Lessinvest.com real estate: Unlock Wealth 2025

Why Lessinvest.com Real Estate is Changing How People Invest

Lessinvest.com real estate offers a modern solution to traditional property investing barriers through fractional ownership and lower minimum investments. Here’s what you need to know:

Key Features:

- Minimum Investment: As low as $100-$500 per property share

- Expected Returns: 6-8% annual cash flow, 40-60% profits after 5 years

- Property Types: Multifamily, commercial, single-family, vacation rentals

- Account Setup: Identity verification completed in under 5 minutes

- Investment Focus: Passive income through professionally managed properties

Real estate investing has always been a proven wealth builder. But traditional property ownership requires huge upfront costs, property management headaches, and deep market knowledge.

Lessinvest.com changes this equation completely.

The platform breaks down expensive properties into affordable shares. Instead of needing $200,000 to buy a rental property, you might invest just $500 for a fractional stake. You get the same rental income and appreciation potential – just scaled to your investment size.

LessInvest.com’s philosophy centers on enabling individuals through practical knowledge and action in personal finance, according to their platform overview. They focus on “doing rather than merely learning” when it comes to building wealth.

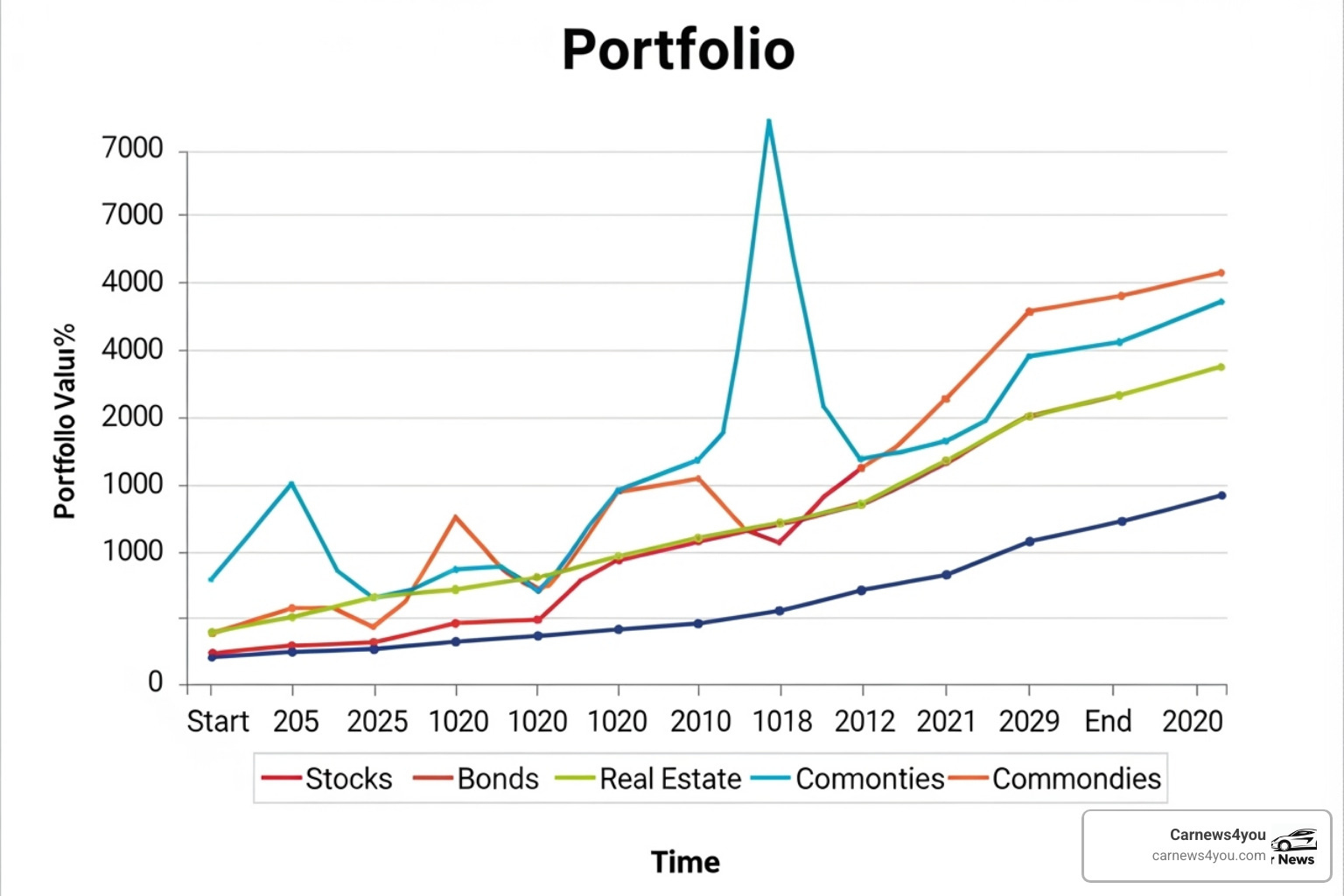

The numbers tell an interesting story. Real estate crowdfunding platforms have facilitated over $8.2 billion in transactions since 2022. Average returns on diversified fractional portfolios range from 14-18% annually.

But like any investment, it comes with risks. Market downturns, property-specific issues, and liquidity constraints can all impact returns.

Explore more about lessinvest.com real estate:

Getting Started with Lessinvest.com Real Estate

Ready to dive into real estate investing? Getting started with lessinvest.com real estate feels refreshingly simple compared to traditional property buying. The platform removes the usual headaches and mountains of paperwork that come with real estate investing.

Think of it like opening a new social media account, but instead of sharing photos, you’re building wealth through property investments.

Creating and Verifying Your Account

Creating your account on lessinvest.com real estate takes about as long as ordering a coffee. You’ll head to their website and provide some basic personal information – nothing too invasive, just the essentials for setting up your investment profile.

The real magic happens during identity verification. This isn’t just a formality – it’s your ticket to legitimate, secure investing. The platform uses an automated system that wraps up in under 5 minutes. You’ll snap a photo of your government-issued ID and take a quick selfie. It’s like a digital handshake that confirms you’re really you.

