Fintechzoom.com dax40: Your 2025 Ultimate Guide

Your Gateway to German Market Success

Accessing comprehensive data and analysis on Germany’s premier stock index, which tracks the 40 largest companies on the Frankfurt Stock Exchange, is key to navigating this market. Here’s what you need to know:

Quick Facts:

- Real-time data to keep you updated

- Free access to basic charts and live quotes

- Advanced tools for technical analysis and alerts

- Educational resources for both new and experienced investors

- Mobile-friendly platforms accessible anywhere

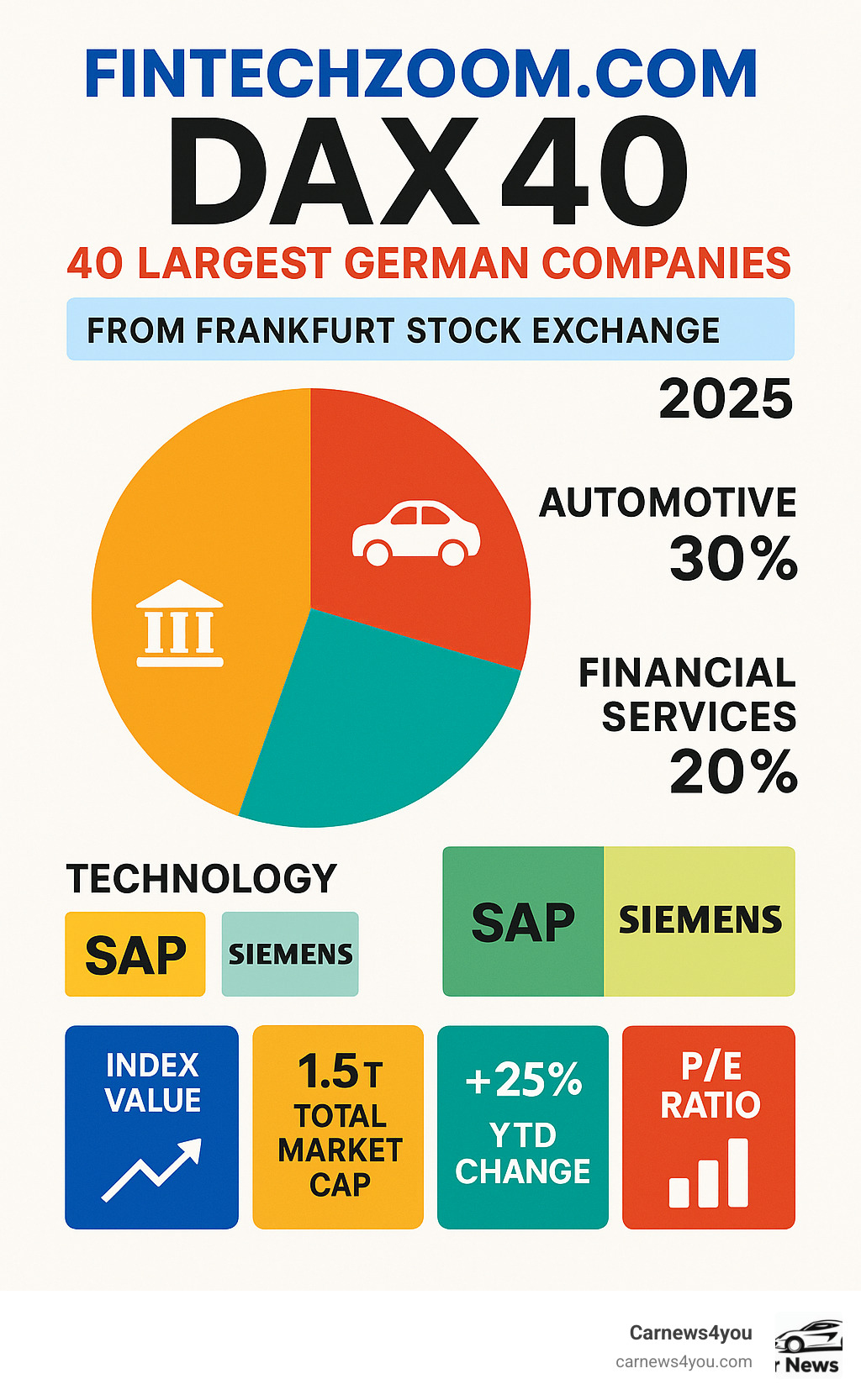

Germany’s DAX 40 isn’t just another stock index – it’s Europe’s economic heartbeat. This powerhouse tracks companies like Volkswagen, Siemens, and SAP that generate 80% of their revenue from global markets, making them less dependent on Germany’s domestic economy.

