5starsstocks.com lithium: 4-Step Ultimate Guide

Understanding the Booming Lithium Market

5starsstocks.com lithium is a platform that claims to provide stock analysis and recommendations for lithium investments, but research shows mixed results and credibility concerns that investors should carefully consider.

Quick Answer for 5starsstocks.com lithium:

- What it is: Online platform offering lithium stock analysis and recommendations

- Performance: Mixed track record – 12% average returns on lithium picks vs 30%+ losses on some cannabis stocks

- User base: 40% under age 35, many first-time investors

- Credibility concerns: Anonymous ownership, low trust scores from third-party evaluators

- Best practice: Use as starting point only, verify with established sources like Morningstar or Zacks

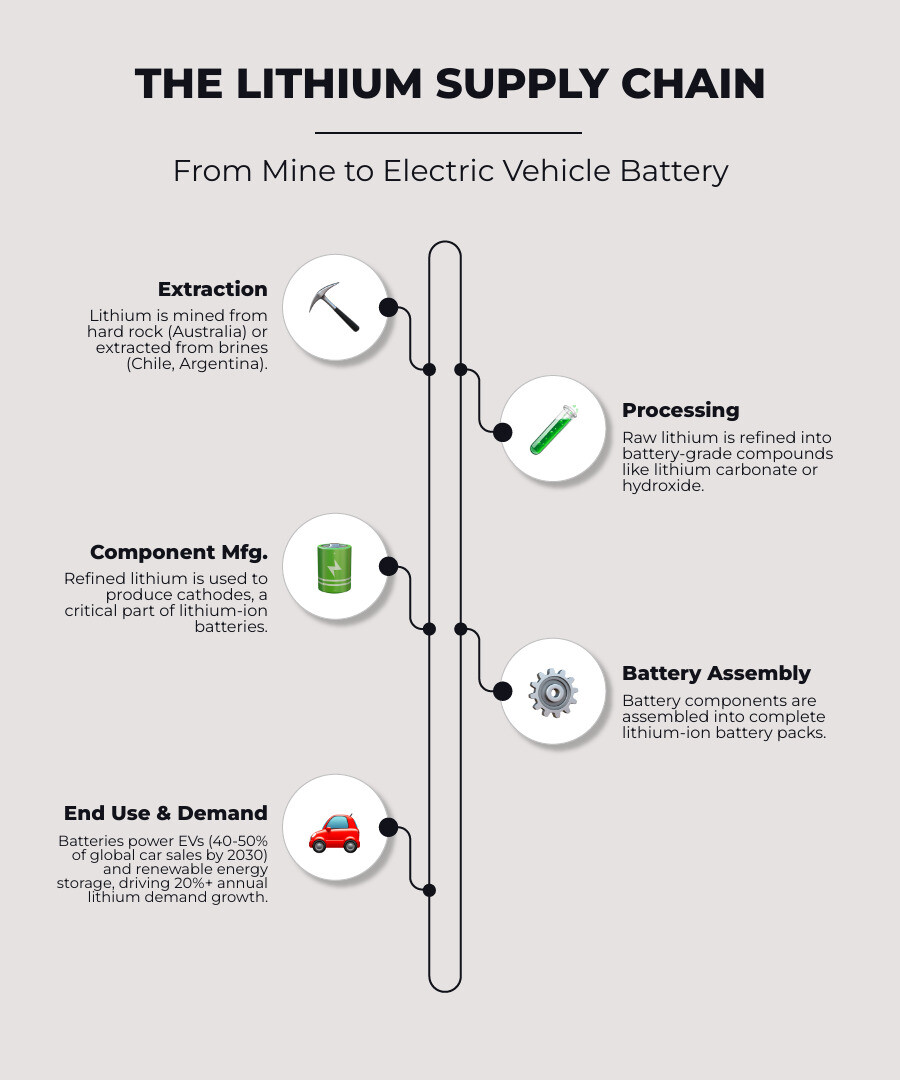

The lithium market has exploded into what experts now call “white gold” – and for good reason. With electric vehicle sales expected to make up 40-50% of global car sales by 2030, lithium demand is projected to grow at over 20% annually through the decade.

This surge has created a rush of online platforms promising to help investors identify the best lithium stocks. But as Goldman Sachs calls lithium “the new gasoline” and The Economist labels it “the world’s hottest commodity,” the quality of investment advice varies wildly.