Behind the scenes, Lessinvest.com runs thorough security checks including Anti-Money Laundering (AML) and Politically Exposed Person (PEP) screenings. Your information gets cross-referenced with security watchlists, which might sound intense, but it’s actually protecting everyone on the platform. This level of security means you can invest with confidence, knowing the platform takes safety seriously.

Funding Your Account and Selecting Your First Property

Once your account gets the green light, it’s time to add some fuel to your investment engine. Lessinvest.com keeps funding simple with bank transfers and wire transfers. No complicated processes or hidden fees – just straightforward money movement from your bank to your investment account.

Here’s where things get exciting. Your investment dashboard becomes your new best friend, showcasing a curated selection of real estate opportunities. Each property listing comes packed with detailed information, from location analysis to projected returns. You’ll find yourself browsing properties like you’re shopping online, except each “purchase” could generate passive income for years.

The platform makes analyzing listings surprisingly enjoyable. You can dig into property details, examine market data, and review the track record of property operators. It’s like having a real estate expert whispering insights in your ear as you explore each opportunity.

Understanding Investment Minimums and Expected Returns

Here’s what makes lessinvest.com real estate truly special – you don’t need a trust fund to get started. Through fractional ownership, you can buy shares of properties rather than entire buildings. Think of it like buying a slice of a really expensive pizza instead of the whole pie.

Investment minimums vary by property, but many opportunities start around $100 to $500 per share. Some premium properties might require $1,000 to $5,000, but that’s still a fraction of what traditional real estate investing demands. This flexibility means you can start small and grow your portfolio as your confidence builds.

The return potential looks promising too. Most properties target a cash-on-cash return of 6-8% annually, which means steady passive income flowing into your account. But the real excitement comes from projected profits upon sale – many properties aim for 40-60% total returns over a 5-year hold period.

These numbers represent the platform’s targets, not guarantees. Real estate investing always involves risk, but the accessibility of fractional ownership makes it much easier to test the waters without diving into the deep end financially.

Evaluating Investment Opportunities on the Platform

Making smart property choices is the heart of successful investing, and lessinvest.com real estate gives us all the tools we need to dig deep into each opportunity. Think of it like shopping for a car – you wouldn’t buy one just because it looks good in the photos, right? The same goes for real estate investments.