Why does this matter? The DAX 40 has surged 25% in early 2024 despite Germany’s economic challenges, proving these multinational giants can thrive independently. With a market cap exceeding 1.5 trillion, the index offers investors exposure to some of Europe’s most innovative companies.

The right tools simplify this complex market by offering accurate data, custom alerts, and expert analysis. Whether you’re tracking SAP’s cloud computing growth or monitoring Volkswagen’s electric vehicle pivot, having the right platform gives you the tools to make informed decisions.

Understanding the DAX 40: Germany’s Economic Powerhouse

Picture this: you’re looking at Germany’s financial heartbeat, and it’s beating strong. The DAX 40, or Deutscher Aktienindex, represents the 40 largest and most liquid companies trading on the Frankfurt Stock Exchange. Think of it as Germany’s financial all-stars team – these aren’t just any companies, but the economic powerhouses that drive Europe’s largest economy forward.

What makes the DAX 40 fascinating is its recent evolution. Until September 2021, it was actually the DAX 30. The expansion from 30 to 40 stocks wasn’t just about adding more companies – it was about creating a broader, more accurate snapshot of Germany’s corporate landscape. This change gave investors like us a richer, more diverse view of what’s happening in one of the world’s most robust economies.

Here’s something that sets the DAX 40 apart: it’s a performance index. Unlike many other indices that just track stock prices, the DAX 40 reinvests dividends back into the calculation. This means when you’re tracking the data, you’re seeing the complete picture of total returns – not just price movements, but the full investment story.

The companies within this elite group span Germany’s most influential sectors. You’ve got automotive giants like Volkswagen revolutionizing electric vehicles, technology leaders like SAP and Siemens pushing the boundaries of enterprise software and industrial automation, chemical innovators like BASF developing tomorrow’s materials, and financial powerhouses like Allianz managing trillions in assets globally.

These aren’t just German companies – they’re global players. Many generate most of their revenue from international markets, making them less dependent on Germany’s domestic economy and more connected to worldwide growth opportunities.

Why the DAX 40 Matters to Global Investors

If you’re wondering why the DAX 40 should be on your investment radar, here’s the compelling story. These companies have massive global reach – we’re talking about businesses that touch every continent and influence markets worldwide. When Siemens develops new industrial technology or SAP launches cloud solutions, the impact ripples across the globe.

The high liquidity and transparency of DAX 40 companies make them attractive to investors everywhere. You can easily buy and sell positions, and there’s no shortage of reliable information to help guide your decisions. This transparency builds confidence and makes research straightforward.

For diversification purposes, the DAX 40 offers something special. You’re not just investing in Germany – you’re gaining exposure to a collection of companies with global footprints and diverse revenue streams. Interestingly, research shows the DAX 40 has a 90% correlation to major U.S. stock indices, which means it often moves in sync with American markets while maintaining its own European character.

This correlation can work both ways – it provides familiar patterns for investors used to U.S. markets, while also offering exposure to European economic dynamics and growth opportunities that might not be available elsewhere.

Pros and Cons of DAX 40 Investment

Let’s be honest about what you’re getting into with DAX 40 investments. Like any smart investment decision, it pays to understand both sides of the coin.

On the positive side, you’re tapping into a strong economic foundation. Germany consistently ranks as Europe’s largest economy and remains a global export leader. The global exposure these companies provide means you’re not betting on just one country’s success – you’re investing in businesses that profit from worldwide economic growth.

