Coreweave Stock: Unlocking 2025’s AI Potential

Why CoreWeave Stock Is Capturing Investor Attention

CoreWeave stock (NASDAQ: CRWV) has become a hot topic in the AI infrastructure space since its March 2025 IPO. Here’s what you need to know:

Key CoreWeave Stock Facts:

- Current Price: Around $100-103 (highly volatile)

- Market Cap: Approximately $49 billion

- Revenue Growth: 544% year-over-year in Q4 2024

- Financial Status: Profitable on revenue but posting significant net losses

- Analyst Rating: Hold with mixed Wall Street sentiment

- 52-Week Range: $33.52 – $187.00

CoreWeave isn’t your typical cloud company. It’s a specialized AI infrastructure provider that offers GPU-powered cloud computing specifically designed for artificial intelligence workloads like model training and inference.

The company has caught Wall Street’s attention for both positive and challenging reasons. On the positive side, CoreWeave boasts impressive partnerships with tech giants like Nvidia and Microsoft, and has seen explosive revenue growth as AI demand surges. The company operates what Nvidia calls “the fastest AI supercomputer in the world” – a $1.6 billion data center in Texas.

However, the stock has been extremely volatile since going public. Despite nearly $2 billion in revenue, CoreWeave is burning cash on massive expansion and has a debt-to-equity ratio near 291%. This has polarized analysts; some see it riding the AI wave, while others worry about unsustainable spending.

Recent earnings reports have added to the drama, with the stock swinging significantly on quarterly results and upcoming lock-up expirations.

What is CoreWeave? The Engine Behind the AI Revolution

Every time you use an AI assistant or see AI-generated art, a digital powerhouse like CoreWeave is working behind the scenes. Understanding their role helps explain why coreweave stock is a hot topic for investors.

Founded in 2017 in Livingston, New Jersey, CoreWeave started with a simple but powerful idea. Instead of spending millions on their own hardware, companies can rent access to CoreWeave’s advanced AI computing power. It’s like having a supercar on demand, without the upfront cost or maintenance.

What makes CoreWeave special isn’t just their hardware – it’s their laser focus on AI. While other cloud companies try to do everything, CoreWeave built their entire business around GPU-powered computing for artificial intelligence. They’ve developed their own smart software that manages these powerful chips, making sure every AI model gets exactly the computing power it needs, when it needs it.

Think of CoreWeave as the electrical grid for the AI revolution. AI developers can tap into its infrastructure on demand, much like getting electricity, without building their own data centers. For more insights into how technology continues to reshape industries, check out our guide on tech innovations.

Core Business Model and Services

CoreWeave’s business is “GPU-as-a-Service”—renting supercomputer access by the hour. This is ideal for AI development, which requires massive power for training but less for daily operations.

Their main service is GPU compute power, primarily using Nvidia’s cutting-edge graphics cards. These are industrial-strength processors that cost tens of thousands of dollars each. CoreWeave houses thousands of them in climate-controlled data centers, ready to tackle the most demanding AI workloads.

But they don’t stop there. CoreWeave also provides traditional CPU computing for the parts of AI work that don’t need GPU power, plus high-speed storage for the massive datasets that AI models consume. Their networking infrastructure moves data at lightning speeds between all these components.

The company offers both bare metal servers (where you get an entire physical machine to yourself) and virtual servers (more flexible, shared resources). They’ve also built sophisticated management tools, including their Kubernetes service and something called “Tensorizer” that helps deploy AI models more efficiently.

What started in 2017 as a GPU rental service has grown into a complete ecosystem for AI development. Companies can focus on building smarter AI instead of worrying about the massive infrastructure needed to power it.

Strategic Importance in the AI Market

Here’s where CoreWeave’s story gets really interesting. When everyone wants AI computing power, CoreWeave has secured what might be the most valuable partnership in tech: exclusive access to Nvidia’s latest GPUs.

