Fintechzoom.com Bitcoin Wallet: Secure 2025 Review

Why Understanding Bitcoin Wallets Matters

A non-custodial bitcoin wallet is a cryptocurrency wallet that lets you manage digital assets like Bitcoin, Ethereum, and other popular cryptocurrencies. This type of wallet focuses on security and simplicity for users who want to store and track their crypto investments.

Quick Overview of a Typical Non-Custodial Wallet:

- Type: Web-based cryptocurrency wallet with multi-currency support

- Security: Bank-level encryption, two-factor authentication, biometric login

- Best For: Beginners and casual investors seeking simple crypto management

- Limitations: No direct fiat purchases, limited DeFi features, no staking options

- Supported Assets: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and select altcoins

The world of cryptocurrency wallets can feel overwhelming. With hundreds of options promising top security and easy-to-use interfaces, choosing the right wallet becomes a challenge.

Many financial technology platforms offer insights and market analysis, with some extending their expertise into the practical field of cryptocurrency storage and management by offering their own wallets.

But is this type of wallet the right choice for you? Understanding what makes these wallets unique – and where they fall short – can help you make a smart decision about securing your digital assets.

This guide breaks down everything you need to know about non-custodial bitcoin wallets, from their core features to potential drawbacks, so you can decide if one fits your crypto needs.

Understanding the Role of Fintech Platforms in the Bitcoin Ecosystem

Think of financial technology (fintech) platforms as your friendly neighborhood guides to the complex world of digital finance. They aren’t just websites throwing around fancy financial jargon – they are platforms that genuinely want to help you make sense of cryptocurrency, Bitcoin price movements, and the ever-changing fintech landscape.

Many platforms have built a reputation for delivering market insights that actually make sense to regular folks. Whether you’re checking Bitcoin prices over your morning coffee or trying to understand why the crypto market suddenly went crazy overnight, these sites offer real-time data and trend analysis without making your head spin.

What makes these platforms particularly interesting is how they combine news aggregation with educational content. You’re not just getting raw data – you’re getting context. The market sentiment indicators help you understand why Bitcoin might be moving up or down, not just that it’s moving.

This type of bitcoin wallet naturally fits into this ecosystem as more than just a storage solution. It represents a commitment to providing practical tools alongside market information.

How Financial Platforms Analyze Bitcoin Price Movements

Ever wonder how anyone can predict where Bitcoin’s headed next? Spoiler alert: nobody has a crystal ball, but a good financial platform does a solid job of breaking down the key factors that tend to push Bitcoin prices around.

Market demand plays the biggest role, of course. When more people want to buy Bitcoin than sell it, prices go up. But what creates that demand? That’s where things get interesting.

Global economic factors have a huge impact. When traditional currencies start looking shaky due to inflation or economic uncertainty, people often turn to Bitcoin as a digital safe haven. Good platforms keep a close eye on these macroeconomic trends.

Then there are supply events – particularly Bitcoin’s halving events that happen roughly every four years. These events literally cut the number of new Bitcoin entering circulation in half, creating scarcity.

Institutional adoption has become increasingly important. When major companies or investment funds announce they’re buying Bitcoin, it tends to boost confidence and drive prices higher. Financial news platforms track these developments closely.

Regulatory news can send Bitcoin on wild rides – sometimes up, sometimes down, depending on whether governments are embracing or restricting cryptocurrency use. A good platform does a good job of explaining how different regulatory announcements might affect your investments.

Evaluating Data Accuracy and Reliability

Let’s be honest about something important: no financial data platform is perfect. But understanding their strengths and limitations helps you use them more effectively.

Many platforms provide real-time data with reasonable accuracy for casual investors and beginners. However, there can be slight delays – sometimes a couple of minutes behind live market prices. For most people checking their portfolio or researching investments, this delay isn’t a big deal. But if you’re doing high-frequency trading, you might want additional data sources.

Update frequency is generally solid, though many platforms rely heavily on data aggregation from various sources rather than direct market feeds. This approach works well for providing comprehensive market overviews but may lack the institutional-grade precision that professional traders require.

Information verification happens through an editorial process, though the depth of analysis can vary. Coverage of Bitcoin mining and halving tends to synthesize information from multiple sources rather than conducting original research.