The growth potential is particularly exciting in sectors like technology and renewable energy, where German companies are pushing boundaries and creating new markets. Plus, the natural diversification across sectors – from automotive to chemicals to finance – helps spread risk across different industries.

However, there are some challenges to consider. Market concentration risk means that despite diversification across sectors, you’re still heavily focused on German companies and European economic conditions. Geopolitical uncertainty can impact these globally-focused businesses, especially during trade disputes or international tensions.

Euro volatility adds another layer of complexity. Since many DAX 40 companies are major exporters, currency fluctuations can significantly impact their competitiveness and profitability in international markets.

Understanding these dynamics helps you make smarter decisions to guide your investment strategy.

Your Guide to DAX 40 Analysis and Data

Finding reliable data and analysis tools for the DAX 40 used to mean jumping between multiple platforms and paying hefty subscription fees. Those days are behind us. Modern financial platforms have transformed how we access German market information, bringing together comprehensive coverage, real-time data, and professional-grade analysis tools in one user-friendly place.

What makes these platforms special isn’t just the datait’s how they present it. They take complex financial information and make it digestible for everyone, from weekend investors to seasoned professionals. In-depth analysis goes beyond simple numbers, providing context and insights that help us understand what’s really happening in the German markets.

The interface often feels intuitive from the moment you land on the site. No confusing menus or hidden featureseverything you need is right where you’d expect to find it.

Key Features and Tools for In-Depth Analysis

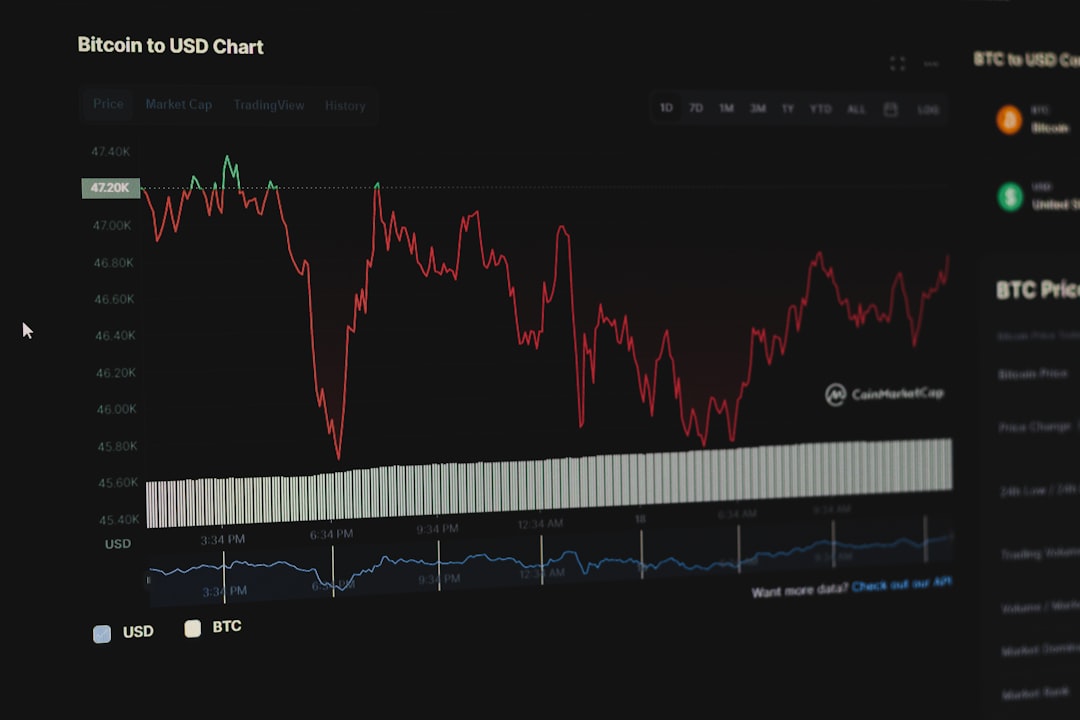

The real magic happens when you dive into the analytical toolkit of a quality platform. Live price updates mean you’re seeing market movements almost as they happen. This is crucial when you’re making time-sensitive investment decisions.