Types of Real Estate Investments Available

The beauty of lessinvest.com real estate lies in its variety. Just like a good buffet, there’s something for everyone’s taste and appetite. Whether you’re looking for steady income or growth potential, the platform offers different property types to match your goals.

Multifamily apartment communities are often the bread and butter of passive investors. These properties house multiple families, which means if one tenant moves out, you’re not losing all your rental income at once. It’s like having multiple streams flowing into the same river.

Commercial properties include office buildings, retail spaces, and warehouses. These can offer higher returns, but they come with different lease structures and tenant needs. Think of them as the more sophisticated cousins in the real estate family.

Single-family rentals are the classic choice – one house, one family, steady income. They’re easier to understand and often appreciate well in growing neighborhoods. Vacation rentals take this concept to tourist hotspots, where short-term stays can generate higher yields, though they require more active management (thankfully, Lessinvest.com handles this for us).

Value-add opportunities are particularly exciting. These involve properties that need some TLC – maybe renovations or better management – to open up their full potential. It’s like buying a diamond in the rough and polishing it to shine.

How to Analyze a Lessinvest.com Real Estate Listing

When we open a listing on lessinvest.com real estate, we’re looking at much more than pretty photos. Each property tells a story, and our job is to read between the lines.

The property details give us the basics – age, condition, size, and any planned improvements. But the real magic happens when we dive into location analysis. That old saying “location, location, location” isn’t just real estate agent chatter. We want to understand the neighborhood’s job market, local amenities, and growth potential.

Market value comes from looking at comparable sales in the area. What have similar properties sold for recently? This helps us gauge whether we’re getting a fair deal. Rental income estimates are equally important – we can research what similar properties rent for to project our potential cash flow.

Here’s where things get interesting: operator information. When we’re investing through fractional ownership, we’re essentially partnering with the property operator. Their track record matters enormously. Have they successfully managed similar projects? Do they have a history of delivering on their promises?

Historical performance data, when available, gives us a glimpse into the property’s past. High occupancy rates and steady rental income are good signs, while frequent tenant turnover might raise red flags.

The platform provides detailed investment insights for each property, but doing our own homework never hurts. It’s like getting a second opinion from a doctor – always a smart move when making important decisions.

Key Risk Factors and Tax Considerations

Let’s be honest – no investment is a guaranteed win, and lessinvest.com real estate doesn’t change that fundamental truth. But understanding the risks helps us make smarter choices.

Market conditions can shift like the weather. Economic cycles, interest rate changes, and local supply-demand imbalances all affect property values and rental income. A booming area today might face challenges tomorrow if a major employer leaves town.

Economic risk extends beyond local markets. National recessions, unemployment spikes, or industry shifts can ripple through real estate markets. Liquidity risk is another reality – real estate isn’t like stocks that we can sell with a click. It takes time to exit these investments.

Property-specific issues can pop up unexpectedly. Major repairs, problem tenants, or management challenges can all eat into our returns. It’s like owning a car – sometimes things break when you least expect it.

But here’s the silver lining that makes real estate investing particularly attractive: tax advantages. These benefits can significantly boost our overall returns.

Depreciation is probably the most valuable tax benefit. We can deduct a portion of the property’s value each year, even if the property is actually going up in value. It’s like having your cake and eating it too.

Mortgage interest deduction applies when properties are financed. The interest paid on loans can often be deducted, reducing our taxable income. For more advanced investors, 1031 exchanges allow deferring capital gains taxes when selling one investment property to buy another.

The Qualified Business Income deduction can let us deduct up to 20% of our qualified business income from certain real estate activities. These tax benefits can add up to substantial savings over time.

Remember though, tax laws are complex and change regularly. It’s always wise to consult with a qualified tax professional who can help us steer these waters and maximize our tax efficiency. Think of them as our financial GPS – helping us find the best route to our destination.

Building and Managing Your Long-Term Portfolio

Success with lessinvest.com real estate goes far beyond making your first investment. Think of it like tending a garden – the real magic happens when you nurture and grow your portfolio over time with thoughtful planning and consistent care.