This Nvidia partnership isn’t just a business deal – it’s like having VIP access. While other companies wait months for new GPU deliveries, CoreWeave gets priority access. Nvidia has even called CoreWeave’s $1.6 billion data center in Texas “the fastest AI supercomputer in the world.” That’s not just marketing speak – it’s recognition from the company that makes the chips powering the AI revolution.

CoreWeave has also landed major partnerships with Microsoft and other tech giants, proving they can handle the biggest AI workloads on the planet. When these companies need to train massive AI models or run complex AI applications, they turn to CoreWeave’s specialized infrastructure.

The company’s CEO recently noted that inference workloads now make up more than 50% of their business. This is significant, showing AI’s shift from the experimental phase to real-world applications used by millions daily.

What makes CoreWeave strategically important isn’t just their current success – it’s their position in the AI supply chain. As artificial intelligence becomes as common as smartphones, someone needs to provide the computing backbone. CoreWeave has positioned itself as that critical infrastructure provider, supporting the next generation of AI applications that will reshape how we work, create, and live.

Decoding CoreWeave Stock (CRWV) Performance and Financials

Now that we understand CoreWeave’s role in the AI ecosystem, let’s examine what makes CoreWeave stock a fascinating, if wild, investment. CRWV is not for the faint of heart; the stock moves with the drama of a thriller.

Read the latest market updates

The company’s financial story is one of explosive growth mixed with serious growing pains. It’s like watching a teenager hit a growth spurt – impressive progress, but also some awkward stumbling along the way.

A Look at Recent Stock Price Movements

CoreWeave’s journey to the public markets began on March 28, 2025, with an IPO that valued it at $23 billion. The debut was muted, with shares opening nearly 3% lower than expectednot the launch many had hoped for.

However, by the third trading day, CoreWeave stock soared past its IPO price as investors acceptd the AI infrastructure story. Since then, it has been a rollercoaster.

The numbers show the volatility. CRWV has a 52-week range between $33.52 and $187.00. Headlines like “CoreWeave Stock Drops” and “Why Shares of CoreWeave Are Plunging” have become common in financial news.

The Q2 earnings report exemplified this volatility. Despite strong revenue and a higher-than-expected backlog, the stock tumbled more than 10% because the company’s losses were wider than Wall Street expected. It’s a classic case of “good news, bad news” that keeps investors on their toes.

Another factor adding pressure is the upcoming lock-up expiration. This is when company insiders – founders, early investors, and employees – can finally sell their shares. While this could create some selling pressure in the short term, it might actually help reduce volatility by increasing the number of shares available for trading.

Trading volume has been substantial, averaging around 26.38 million shares and sometimes spiking to over 51 million on news-heavy days. Staying informed on market movements is crucial for any investor in a volatile stock like this.

Key Financial Metrics You Need to Know for coreweave stock

Let’s talk numbers – and trust me, CoreWeave’s financials are a study in contrasts. On one hand, you have revenue growth that would make any CEO smile. On the other hand, you have losses that would make any CFO reach for antacids.