The challenge? Separating reliable research from promotional hype in a sector where a single Oregon lithium findy could contain enough material for 10 billion smartphones or 600 million Tesla Model 3s.

Many platforms targeting younger investors promise easy profits, but independent studies show concerning accuracy rates. Some lithium stock recommendations have delivered solid returns, while others in related sectors have seen losses exceeding 30%.

5starsstocks.com lithium terminology:

Lithium, a soft, silvery-white metal, is undeniably a fundamental resource for the global energy transition. Its importance is driven by its crucial role in rechargeable batteries, which power everything from our smartphones and laptops to electric vehicles (EVs) and large-scale renewable energy storage systems. The demand for lithium has surged due to global government pushes for green energy solutions and the explosive expansion of the EV sector.

In fact, the global lithium market is expected to grow at a compound annual growth rate (CAGR) of over 20% through 2030. Analysts at Roskill suspect that demand for lithium will increase by 18% annually until 2030, with the EU expecting demand to be 18 times higher by 2030 compared to 2020. This makes lithium a critical component in the future of clean energy.

The supply chain for lithium is complex, involving extraction, processing, and production of lithium compounds like lithium carbonate and lithium hydroxide. Key companies dominating this market include Albemarle Corporation (ALB), SQM (Sociedad Química y Minera de Chile), and Lithium Americas (LAC), among others like Livent, Ganfeng Lithium, Pilbara Minerals, and Orocobre. These companies operate in major lithium mining regions, with Chile holding around 9.2 million tons of reserves, Australia 4.7 million tons, Argentina 1.9 million tons, and China 1.5 million tons. You can explore more about global lithium reserves here: Global lithium reserves by country.

Understanding this dynamic landscape is crucial for any investor. The future of lithium is bright, with its demand only set to increase as the world moves towards electric vehicles, renewable energy storage, and sustainable technologies. For broader market insights, you can check out Car News 4 You Markets.

A Critical Look at Online Lithium Stock Analysis Tools

The hunt for the next big investment opportunity has led many of us down the rabbit hole of online stock analysis platforms. With lithium’s meteoric rise, specialized tools claiming to decode this complex market have popped up everywhere. 5starsstocks.com lithium is one such platform that’s caught attention, promising AI-driven insights and expert guidance in this red-hot sector.

But here’s the thing – when something sounds too good to be true in investing, it usually is.

5starsstocks.com lithium positions itself as a modern solution for investors seeking lithium stock guidance. The platform uses an AI-driven analysis system combined with a star-based rating system (1-5 stars) that evaluates stocks across five key areas: fundamentals, growth potential, valuation, market sentiment, and risk.

What’s interesting about their user base is that 40% are under age 35, with about one-third being students or first-time investors. This demographic suggests the platform is attracting newcomers to investing who want simplified, digestible advice rather than complex financial jargon.

The performance picture, however, tells a more complicated story. While 5starsstocks.com lithium has shown some success with lithium picks – averaging around 12% returns – their track record becomes shakier when you look at other sectors. Cannabis stock recommendations have reportedly led to losses exceeding 30% for some users, though defense stocks have performed better with average gains around 18%.

Here’s where things get concerning: an independent study found the platform’s recommendations were only 35% accurate. Sample portfolios following their advice lost about 5.6% of total value while the S&P 500 gained 8.2% during the same period. That’s not exactly the “financial freedom” they promise.

The Pros and Cons of Using Online Lithium Stock Research Platforms

Let’s be honest about what you’re getting with platforms like 5starsstocks.com lithium. Like most things in life, there’s a mix of good and not-so-good.

On the positive side, these platforms do offer some genuine value. Their emerging trend coverage is actually pretty impressive – they’re quick to spot and analyze niche sectors like lithium, 3D printing, and defense stocks before they hit mainstream attention. For investors looking to get ahead of the curve, this early coverage can be valuable.

The user-friendly interface is another win. Many users genuinely appreciate the clean design and easy navigation. If you’re new to investing and traditional financial platforms feel overwhelming, this simplified approach can help you dip your toes in the water. Their educational resources, including webinars and tutorials, do provide some learning value for beginners.

The platform also attempts diverse sector analysis, tailoring content to different investment styles from passive income to value investing. This breadth can help you explore different approaches to building your portfolio.

