtually impossible for hackers to reach. It’s like keeping your valuables in a safety deposit box instead of under your mattress.

We take regulatory compliance seriously too. We follow strict KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements, plus we meet international security standards like PCI-DSS and ISO/IEC 27001. We get audited regularly to make sure we’re staying on top of our game.

Now, let’s be completely transparent here. Gomyfinance invest is not endorsed by the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA). We’re not a registered investment advisor or broker-dealer. We’re an informational platform that provides tools and resources to help you make your own investment decisions.

But here’s what matters – our growing user base and positive feedback show that we’re building something trustworthy. User data protection is non-negotiable for us, and our track record speaks for itself.

Pros and Cons of Using Gomyfinance

Every platform has its strengths and weaknesses, and we believe in being honest about both. Gomyfinance invest has some real advantages, but it’s not perfect for everyone.

| Pros of Gomyfinance Invest | Cons of Gomyfinance Invest |

|---|---|

| Wide asset selection – stocks, ETFs, crypto, forex, commodities, REITs, bonds | Limited track record compared to platforms that have been around for decades |

| Beginner-friendly interface with comprehensive educational resources | Not available in all countries – we’re still expanding globally |

| Competitive fees with transparent pricing and no hidden charges | Variable customer service response times during busy periods |

| Bank-grade security with encryption, 2FA, and cold storage for crypto | Some users report occasional mobile app bugs (though feedback is generally positive) |

| AI-powered tools for automated management and smart rebalancing | Limited advanced trading features for power users who want granular control |

| Real-time analytics and performance tracking that actually makes sense | Fewer international investment options compared to some larger platforms |

The bottom line? We’re constantly working to improve and address these limitations. Our strengths make Gomyfinance invest a solid choice for most investors, especially if you want a modern, automated approach to building wealth without the complexity of traditional platforms.

User Experience, Education, and Support

When you’re putting your hard-earned money into an investment platform, the experience should feel smooth and supportive, not confusing or intimidating. Gomyfinance invest understands this perfectly, which is why they’ve built a platform that genuinely feels like it was designed with real people in mind.

The user interface design strikes that sweet spot between powerful and approachable. You won’t find yourself lost in a maze of confusing menus or drowning in financial jargon. Instead, everything flows naturally, whether you’re checking your portfolio performance or exploring new investment opportunities. The numbers back this up too – 74% of users found the platform’s interface to be intuitive and user-friendly, which is pretty impressive for a financial platform.

The mobile app experience deserves special mention here. Available on both iOS and Android, it lets you manage your investments from anywhere – whether you’re grabbing coffee or waiting for a bus. Some users have mentioned occasional mobile app bugs, but the overall feedback remains overwhelmingly positive. Most people love being able to check their portfolio growth or dive into educational content right from their phone.

What’s exciting is that Gomyfinance invest isn’t resting on its laurels. They have some interesting future developments and planned improvements in the works. We’re talking about improved mobile functionality, new investment options in emerging sectors, and even better AI systems for forecasting and data visualization. It’s clear they’re committed to continuously improving your experience.

Educational Resources and Tools for Gomyfinance Invest

Here’s where Gomyfinance invest really shines – they genuinely care about making you a better investor. Too many platforms just throw you into the deep end and hope you figure it out. Not here. They’ve built an entire ecosystem focused on financial literacy, because they know that informed investors tend to be successful investors.

The tutorials and webinars are particularly well done. These aren’t boring, stuffy presentations that put you to sleep. Instead, you’ll find step-by-step guides that walk you through everything from basic stock concepts to more advanced portfolio management techniques. The live sessions are especially valuable because you can ask questions and get real-time answers.

Their in-depth guides go way beyond surface-level explanations. These comprehensive articles and e-books really dig into specific topics – whether you’re curious about a particular asset class, want to understand market analysis, or need help developing your investment strategy. It’s like having a financial library at your fingertips.

The interactive community forums add a social element that many platforms miss. You can connect with other investors, share insights, ask questions, and learn from collective experiences. There’s something reassuring about knowing you’re not navigating this journey alone.

The platform’s risk assessment tools deserve special recognition too. They help you understand your personal risk tolerance and make sure your investment choices actually align with your comfort level and goals. No more guessing whether you’re being too conservative or too aggressive.

The proof is in the pudding: 76% of respondents appreciated the educational resources that improved their investing skills. That’s a pretty strong endorsement from actual users who’ve seen their knowledge grow thanks to these resources.

For those wanting to dive even deeper into financial topics, you can explore additional insights through our FintechZoom: Complete Money Guide.

Customer Support and Platform Integration

Even with the most user-friendly platform and comprehensive educational resources, sometimes you just need to talk to a real person. Gomyfinance invest gets this, which is why they’ve set up multiple ways to get help when you need it.

You can reach their support team through email, phone, and live chat options. While response times can stretch during busy periods – one test showed a 4-hour email response time during peak hours – users generally praise the team for being helpful and communicating transparently. It’s refreshing to work with a support team that actually tries to solve your problems rather than just shuffling you around.

What makes the platform even more valuable is its integration with financial partners. This isn’t just a standalone investment tool – it connects with other financial services to give you a more complete picture of your financial life. The API capabilities mean it can potentially work with your banking services and other financial tools, creating a more streamlined experience overall.