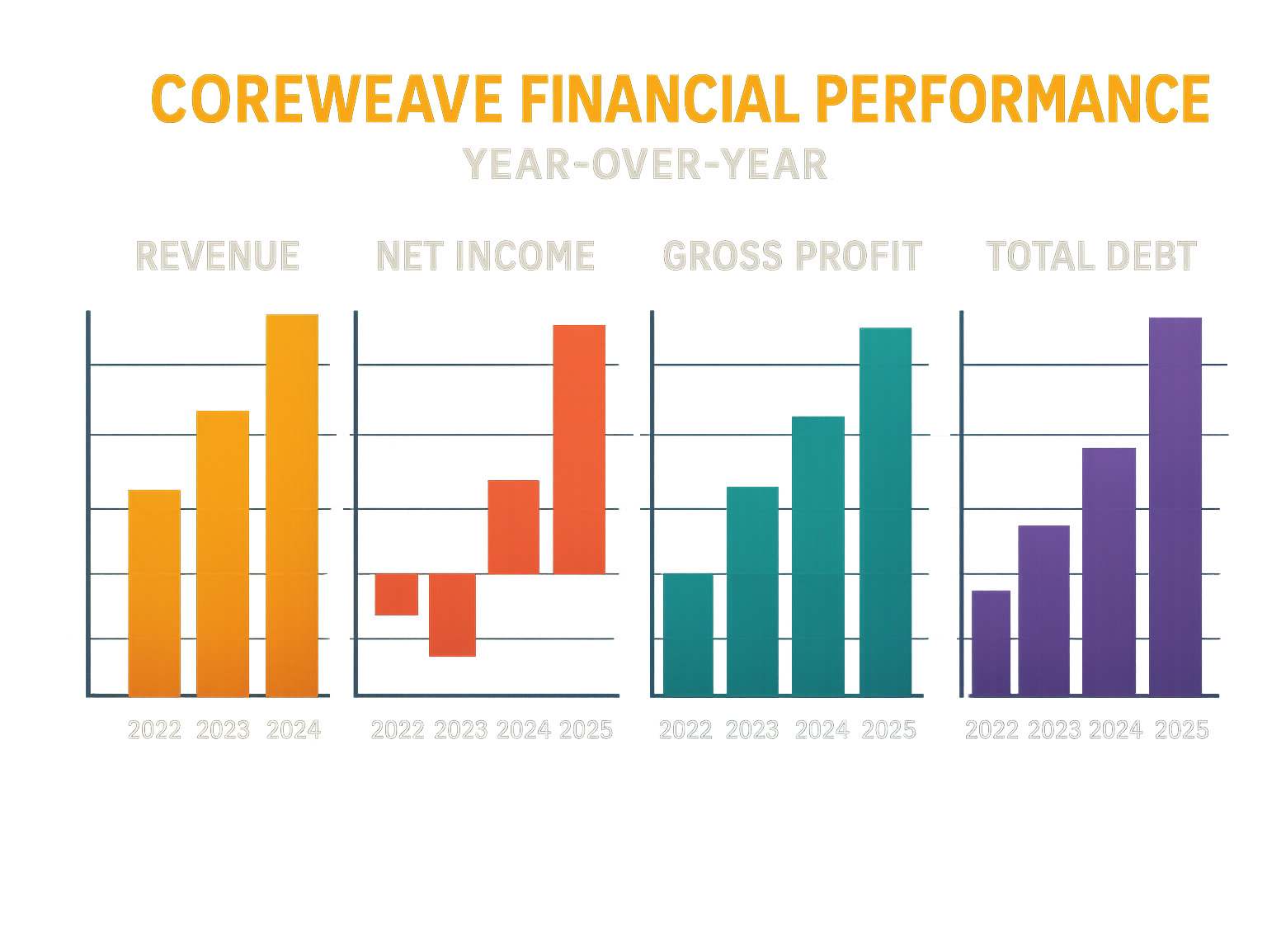

| Metric | 2022 (Millions USD) | 2023 (Millions USD) | 2024 (Millions USD) | Q4 2024 (Millions USD) |

|---|---|---|---|---|

| Revenue | 15.83 | 228.94 | 1915.43 | 747.43 |

| Gross Profit | 3.71 | 160.16 | 1422.08 | N/A |

| Net Income | -31.06 | -593.75 | -863.45 | -51.37 |

| Total Debt | N/A | 1527.30 | 8018.26 | N/A |

| Market Cap | N/A | N/A | ~49,000 | N/A |

| EPS (TTM) | N/A | N/A | -2.02 to -3.82 | N/A |

The revenue growth is stunning. CoreWeave went from $15.83 million in 2022 to nearly $2 billion in 2024. The Q4 2024 revenue alone was $747.43 million, a 544% year-over-year increase, while Q2 saw 207% year-over-year growth.

