fintechzoom.com etf market: Ultimate Guide 2025

Why ETFs Have Become the Investment Vehicle of Choice

Navigating the fintechzoom.com etf market requires a solid understanding of Exchange-Traded Funds (ETFs). This guide provides clear insights and analysis for both beginners and experienced investors in this rapidly growing investment space.

Quick Overview: What You Need to Know About ETFs

- Definition: Investment funds that trade on stock exchanges like individual stocks

- Key Benefit: Instant diversification across dozens or hundreds of securities

- Trading: Buy and sell during market hours with real-time pricing

- Costs: Typically lower expense ratios than mutual funds (often under 0.20%)

- Popular Types: Index ETFs, sector ETFs, bond ETFs, and thematic ETFs

ETFs have grown from niche instruments in the 1990s to a multi-trillion-dollar industry today. This explosive growth stems from their unique combination of benefits: the diversification of mutual funds with the trading flexibility of stocks.

Unlike mutual funds that price once daily, ETFs trade throughout market hours. This means you can buy or sell your position anytime the market is open, just like buying shares of Apple or Microsoft.

The appeal is simple. Instead of researching individual companies, you can invest in an entire market sector, country, or investment theme through a single purchase. Want exposure to the top 500 U.S. companies? Buy an S&P 500 ETF. Interested in emerging technology trends? There’s likely a thematic ETF for that too.

