5starsstocks.com best stocks: Unbiased 2025 Guide

What is 5starsstocks.com and Its Stock Selection Process?

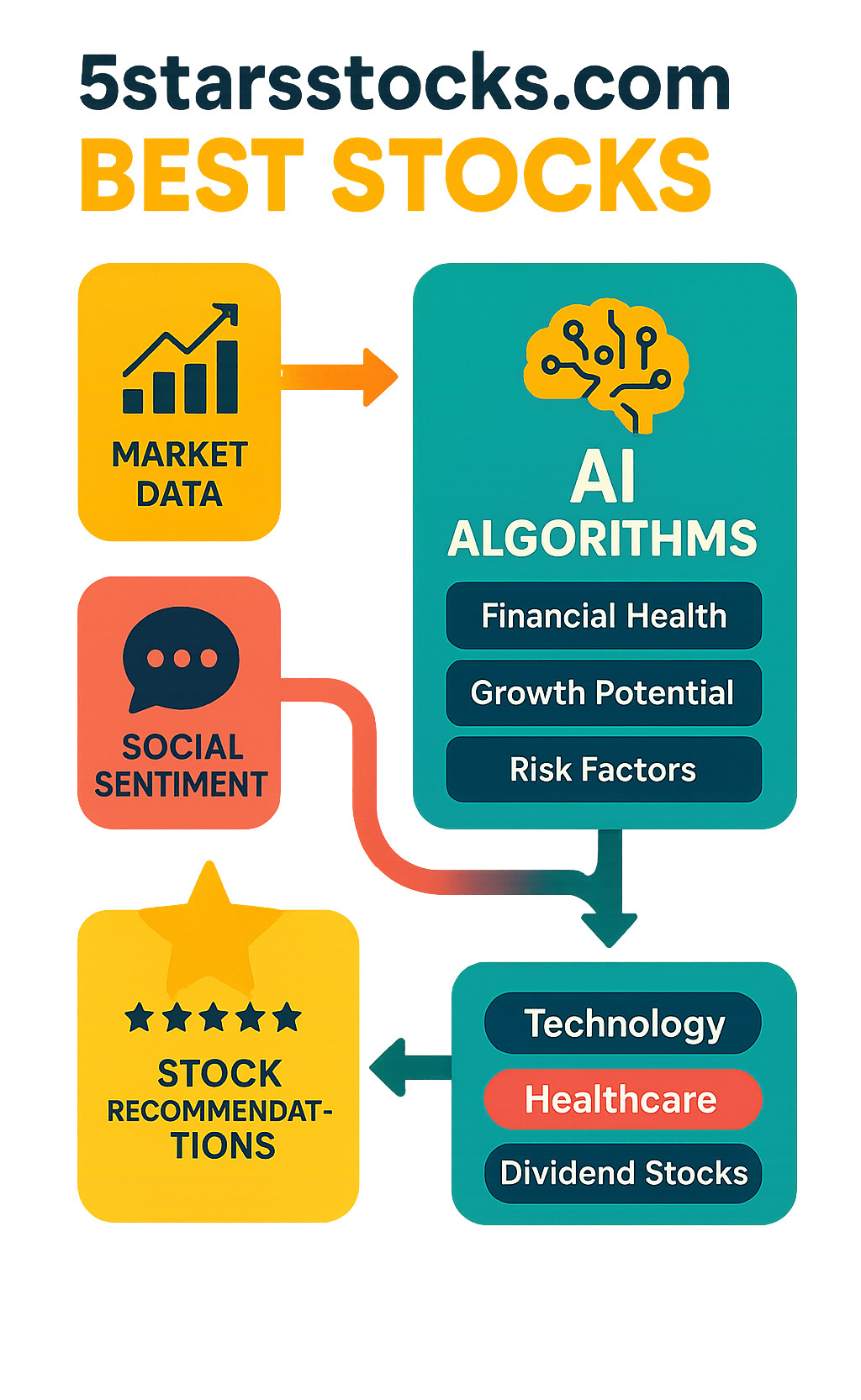

5starsstocks.com best stocks represent a curated selection from an AI-powered investment platform that launched in 2023. The platform claims to use artificial intelligence to analyze market data, social media sentiment, and financial metrics to identify top-performing stocks across multiple sectors.