But here’s where the red flags start waving. The lack of transparency is probably the biggest concern. We don’t know who’s behind the analysis or what their qualifications are. In the financial world, that’s like buying medication from someone who won’t tell you if they’re actually a doctor.

Their unverified track record is equally troubling. Despite claims of AI accuracy, there’s no long-term, independently verified performance history. The platform launched in 2023, so we’re looking at a very short timeline with mixed results.

The surface-level analysis is another limitation. Compared to established financial research firms, the insights often feel shallow. You’re not getting deep dives into company financials, competitive positioning, or management quality – the stuff that really matters for long-term investment success.

Perhaps most concerning is the potential promotional bias. Claims about “opening up financial freedom” and finding the “best stocks” sound more like marketing hype than objective financial advice. The “buy now” signals might push you toward impulsive decisions rather than thoughtful analysis.

For broader context on how these platforms fit into the financial landscape, check out Car News 4 You Economy for more insights.

Red Flags and Credibility Concerns

If 5starsstocks.com lithium were a restaurant, the health inspector would probably have some serious questions. Several credibility concerns should make any investor pause before diving in.

The anonymous ownership is the elephant in the room. When someone’s giving you financial advice that could impact your life savings, don’t you want to know who they are? This lack of transparency makes it impossible to assess the qualifications or motivations of the people behind the recommendations.

Third-party evaluators have noticed these issues too. ScamAdviser gave the platform a trust score of just 66/100, citing “substantial doubts about the site’s authenticity.” That’s not exactly a ringing endorsement from independent watchdogs.

The exaggerated claims are another red flag waving frantically. While optimism is nice, promises of consistent market-beating returns without acknowledging the inherent risks of investing are misleading. One cannabis stock with a “strong buy” rating reportedly dropped 67% – hardly the path to financial freedom they advertise.

The inconsistent performance across sectors suggests their AI models might not be as sophisticated as claimed. Some sectors see decent returns while others crash and burn. This inconsistency, combined with overall underperformance compared to major indices, raises questions about the platform’s effectiveness.

Finally, the absence of clear risk warnings and what some users describe as “pushy sales strategies” are concerning. Responsible financial platforms emphasize that investing always involves risk. This is particularly relevant when dealing with platforms that might fall into High Risk Merchant Account at Highriskpay.com territory.

The bottom line? While 5starsstocks.com lithium might offer some interesting starting points for research, treating it as your primary source for investment decisions could be a costly mistake. Think of it more like a conversation starter than a trusted financial advisor.

Comparing Investment Research Approaches

When you’re looking to invest in lithium stocks, the quality of your research can make or break your portfolio. It’s like choosing between a GPS that’s been tested for years versus one that just launched last week – both might get you there, but which one would you trust with your hard-earned money?

The investment research landscape offers two distinct paths. On one side, you have newer platforms like 5starsstocks.com lithium promising quick insights and AI-driven recommendations. On the other side, established financial resources like Morningstar, Zacks, Yahoo Finance, and Bloomberg Terminal have been helping investors make informed decisions for decades.

Here’s what makes the difference: transparency and track records. Established platforms typically show you exactly who their analysts are, what credentials they hold, and how their past predictions performed. Morningstar, for example, has over 40 years of credible research under its belt, focusing on detailed fundamental analysis of companies, mutual funds, and ETFs.

These traditional sources don’t just throw numbers at you – they dig deep. They’ll tell you about a lithium company’s management team, debt levels, competitive advantages, and potential risks. Their analysis is generally more comprehensive and less likely to be influenced by promotional bias.

The newer platforms often take shortcuts. While they might catch emerging trends quickly, they sometimes sacrifice depth for speed. This approach can work for getting initial ideas, but it’s risky as your primary research source.

For those looking to understand the broader fintech landscape and how these tools fit in, our Car News 4 You Fintech-Guides offer valuable context and practical insights.

Evaluating Online Lithium Research Methods

Think of investment research tools like restaurants – some serve fast food while others offer carefully prepared meals. Both have their place, but you need to know what you’re getting.

Analyst credentials represent perhaps the biggest difference. Established platforms typically feature analysts with disclosed backgrounds, often holding CFA designations or advanced degrees in finance. Meanwhile, platforms like 5starsstocks.com lithium keep their analysts anonymous, making it impossible to verify their expertise.