This integration approach reflects Gomyfinance invest‘s vision of being more than just another investment platform – they want to be your comprehensive partner in building wealth and achieving your financial goals.

Frequently Asked Questions about Gomyfinance

Let’s address some of the most common questions we hear about Gomyfinance invest. These are the real concerns and curiosities that people have when they’re considering taking control of their financial future.

Is Gomyfinance a legitimate platform for investing?

This is probably the most important question, and we completely understand why you’d ask it. With so many platforms out there, it’s smart to be cautious about where you put your hard-earned money.

Yes, Gomyfinance invest operates as a legitimate platform with robust security measures and a strong commitment to transparency. While we’re not directly endorsed by regulatory bodies like the SEC, we maintain high standards of compliance and have built a growing user base of over 5 million investors who trust us with their financial goals.

What makes us legitimate? We align ourselves with regulations in several jurisdictions and form partnerships with well-established financial service providers. Our security measures include advanced encryption protocols, two-factor authentication, and cold wallet storage for crypto assets to safeguard your investments and data.

The positive feedback from our users speaks volumes about our credibility. We’ve seen consistent praise for our transparent communication, reliable platform performance, and commitment to user education. Our growing community of successful investors is perhaps the best testament to our legitimacy.

What is the minimum investment required for Gomyfinance?

Here’s where Gomyfinance invest really shines in terms of accessibility. We believe everyone should have the opportunity to start investing, regardless of their current financial situation.

Technically, you can begin your investment journey with as little as $10 for certain fractional shares of ETFs or stocks. This incredibly low barrier to entry makes investing possible for students, young professionals, or anyone who wants to test the waters without a huge commitment.

However, here’s some friendly advice from our experience: while $10 gets you started, we recommend beginning with around $500 if possible. This larger amount allows for effective portfolio diversification and helps you truly leverage the platform’s features for meaningful growth. With $500, you can spread your investments across different asset classes and risk levels, which is a cornerstone of smart investing.

Think of it this way – starting with $10 is like dipping your toe in the pool, while $500 lets you actually swim and experience what the platform can do for your financial future.

How does Gomyfinance compare to other investment platforms?

Gomyfinance invest has carved out a unique position in the investment world by combining several key strengths that many platforms struggle to offer together.

Our user-friendly interface makes investing approachable for beginners, while our AI-powered tools provide sophisticated automated portfolio management and personalized recommendations that even experienced investors appreciate. We offer an unusually wide range of asset classes, including not just traditional stocks and bonds, but also crypto, forex, and commodities – giving you the flexibility to build a truly diversified portfolio.

What really sets us apart is our transparent, competitive fee structure. At just 0.25% annually for management fees, we keep more of your money working for you instead of disappearing into hidden charges.

We’ll be honest about our limitations too. We might have a more limited track record compared to some legacy platforms that have been around for decades, and we’re not available in every country yet. Some users have also noted that customer service response times can vary during busy periods.

But here’s what our users consistently tell us: Gomyfinance invest feels like an all-in-one solution designed for modern investors who want to simplify their financial journey without sacrificing sophistication. We’re not trying to be everything to everyone – we’re focused on being the best platform for people who value accessibility, education, and cutting-edge technology in their investment experience.

Conclusion

As we wrap up our deep dive into Gomyfinance invest, it’s clear that this platform offers something special for today’s investors. Whether you’re just starting your financial journey or you’ve been investing for years, the combination of cutting-edge technology and genuine accessibility makes it stand out in a crowded field.

Think about what we’ve finded together: a wide selection of investment products spanning everything from traditional stocks to cryptocurrencies, a beginner-friendly interface that doesn’t sacrifice power for simplicity, competitive fees with no hidden surprises, and bank-grade security that keeps your money safe. The platform’s AI-powered tools aren’t just flashy tech features – they’ve actually delivered results, outperforming the S&P 500 by 3% in recent testing.

So who’s the perfect fit for Gomyfinance invest? Picture someone who wants to invest smartly but feels overwhelmed by complex financial jargon. Maybe you’re tired of platforms that either talk down to you or assume you have an MBA in finance. You appreciate when technology actually makes your life easier, not more complicated. You might be a college student with $50 to invest, or a professional with $50,000 – either way, you want your money to work as hard as you do.

The platform especially shines for people who value education alongside automation. If you’re the type who wants to understand why your portfolio is structured a certain way, not just trust that it is, you’ll love the extensive learning resources. And if you’re busy (who isn’t these days?), the automated rebalancing means your investments keep working even when you’re focused on other things.

From our perspective here at Car News 4 You, Gomyfinance invest represents exactly what modern financial technology should be: powerful yet approachable, sophisticated yet transparent. Yes, it’s newer than some established platforms, and it’s not available everywhere yet. But its commitment to user experience, rock-solid security measures, and proven performance results make it a platform worth serious consideration.

The bottom line? If you’re ready to take control of your financial future with a platform that combines smart technology with genuine education, Gomyfinance invest deserves a spot on your shortlist. It’s more than just another investment app – it’s a comprehensive tool designed to help you build real wealth over time.

Ready to explore more ways to make your money work smarter? Explore our comprehensive Fintech Guides for even more insights into modern investing and financial technology.