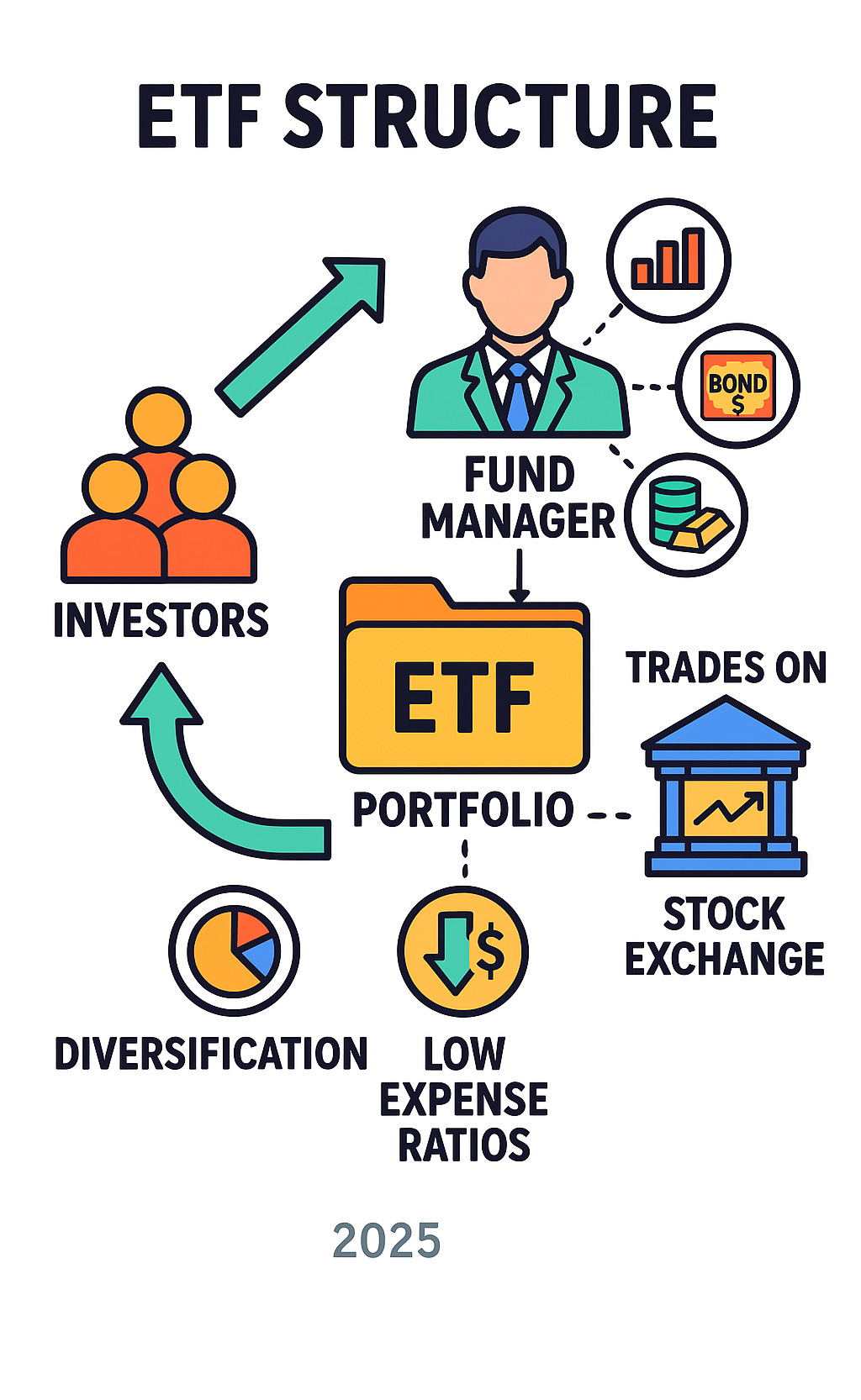

Understanding the Basics of ETFs

So, what exactly is an ETF, and how does it stack up against its more traditional cousin, the mutual fund? At its heart, an ETF is an investment fund that holds a collection, or “basket,” of securities—these could be stocks, bonds, commodities, or a mix of everything. What makes ETFs truly unique is that they trade on stock exchanges throughout the day, just like individual stocks. This means we can buy or sell them at any point during market hours, and their price can fluctuate moment by moment.

Think of it this way: if you wanted to own a piece of every company in the S&P 500 index, buying each stock individually would be a monumental task (and expensive!). An S&P 500 ETF does that for us in one neat package. We buy shares of the ETF, and those shares represent a tiny slice of all those underlying companies.

Mutual funds, on the other hand, are priced only once a day, typically after the market closes, based on their Net Asset Value (NAV). If we place an order to buy or sell a mutual fund, we won’t know the exact price until the end of the trading day. This “end-of-day” pricing is a key difference from ETFs. ETFs offer us the flexibility to react to market movements in real-time, which can be a significant advantage for some investors.

ETF Investing: What Makes It Unique?

The unique characteristics of ETF investing are what have fueled their incredible popularity. Let’s dig into what sets them apart:

- Tradability: As we’ve mentioned, ETFs offer intraday trading, meaning we can buy and sell them throughout the trading day at real-time prices. This flexibility allows us to capitalize on market shifts or adjust our portfolios quickly. Mutual funds, with their once-a-day pricing, don’t offer this dynamic trading capability.

- Real-time Pricing: When we buy an ETF, we know the price we’re paying right then and there. This transparency is a big draw compared to mutual funds where the price is determined hours later.

- Expense Ratios: Generally, ETFs boast lower expense ratios than mutual funds. An expense ratio is the annual fee charged by the fund to cover its operating expenses. Because many ETFs are passively managed (meaning they simply track an index rather than having a team of managers actively picking stocks), they tend to have lower overheads. For instance, many popular ETFs have expense ratios as lean as 0.12 percent, which is quite competitive!

- Tax Efficiency: ETFs are often more tax-efficient than mutual funds. Their structure allows them to minimize capital gains distributions, which can lead to a lower tax burden for us, the investors. This is a subtle but powerful benefit, especially for long-term investors.

- Transparency: We always know what’s inside an ETF. Their holdings are typically disclosed daily, giving us full transparency into what we’re investing in. This contrasts with mutual funds, which might only disclose their holdings quarterly.

- Management Style: Many ETFs are passively managed, aiming to replicate the performance of a specific index (like the S&P 500 or Nasdaq-100). This “set it and forget it” approach often leads to consistent, market-matching returns. While actively managed ETFs do exist, a significant portion of the market leans towards passive strategies due to their cost-effectiveness and generally strong performance.

The Core Advantages of ETF Investing

The allure of ETFs isn’t just their tradability; it’s the comprehensive suite of benefits they offer, making them a powerful tool for almost any investor.

When we think about what makes ETFs so appealing, it really comes down to five core benefits that work together beautifully: diversification, lower costs, liquidity, transparency, and tax efficiency. These advantages make ETFs accessible to everyone, from complete beginners to seasoned investors.

The beauty of ETF investing lies in how these benefits compound over time. Lower costs mean more money stays in our pockets. Better diversification helps us sleep better at night. And the ability to trade anytime gives us control when we need it most.