But here’s where things get complicated. Despite this incredible top-line performance, CoreWeave is still burning money. Net losses have grown from $31 million in 2022 to over $863 million in 2024. It’s like having a Ferrari that goes incredibly fast but guzzles gas at an alarming rate.

The company’s market cap sits around $49 billion, which shows investors are betting big on the future. But there’s a concerning trend in the debt numbers. Total debt exploded from $1.53 billion in 2023 to over $8 billion in 2024. This gives CoreWeave a debt-to-equity ratio of over 290% – some sources even cite over 600% quarterly. That’s a lot of borrowed money fueling this growth engine.

The earnings per share (EPS) tells the profitability story clearly: it’s negative, ranging from -$2.02 to -$3.82 on a trailing twelve-month basis. For investors, this means CoreWeave stock is purely a growth play right now, not an income investment.

Analyst Consensus and Price Targets

Wall Street’s take on CoreWeave stock is mixed. The average analyst rating is “Hold,” which signals uncertainty about its future direction.

Despite the cautious official rating, many analysts are “largely bullish” on the company’s prospects. The average 12-month price target hovers around $106.79, suggesting about 7% upside potential from recent trading levels. It’s not a screaming buy signal, but it’s not a run-for-the-hills warning either.

The analyst community is genuinely split on this one. The bull camp points to CoreWeave’s explosive revenue growth, massive customer backlog, and those golden partnerships with Nvidia, Microsoft, and Google. They argue that the post-earnings sell-off was “overblown” and that the company is perfectly positioned to ride the AI wave.

The bear camp, however, raises some valid concerns. They worry about the persistent losses, the aggressive debt-financed expansion, and whether CoreWeave can ever justify its sky-high valuation. Some analysts describe the company as being “in a Catch-22” – it needs to spend heavily to grow, but that spending is creating unsustainable losses.

We’ve seen analysts flip from “Bear to Bull” after strong quarterly results, while others remain cautious about the company’s path to profitability. This disagreement reflects the broader challenge of valuing a high-growth company in an emerging market like AI infrastructure.

For investors, this analyst split means doing your homework is more important than ever. CoreWeave stock represents both the promise and the peril of investing in the AI revolution.

The Bull vs. Bear Case: Opportunities and Risks

Investing in CoreWeave stock presents both exciting potential and significant risk. The company is riding a massive technological wave but is also burning cash rapidly. Let’s examine the bull and bear cases for this fascinating investment.

The reality is that CoreWeave represents everything thrilling and terrifying about investing in cutting-edge technology. On one hand, you have a company perfectly positioned for what many consider the most important technological shift since the internet. On the other hand, you have serious financial challenges that could sink even the most promising business. For those looking to understand more investment strategies, our Fintechzoom Money Complete Guide offers valuable insights.

The Bull Case: Riding the AI Wave

The bull case for CoreWeave stock is compelling, starting with its timing. Amid the “AI revolution,” CoreWeave is positioned like a shovel-seller during a gold rush that could last for decades.

The demand for AI computing power is absolutely exploding. Every AI application, from chatbots to image generators, requires immense GPU power. CoreWeave’s 207% year-over-year Q2 revenue growth proves businesses desperately need what it sells.

What makes this even more exciting is CoreWeave’s strategic partnerships that read like a who’s who of tech. Its Nvidia relationship provides priority access to chips when others wait. When Nvidia calls its Texas data center “the fastest AI supercomputer in the world,” that’s a powerful endorsement that opens doors.

The Microsoft and Google partnerships are equally impressive. CoreWeave powers some of the world’s most ambitious AI projects. When tech giants trust you with their most critical workloads, it says something about your capabilities and reliability.

Here’s what really gets investors excited: CoreWeave isn’t trying to be everything to everyone. While other cloud providers offer hundreds of services, CoreWeave has laser-focused on AI infrastructure. This specialization means they can optimize everything – from their software to their cooling systems – specifically for AI workloads. It’s like the difference between a Swiss Army knife and a surgeon’s scalpel.

