Alaska Permanent Fund Dividend Stimulus Payment: Quick 3 Steps

Why Alaska’s Annual Oil Revenue Payment Matters to Residents

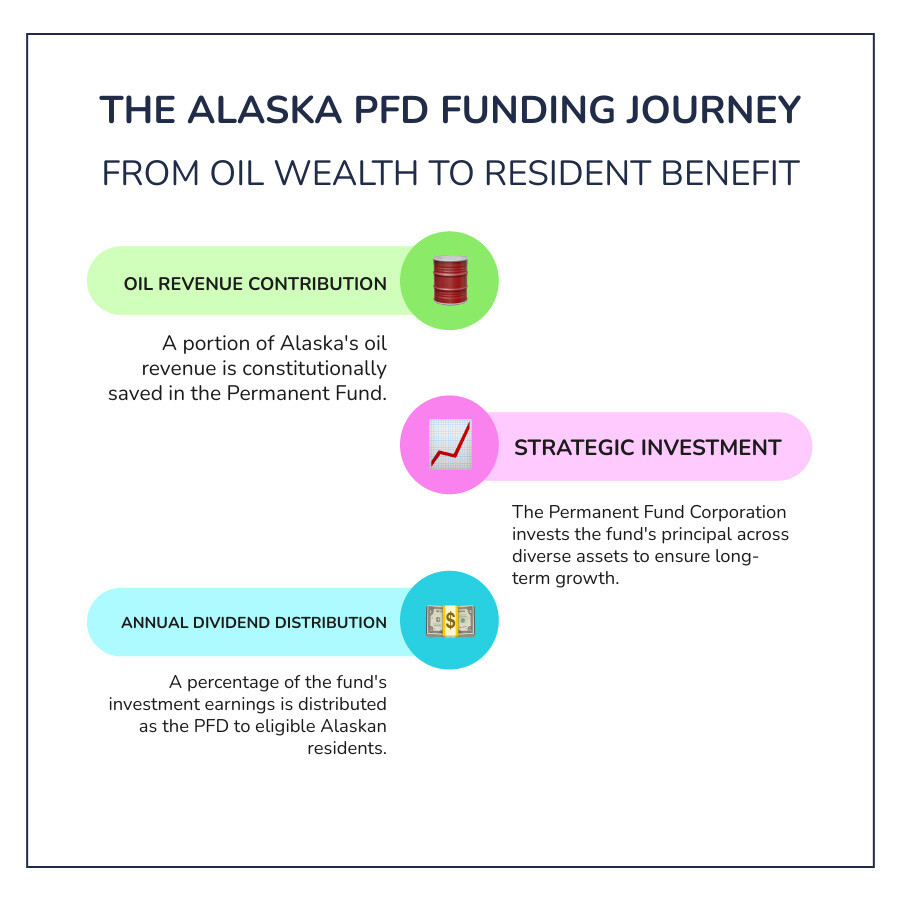

The alaska permanent fund dividend stimulus payment is an annual payment to eligible Alaskans from the state’s oil revenue savings. Unlike federal stimulus, this dividend comes from Alaska’s Permanent Fund, established in 1976 to save oil wealth for future generations.

Quick Facts:

- 2024 Payment Amount: $1,702 per eligible resident

- Funding Source: Oil revenue and investment earnings

- Eligibility: Must be Alaska resident for full calendar year

- Application Period: January 1 – March 31 annually

- Payment Schedule: August through October distributions

Every fall, Alaska sends residents a check. For many families, this payment helps cover essential costs like fuel, groceries, or other winter expenses.

The process involves three straightforward steps: confirming eligibility, applying by the deadline, and checking your status online. Each step has specific requirements that determine if you receive a payment.

In 2024, over 600,000 Alaskans received the dividend, injecting nearly $1 billion into the state’s economy. The payment represents Alaska’s commitment to sharing its natural resource wealth with its year-round residents.

What is the Alaska Permanent Fund Dividend (PFD)?

The Alaska Permanent Fund Dividend originated in 1976 when Alaskans voted to create the Alaska Permanent Fund. This decision turned the state’s oil wealth into a permanent savings account instead of spending it immediately. The idea was to save a portion of oil revenue for the future, creating a fund that pays residents back every year.

The Alaska Permanent Fund Corporation manages the fund by investing it in a diversified portfolio of stocks, bonds, and real estate worldwide to ensure steady growth.

Crucially, the dividend doesn’t come from current oil sales but from the Permanent Fund’s investment earnings. Each year, a portion of those earnings (around 5%) is distributed to residents.

For 2024, eligible Alaskans received $1,702 each, which included a base dividend and an energy relief payment. This was an increase from the 2023 amount of $1,312.

The economic impact is significant. When over 600,000 Alaskans get their alaska permanent fund dividend stimulus payment, it adds nearly a billion dollars to the state’s economy. For many families, this annual payment helps cover essential expenses like heating fuel and groceries as winter approaches.

This program is sustainable because it’s funded by investment returns, not the original principal, allowing it to continue indefinitely. It showcases Alaska’s forward-thinking resource management.