How ETFs Help Manage Risk and Save Time

One of the most compelling reasons to accept ETFs is their ability to help us manage investment risk while saving us precious time. Let’s be honest – most of us have better things to do than spend hours researching individual stocks.

Spreading risk through instant diversification is perhaps the biggest game-changer. When we buy a single ETF share, we’re not putting all our eggs in one basket. Instead, we’re getting a tiny slice of dozens, hundreds, or even thousands of companies. If one company has a rough quarter, the impact on our investment gets cushioned by all the others in the fund.

Think about it this way: if we owned just one tech stock and it dropped 20%, we’d feel that pain directly. But if we own a tech ETF with 50 companies and one drops 20%, it barely moves the needle on our overall investment. That’s the power of automated portfolio management working in our favor.

Reduced research time is another huge benefit that often gets overlooked. Imagine trying to research every company in the S&P 500 before making an investment decision. We’d need a team of analysts and months of work! ETFs do this heavy lifting for us, giving us exposure to entire market segments without requiring us to become experts on every single company.

The passive investing approach that many ETFs follow means we can “set it and forget it” without constantly worrying about whether we’re picking the right stocks. This approach has historically delivered solid, market-matching returns while keeping stress levels manageable.

The Importance of Liquidity and Low Costs

The combination of liquidity and low costs makes ETFs incredibly attractive, especially when compared to traditional investment options. These features work together to keep more money in our pockets while giving us flexibility when we need it.

Intraday trading gives us the freedom to buy or sell our ETF shares anytime the market is open. Need to access your money quickly? No problem. Want to take advantage of a market dip? You can act immediately. This liquidity provides peace of mind, even for long-term investors who rarely trade.

While we’re trading, it’s worth understanding the bid-ask spread – the small difference between what buyers are willing to pay and what sellers want. For popular ETFs, this spread is usually tiny, meaning our transaction costs stay minimal. It’s just another way ETFs keep costs low.

Expense ratios are where ETFs really shine. These annual fees are typically much lower than what we’d pay for actively managed mutual funds. The difference might seem small – maybe 0.5% or 1% – but over decades of investing, those savings add up to thousands of dollars staying in our portfolio instead of going to fund managers.

Commission-free trading has made ETFs even more accessible. Many brokers now offer hundreds or even thousands of ETFs that we can buy and sell without paying per-trade fees. This eliminates one of the traditional barriers to investing and makes it easier to build a diversified portfolio without worrying about trading costs eating into our returns.

For more insights into market movements and trends that can inform our ETF choices, more info about market trends provides valuable context for making informed investment decisions in the fintechzoom.com etf market.

Navigating the Fintechzoom.com ETF Market: Trends and Insights

To understand the dynamic world of ETFs, investors need access to quality information, analysis, and strategic guidance. This is essential for making smarter investment decisions in the fintechzoom.com etf market.

What Is the fintechzoom.com etf market?

The term fintechzoom.com etf market refers to the dynamic online space where investors find information, analysis, and data on Exchange-Traded Funds. It’s not a physical trading floor but a digital ecosystem of financial news, guides, and tools. Navigating this space effectively is key to making smart investment decisions.

This ecosystem provides educational resources for everyone, from beginners learning the basics to experts seeking advanced strategies. The goal is to bridge the gap between complex financial data and practical investment decisions. Instead of confusing jargon, investors should seek out clear explanations that make complex ETF concepts manageable, whether they are just starting their investment journey or have been at it for years.

Staying informed requires updated insights that reflect what’s actually happening in the markets right now. In the fast-moving world of finance, yesterday’s information can quickly become irrelevant. This real-time approach helps investors stay informed about market trends and make decisions based on current conditions rather than outdated data.

Investors can also find practical strategies that they can actually use, from basic buy-and-hold approaches to more sophisticated techniques like sector rotation. The best resources offer comprehensive coverage spanning everything from basic ETF definitions to complex instruments like leveraged and inverse ETFs.

For those wanting to explore the broader fintech landscape, our Fintech Guides provide additional context and insights that complement ETF investing knowledge.

Types of ETFs You Can Explore

The ETF universe is remarkably diverse, and understanding the different types available can help us build portfolios that truly match our investment goals and risk tolerance.

Index ETFs form the backbone of many portfolios, and for good reason. These funds track specific market indices, giving us instant exposure to entire markets or segments. The S&P 500 ETFs like SPY provide ownership in America’s 500 largest companies, while Nasdaq-100 ETFs like QQQ focus on the biggest non-financial companies on the Nasdaq exchange. These are perfect when we want broad market exposure without having to pick individual stocks.