Advanced charting tools deserve special mention. These aren’t your basic line graphs. You can overlay multiple technical indicators like moving averages, Bollinger Bands, and MACD patterns. To spot trends, you can often draw your own trendlines directly on the charts. The best platforms remember your preferences, so your customized setup is waiting for you every time you log in.

Historical data access extends back years, giving you the context needed to understand current market conditions. This feature becomes invaluable when you’re backtesting strategies or trying to understand how the DAX 40 has responded to similar economic conditions in the past.

The custom alerts system works like having a personal market assistant. Set price thresholds, volume spikes, or technical indicator triggers, and you’ll get notified instantly. No more staring at charts all daylet the platform watch the markets for you.

Each DAX 40 company gets its own detailed profile with company profiles and financial reports. This means you can drill down from the index level to understand what’s driving individual stock movements. The integrated news feeds keep everything in context, showing how current events might impact your investments.

How to Access Live DAX 40 Data

Getting started is refreshingly straightforward. Here’s a typical process:

- Visit a financial data website and look for the search bar

- Use the search bar to type “DAX 40” or simply “DAX”

- Steer to the indices section from the main menu if you prefer browsing

- Select DAX 40 from the list of available indices

- Customize your chart view by selecting timeframes and adding indicators

- Set up alerts using an alerts tab to monitor specific price levels or conditions

The whole process usually takes less than two minutes, and you’ll have access to institutional-quality data without any complicated setup procedures.

The Benefits of Using a Quality Data Platform for Your DAX 40 Strategy

Using a reliable platform for your investment strategy transforms how you approach the German markets. The platform’s improved decision-making capabilities come from having all the information you need in one place, updated in real-time, with the analytical tools to make sense of it all.

Timely insights become second nature when you’re working with data that updates frequently. Market opportunities that might have slipped by in the past become visible and actionable. The platform’s analysis helps you understand not just what’s happening, but why it’s happening.

Educational resources deserve special recognition. Whether you’re just starting out or have years of experience, many platforms provide guides, articles, and interactive tools that deepen your market understanding. These aren’t generic tutorialsthey’re specifically focused on helping you succeed with DAX 40 investments.

Accessibility across devices means your investment strategy doesn’t stop when you leave your desk. A mobile-responsive design ensures you can monitor positions, adjust alerts, and stay informed from anywhere with an internet connection.

This comprehensive approach to financial information makes a quality data platform an invaluable resource for serious DAX 40 investors.

Effective Investment Strategies and Risk Management for the DAX 40

Getting into DAX 40 investing doesn’t have to be overwhelming. Think of it like building a house – you need a solid foundation, the right tools, and a clear plan. Whether you’re dreaming of long-term wealth building or looking for shorter-term trading opportunities, success comes down to balancing growth potential with smart risk management.

The DAX 40’s blend of industrial powerhouses and innovative tech companies creates multiple pathways for investment. Your personal approach will depend on how much risk you’re comfortable with, what you’re hoping to achieve, and how long you’re willing to wait for results.

Popular Ways to Invest in the DAX 40

When it comes to getting exposure to Germany’s top companies, you’ve got several solid options to choose from.

Direct stock investments give you the most control. If you believe SAP’s cloud business is going to dominate or think Siemens’ industrial automation will keep growing, you can buy shares directly. This approach works best when you enjoy researching individual companies and don’t mind the extra work of building your own diversified portfolio.

Exchange-Traded Funds (ETFs) are like buying a slice of the entire DAX 40 pie with one purchase. A popular choice is the Global X DAX Germany ETF, which tracks the index closely. ETFs are brilliant because they’re typically low-cost, highly liquid, and instantly give you exposure to all 40 companies without having to pick winners and losers.

Mutual funds work similarly to ETFs but come with professional management. Fund managers actively monitor the holdings and make adjustments based on market conditions. While fees are usually higher than ETFs, some investors appreciate having experienced professionals making the day-to-day decisions.