Quick Answer – Key Facts About 5starsstocks.com:

- Rating System: Uses a five-star system based on past performance, growth potential, market stability, and risk factors

- Stock Categories: Offers passive stocks, dividend stocks, and value stocks across sectors like technology, healthcare, and defense

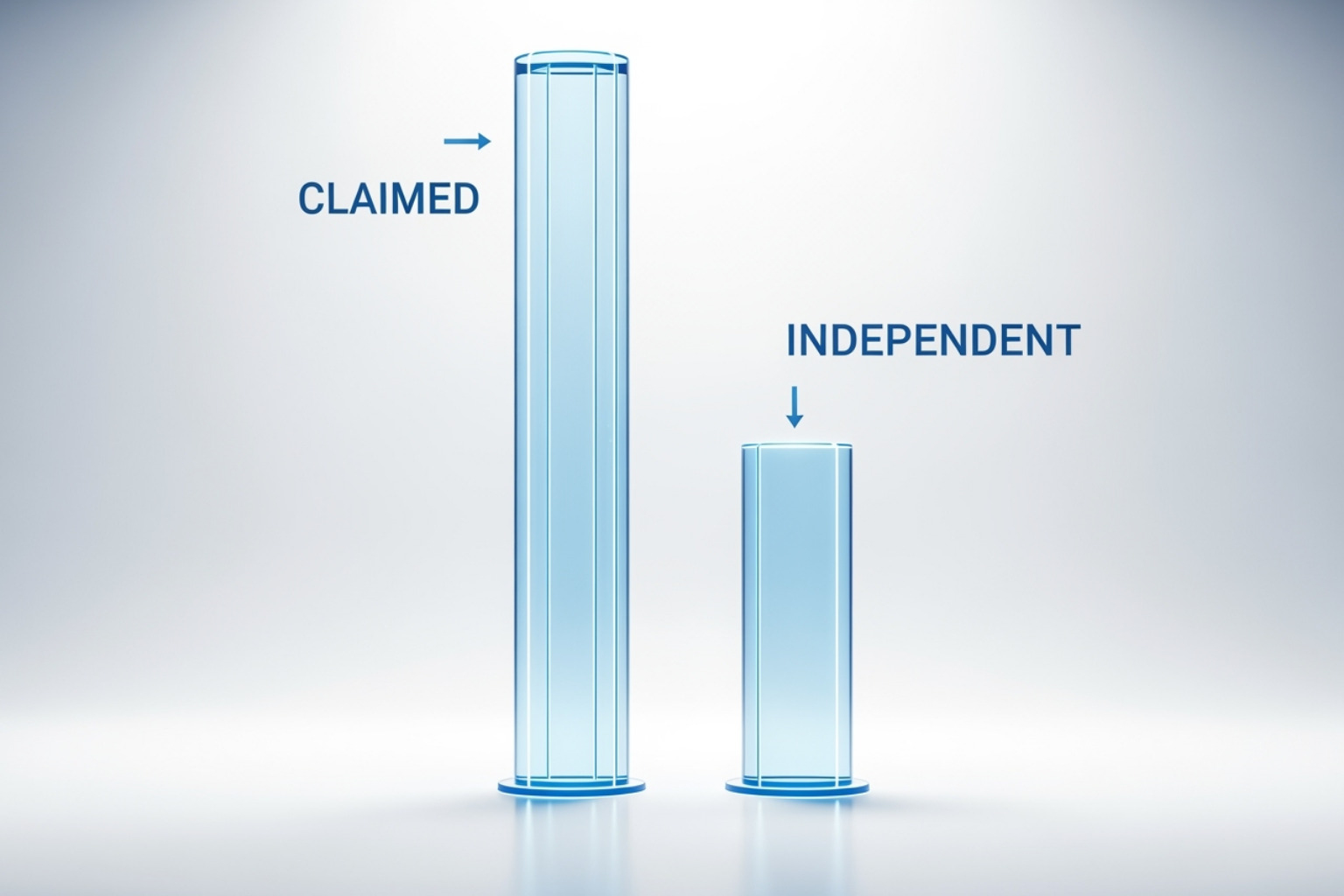

- AI Claims: Reports 70% accuracy rate for stock predictions (though independent studies suggest 35% actual accuracy)