The expanding data center footprint tells another part of the growth story. CoreWeave isn’t just talking about growth – they’re building it, literally. Every new data center represents millions of dollars in future revenue potential, and they’re expanding aggressively to meet demand that seems almost insatiable.

Some analysts even argue that after recent stock price drops, CoreWeave stock has become attractively valued for those willing to take a long-term bet on AI’s continued growth.

The Bear Case: Navigating the Headwinds for coreweave stock

Now for the sobering reality check. Despite all that exciting growth, CoreWeave has some serious financial challenges that keep even optimistic investors awake at night.

The biggest concern is the “growth at any cost” problem. While CoreWeave generated nearly $2 billion in revenue in 2024, it lost $863 million. This massive cash burn is enough to make even deep-pocketed investors nervous. Every quarter, they’re essentially spending more than they’re bringing in, which works great until it doesn’t.

The debt situation is particularly worrying. CoreWeave’s total debt jumped to over $8 billion in 2024, giving them a debt-to-equity ratio that would make a credit counselor faint. We’re talking about borrowing money at high interest rates to fund expansion, which means they’re not just racing to grow – they’re racing to grow before the debt payments become unmanageable.

This creates a “Catch-22” situation. CoreWeave must spend heavily on new data centers and equipment to capture the AI market, but this spending prevents it from becoming profitable. It’s like trying to fill a leaky bucket; the faster you pour, the more you lose.

The profitability timeline remains unclear, and that’s scary for investors. While revenue is growing spectacularly, there’s no clear path to when CoreWeave will actually start making money instead of burning it. The Q2 earnings showed a wider-than-expected loss, which spooked investors who were hoping to see some progress toward profitability.

There’s also the potential for stock dilution. When companies need cash and can’t generate it from operations, they often issue more shares. This means your slice of the CoreWeave pie gets smaller, even if the overall pie is growing.

Finally, some market watchers worry about broader AI market sustainability. While AI demand seems endless now, technology markets can shift quickly. If the AI boom slows down or if larger cloud providers decide to compete more aggressively in this space, CoreWeave’s specialized focus could become a liability instead of an advantage.

The bottom line? CoreWeave stock offers the chance to ride one of the most exciting technological waves in history, but it comes with financial risks that could wipe out investors if the company can’t figure out how to turn revenue growth into actual profits.

Frequently Asked Questions about CoreWeave

Investing in cutting-edge tech companies like CoreWeave can feel overwhelming, especially when you’re trying to make sense of all the financial jargon and market dynamics. We get it – that’s why we’ve compiled answers to the most common questions investors ask us about CoreWeave stock.

Is CoreWeave profitable?

No, CoreWeave is not profitable right now. Despite incredible revenue growth, the company is posting significant net losses, including -$863.45 million in 2024.

But before you write them off, let’s put this in perspective. CoreWeave is essentially in “growth mode” – they’re spending massive amounts of money to build out their data centers and snap up those highly coveted Nvidia GPUs that everyone in the AI world desperately wants.

Think of it like building a highway: there’s a massive upfront investment in infrastructure before any revenue is collected. CoreWeave is in this construction phase, pouring money into infrastructure based on the belief that AI demand will surge.

Their capital expenditures are currently far exceeding their earnings, which is typical for companies trying to capture market share in a rapidly expanding industry. The big question, of course, is whether they can eventually flip that switch from “spending to grow” to “growing profitably.”

How does CoreWeave differentiate itself in the cloud market?

CoreWeave has carved out a unique niche that sets them apart from the big general-purpose cloud providers. While others try to be everything to everyone, CoreWeave has laser-focused on one thing: high-performance GPU computing for AI workloads.

They are purpose-built for AI workloads. Their entire infrastructure, from the hardware they choose to the software they develop, is optimized specifically for AI model training and inference. This specialization makes them a precision tool for AI, unlike more general cloud providers.