Research depth varies dramatically too. Traditional platforms provide comprehensive reports covering everything from cash flow analysis to competitive positioning. They’ll examine a lithium company’s mining operations, reserve quality, extraction costs, and long-term contracts. Newer platforms often rely on AI-driven surface-level analysis that might miss crucial details.

Transparency becomes critical when your money is on the line. Established sources clearly explain their methodologies, provide disclaimers about risks, and often have their performance audited by third parties. This transparency helps you understand exactly how they reached their conclusions.

Track records tell the real story. While newer platforms might claim impressive returns, established sources have decades of verifiable performance data. You can see exactly how their recommendations performed during market crashes, bull runs, and everything in between.

Cost structures also differ significantly. Most established platforms offer substantial free content, with premium subscriptions typically running $20-40 monthly for advanced features. Newer platforms often promise free access but may have hidden costs or unclear pricing structures.

Recommended Steps for Reliable Information Gathering

Building a solid research foundation requires more than just picking one source and hoping for the best. Think of it like cooking a great meal – you need multiple quality ingredients working together.

Start by reviewing multiple sources for any lithium investment you’re considering. If 5starsstocks.com lithium flags an interesting company, don’t stop there. Check what Morningstar says about their financials, see if Zacks has analyst coverage, and read recent news on Yahoo Finance. This cross-referencing helps you spot inconsistencies and build confidence in your decisions.

Cross-checking data becomes your safety net. Financial figures should align across reputable sources – if one platform shows dramatically different revenue numbers than others, that’s a red flag worth investigating further.

Educational resources can transform you from a passive recommendation-follower into an informed decision-maker. Understanding basic concepts like price-to-earnings ratios, debt-to-equity ratios, and cash flow analysis helps you evaluate any lithium stock recommendation more critically.

Free stock charts and market data give you the power to perform your own preliminary analysis. Many platforms offer these tools without charge, letting you track price movements, trading volumes, and technical indicators.

For investors preferring broader exposure to the lithium sector, Exchange Traded Funds (ETFs) offer built-in diversification with lower individual stock risk. Our Car News 4 You ETF Market Guide 2025 provides detailed guidance on this approach.

The goal isn’t to become a professional analyst overnight. Instead, you’re building enough knowledge to ask the right questions and spot potential red flags. This approach protects you from relying too heavily on any single source – especially one with questionable credentials or mixed performance records.

How to Properly Evaluate Lithium Stocks: A 4-Step Framework

When you’re thinking about investing in lithium stocks, it’s tempting to just pick the company with the coolest name or the flashiest website. But here’s the thing – successful lithium investing requires a solid game plan. Think of it like buying a car: you wouldn’t just pick one because it looks shiny, right? You’d check under the hood first.

The lithium market is exciting, but it’s also complex. Between geopolitical factors, technological advancements like Direct Lithium Extraction (DLE), and constantly shifting demand patterns, there’s a lot to consider. That’s why we’ve put together this straightforward 4-step framework to help you make smarter decisions.

Our approach combines fundamental analysis with industry-specific insights. We look at traditional valuation metrics like P/E and P/B ratios, but we also dig into the unique aspects of lithium companies – their mining operations, reserve quality, and position in the supply chain.

Risk assessment is crucial here too. The lithium sector can be volatile, with prices swinging based on everything from new battery technology to political changes in mining countries. Platforms like 5starsstocks.com lithium might give you quick picks, but they often miss these deeper considerations.

Here are the key factors we focus on when evaluating any lithium stock: financial health through revenue growth and debt levels, competitive advantages like unique extraction methods or exclusive supply contracts, management quality and their strategic vision, mining operations efficiency and reserve quality, geopolitical stability in their operating regions, and technological developments that could impact their business model.

Step 1: Analyze Company Fundamentals and Financial Health

Before you get excited about a lithium company’s growth potential, you need to make sure they’re not bleeding money. It’s like checking if someone can actually drive before you lend them your car.

Start with the basics: revenue growth, profit margins, and debt levels. A healthy lithium company should show consistent revenue increases, especially given the booming demand. But growth means nothing if they’re spending more than they’re making.

The debt-to-equity ratio is particularly important in mining. These companies often need massive upfront investments to get operations running. Too much debt can sink them if lithium prices drop unexpectedly.

Look at their cash flow statements too. Mining companies can show profits on paper while struggling with actual cash. You want to see positive free cash flow – that’s the real money left after they pay for everything they need to keep the lights on.