- Trust Score: ScamAdviser gives it 66/100, indicating moderate risk

- Performance: Independent analysis shows a test portfolio lost 5.6% while S&P 500 gained 8.2% in the same period

The platform operates as a stock research service rather than a regulated brokerage. It targets both beginner and experienced investors with its simplified rating system and sector-specific recommendations.

5starsstocks.com generates revenue through subscription services and advertising, offering premium features like advanced alerts and deeper analysis. The platform covers major sectors including AI stocks, healthcare, energy, and emerging areas like 3D printing.

Key concerns include anonymous ownership, lack of regulatory oversight, and significant gaps between claimed and independently verified performance results.

5starsstocks.com best stocks basics:

How 5starsstocks.com Claims to Identify Top Stocks

The world of AI-powered stock picking sounds like something straight out of a sci-fi movie, doesn’t it? 5starsstocks.com wants you to believe they’ve cracked the code on finding winning stocks using artificial intelligence. But let’s take a closer look at what’s actually happening behind the curtain and how they claim to identify their 5starsstocks.com best stocks.

The AI Engine and Data Sources

According to 5starsstocks.com, their artificial intelligence engine works around the clock, analyzing massive amounts of market data to spot trends and opportunities. They claim their system processes everything from historical stock prices to current news headlines, and even tracks social media sentiment to gauge public opinion about different companies.

The platform boasts about its machine learning capabilities and predictive algorithms that supposedly make sense of all this information. Their Smart Alerts System is designed to notify users when their AI spots what it considers a promising investment opportunity.

Here’s where things get interesting though – and a bit concerning. The exact details of how their AI actually works remain a mystery. It’s what tech folks call a “black box” system. You can see what goes in (data) and what comes out (stock recommendations), but the magic happening in between? That’s their secret sauce, and they’re not sharing the recipe.

This lack of transparency makes it tough to verify whether their artificial intelligence is as sophisticated as they claim, or if it’s more like a fancy calculator with good marketing. For more insights into financial technology trends, check out our Fintech Guides.

Decoding the Five-Star Rating System

The heart of 5starsstocks.com’s appeal lies in its simple five-star rating system. Just like rating a restaurant or movie, they rate stocks from one to five stars based on their analysis. It’s designed to make complex financial decisions feel as easy as choosing what to watch on Netflix.

Their rating criteria supposedly includes past performance, growth potential, market stability, and risk factors. A five-star stock, according to their system, excels in all these areas and represents their highest confidence pick.

The problem? They don’t tell you exactly how they weigh these different factors. Is a company’s past performance more important than its growth potential? How do they balance market stability against risk? Without knowing the specifics, you’re essentially trusting their judgment without being able to verify their reasoning.

This simplified approach might feel user-friendly, but it can also be misleading. Real stock analysis involves dozens of factors, complex relationships, and nuanced judgments that don’t always fit neatly into a star system.

Sectors and Stock Categories Covered

5starsstocks.com casts a pretty wide net when it comes to the types of stocks they analyze. They’ve organized their recommendations into three main investment styles to match different investor preferences.

Passive stocks are positioned as the “set it and forget it” option – stocks that don’t require constant monitoring and are suitable for long-term investors who want steady growth without the stress.

Dividend stocks focus on companies that regularly pay shareholders a portion of their profits. These are marketed toward investors seeking regular income from their investments, especially those nearing or in retirement.

Value stocks represent companies that appear to be trading for less than they’re actually worth. Think of it like finding a designer jacket at a thrift store – the idea is you’re getting quality at a discount price.

Beyond these investment styles, the platform covers an impressive range of sectors. They analyze everything from cutting-edge technology sector companies working on artificial intelligence and 3D printing to traditional healthcare sector stocks and defense stocks.