When compared to industry standards, many platforms hold their own for general market tracking and educational content. They are particularly strong at making complex information accessible to newcomers.

The smart approach? Use a reliable platform as your primary source for understanding market trends and learning about cryptocurrency, but cross-reference important information with other reputable sources when making significant investment decisions.

Analyzing the Features of a Non-Custodial Bitcoin Wallet

When you first open a user-friendly bitcoin wallet, you’ll notice it doesn’t try to overwhelm you with bells and whistles. Instead, it focuses on getting the basics right – and that’s actually refreshing in a world where crypto apps often feel like rocket ship control panels.

The wallet’s core functionalities are exactly what you’d expect from a solid cryptocurrency storage solution. You can store your digital assets safely, which is obviously the main point. Sending and receiving crypto works smoothly through a clean interface that won’t leave you second-guessing whether you’ve entered the right wallet address.

One feature to look for is a comprehensive transaction history. Every Bitcoin you’ve sent, every small altcoin purchase you’ve made – it should all be there in an easy-to-read format. No more wondering “Did that transaction actually go through?” or scrambling through emails to find confirmation receipts.

The portfolio tracking capability is where things get interesting. Rather than jumping between different apps to check your Bitcoin price or see how your Ethereum is performing, everything lives in one place. You can monitor your overall holdings, check current market values, and get a clear picture of your crypto investments without the usual app-switching dance.

Key Security Protocols of a Secure Bitcoin Wallet

Let’s talk about what really matters when you’re storing digital money: keeping it safe. A good bitcoin wallet takes security seriously, and it shows in the layers of protection built in.

Bank-level encryption forms the foundation of a strong security approach. This means your data gets the same treatment as information at major financial institutions – scrambled in ways that would take hackers centuries to crack with current technology.

The two-factor authentication (2FA) feature adds a crucial second barrier. Even if someone somehow gets your password, they’d still need access to your phone to get that verification code. It’s like having two locks on your front door – one isn’t enough anymore.

For mobile users, biometric login support makes accessing your wallet both secure and convenient. Your fingerprint or face becomes your key, which is pretty hard for someone else to replicate (unless they’re in a spy movie).

The wallet should handle private key management in a way that puts you in control. This is huge because it means you’re not trusting a third party with your crypto keys – you hold them. It’s the difference between keeping your money in your own safe versus letting someone else hold it for you.

When you set up the wallet, you’ll get a seed phrase recovery option – usually 12 or 24 words that act as your master backup key. Write these down, store them safely, and never share them with anyone. This phrase is your lifeline if something happens to your device or you forget your password.

Supported Cryptocurrencies and Asset Management

The beauty of a good bitcoin wallet lies in its multi-currency support – you won’t need to juggle multiple apps just to manage different types of crypto.

Bitcoin (BTC) support should be rock-solid. But many don’t stop there. Ethereum (ETH) integration means you can manage your smart contract investments and DeFi tokens alongside your Bitcoin holdings. Litecoin (LTC) support rounds out the major cryptocurrency trio, giving you access to faster transaction times when you need them.

Beyond these household names, many wallets support select altcoins that have gained traction in the market. Development teams regularly update their supported cryptocurrency lists based on what users actually want and what’s making waves in the crypto space.

This comprehensive asset management approach means you can track everything from one dashboard. Whether you’re holding Bitcoin for the long term, trading Ethereum, or experimenting with newer altcoins, your entire crypto portfolio lives under one roof. No more remembering which wallet holds which coins or dealing with multiple backup phrases and security setups.

The streamlined approach makes managing a diversified crypto portfolio feel less like a part-time job and more like checking your regular bank account – simple, straightforward, and secure.

Pros, Cons, and Ideal User Profile

Every tool has its strengths and weaknesses, and a non-custodial bitcoin wallet is no exception. We’ve assessed the typical user experience, identified the target audience, and pinpointed common limitations to help you decide if it’s the right fit.

From our perspective, one of the most compelling aspects of this type of wallet is its ease of use. The user interface is often praised for being intuitive and easy to steer. Many offer a clean, user-focused design that sets a high standard for user experience in the fintech space. Whether you’re a complete novice or have some crypto experience, these wallets aim to make the process of managing digital assets feel polished and familiar. Users generally appreciate a user-friendly design and robust security measures.