Sector ETFs let us get more targeted with our investments. If we believe technology is the future, we can invest in a tech sector ETF. If we think healthcare will outperform, there’s an ETF for that too. These funds allow us to express our market views while still maintaining diversification within specific industries.

Commodity ETFs offer something completely different—exposure to physical goods like gold, oil, or agricultural products. Gold ETFs are particularly popular because they give us the benefits of gold ownership without the hassle of storing actual metal bars in our basement!

For those seeking steady income, Bond ETFs invest in various types of bonds from governments and corporations. These can provide regular income payments and help balance out the volatility that comes with stock investments.

Thematic ETFs are where things get really interesting. These funds focus on major trends shaping our world—artificial intelligence, clean energy, cybersecurity, or even space exploration. They let us invest in the themes we believe will drive future growth.

Cryptocurrency ETFs represent the newest frontier in ETF investing. These funds provide exposure to Bitcoin and other digital assets without requiring us to steer cryptocurrency exchanges or manage digital wallets ourselves. Given the volatility and complexity of this space, our Fintechzoom.com Bitcoin Price Guide 2025 can provide deeper insights into this rapidly evolving market.

The beauty of this variety is that we can mix and match different ETF types to create a portfolio that reflects our unique investment goals, risk tolerance, and beliefs about where the markets are heading.

Choosing Your Tools: Key Considerations for ETF Investors

Once we understand what ETFs are and their advantages, the next step is choosing the right platform and approach for our investments. This involves a bit of research and understanding our own investing style.

| Feature | Beginner Investor | Advanced Investor |

|---|---|---|

| ETF Selection | Focus on broad-market ETFs (S&P 500, Total Stock Market) with low fees | Access to niche sectors, international markets, and specialized strategies |

| Platform Fees | Look for commission-free trading and no account minimums | May accept higher fees for premium research tools and advanced features |

| Research Tools | Basic screeners and educational content | Advanced charting, analyst reports, and real-time data feeds |

| Account Features | Simple buy/sell functionality with mobile access | Options trading, margin accounts, and portfolio analysis tools |

The beauty of today’s investing landscape is that we have more choices than ever before. Whether we’re just starting out or we’ve been investing for years, there’s likely a platform that fits our specific needs and budget.

What to Look for in an ETF Investment Platform

Choosing the right investment platform can make or break our ETF investing experience. Let’s walk through the key features that matter most when we’re comparing our options.

ETF availability is perhaps the most important factor. Some platforms offer thousands of ETFs, while others focus on a curated selection. If we’re beginners, a smaller, well-chosen selection might actually be helpful—it prevents us from feeling overwhelmed. More experienced investors might want access to specialized ETFs covering emerging markets or niche sectors like clean energy or artificial intelligence.

The expense ratios of available ETFs should be a major consideration. Even a difference of 0.1% in annual fees can add up to thousands of dollars over decades of investing. The best platforms highlight low-cost options and make it easy to compare fees across similar ETFs.

Account fees can eat into our returns if we’re not careful. Many modern platforms have eliminated account maintenance fees and minimum balance requirements, which is fantastic news for new investors. However, some premium platforms still charge these fees in exchange for advanced features and personalized service.

Platform usability matters more than we might think. If the platform is confusing or difficult to steer, we’re less likely to stay engaged with our investments. The best platforms offer clean, intuitive interfaces that work well on both computers and mobile devices. After all, we want investing to feel manageable, not frustrating.

Research and data tools can help us make better investment decisions. For beginners, this might mean access to educational articles and simple portfolio analysis tools. More advanced investors often want detailed performance charts, analyst ratings, and the ability to compare multiple ETFs side by side.

Customer support becomes crucial when we have questions or encounter problems. Look for platforms that offer multiple ways to get help—whether that’s phone support, live chat, or comprehensive online help centers. When our money is on the line, we want to know help is available when we need it.

It’s worth noting that current economic conditions, including decisions by institutions like the US Federal Reserve regarding interest rates, can impact ETF performance. A good platform will help us understand these broader market factors and how they might affect our investments.

A key topic within the fintechzoom.com etf market is how different platforms stack up against each other, providing valuable insights for investors trying to make the best choice for their situation. The “best” platform is the one that matches our investing style, experience level, and long-term goals.