Their AI-powered analytics supposedly monitor emerging trends in areas like fintech, cybersecurity, biotechnology, energy, and even niche markets like cannabis and cryptocurrency-related stocks. The goal is to provide opportunities across the entire economic landscape, regardless of market conditions.

You can explore broader market trends and analysis through our Car News 4 You Markets section for additional context on these various sectors.

The breadth of coverage sounds impressive, but it also raises questions about depth. Can one platform really provide expert-level analysis across such diverse industries? Each sector has its own unique dynamics, regulatory environment, and growth drivers that require specialized knowledge to properly evaluate.

Performance and User Experience: A Closer Look at 5starsstocks.com Best Stocks

When any platform promises to revolutionize investing with AI, we naturally want to know: does it actually deliver results? The gap between marketing promises and real-world performance can be eye-opening, and 5starsstocks.com best stocks provide a perfect case study in why independent analysis matters.

Claimed Performance and User Feedback

5starsstocks.com boldly claims their AI achieves around 70% accuracy for stock recommendations. If true, this would be remarkable in the notoriously unpredictable world of investing. Their success stories sound almost too good to be true: Sarah the teacher achieved “financial freedom,” John the small business owner generated passive income to grow his company, and Maria built her first balanced portfolio with growing dividends.

These testimonials paint an appealing picture of consistent wins and investor empowerment. The platform emphasizes how their “expert-created recommendations” and “real-time analysis” help users invest with confidence. It’s exactly what every investor dreams of hearing.

But here’s where things get interesting – and concerning.

Portfolio Performance Insights

Independent research tells a dramatically different story about 5starsstocks.com best stocks. When analysts actually tracked the platform’s recommendations, they found that only 35% were profitable – roughly half of what the company claims.

Even more troubling, a test portfolio built entirely on their picks lost 5.6% during a period when the S&P 500 gained a healthy 8.2%. That’s not just missing out on gains – it’s a 13.8% underperformance compared to simply buying a broad market index.

Think about that for a moment. You could have thrown a dart at the stock market, bought an index fund, and done significantly better than following their “AI-powered” recommendations. This kind of underperformance raises serious questions about the effectiveness of their system.

Investor Experiences and Platform Use

Real user experiences with the platform tell a mixed story, which honestly reflects the complexity of investing itself. Some users have reported genuine wins – +34% gains over two months with certain lithium stock picks, and steady dividend returns from their income stock recommendations. The platform’s beginner-friendly interface does seem to help new investors understand market basics.

However, the negative experiences are equally telling. Several of their “strong buy” ratings reportedly led to significant losses for users who followed the advice. Their cannabis stock recommendations showed particular volatility, creating unpredictable outcomes that left some investors burned.

This stark difference between glowing testimonials and independent performance data highlights a crucial point: while platforms like 5starsstocks.com might offer interesting ideas, treating their recommendations as gospel can be financially dangerous. The real-world performance simply doesn’t match the marketing hype, and investors need to approach these services with healthy skepticism and thorough personal research.

Key Considerations and Trustworthiness Score

When you’re thinking about trusting your hard-earned money to any investment platform, especially one promising AI-powered miracles, you need to ask the tough questions. Unfortunately, when we dig deeper into 5starsstocks.com best stocks, several concerning issues emerge that every potential user should understand.

Transparency and Oversight

Here’s where things get really murky. 5starsstocks.com operates in complete anonymity – we have no idea who runs it, who built their AI system, or what qualifications these mystery people might have. Think about it: would you take financial advice from someone wearing a mask who won’t tell you their name?

This isn’t just unusual – it’s a massive red flag in the financial world. Legitimate financial advisors proudly display their credentials, experience, and regulatory registrations. They want you to know exactly who you’re trusting with your money. The fact that 5starsstocks.com’s operators remain completely hidden raises serious questions about accountability.

The regulatory situation is equally concerning. Unlike traditional brokerages or registered investment advisors, 5starsstocks.com operates without oversight from the SEC or FINRA. This means there’s no regulatory body watching over their practices or ensuring they follow proper standards. If something goes wrong, you have no official recourse or protection.