Core Diversification Strategies for Investors

Here’s the golden rule of investing: never put all your eggs in one basket. Diversification protects you from the ups and downs of any single investment, and lessinvest.com real estate makes this strategy surprisingly simple to execute.

Asset class diversification means mixing different types of properties in your portfolio. Instead of only buying shares in apartment buildings, you might also invest in commercial properties or vacation rentals. Each type responds differently to market conditions, so when one struggles, another might thrive.

Geographic diversification spreads your investments across different cities and regions. If the economy takes a hit in one area, your properties in other locations can help balance things out. The platform offers opportunities in various markets, giving you the flexibility to invest nationwide without the headache of managing properties yourself.

Property type diversification lets you balance steady income generators with higher-growth opportunities. You might combine stable multifamily properties that provide consistent cash flow with value-add projects that offer bigger potential returns after renovations or improvements.

The beauty of this approach is that you’re not trying to predict which single investment will perform best. Instead, you’re building a portfolio that can weather different market conditions and capitalize on various opportunities.

Tracking Performance and Reinvesting Dividends

Once your money is working for you, keeping tabs on performance becomes part of your routine. The lessinvest.com real estate platform dashboard makes this refreshingly straightforward, giving you a clear view of how each investment is performing.

You’ll see asset value tracking that shows how your fractional shares are appreciating over time. The platform also provides detailed return metrics that break down your cash flow from rental income and any appreciation in property values.

Here’s where the magic of compounding growth comes into play. When your properties generate rental income, you have a choice: take that cash or reinvest it into new opportunities on the platform. Reinvesting dividends is like adding fuel to a fire – your earnings start earning their own returns, accelerating your wealth building.

Think of it this way: if you reinvest a $50 dividend into a new property share, that $50 starts generating its own income and appreciation. Over time, this snowball effect can dramatically boost your portfolio’s growth compared to simply taking the cash.

The platform’s performance tracking tools help you make informed decisions about which dividends to reinvest and where to deploy new capital for maximum impact.

The Primary Benefits of Using Lessinvest.com Real Estate

After exploring all these strategies, it’s worth stepping back to appreciate why lessinvest.com real estate has become such an attractive option for everyday investors like us.

Accessibility stands out as the biggest game-changer. Real estate investing used to require deep pockets and extensive knowledge. Now, almost anyone can start building wealth through property ownership, regardless of their starting point.

The lower capital requirements mean you can begin with just a few hundred dollars instead of hundreds of thousands. This opens doors that were previously locked for most people, making real estate investing a realistic goal rather than a distant dream.

Professional management takes the stress out of property ownership. No more dealing with tenant complaints, maintenance issues, or late-night emergency calls. The experienced operators handle all the day-to-day responsibilities while you enjoy the benefits of ownership.

The passive income stream creates a beautiful situation where your money works while you sleep. Monthly or quarterly distributions from rental income provide steady cash flow that can supplement your regular income or be reinvested for growth.

Finally, portfolio diversification helps you build a more resilient financial future. Real estate often moves independently from stocks and bonds, giving your overall investment portfolio better balance and potentially smoother returns over time.

These benefits combine to offer something truly special: a modern way to participate in real estate’s wealth-building potential without the traditional barriers and headaches that kept so many people on the sidelines.

Frequently Asked Questions about Lessinvest.com

We know that jumping into real estate investing can feel overwhelming at first. That’s completely normal! We’ve gathered the most common questions people ask about lessinvest.com real estate to help clear up any confusion and get you feeling confident about your investment journey.

How can I start investing in real estate with minimal financial resources?

This is probably the question we hear most often, and honestly, it’s what makes lessinvest.com real estate so exciting! Gone are the days when you needed a massive bank account to get started in real estate.

Fractional ownership is your best friend here. Think of it like buying a slice of pizza instead of the whole pie. You get to taste the same delicious benefits – rental income and property appreciation – but at a fraction of the cost. Through Lessinvest.com, you can own a piece of professionally managed properties for just a few hundred dollars.

The platform operates on a crowdfunding model, which means your money joins forces with other investors to tackle bigger, better properties. It’s like having a really smart investment club where everyone pools their resources together.