Who is eligible to receive the Alaska PFD stimulus payment?

To receive the alaska permanent fund dividend stimulus payment, you must meet specific requirements designed to ensure the money goes to genuine, committed residents.

The main residency requirement is living in Alaska for the entire calendar year before the dividend year (e.g., all of 2024 for the 2025 PFD). You must also intend to remain an Alaska resident indefinitely.

You cannot claim residency or receive resident benefits (like in-state tuition or voting rights) in any other state. If you are absent for more than 180 days, it must be for an “allowable” reason like military service, medical treatment, or full-time schooling to maintain eligibility.

Your criminal record matters. You are ineligible if incarcerated for a felony during the qualifying year, or for certain misdemeanors if you have prior offenses.

Finally, a physical presence requirement mandates you be in Alaska for at least 72 consecutive hours during the qualifying period. These strict rules ensure the dividend goes to true year-round residents.

Is the Alaska PFD stimulus payment considered taxable income?

Yes, the Alaska PFD is generally considered taxable income by the IRS for federal tax purposes. The good news is Alaska has no state income tax, but the federal government does tax your alaska permanent fund dividend stimulus payment.

In 2022, the IRS ruled that the energy relief portion ($662.19) of the $3,284 PFD was potentially tax-exempt, while the rest remained taxable. The DOR Response to IRS Guidance on 2022 PFD provides more detail.

You’ll receive a 1099 form (1099-MISC or 1099-NEC) for tax purposes, accessible through your MyPFD account online, which helps you report the income on your federal tax return.

Since tax rules can change and situations vary, we strongly recommend consulting a tax professional for personalized advice on handling your PFD taxes.

Step 1: Confirm Your PFD Eligibility Requirements

Before applying for the alaska permanent fund dividend stimulus payment, you must confirm you qualify. Missing this step will cost you the payment. The state’s requirements are strict to ensure the PFD, funded by oil wealth, goes to genuine, committed Alaskans.

The Full-Year Residency Rule

To qualify for the 2025 payment, you must have been an Alaska resident for the entire 2024 calendar year (January 1 – December 31). Alaska must have been your primary home where you intended to remain indefinitely.

The “No Double-Dipping” Rule

You cannot have claimed residency or received resident benefits (like property tax breaks or in-state tuition) in another state since December 31, 2023. Alaska requires your full commitment.

Understanding the 180-Day Absence Limit

Generally, you cannot be absent from Alaska for more than 180 days during 2024. However, certain absences don’t count against you. Military service, medical treatment not available in Alaska, and attending school as a full-time student are common allowable absences. If you think you qualify, you will need to provide documentation when you apply.

Criminal Record Considerations

The state has clear rules about criminal convictions. If you were sentenced for or incarcerated for a felony at any point during 2024, you will not qualify for that year’s dividend. You are also ineligible if incarcerated for a misdemeanor in 2024 and have a prior felony or at least two prior misdemeanors since January 1, 1997.

The 72-Hour Physical Presence Rule

You must have been physically present in Alaska for at least 72 consecutive hours at some point during either 2023 or 2024. This ensures you actually set foot in the state during the qualifying period.

Taking time to review these requirements can save you frustration. If you’re unsure about your eligibility, research thoroughly or contact the Permanent Fund Dividend Division directly.

Step 2: Apply and Note Key Deadlines

Once you confirm eligibility, it’s time to apply for your alaska permanent fund dividend stimulus payment. Timing is critical; missing the deadline means waiting another year.

The application window is January 1st to March 31st annually. Don’t wait until the last minute to apply.

Applying online via your myAlaska account is the fastest and most accurate method. The state’s secure portal is user-friendly and provides instant confirmation.

Paper applications are also available but take longer to process and must be delivered before the deadline.

The payment schedule is organized, with distributions in August, September, and October. Payments are sent in batches based on when an application is approved to “Eligible-Not Paid” status. Early approval means an earlier payment.

Direct deposit is the fastest way to get paid. Paper checks take weeks longer. Ensure your banking information is accurate during the application to avoid delays.

The payment timeline runs from late August through October. Your specific payment date depends on when your application is fully processed and approved.

The March 31st deadline is firm; no late applications are accepted. The state needs this cutoff to process hundreds of thousands of applications smoothly.

Step 3: Check Your Application Status Online

After applying, you can track your alaska permanent fund dividend stimulus payment online. This is an essential step for staying informed about your payment. The main tool is the MyPFD portal on the Alaska Department of Revenue’s Permanent Fund Dividend Division website.

To check your status, go to the myPFD portal to check your status and log in with your myAlaska account. This secure login protects your information. Once logged in, you can view your application details and current status.

The status “Eligible-Not Paid” is good news. It means your application is approved, and you are simply waiting for the scheduled payment date.

The MyPFD portal is also for updating crucial information. If you move or change banks, you can update this directly in the portal (if you filed with a myAlaska account). Otherwise, you must submit a paper Address Change or Payment Method form.