Valuation metrics like P/E and P/B ratios help you understand if you’re paying a fair price. But remember – lithium companies often trade at higher multiples than traditional stocks because of their growth potential. Check out earnings reports to get the latest financial data.

The key is finding companies that balance growth with financial stability. A lithium stock might promise the moon, but if their finances are shaky, you could be in for a bumpy ride.

Step 2: Assess Mining Operations and Reserves

Here’s where lithium investing gets interesting – and complicated. Not all lithium is created equal, and neither are the ways companies get it out of the ground.

Mining locations matter enormously. Chile dominates with massive salt flat operations, Australia leads in hard rock mining, and Argentina is rapidly expanding its brine operations. Each location comes with different costs, environmental challenges, and political risks.

Extraction methods vary widely too. Traditional hard rock mining in Australia tends to be more expensive but more reliable. Salt flat extraction in South America can be cheaper but uses enormous amounts of water – a growing concern in desert regions.

Pay attention to production capacity and expansion plans. Companies like Albemarle and SQM have spent years scaling up operations. Newer players might promise big numbers, but can they actually deliver?

Future projects are crucial for long-term growth. The recent findy of a massive lithium deposit in Oregon shows how new finds can reshape the industry. But remember – finding lithium and actually mining it profitably are two very different things.

Look for companies with proven reserves, efficient operations, and realistic expansion timelines. For more insights into top performers, check out Top Lithium Stocks To Consider – March 4th.

Step 3: Understand Market Position and Growth Catalysts

Now comes the fun part – figuring out which companies are positioned to win as the lithium boom continues. This is where you separate the real players from the wannabes.

Competitive advantage is everything in this space. Some companies have proprietary extraction technology that cuts costs. Others have locked-in supply deals with major automakers. A few have access to the highest-quality deposits. These advantages create moats that protect profits.

Market share tells you a lot about staying power. Albemarle controls about one-third of global lithium production – that’s serious market power. But don’t ignore smaller companies with unique advantages or promising new technologies.

Supply contracts with automakers are pure gold. When Tesla signs a long-term deal with a lithium producer, that’s guaranteed revenue for years. These partnerships often involve upfront payments and price protections too.

Management quality can make or break a mining company. Look for teams with proven track records in the industry. Mining is complex, and experience matters when things get tough.

Don’t forget about growth catalysts beyond just EV demand. Energy storage for renewable power is growing fast. New battery technologies might change demand patterns. Government policies supporting domestic mining could benefit certain companies.

For broader context on battery metals, our Car News 4 You Nickel Guide 2025 offers valuable insights into related markets that could impact lithium demand.

Frequently Asked Questions about Lithium Stock Investing

We get it – lithium investing can feel overwhelming, especially when you’re trying to figure out which sources to trust and which risks to watch for. Let’s tackle the most common questions we hear from investors like you.

Are online lithium stock research tools reliable for recommendations?

Here’s the honest truth about platforms like 5starsstocks.com lithium: they’re a mixed bag at best. While these online tools can spark some interesting ideas and offer basic educational content, trusting them for serious investment decisions is like asking your neighbor’s kid to fix your car engine – they might know a thing or two, but you probably want a real mechanic.

The biggest red flag? Most of these platforms, including 5starsstocks.com lithium, operate with zero transparency about who’s actually behind the analysis. We don’t know their credentials, their methods, or even their real names. That’s concerning when your hard-earned money is on the line.

The track record isn’t much better. While some lithium picks have shown decent returns, the overall performance has been inconsistent at best. Independent studies suggest these platforms underperform major market indices more often than not. If their cannabis stock recommendations lost over 30% for some users, what does that say about their research quality?

Our recommendation? Use these tools as a starting point only. Think of them like a restaurant suggestion from a friend – worth considering, but you’ll still want to read the reviews and check the menu before making a reservation. Always verify their claims with established sources and do your own homework.

What are the biggest risks when investing in the lithium sector?

Even though lithium looks like the golden ticket to the future, it comes with some serious speed bumps that could shake up your investment portfolio.

Price volatility is probably the biggest headache you’ll face. Lithium prices swing more wildly than a playground seesaw. Between 2018 and mid-2020, prices dropped significantly due to oversupply concerns. One month you’re celebrating gains, the next you’re wondering what happened to your money.

