Subsidized vs Unsubsidized Student Loans: Ultimate 2025

Understanding Federal Student Loans: The Basics You Need to Know

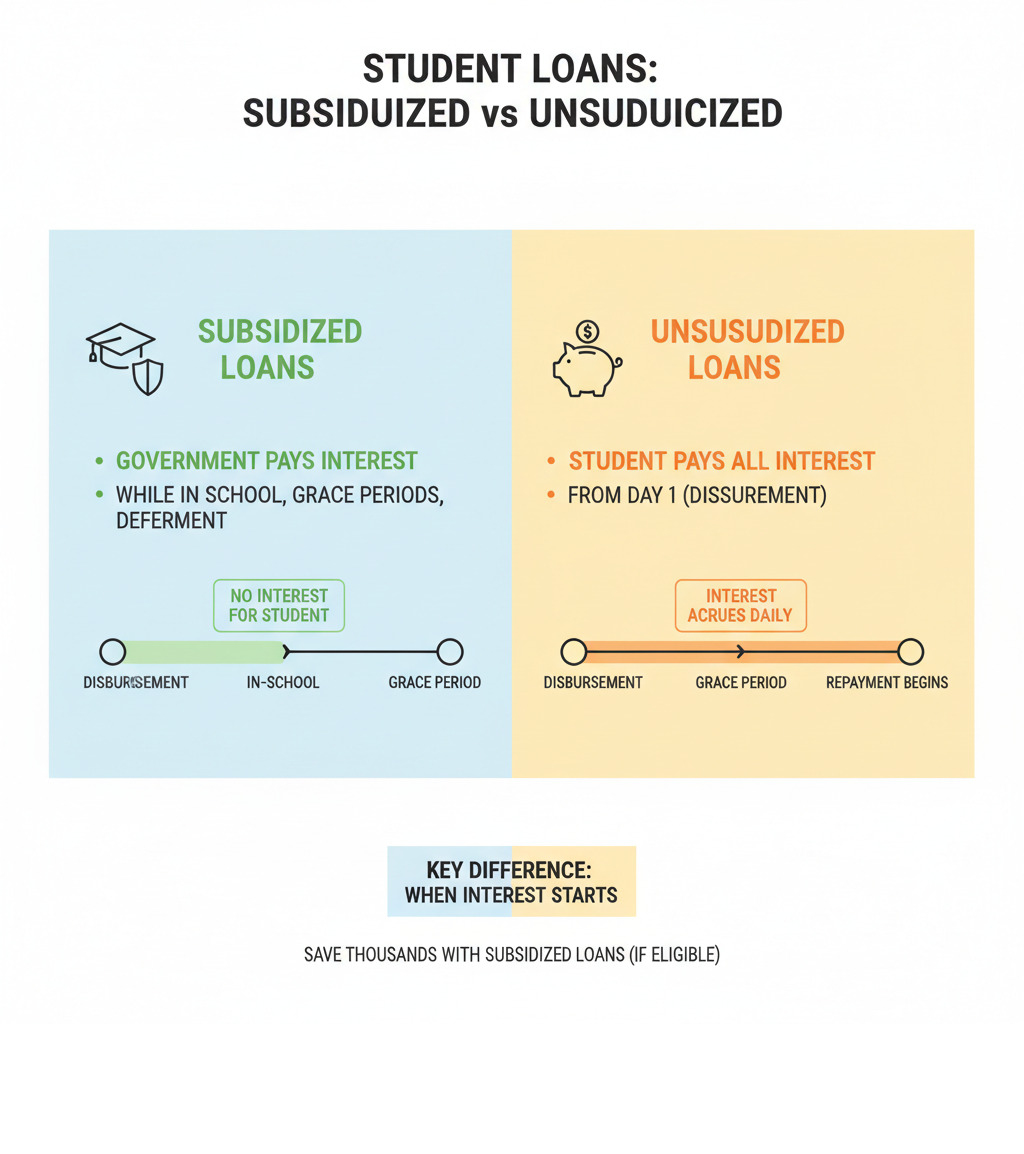

Subsidized vs unsubsidized student loans are two types of federal financial aid that help millions of students pay for college, but they work very differently when it comes to who pays the interest.