So, who is the ideal user for a simple, non-custodial wallet?

- Beginners: If you’re just dipping your toes into cryptocurrency, this type of wallet is an excellent starting point. Its simplicity and clear-cut approach make it less intimidating than some of the more feature-rich (and complex) options out there.

- Casual Investors: For those holding smaller amounts of crypto or primarily looking for secure storage and basic transaction capabilities, the wallet offers a reliable, no-nonsense solution. It’s perfect for users who want to learn more about cryptocurrencies but don’t need highly advanced features from day one.

- Users Seeking Convenience: With multi-platform access (mobile and web), it allows you to manage your Bitcoin on the go, providing quick access when needed.

We believe that for anyone seeking a reliable, straightforward, and secure way to manage their initial crypto investments, this type of wallet delivers. It’s not trying to be a Swiss Army knife, but rather a focused and efficient tool.

Limitations and Drawbacks to Consider

While this type of wallet excels in simplicity and security for its target audience, it’s important to be aware of its limitations. No single wallet can be all things to all people, and this kind of offering has certain drawbacks that might not suit every user, especially those with advanced needs.

Here are the key limitations to be aware of:

- No Direct Fiat-to-Crypto Purchases: Many simple non-custodial wallets do not support direct fiat-to-crypto purchases within the app. This means you cannot directly buy Bitcoin or other cryptocurrencies using traditional money (like USD or EUR) from within the wallet. Users must first purchase crypto on external platforms or exchanges and then transfer it to their wallet address.

- Limited Advanced Features: These wallets often focus heavily on security and storage. Consequently, they may not offer more advanced functionalities such as staking, yield farming, or lending features. They are often not designed for advanced users seeking DeFi integrations like staking, swapping, or lending protocols.

- No DeFi Integrations: If you’re looking to interact with decentralized finance (DeFi) applications, participate in liquidity pools, or engage in complex crypto strategies, this wallet might fall short. It’s more of a secure storage and basic transaction tool rather than a portal to the broader DeFi ecosystem.

- Customer Support Responsiveness and Glitches: While user reviews for any app can be positive, some users may report concerns about customer support responsiveness and occasional transaction processing glitches. While these might not be widespread for a given wallet, it’s something to consider for users who might need frequent assistance.

If your primary goal is secure storage and straightforward sending/receiving of major cryptocurrencies, a simple non-custodial wallet is a strong contender. However, if you’re an advanced user seeking to maximize your crypto’s utility through staking, lending, or complex DeFi interactions, you might need to explore other wallet options.