Geopolitical drama adds another layer of complexity. Most lithium comes from places that aren’t always politically stable. When tensions flare between major powers or governments change mining policies overnight, your stocks can take a hit. It’s like playing chess while someone keeps changing the rules.

Environmental regulations are tightening everywhere, and for good reason. Lithium extraction, especially from salt flats, uses enormous amounts of water – sometimes in areas where water is already scarce. As governments crack down on environmental practices, production costs could skyrocket or projects might get shut down entirely.

Don’t forget about technological disruption either. While lithium-ion batteries rule today, researchers are constantly working on alternatives. Sodium-ion batteries, improved recycling methods, or entirely new technologies could reduce demand for newly mined lithium faster than you’d expect.

For context on how commodity markets can shift, our Car News 4 You Natural Gas guides show similar volatility patterns across different sectors.

Should I invest in individual lithium stocks or a lithium ETF?

This question comes down to your personal risk appetite and how much time you want to spend researching. Both approaches have their place, but they’re quite different animals.

Individual lithium stocks are like betting on a single horse in a race. If you pick a winner like Albemarle or SQM, you could see spectacular returns. But if that company hits operational problems, faces supply chain issues, or makes poor strategic decisions, your investment could tank hard. It’s higher risk, higher potential reward, but it demands serious research into each company’s financials, management team, and competitive position.

Lithium ETFs take a different approach – they’re like buying a ticket to the entire race instead of betting on one horse. These funds hold shares in multiple lithium and battery-related companies, spreading your risk across the whole sector. You won’t get the explosive gains of picking the perfect individual stock, but you also won’t get crushed if one company stumbles. It’s diversification with lower risk, making them ideal for investors who want lithium exposure without the stress of picking winners.

For most people, especially those new to the sector, ETFs make more sense. They give you broad exposure to lithium’s growth potential while protecting you from company-specific disasters. You can learn more about building diversified portfolios through our Car News 4 You Dax40 guides.

The bottom line? If you’re just starting out or prefer a hands-off approach, go with ETFs. If you love research and can handle the volatility, individual stocks might be your thing. Just remember – never put all your eggs in one basket, no matter which route you choose.

Final Verdict: Navigating Your Lithium Investment Journey

After diving deep into lithium investing and examining platforms like 5starsstocks.com lithium, we’ve reached some important conclusions that could save you both money and heartache.

The lithium market is undeniably exciting. With electric vehicles projected to dominate the roads and renewable energy storage becoming essential, lithium truly deserves its “white gold” nickname. The numbers don’t lie – demand growing at 20% annually through 2030 creates genuine investment opportunities.

But here’s where things get tricky. Our analysis of 5starsstocks.com lithium reveals a platform that falls short of what serious investors need. The mixed performance record, anonymous ownership, and low trust scores from independent evaluators paint a concerning picture. When an independent study shows only 35% accuracy and portfolios losing 5.6% while the S&P 500 gained 8.2%, that’s not just disappointing – it’s potentially harmful to your financial health.

The bottom line? Use platforms like 5starsstocks.com lithium as a starting point for ideas, nothing more. Think of them like that friend who gives stock tips at parties – sometimes they’re right, but you wouldn’t bet your retirement on their hunches.

Due diligence isn’t just investment jargon – it’s your financial lifeline. Every claim needs verification through multiple trusted sources. When someone promises easy profits or uses phrases like “opening up financial freedom,” your skeptical radar should start beeping loudly.

The beauty of today’s investment landscape is the wealth of credible resources available. Established platforms offer transparent methodologies and proven track records. Free resources provide solid market data and educational content. The tools are there – you just need to use the right ones.

Successful lithium investing requires patience and a long-term perspective. This market will continue evolving with technological breakthroughs, geopolitical shifts, and changing demand patterns. Companies with strong fundamentals, quality reserves, and solid management teams will likely emerge as winners, but identifying them takes real research.

Building wealth isn’t about finding the next hot stock tip. It’s about making informed decisions based on solid research and maintaining a diversified approach that matches your risk tolerance. Whether you choose individual stocks or ETFs, make sure your choices align with your overall financial goals.

The lithium revolution is real, and the investment opportunities are genuine. Just make sure you’re getting your information from sources you can trust. Your future self will thank you for taking the time to do it right.

For more insights into exciting investment opportunities beyond traditional markets, explore our comprehensive guide: Explore more investment guides for adventure vehicles.