Key Differences at a Glance:

- Subsidized Loans: Government pays interest while you’re in school, during grace periods, and deferment

- Unsubsidized Loans: You pay all interest from the day the loan is disbursed

- Eligibility: Subsidized requires financial need (undergraduates only); Unsubsidized available to all students

- Interest Rate: Same rate for both (6.533% for undergraduates in 2024-2025)

- Limits: Lower borrowing limits for subsidized loans

With 53% of undergraduates taking on federal loan debt, understanding these differences can save you thousands of dollars over the life of your loans. The main advantage of subsidized loans is simple: the government covers your interest while you’re focused on your studies.

Both loan types require filling out the Free Application for Federal Student Aid (FAFSA) and offer the same fixed interest rates and flexible repayment options. The key is knowing which one you qualify for and how much you can borrow.

The stakes are real. If the federal subsidized loan program were eliminated, students would pay approximately 12% more over the life of their loans – that’s about $40 more per month on a standard repayment plan.

Related content about subsidized vs unsubsidized student loans:

Key Differences: Subsidized vs Unsubsidized Student Loans

Choosing between federal student loans can feel overwhelming, but understanding subsidized vs unsubsidized student loans is actually pretty straightforward once you know what to look for. Both loans come from the U.S. Department of Education and offer the same great federal benefits – but they handle interest payments in completely different ways.

Here’s where things get interesting. The biggest difference between these loans isn’t the interest rate (they’re actually the same!). It’s who pays the interest and when.

| Feature | Direct Subsidized Loans | Direct Unsubsidized Loans |

|---|---|---|

| Interest Payer (in-school, grace, deferment) | U.S. Department of Education covers interest during school, grace period, and deferment | You’re responsible for all interest from day one |

| Eligibility Basis | Must demonstrate financial need through FAFSA | No financial need requirement |

| Eligible Students | Undergraduate students only | Both undergraduate and graduate students |

| Borrowing Limits | Lower annual and total limits | Higher borrowing limits available |

Who Pays the Interest?

Think of subsidized loans as getting a helping hand from Uncle Sam. When you have a subsidized loan, the government subsidy kicks in to cover your interest during three key times: while you’re in school (enrolled at least half-time), during your six-month grace period after graduation, and during any deferment periods.

This means your loan balance stays exactly the same during these periods. No interest accrual, no surprises – just a loan that patiently waits for you to finish your education.

Unsubsidized loans work differently. From the moment your loan money hits your school account, the interest meter starts running. You have borrower responsibility for every penny of interest that builds up.

Here’s the kicker: if you don’t pay that interest while you’re in school, it gets added to your loan balance through a process called capitalized interest. Suddenly, you’re paying interest on your original loan plus the unpaid interest. It’s like compound interest, but not in a good way.

Who is Eligible for Each Loan Type?

Getting a subsidized loan requires jumping through one important hoop: proving financial need. When you fill out your FAFSA, the government looks at your family’s income, assets, and other factors to determine if you qualify. The FAFSA determination considers your school’s cost of attendance minus what your family can reasonably contribute.

Only undergraduate students can get subsidized loans. Once you graduate and move on to grad school, this option disappears.

Unsubsidized loans are much more inclusive. Graduate and professional students can borrow them, and so can undergraduates – regardless of family income. Rich or poor, these loans are available as long as you’re enrolled at least half-time in an eligible program (enrollment status matters here).

How Do They Compare to Other Financial Aid?

Before diving into any loans, smart students always look at free money first. Grants and scholarships don’t need to be paid back, making them the golden ticket of financial aid. Work-study programs let you earn money while gaining valuable work experience.

When free money isn’t enough, federal loans beat private student loans hands down. Here’s why federal loans are usually your better bet:

Fixed interest rates mean your rate never changes, giving you predictable payments for life. Flexible repayment options include income-driven plans that adjust based on what you actually earn after graduation.

Federal loans also come with federal loan benefits like potential forgiveness programs, deferment options if you hit financial hardship, and no credit checks for most students.

Private loans? They often require good credit or a co-signer, may have variable rates that can increase over time, and typically offer fewer protections if you struggle to repay.

The smart strategy is simple: exhaust grants and scholarships first, then accept subsidized federal loans, followed by unsubsidized federal loans, and only consider private loans as a last resort.

Eligibility and How to Apply for Federal Loans

Getting federal student aid doesn’t have to feel overwhelming. Whether you’re trying to figure out subsidized vs unsubsidized student loans or just starting your college funding journey, everything begins with one simple step: filling out the FAFSA. Think of it as your golden ticket to understanding what help is available for your education.