For more experienced traders, CFDs (Contracts for Difference) and derivatives offer ways to speculate on DAX 40 price movements without owning the actual stocks. These instruments often use leverage, which can amplify both your gains and losses significantly. They’re definitely not for beginners – think of them as the sports cars of investing: exciting but requiring skill to handle safely.

No matter which route you choose, always research the performance of DAX 40 companies and pick a trustworthy broker with solid DAX 40 trading access.

Using Data Platforms for Smart Risk Management

Smart investing isn’t just about picking winners – it’s about protecting yourself when things don’t go as planned. Reliable financial data platforms offer several tools that can help you sleep better at night.

Diversification and portfolio balancing might sound fancy, but it’s really just the old “don’t put all your eggs in one basket” wisdom. While the DAX 40 already spreads your risk across different sectors, you can go further by mixing in other assets, regions, and investment types. Detailed sector analysis helps you see if you’re getting too heavy in automotive stocks or need more exposure to technology companies.

Monitoring economic indicators is like checking the weather before a big outdoor event. Interest rates, inflation, and GDP growth all influence how DAX 40 companies perform. Quality platforms track these economic signals and explain how they might affect your investments, helping you spot storms before they hit.

Using stop-loss orders is your safety net. These automatically sell your holdings if prices drop to a level you’ve set beforehand, limiting your losses. While information platforms don’t execute trades directly, they often integrate smoothly with brokerage platforms, making it easier to set up these protective orders.

Staying informed with news alerts keeps you in the loop when important things happen. By setting up custom alerts, you’ll know immediately when a DAX 40 company reports earnings, announces a merger, or faces regulatory changes. This real-time information helps you react quickly to both opportunities and threats.

By combining these investment strategies with solid risk management – and staying informed – you’re setting yourself up to potentially profit from Germany’s economic strength while protecting yourself from unexpected market turbulence.

Future Outlook: DAX 40 Trends and Key Companies for 2025

Looking ahead to 2025, the DAX 40 landscape presents a fascinating picture of resilience and change. Despite Germany facing domestic economic headwinds, the DAX 40 continues to demonstrate remarkable strength – a testament to the global reach of its constituent companies.

This economic paradox we’re witnessing is quite remarkable. While Germany grapples with recession-like conditions at home, its stock index has been surging. Why? Because these aren’t just German companies anymore – they’re global powerhouses that happen to be headquartered in Germany.

Sustainability is becoming the new gold standard for DAX 40 companies. Investors are increasingly drawn to businesses with strong environmental, social, and governance credentials. Companies like BASF in chemicals and Siemens in industrial technology are leading this charge, integrating green practices into their core operations. This isn’t just about doing good – it’s about doing well financially too.

The digital change and AI revolution continues to reshape entire industries. We’re seeing unprecedented investment in artificial intelligence and automation across the DAX 40. This technological wave isn’t slowing down; if anything, it’s accelerating as companies realize that staying competitive means staying ahead of the digital curve.

Global economic factors remain the wild card in this equation. With DAX 40 companies generating the majority of their revenue internationally, geopolitical stability and trade relationships with major economies like the U.S. and China play crucial roles.

Several companies are particularly well-positioned to drive the index’s performance in 2025. SAP stands out as a digital change leader, continuously innovating in enterprise software and cloud computing solutions. Their influence on the DAX 40’s growth trajectory cannot be overstated.

Siemens represents the perfect blend of traditional industrial strength and cutting-edge technology. From industrial automation to smart infrastructure, they’re building the backbone of tomorrow’s economy. Their diversified portfolio provides both stability and growth potential.

Rheinmetall has emerged as an unexpected star in today’s geopolitical climate. With global defense spending on the rise, this defense contractor is experiencing significant growth that extends well beyond traditional expectations.

Allianz brings financial stability to the mix. As a global insurance and financial services provider, their international diversification offers a steady foundation that helps balance the index during volatile periods.

Volkswagen might surprise some observers, but their aggressive pivot toward electric vehicles and sustainable mobility solutions positions them at the forefront of the automotive revolution. Despite facing challenges, their commitment to the EV transition reflects the broader industry’s change.