This lack of oversight becomes particularly important when you remember that investment decisions should be based on your individual circumstances. Organizations like the Financial Industry Regulatory Authority (FINRA) exist specifically to protect investors from questionable practices.

Methodology and AI Transparency

The platform loves to throw around terms like “proprietary algorithms” and “advanced AI analysis,” but here’s the problem: they won’t show you how any of it actually works. Their AI system is essentially a black box – you’re supposed to trust that it’s sophisticated and effective, but you can’t verify that claim.

Real financial research firms typically provide detailed explanations of their methodologies. They’ll tell you exactly how they analyze companies, what metrics they prioritize, and how they reach their conclusions. This transparency allows you to understand and evaluate their approach.

5starsstocks.com offers none of this analytical depth. There are no technical papers, no independent audits of their AI system, and no detailed explanations of how stocks earn their star ratings. You’re essentially being asked to trust a system that could be anything from genuinely sophisticated algorithms to simple random number generators.

This opacity becomes even more problematic when you consider how complex financial technology can be – whether we’re talking about stock analysis or managing something like a Car News 4 You Crypto Wallet. Transparency builds trust, and trust is everything in finance.

Evaluating 5starsstocks.com: The Overall Verdict

So where does this leave us? ScamAdviser gives 5starsstocks.com a trust score of 66 out of 100, which translates to “moderate risk.” That’s basically saying “proceed with extreme caution” in the nicest way possible.

Our assessment aligns with this cautionary rating, though we’d argue the concerns run even deeper. While we can’t definitively call it a scam without more evidence, the combination of anonymous operators, zero regulatory oversight, unverified performance claims, and a completely opaque AI system creates a risk profile that should make most investors run in the opposite direction.

The independent performance data we discussed earlier – showing actual losses when the market was gaining – only reinforces these concerns. When a platform claims 70% accuracy but independent testing shows 35%, you have to question everything else they’re telling you.

In the financial world, trust isn’t built on flashy marketing or promises of easy money. It’s built on transparency, accountability, and verifiable track records. Unfortunately, 5starsstocks.com best stocks recommendations come wrapped in too much mystery and too many red flags for comfort.

How to Safely Use 5starsstocks.com and Improve Your Stock Research

Let’s be honest – after everything we’ve covered about 5starsstocks.com best stocks, you’re probably wondering if there’s any safe way to use this platform at all. The answer is yes, but with serious precautions. Think of it like using a metal detector on the beach – you might find something interesting, but most of what you dig up will be bottle caps, not treasure.

Best Practices for Using the Platform

If you’re determined to explore 5starsstocks.com despite the red flags, treat it as nothing more than an idea generation tool. Picture yourself browsing a magazine rack – you might spot an interesting headline that sparks your curiosity, but you wouldn’t make major life decisions based on a magazine cover alone.

The golden rule here is independent verification. Every single stock recommendation you encounter needs to be thoroughly researched through reputable sources like SEC filings, established financial platforms, and analyst reports from recognized firms. Think of 5starsstocks.com as suggesting a restaurant, but you still need to read the reviews, check the health department ratings, and maybe peek at the menu before making a reservation.

Due diligence becomes your best friend in this process. Stock prices fluctuate constantly, and past performance never guarantees future results. Smart investors implement stop-loss orders to protect themselves – consider setting these at 15% below your purchase price for any speculative positions.

The most important thing? Avoiding hype at all costs. Those flashy success stories and bold accuracy claims we discussed earlier? Treat them like you would a “too good to be true” infomercial. Focus on cold, hard data instead of emotional marketing messages.