The FAFSA: Your Gateway to Federal Aid

The Free Application for Federal Student Aid (FAFSA) is basically the key that open ups all federal financial aid opportunities. Without it, you can’t get grants, work-study jobs, or federal student loans – including both subsidized and unsubsidized options.

Here’s the thing about the FAFSA: you need to fill it out every single year you plan to be in school. It’s not a one-and-done deal. The good news? You can complete it online through the FAFSA application portal, which makes the process much smoother than the old paper days.

When you fill out the FAFSA, you’ll provide details about your family’s income and assets. The government uses this information to calculate your Student Aid Index (SAI) – this replaced the old Expected Family Contribution system starting in 2024-2025. Your SAI, combined with your school’s Cost of Attendance (COA), helps determine whether you qualify for subsidized loans or just unsubsidized ones.

After you submit your FAFSA, your school’s financial aid office becomes your best friend. They’ll review your information and put together a personalized award letter that shows exactly what aid you qualify for. This letter breaks down everything – grants, work-study opportunities, and yes, those federal loans we’ve been talking about.

Steps After Applying

Once you get that award letter in your hands (or inbox), you’re not quite done yet. There are a few more steps to actually get your loan money, but they’re pretty straightforward.

First, you need to decide about accepting or declining loans. Just because you’re offered a certain amount doesn’t mean you have to take it all. Smart borrowers only take what they truly need – remember, this is money you’ll eventually pay back with interest.

If this is your first rodeo with federal loans, you’ll need to complete Entrance Counseling. Don’t worry – it’s not as scary as it sounds. This online session walks you through everything you need to know about your loans. You’ll learn about interest rates, repayment options, and your responsibilities as a borrower. You can knock this out on the StudentAid.gov portal whenever it’s convenient for you.

The final step is signing your Master Promissory Note (MPN). This is essentially your promise to pay back the loan, along with any interest and fees. The cool thing about the MPN is that once you sign it, it can cover multiple loans for up to 10 years. So you probably won’t need to sign a new one every year.

All of these steps can be completed online through the StudentAid.gov portal, making the whole process much more manageable. Once you’ve completed everything, your school will receive your loan funds and apply them to your tuition and other approved educational expenses.

The application process might seem like a lot at first, but thousands of students steer it successfully every year. Take it one step at a time, and don’t hesitate to reach out to your school’s financial aid office if you have questions along the way.

Understanding Loan Limits, Rates, and Fees

Beyond eligibility and application, understanding the practical financial details—how much you can borrow, what interest rate you’ll pay, and any associated fees—is crucial for both subsidized vs unsubsidized student loans. These factors directly impact your total debt and future repayment obligations.

How Much Can You Borrow?

Think of federal loan limits like a safety net with built-in boundaries. The government sets both annual borrowing limits (how much you can take each school year) and aggregate loan limits (your lifetime maximum) to help prevent students from drowning in debt.

Your borrowing capacity depends on three key factors: whether you’re considered a dependent or independent student, what year you’re in school, and if you’re pursuing undergraduate or graduate studies.

Dependent undergraduate students typically have lower limits because the system assumes parents can help with costs. In your first year, you can borrow up to $5,500 total, but only $3,500 can come from subsidized loans. Second-year students can borrow $6,500 (with $4,500 subsidized), while third-year students and beyond can access $7,500 annually (with $5,500 subsidized). Your aggregate limit as a dependent undergraduate is $31,000, with no more than $23,000 coming from subsidized loans.

Independent undergraduate students get higher limits since they’re flying solo financially. First-year independent students can borrow $9,500 (still only $3,500 subsidized), second-year students can access $10,500 ($4,500 subsidized), and third-year and beyond students can borrow $12,500 ($5,500 subsidized). The aggregate limit jumps to $57,500, with the same $23,000 subsidized cap.

Graduate and professional students face a different reality entirely. They can borrow up to $20,500 annually, but here’s the catch—it’s all unsubsidized loans since graduate students aren’t eligible for subsidized loans. The aggregate limit is $138,500 (including any undergraduate loans), though certain health professions can borrow up to $224,000.

Just because you can borrow the maximum doesn’t mean you should. For subsidized loans, you can’t borrow more than your demonstrated financial need anyway—so if your calculated need is only $2,000, that’s your limit regardless of the annual cap.

Current Interest Rates and Fees

Here’s some good news: federal student loans come with fixed interest rates, which means your rate stays locked in for the entire life of your loan. No surprises, no sudden jumps—just predictable payments you can plan around.