CoreWeave also develops its own proprietary software and management tools, including their Kubernetes service and various fleet management systems. This isn’t just about renting out computer power – they’re providing custom solutions that can be more cost-effective for specific AI workloads.

The result? When AI companies need to train massive models or run complex inference workloads, CoreWeave can often deliver better performance at a more competitive price than general cloud providers who are trying to serve every type of computing need under the sun.

What is the significance of the Nvidia partnership?

The Nvidia partnership is absolutely crucial to CoreWeave’s success – it’s honestly hard to overstate how important this relationship is.

First, it provides priority access to GPUs. Nvidia’s chips are in high demand and difficult to acquire. As an “Nvidia-backed firm,” CoreWeave gets priority access, allowing it to expand capacity faster than competitors and deliver on its promises to AI companies that need this computing power.

But it goes beyond just getting the hardware first. Nvidia’s public endorsement carries enormous weight in the tech world. When Nvidia calls CoreWeave’s Texas data center “the fastest AI supercomputer in the world,” it’s a significant stamp of approval that attracts clients.

The partnership also ensures deep technological alignment. CoreWeave’s software and services are built to squeeze every ounce of performance out of Nvidia’s chips. This optimization can make a real difference when you’re dealing with the massive computational demands of modern AI.

Finally, this relationship helps CoreWeave attract top-tier clients. When major AI companies are choosing where to run their most important workloads, knowing that CoreWeave has Nvidia’s backing and access to the latest hardware makes the decision much easier. It’s a big reason why they’ve been able to capture business from tech giants like Microsoft and Google.

Without this partnership, CoreWeave stock would represent a much riskier investment, as the company would struggle to compete in the highly demanding world of AI infrastructure.

Conclusion

After a deep dive, CoreWeave stock clearly embodies both the incredible promise and inherent risks of investing in the AI revolution. It’s a high-stakes investment where the potential rewards and risks are massive.

What makes CoreWeave truly compelling is its laser focus on specialized AI infrastructure, a critical need in the tech world. Instead of being a generalist, it aims to be the best at powering AI workloads. Their partnerships with Nvidia and Microsoft aren’t just business deals – they’re strategic lifelines that give them access to the most coveted technology in the world right now.

The numbers tell an exciting yet concerning story. The explosive revenue growth from $15.83 million to nearly $2 billion in two years is almost unprecedented, showing immense demand for what CoreWeave offers.

However, CoreWeave stock gets tricky. Despite massive revenue, the company is losing money, with net losses over $863 million in 2024. It’s like a busy restaurant that’s unprofitable due to high expansion costs.

The high debt levels and persistent losses create an investment paradox. CoreWeave must spend heavily to lead in the AI race, but that spending prevents the profitability that would make investors comfortable. It’s a high-stakes “spend money to make money” scenario.

For anyone considering CoreWeave stock, this isn’t a “set it and forget it” investment. The company is betting everything on the continued explosion of the AI revolution, and they’re asking investors to join them. If AI demand keeps growing, CoreWeave could emerge as one of the most valuable infrastructure companies in the world. But if the AI market cools down or if profits don’t materialize, things could get rocky fast.

The volatility we’ve seen since their IPO – with that wild 52-week range from $33.52 to $187.00 – isn’t going away anytime soon. This stock will likely continue to swing based on earnings reports, market sentiment about AI, and broader economic conditions.

We believe CoreWeave stock represents one of the purest plays on the AI infrastructure boom available to public investors. It’s not for everyone, but for those who truly believe AI is reshaping our world and want to invest in the picks and shovels of this digital gold rush, CoreWeave deserves serious consideration.

As always, we encourage you to do your homework before making any investment decisions. The AI revolution is real, but so are the risks of investing in companies racing to capitalize on it. Here at Carnews4you.com, we’ll keep tracking CoreWeave’s journey and helping you steer these exciting but unpredictable waters.

Explore more high-growth investment sectors in our guide to Adventure Vehicles