Analyzing 5starsstocks.com Best Stocks: A Sample Review

Let’s roll up our sleeves and look at how proper fundamental analysis should work. Here’s a comparison of key metrics for some major stocks that often appear in various recommendation lists:

| Metric | AAPL | MSFT | JNJ | TSLA | AMZN |

|---|---|---|---|---|---|

| P/E Ratio | 28.4 | 32.1 | 23.7 | 90.2 | 60.5 |

| Annual Revenue Growth (%) | 14.5 | 13.0 | 5.8 | 25.4 | 18.2 |

| Dividend Yield (%) | 0.6 | 0.9 | 2.7 | 0.0 | 0.0 |

| EPS Growth (%) | 16.0 | 15.7 | 8.5 | 30.1 | 11.3 |

| Market Capitalization ($B) | 2250 | 2100 | 435 | 850 | 1650 |

Understanding financial health through these numbers tells you more than any star rating ever could. Take Tesla’s P/E ratio of 90.2 – that’s investors betting heavily on future growth, but it also means you’re paying a premium price. Compare that to Johnson & Johnson’s more conservative 23.7, which might indicate a mature, stable company.

Valuation metrics like these help you understand what you’re actually buying. JNJ’s 2.7% dividend yield makes it attractive for income seekers, while Tesla and Amazon reinvest everything back into growth. Neither approach is wrong, but they serve different investment goals.

Top Tips for Reliable Stock Research

Building a solid research foundation goes far beyond any single platform. Established research methods have stood the test of time for good reason – they work when applied consistently.

Start by leveraging brokerage tools from reputable firms. Most established brokerages offer extensive research reports, screening tools, and analyst ratings to their clients at no extra cost. These tools often provide the same level of analysis that professional money managers use.

Reviewing public filings might sound boring, but it’s where the real story lives. The SEC’s EDGAR database contains every major company’s official reports – their annual 10-K forms, quarterly 10-Q reports, and other crucial disclosures. This is where companies must tell the truth about their financial situation, challenges, and future plans.

In-depth fundamental research means understanding the business behind the stock ticker. What does this company actually do? How do they make money? Who are their competitors? What keeps the CEO awake at night? These questions matter more than any algorithmic rating.

Don’t forget the bigger picture either. Economic trends, interest rate changes, and global events all influence individual stock performance. Our Car News 4 You Economy section can help you stay informed about these broader market forces.

Successful investing isn’t about finding the perfect stock-picking service – it’s about developing your own analytical skills and making informed decisions based on solid research. Your future self will thank you for taking the time to learn these fundamentals properly.

Frequently Asked Questions about 5starsstocks.com

After diving deep into 5starsstocks.com and analyzing its claims, performance, and transparency issues, we know you probably have some burning questions. Let’s tackle the most common concerns investors bring up about this platform and give you the straight answers you need.

Can you actually make money with 5starsstocks.com?

Here’s the honest truth: making consistent money by following 5starsstocks.com best stocks recommendations alone appears highly unlikely. The numbers tell a sobering story that contradicts the platform’s marketing claims.

Independent analysis revealed that a test portfolio built entirely on their recommendations actually lost 5.6% during a period when the S&P 500 gained a healthy 8.2%. That’s a staggering 13.8% underperformance compared to simply investing in a basic market index fund.

Even more concerning is the accuracy rate. While 5starsstocks.com boldly claims a 70% success rate, independent verification found their picks were only profitable about 35% of the time. This means their recommendations were wrong nearly two-thirds of the time during the testing period.

Now, we’re not saying it’s impossible to make money using their ideas as a starting point. Some users have reported gains on individual picks, particularly in volatile sectors like lithium stocks. However, relying solely on their ratings without your own research appears to be a recipe for disappointment and potential losses.

The platform’s business model revolves around attracting subscribers and selling premium services, not necessarily ensuring your investment success. Those glossy testimonials about Sarah the teacher achieving “financial freedom” should be taken with a hefty grain of salt.

Who owns 5starsstocks.com?

This question hits at the heart of what makes 5starsstocks.com so problematic. The platform operates with complete anonymity – no names, no faces, no credentials, and no accountability.

You won’t find any information about who developed their supposed AI system, who makes the final stock selections, or who’s responsible if their recommendations lead to significant losses. There’s no “About Us” page with team photos and LinkedIn profiles like you’d expect from a legitimate financial service.

This lack of transparency is a massive red flag in the financial world. When you’re getting investment advice, you want to know you’re dealing with qualified professionals who have skin in the game and reputations to protect. Anonymous operators can disappear overnight, leaving users with no recourse for poor advice or misleading claims.