Interest rates are set annually by the government and apply to loans disbursed during specific periods. For the 2024-2025 academic year (loans disbursed between July 1, 2024, and June 30, 2025), undergraduate rates are 6.53% for both subsidized and unsubsidized loans, while graduate unsubsidized loans carry an 8.083% rate.

These rates might seem high compared to a few years ago, but they’re still generally more favorable than private student loans. You can always check the most current rates at current federal interest rates on StudentAid.gov.

There’s one small fee to be aware of: the loan origination fee. Currently set at 1.057%, this fee gets deducted proportionally from each loan disbursement. So if you borrow $5,000, you’ll actually receive about $4,947 after the fee is taken out. It’s not huge, but it’s worth factoring into your calculations.

The beauty of federal loans lies in their consistency and borrower protections. Unlike private loans that might start with attractive teaser rates only to climb higher later, federal rates give you the peace of mind that comes with knowing exactly what you’ll owe.

Repayment and the Long-Term Impact

This is where the rubber meets the road with your subsidized vs unsubsidized student loans. Understanding repayment isn’t just about knowing when your first payment is due – it’s about grasping how these different loan types will affect your wallet for years to come.

The good news? You get a breather before payments start. Federal student loans come with a six-month grace period after you graduate, leave school, or drop below half-time enrollment. Think of it as your financial adjustment period while you find your footing in the real world.

Here’s where the loan types diverge again. During this grace period, subsidized loans continue getting that government interest coverage – it’s like having a protective shield around your loan balance. But with unsubsidized loans, the interest meter keeps running. If you can’t pay that interest during your grace period, it gets added to your principal balance through a process called capitalization. Suddenly, you’re paying interest on interest – not exactly the graduation gift you were hoping for!

Your loan servicer will be your main point of contact during repayment. This is the company assigned by the U.S. Department of Education to handle your billing and answer your questions. They’ll send you all the important details about when your first payment is due and how much you’ll owe.

Understanding Your Repayment for subsidized vs unsubsidized student loans

The standard repayment plan gives you a straightforward 10-year timeline with fixed monthly payments. It’s simple and gets you debt-free fastest, but the monthly payments might feel steep right out of college.

Fortunately, federal loans offer flexibility that private loans often don’t. Income-driven repayment plans can be a lifesaver if your starting salary has you eating ramen more than you’d like. These plans adjust your monthly payment based on what you actually earn and your family size. There are also extended repayment options that stretch your payments up to 25 years, and graduated plans where payments start low and increase over time as your career (hopefully) takes off.

The real kicker comes with interest capitalization, especially for unsubsidized loans. Let’s say you borrowed $27,000 in unsubsidized loans at 6% interest and didn’t pay anything during school or your grace period. That unpaid interest gets added to your loan balance, meaning you’ll pay interest on a bigger amount for the entire repayment period.

Here’s a money-saving tip: if you can manage even small interest payments while in school on your unsubsidized loans, do it. Even $25 or $50 a month can prevent that interest snowball from growing. The accrued interest calculator can show you exactly how much this strategy could save you.

The Future of the Subsidized Loan Program

Unfortunately, the subsidized loan program faces an uncertain future. Political discussions have included proposals to eliminate subsidized loans entirely, as outlined in a House reconciliation bill. This isn’t just political theater – it would have real impacts on your wallet.

Our analysis shows that without subsidized loans, students could pay about 12% more over their loan lifetime. Here’s what that looks like in real numbers: a student borrowing $19,000 in subsidized loans and $8,000 in unsubsidized loans would typically repay around $28,560 total. If that same $19,000 had to be unsubsidized instead, their total repayment jumps to about $32,039.

That’s an extra $40 per month on a standard 10-year repayment plan – money that could go toward building an emergency fund, saving for a house, or just having a little breathing room in your budget. For students already struggling with increased monthly payments and rising student debt levels, losing subsidized loans would make college affordability even more challenging.

The potential elimination of this program highlights why understanding these loan differences matters so much. Every dollar of subsidized borrowing you can secure now could save you significantly down the road.

Frequently Asked Questions about Federal Student Loans

We get it – student loans can feel overwhelming, and you probably have a dozen questions swirling around in your head. Don’t worry, you’re not alone! Let’s explore the most common questions we hear about subsidized vs unsubsidized student loans and give you the straight answers you need.