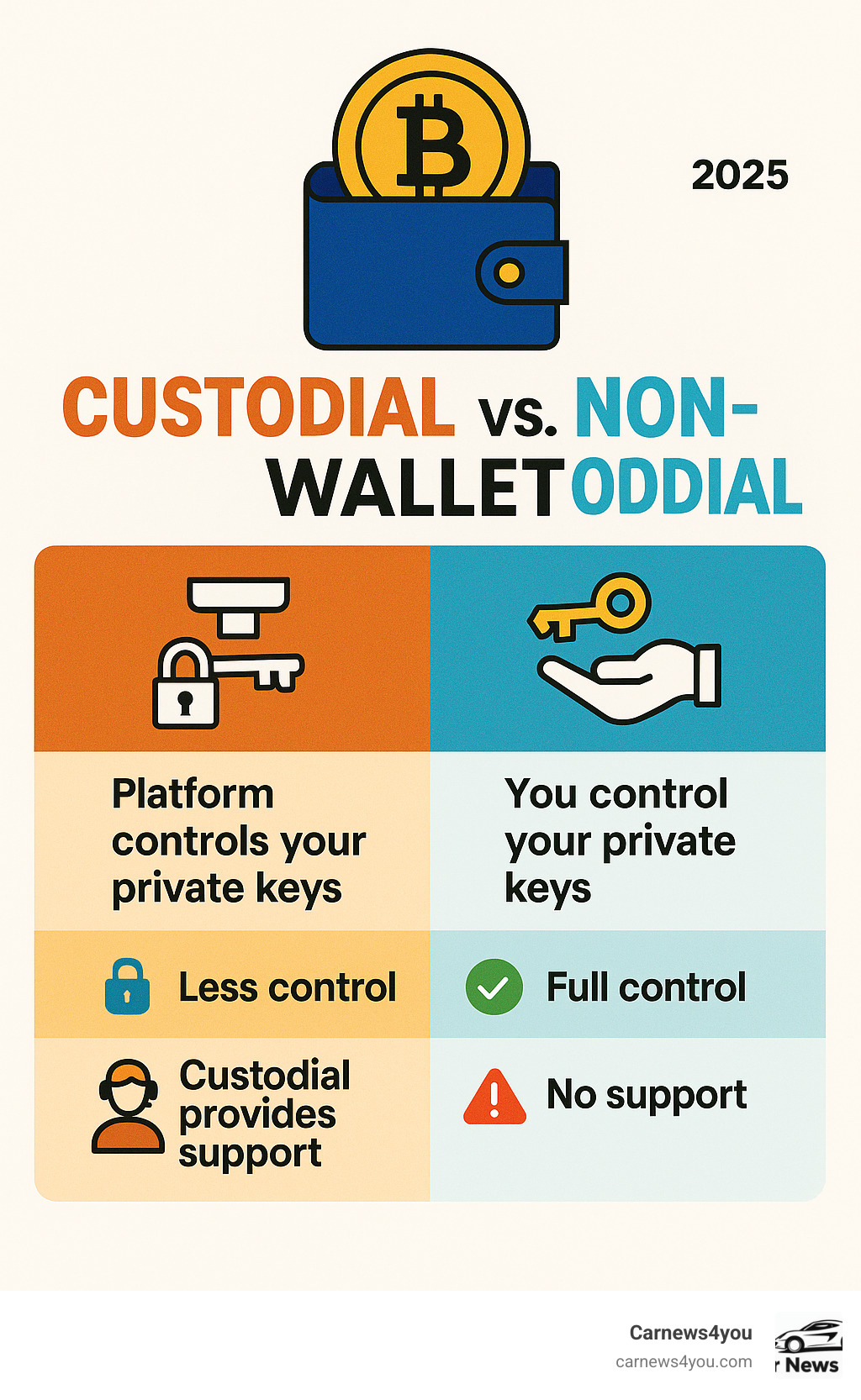

Is It a Custodial or Non-Custodial Solution?

This is perhaps one of the most critical questions when evaluating any cryptocurrency wallet, as it directly impacts your control and security. The type of wallet we are discussing operates as a non-custodial solution.

What does this mean for you?

- User Control: In a non-custodial wallet, you maintain full control over your private keys. Your private keys are the cryptographic codes that prove ownership of your cryptocurrency and allow you to authorize transactions. The wallet provider does not hold or have access to these keys.

- Asset Security: Because you control your private keys, your assets are not held by a third party. This significantly reduces the risk associated with centralized exchanges or custodial services, where your funds might be vulnerable if the platform is hacked or faces regulatory issues. It means your Bitcoin is truly yours.

- Decentralization: This aligns with the core philosophy of cryptocurrency, which emphasizes decentralization and individual financial sovereignty.

- Responsibility: With great power comes great responsibility! Since you control your private keys, you are solely responsible for their security. Losing your seed phrase (which is derived from your private keys) means losing access to your funds forever. The wallet provider cannot help you recover them if you lose your seed phrase.

We believe that being a non-custodial solution is a significant strength, as it empowers users with true ownership and control over their digital assets.

Frequently Asked Questions about Bitcoin Wallets

We know that choosing a cryptocurrency wallet can raise plenty of questions. After diving deep into non-custodial bitcoin wallets, we’ve gathered the most common concerns users have and provided clear, honest answers to help you make an informed decision.

How do non-custodial wallets handle transaction fees?

Here’s some good news: most non-custodial wallet software is completely free to download and use. You won’t pay a penny just for having the wallet on your device or managing your crypto portfolio through its interface.