Beyond fractional ownership, there are other creative approaches worth considering. House hacking involves buying a multi-unit property, living in one part, and renting out the rest. Your tenants basically help pay your mortgage! Wholesaling is another strategy where you find great deals and connect them with other investors for a fee, though this requires more market knowledge and hustle.

The beauty of Lessinvest.com is that it removes most of these complications. You simply choose your investment amount, pick a property that excites you, and let the professionals handle the rest.

Is the information on Lessinvest.com considered financial advice?

This is such an important question, and we’re glad you asked! The short answer is no – the information on lessinvest.com real estate is designed for educational purposes only. Think of it as a really helpful friend sharing what they know about real estate, not a licensed professional giving you personalized advice.

Lessinvest.com believes strongly in empowering people with knowledge and practical insights. They want to help you understand how real estate investing works so you can make smart decisions. But at the end of the day, you’re the captain of your own financial ship.

Personal responsibility is key here. While the platform provides valuable information to guide your thinking, your investment choices are ultimately yours to make. Every investment carries risk, including the possibility of losing money.

Before making any major financial moves, especially with real estate, we always recommend chatting with licensed professionals. A financial advisor, accountant, or attorney can look at your specific situation and help you figure out what makes sense for your goals and circumstances.

What are some ways to begin investing in real estate with only $1,000?

A thousand dollars might not sound like much in the real estate world, but you’d be surprised what doors it can open! Thanks to modern investing platforms, that $1,000 can actually go pretty far.

Fractional ownership opportunities through platforms like Lessinvest.com are your most direct route. Instead of needing hundreds of thousands to buy a whole property, you’re buying a small percentage that fits your budget. You still get your share of the rental income and any appreciation when the property increases in value.

Real estate crowdfunding platforms like Lessinvest.com make this possible by combining your $1,000 with money from other investors. Together, you can access high-quality properties that would be impossible to afford alone. Many of these platforms offer entry points right around the $1,000 mark, and some even lower for certain opportunities.

The key is starting somewhere and learning as you go. Your first $1,000 investment teaches you how the process works, how to evaluate properties, and what to expect from returns. As you gain confidence and hopefully see some profits, you can reinvest and gradually build a more substantial portfolio.

Every successful real estate investor started with their first investment. Lessinvest.com real estate makes that first step more accessible than it’s ever been before.

Conclusion: Your Next Step in Smarter Property Investment

We’ve taken quite a journey together exploring lessinvest.com real estate, and what we’ve finded is truly exciting. This isn’t just another investment platform – it’s genuinely changing how everyday people can build wealth through real estate.

Think about where we started. Traditional property investing used to require massive down payments, dealing with tenant headaches at 2 AM, and having deep pockets for unexpected repairs. Lessinvest.com real estate has flipped that script entirely.

Now, with as little as a few hundred dollars, we can own a piece of professionally managed properties. We get the rental income, the appreciation potential, and the tax benefits – without the stress of being a landlord. It’s like having our cake and eating it too!

The democratization of real estate investing is happening right now, and platforms like Lessinvest.com are leading the charge. What used to be reserved for wealthy investors is now accessible to anyone with a smartphone and a few hundred dollars to invest.

But here’s what really matters: taking action. We can read about investing all day long, but nothing happens until we actually start. The beauty of fractional ownership is that we can start small, learn as we go, and gradually build our confidence and portfolio.

Your practical next steps are straightforward. Create your account, complete the quick verification process, and start browsing properties. Maybe invest in just one fractional share to get your feet wet. See how it feels to receive your first rental income payment. Then gradually expand as you become more comfortable.

Building wealth isn’t about making one perfect investment decision. It’s about consistent action over time. Every small step we take today compounds into something much bigger down the road.

The future of investing is more accessible, more transparent, and more user-friendly than ever before. Lessinvest.com real estate represents this evolution perfectly – making proven wealth-building strategies available to everyone, not just the wealthy few.

We hope this guide has given you the confidence and knowledge to take that next step. Your financial well-being is worth the effort, and fractional real estate investing might just be the missing piece in your wealth-building puzzle.

And hey, while you’re busy building your real estate empire, don’t forget about your other trips! Find the best cars for your next trip – because successful investors deserve great road trips too.