Legitimate financial advisors are required to register with regulatory bodies and disclose their qualifications. The fact that 5starsstocks.com operates in the shadows should make any serious investor think twice about trusting their recommendations.

Is the AI on 5starsstocks.com real?

The short answer? We simply don’t know – and that’s the problem.

5starsstocks.com heavily markets its “advanced AI” and “proprietary algorithms” as the secret behind their stock-picking prowess. However, they provide zero technical details, no academic validation, and no independent audits to verify these claims. Their AI system is essentially a complete black box.

It’s entirely possible they use some form of automated data analysis – many websites do. But calling basic algorithms “AI” has become a popular marketing tactic. True AI in finance requires transparency, rigorous testing, and often oversight from qualified data scientists to ensure effectiveness and prevent dangerous biases.

Without being able to examine their methodology, there’s no way to determine if their system is genuinely sophisticated or simply a basic stock screener with fancy marketing. The significant gap between their claimed accuracy and independently verified results suggests their AI might not be as as advertised.

Real AI-powered investment platforms typically publish research papers, undergo third-party audits, and provide detailed explanations of their models. The fact that 5starsstocks.com provides none of these raises serious questions about the legitimacy of their AI claims.

When evaluating 5starsstocks.com best stocks or any AI-driven investment platform, extraordinary claims require extraordinary evidence – evidence that simply isn’t available here.

Conclusion: A Final Verdict

So where does this leave us after digging deep into 5starsstocks.com best stocks and all the claims surrounding this AI-powered platform? It’s time for some honest talk about what we’ve finded.

Our Take on 5starsstocks.com Best Stocks

The idea behind 5starsstocks.com honestly sounds pretty amazing at first glance. Who wouldn’t want an AI system that can crunch massive amounts of data and hand you a neat five-star rating for the best stocks? It’s like having a crystal ball for the stock market, right?

Unfortunately, the reality doesn’t match the marketing hype. While the concept of AI-driven stock analysis has genuine potential, the execution here raises serious concerns that we simply can’t ignore.

The biggest red flags keep coming back to transparency issues. When a platform won’t tell you who’s behind it, how their AI actually works, or provide verifiable performance data, that’s a problem. Add in the fact that independent testing showed their picks were wrong about 65% of the time (compared to their claimed 30% error rate), and you start to see why that ScamAdviser score of 66/100 makes sense.

The platform launched in 2023 with big promises, covering everything from dividend stocks to emerging sectors like 3D printing and AI. But when a test portfolio built on their recommendations lost 5.6% while the S&P 500 gained 8.2% in the same period, that’s not just disappointing – it’s a significant underperformance that could hurt real investors.

Could 5starsstocks.com serve as a starting point for stock ideas? Maybe. But treating it as anything more than that seems risky given what we’ve learned. The lack of regulatory oversight means there’s no safety net if things go wrong, and the anonymous ownership means there’s no one to hold accountable.

Final Recommendations

Here’s the bottom line: your money deserves better than unverified claims and mystery algorithms.

Stick with what works and what’s accountable. Use established brokerages, regulated financial advisors, and transparent research platforms. These services might not promise magical AI solutions, but they offer something more valuable – reliability and accountability. When things are regulated by the SEC or FINRA, you have protections and recourse if something goes wrong.

Your own research is your best friend. Learn to read company financials, understand basic valuation metrics, and always cross-check information from multiple credible sources. It takes more time than clicking on a five-star rating, but it’s infinitely more reliable. The fundamentals of good investing haven’t changed just because AI entered the picture.

Investing is a long game. There are no shortcuts to building wealth, despite what flashy marketing might suggest. The most successful investors we know got there through patience, education, and disciplined decision-making – not by following anonymous tips from mystery platforms.

We know it’s tempting to look for that edge, that secret sauce that’ll make investing easier. But your financial future is too important to gamble on unproven systems with questionable track records. Invest wisely, do your homework, and trust verified sources over marketing promises.

Explore more in-depth guides to help you build the knowledge and skills for successful long-term investing.