Critically, you must submit any address or banking changes by August 31st to ensure they are processed before mass payments begin. Missing this deadline can cause your payment to be sent to the wrong place or be returned.

Avoid common mistakes that cause delays: incorrect Social Security Numbers or dates of birth, outdated banking information, missing signatures, incomplete applications, failing to report absences properly, claiming residency elsewhere, or not meeting the 72-hour physical presence requirement.

Regularly checking your status and keeping your information current ensures a smooth payment process and helps avoid potential headaches.

How the PFD Compares to Other State Stimulus Programs

The alaska permanent fund dividend stimulus payment is unique in the U.S. Unlike typical state stimulus payments, the PFD is a long-standing constitutional program funded by oil wealth investment earnings. Let’s compare it to other state programs.

New York’s STAR Program offers property tax relief of $350 to $1,500 to homeowners, funded by the state’s general fund. It benefits about 3 million residents, saving them $2.2 billion annually.

California’s Guaranteed Income Pilot is an experimental program providing $1,000 monthly to select low-income families for about three years. Funded by grants, it tests the effects of guaranteed basic income on poverty.

| Feature | Alaska PFD | New York STAR | California Pilot |

|---|---|---|---|

| Funding Source | Oil revenue investment earnings | Property tax relief | Grants and donations |

| Who Gets It | All eligible Alaska residents | Homeowners only | Low-income families in select areas |

| Payment Amount | $1,702 (2024) | $350-$1,500 annually | $1,000 monthly |

| Payment Schedule | Once per year | Annual tax credit | Monthly payments |

| Purpose | Share state’s oil wealth | Reduce property tax burden | Test basic income concept |

The biggest difference is the funding source. Alaska’s PFD comes from oil wealth investment earnings, not taxes. New York’s STAR is tax relief, and California’s pilot uses grants.

Beneficiaries also differ. Alaska’s PFD is universal for residents. New York’s STAR is for homeowners only, while California’s pilot targets specific low-income groups.

The timing and purpose vary. Alaska’s annual payment is a long-term wealth-sharing plan. Other programs address immediate needs like tax relief or poverty reduction.

The PFD injects nearly $1 billion into Alaska’s economy annually, a unique model of sharing prosperity funded by oil revenue. It’s a tangible commitment to sharing the state’s wealth with its residents, year after year.

Frequently Asked Questions about the PFD

The alaska permanent fund dividend stimulus payment is a unique program that raises many questions. Here are answers to the most common ones.

How much will the 2025 Alaska PFD stimulus payment be?

The exact 2025 amount is not yet known. The 2024 alaska permanent fund dividend stimulus payment was $1,702, which provides a good estimate. The final amount depends on the Alaska Permanent Fund’s investment performance and the amount appropriated by the Alaska Legislature.

The amount varies annually. The Alaska Department of Revenue will announce the official amount closer to the distribution dates, so watch for the official word.

Can I apply if I moved to Alaska in the middle of the qualifying year?

No. To qualify for the alaska permanent fund dividend stimulus payment, you must have been an Alaska resident for the entire calendar year, with no exceptions. For the 2025 PFD, you must have resided in Alaska from January 1st through December 31st, 2024.

This rule ensures recipients are committed, year-round residents. If you moved in 2024, you can apply for the 2026 PFD after establishing a full calendar year of residency in 2025.

Where can I find official, trustworthy information about the PFD?

It’s crucial to use official sources to avoid scams. The only official source for information is the state website: pfd.alaska.gov. It is maintained by the Permanent Fund Dividend Division and has all necessary forms and updates.

Avoid social media ads promising help; they are likely scams. The PFD application is free, and the state will never ask for personal details via unsolicited emails or texts. Always go directly to the official website.

Other trustworthy sources include the Alaska Department of Revenue and Alaska Permanent Fund Corporation websites. The state takes security seriously and posts warnings on the MyPFD portal. Always use official government sources to protect your personal and financial information.

Conclusion

Claiming your alaska permanent fund dividend stimulus payment is straightforward. This guide provides the steps to get your share of Alaska’s unique oil wealth distribution program.

The PFD system involves three simple steps: confirm your eligibility, apply before the deadline, and track your application status online, updating your information as needed.

Alaska’s program is remarkable because it turns natural resources into direct payments for residents. The 2024 payment of $1,702 per eligible resident helped countless families with essential costs.

The alaska permanent fund dividend stimulus payment is more than just income; it’s a thank you to year-round residents, providing a uniquely Alaskan financial foundation for costs like winter heating.

This dividend is a reward for being part of the community. In 2024, it injected nearly a billion dollars into local economies, making a real difference in Alaskans’ lives.

At Car News 4 You, we believe understanding your finances opens doors to bigger opportunities. Now that you’ve mastered the PFD process, why not put that knowledge to work? Explore more financial guides for your next big purchase and find how smart financial planning can help you achieve your goals, whether that’s upgrading your ride or planning your next adventure.

The PFD isn’t going anywhere – it’s been around since 1976 and will likely continue for generations to come. Master these three steps once, and you’ll be set for years of successful applications and payments.