Which loan is better and should I accept first?

Here’s the thing – if you qualify for a Direct Subsidized Loan, it’s hands down the better choice. Why? Because while you’re hitting the books, stressing about exams, and surviving on ramen noodles, the government is quietly paying your loan interest. That’s money staying in your pocket instead of piling onto your debt.

Think of it like having a generous friend who covers your tab while you’re still figuring things out. Subsidized loan benefits are real and substantial – they can save you thousands over the life of your loan.

When prioritizing aid, we always recommend this game plan: grab every grant and scholarship you can first (that’s free money!), then accept your subsidized loans up to the full amount you’re offered. Only after you’ve maxed out subsidized options should you consider unsubsidized loans for any remaining costs you need to cover.

But here’s a crucial piece of advice: borrow only what you need. Just because you’re approved for $7,500 doesn’t mean you have to take it all. Every dollar you borrow today is a dollar you’ll pay back tomorrow, with interest. Be smart about it.

Are graduate students eligible for subsidized loans?

Unfortunately, no – graduate students lost eligibility for subsidized loans back in July 2012. We know, it’s a bummer when you’re already facing higher tuition costs for advanced degrees.

Graduate student eligibility is limited to unsubsidized loans for graduate school and potentially PLUS loans (called Grad PLUS loans). While you won’t get that sweet interest subsidy, federal unsubsidized loans still beat private loans in most cases. You’ll get fixed interest rates and more flexible repayment options than you’d typically find with private lenders.

The silver lining? You can borrow more as a graduate student – up to $20,500 per year in unsubsidized loans. Just remember, that interest starts adding up from day one, so consider making interest payments while in school if you can swing it.

What happens if I drop below half-time enrollment?

Life happens, and sometimes your enrollment status changes. If you drop below half-time enrollment, several important things kick into motion that you need to understand.

First, you’ll lose your in-school deferment immediately. This means the clock starts ticking on your loan repayment timeline. Your grace period begins right away – that six-month buffer before you have to start making payments.

Once your grace period ends, repayment starts whether you’ve graduated or not. This can catch students off guard, especially if they were planning to return to school later.

Here’s the kicker for subsidized loans: interest accrual on subsidized loans begins as soon as you drop below half-time. Remember how we said the government pays your interest while you’re in school? Well, that party ends the moment your enrollment status changes. Your subsidized loans essentially start acting like unsubsidized loans, meaning you become responsible for all that accumulating interest.

If you’re thinking about changing your enrollment status, definitely chat with your school’s financial aid office first. They can walk you through exactly how it’ll affect your specific situation and help you make an informed decision.

Conclusion

Making smart choices about subsidized vs unsubsidized student loans can literally save you thousands of dollars over the life of your education financing. We’ve walked through the essential differences together, and now you’re armed with the knowledge to make informed decisions that work for your unique situation.

The bottom line is this: subsidized loans are your best friend if you’re an undergraduate with financial need. Having the government cover your interest while you’re studying, during your grace period, and through any deferments is like getting a helping hand when you need it most. It’s free money toward your interest payments – and who doesn’t love that?

Unsubsidized loans, while they don’t come with that sweet interest subsidy, are still solid federal options. They offer the same fixed interest rates and borrower protections that make federal loans so much better than most private alternatives. Plus, they’re available to everyone – undergraduates, graduate students, and those who don’t qualify for need-based aid.

Remember the golden rule of student borrowing: only take what you actually need. Just because you’re offered the maximum amount doesn’t mean you have to accept it. Every dollar you borrow today is a dollar you’ll pay back tomorrow, with interest. Start with free money like grants and scholarships, then work-study programs, then subsidized loans, and finally unsubsidized loans if you still need more funding.

The landscape of student aid is always evolving. With potential changes to the subsidized loan program on the horizon, understanding your options becomes even more crucial. The difference between paying 12% more over the life of your loans versus getting that government interest subsidy isn’t just numbers on a page – it’s real money that affects your monthly budget after graduation.

At Car News 4 You, we’re committed to helping you steer complex financial decisions with confidence. Whether you’re figuring out student loans, exploring cryptocurrency, or diving into other financial topics, we’ve got your back with practical, easy-to-understand guidance.

Making smart financial decisions for your education sets the foundation for your entire financial future. You’ve got this – and now you’ve got the knowledge to make choices that work for you. Explore our comprehensive financial guides for more insights on managing your money wisely.