The beauty of tracking these trends with access to real-time data and analysis is that it helps us understand these complex market dynamics. As central bank policies shift and interest rates fluctuate, staying informed becomes our greatest asset for making smart investment decisions and spotting emerging opportunities before they become obvious to everyone else.

Frequently Asked Questions about Tracking the DAX 40

When it comes to tracking Germany’s premier stock index, we get a lot of questions from both new and experienced investors. Let’s explore the most common ones to help you make the most of the available tools.

Is DAX 40 data free to access?

The good news is that basic features on many financial platforms are completely free to use! You can often access live DAX 40 quotes, basic charting tools, and news feeds without paying a penny. This makes it incredibly accessible for anyone wanting to keep an eye on Germany’s top companies.

However, if you’re looking to take your analysis to the next level, premium plans may open up advanced tools like multi-chart layouts, exclusive analyst reports, and sophisticated technical indicators. The beauty of this model is that no subscription is typically needed for basic tracking.

Can I trade the DAX 40 on data platforms?

It’s important to understand the difference between an analysis platform and a brokerage. Most data platforms are for research and information, not for executing trades. Think of them as your research headquarters rather than your trading desk.

However, many platforms integrate smoothly with brokerages, creating a bridge between your research and your actual trading. This setup allows you to use powerful analysis tools while still choosing the broker that best fits your needs and trading style.

How often is DAX 40 data updated?

Speed matters in today’s markets, and top-tier platforms deliver with real-time updates. Some offer low latency that ensures you’re seeing market movements almost instantly.

This accuracy in fast-moving markets is crucial when you’re tracking an index like the DAX 40, where prices can shift rapidly based on global events, company announcements, or economic data releases. Whether you’re a day trader looking for quick opportunities or a long-term investor monitoring your positions, this real-time data keeps you in the loop and ensures you are not looking at stale information.

Conclusion

What a journey we’ve taken together through Germany’s most important stock index! The DAX 40 isn’t just a collection of numbers on a screen – it’s the economic heartbeat of Europe’s largest economy and a window into the performance of 40 powerhouse companies that shape global markets.

We’ve explored how this remarkable index stands apart as a performance index, giving us the complete picture by including dividend reinvestment. This means we’re seeing the true story of returns, not just price movements. The companies within the DAX 40 – from automotive giants like Volkswagen to tech innovators like SAP – generate most of their revenue globally, making them resilient even when Germany’s domestic economy faces headwinds.

Risk and reward walk hand in hand with DAX 40 investing. Yes, there’s market concentration risk and the ever-present uncertainty of geopolitical events. But the flip side offers us exposure to some of the world’s most innovative companies, high liquidity, and excellent diversification opportunities across key sectors like technology, automotive, and finance.

Throughout our exploration, a reliable data platform has emerged as an indispensable ally for anyone serious about German market investing. Those real-time updates and advanced charting tools aren’t just fancy features – they’re the difference between catching opportunities and missing them. Whether you’re setting up custom alerts or diving deep into historical data, the right platform transforms complex market analysis into something manageable and actionable.

The smart risk management tools we’ve discussed – from diversification strategies to stop-loss orders – become so much more powerful when backed by real-time insights. It’s like having a financial analyst working around the clock, keeping us informed about everything from company earnings to broader economic indicators.

Looking toward 2025, the trends are clear: sustainability, digital change, and artificial intelligence will continue driving the DAX 40 forward. Companies like Siemens with their industrial automation focus and Rheinmetall with their defense sector growth are positioned to lead this charge. The future looks bright for investors who stay informed and adapt to these evolving trends.

Access to quality data represents more than just another financial tool – it’s your gateway to empowered investing. By putting comprehensive data, analysis tools, and educational resources at your fingertips, it helps level the playing field between individual investors and institutional players. A good platform doesn’t just show you what’s happening; it helps you understand why it’s happening and what you can do about it.

Here at Carnews4you, we’re passionate about bringing you diverse insights across all the topics that matter to your financial well-being. Understanding how to use these powerful platforms is just one piece of the puzzle in building your investment knowledge and confidence.

Ready for your next trip? Learn more about the best cars for camping and find how the right vehicle can open up a world of outdoor possibilities!