However, like every cryptocurrency wallet out there, you will encounter network fees when you send or exchange your digital assets. Think of these fees as the cost of doing business on the blockchain – they’re not going to the wallet developer, but rather to the miners and validators who keep the Bitcoin network secure and running smoothly.

These network fees can fluctuate based on a couple of key factors. When blockchain congestion is high (imagine rush hour traffic, but for crypto transactions), fees tend to spike as users compete to get their transactions processed quickly. The type of cryptocurrency you’re sending also matters, since each blockchain has its own fee structure.

A good wallet will show you the estimated fee before you hit the send button, so there are no nasty surprises. This fee transparency helps you decide whether to proceed with a transaction or wait for network conditions to improve.

Do these wallets offer built-in market tracking or analytical tools?

Many do! This is where a good wallet can shine beyond just being a digital vault for your crypto. Some platforms leverage their expertise in financial analysis to bring you integrated analytics right within the wallet interface.

You can often find real-time price charts for Bitcoin and other supported cryptocurrencies, so you can track how your investments are performing without jumping between different apps. The portfolio performance tracking gives you a bird’s-eye view of your overall crypto holdings, complete with visual representations of gains and losses.

Some wallets also include a market news feed that keeps you updated on important developments that might affect your investments. This integration of market data and wallet functionality creates a seamless experience – you can check prices, read the latest crypto news, and manage your assets all from one place.

How do I set up and secure a Bitcoin wallet?

Setting up a non-custodial bitcoin wallet is refreshingly straightforward, but the security steps are absolutely critical. Let’s walk through this process together, because getting it right from the start will save you headaches (and potentially heartache) down the road.

Account creation typically begins with downloading the wallet app and creating a strong password or PIN. Once you’re in, you should immediately explore the security settings and enable two-factor authentication (2FA) if available. This extra layer of protection means that even if someone somehow gets your password, they still can’t access your wallet without that second verification step.

Now comes the most important part: securely storing your seed phrase. During setup, you’ll receive a 12- or 24-word recovery phrase that’s essentially the master key to your entire wallet. Write this phrase down on paper – yes, actual paper – and store it somewhere safe and private. Don’t screenshot it, don’t email it to yourself, and definitely don’t store it on your computer. This phrase is your only lifeline if something goes wrong with your device or account.

Following these general security best practices will keep your digital assets protected. Biometric login options add convenience without compromising security, and regular monitoring of your transaction history helps you spot any unauthorized activity quickly.

With a non-custodial wallet, you’re in complete control – which is both empowering and a big responsibility.

Conclusion

We’ve taken quite a journey together exploring non-custodial bitcoin wallets, diving deep into everything from their core features to their security protocols. Think of this guide as your roadmap through the sometimes confusing world of cryptocurrency storage – we wanted to give you all the facts you need to make a smart choice about protecting your digital assets.

So what’s the bottom line? A simple, non-custodial bitcoin wallet really shines when it comes to simplicity and security. If you’re new to crypto or just want a straightforward way to store your Bitcoin and other major cryptocurrencies, this type of wallet hits the sweet spot. Its clean interface won’t overwhelm you with complex features, and the non-custodial approach means you truly own your digital assets – no third party holding your keys.

The security features are genuinely impressive. Bank-level encryption, two-factor authentication, and biometric login options create multiple layers of protection around your funds. It’s like having a digital fortress for your crypto, but one that’s actually easy to steer.

But let’s be honest about where they can fall short. If you’re looking to dive deep into DeFi, earn rewards through staking, or buy crypto directly with your credit card, you’ll likely need to look for a more feature-rich wallet. A basic non-custodial wallet is more like a secure vault than a full-service financial platform.

Many fintech platforms are committed to breaking down complex financial concepts into digestible information, and this often extends into their wallet designs. It’s clear they understand that not everyone wants to become a crypto expert overnight.

Here’s the thing about choosing a crypto wallet – it’s deeply personal. Your needs, comfort level with technology, and investment goals all play a role. For those who value ease of use, strong security, and true ownership of their digital assets, a simple non-custodial wallet makes a compelling case.

With great crypto power comes great responsibility. Whether you choose this type of wallet or another, always keep your seed phrase safe and stay informed about best security practices.

We hope this comprehensive guide has given you the confidence to make an informed decision about your crypto storage needs.