Fintechzoom.com Economy: 5 Quick Wins

Understanding the FintechZoom Economy Revolution

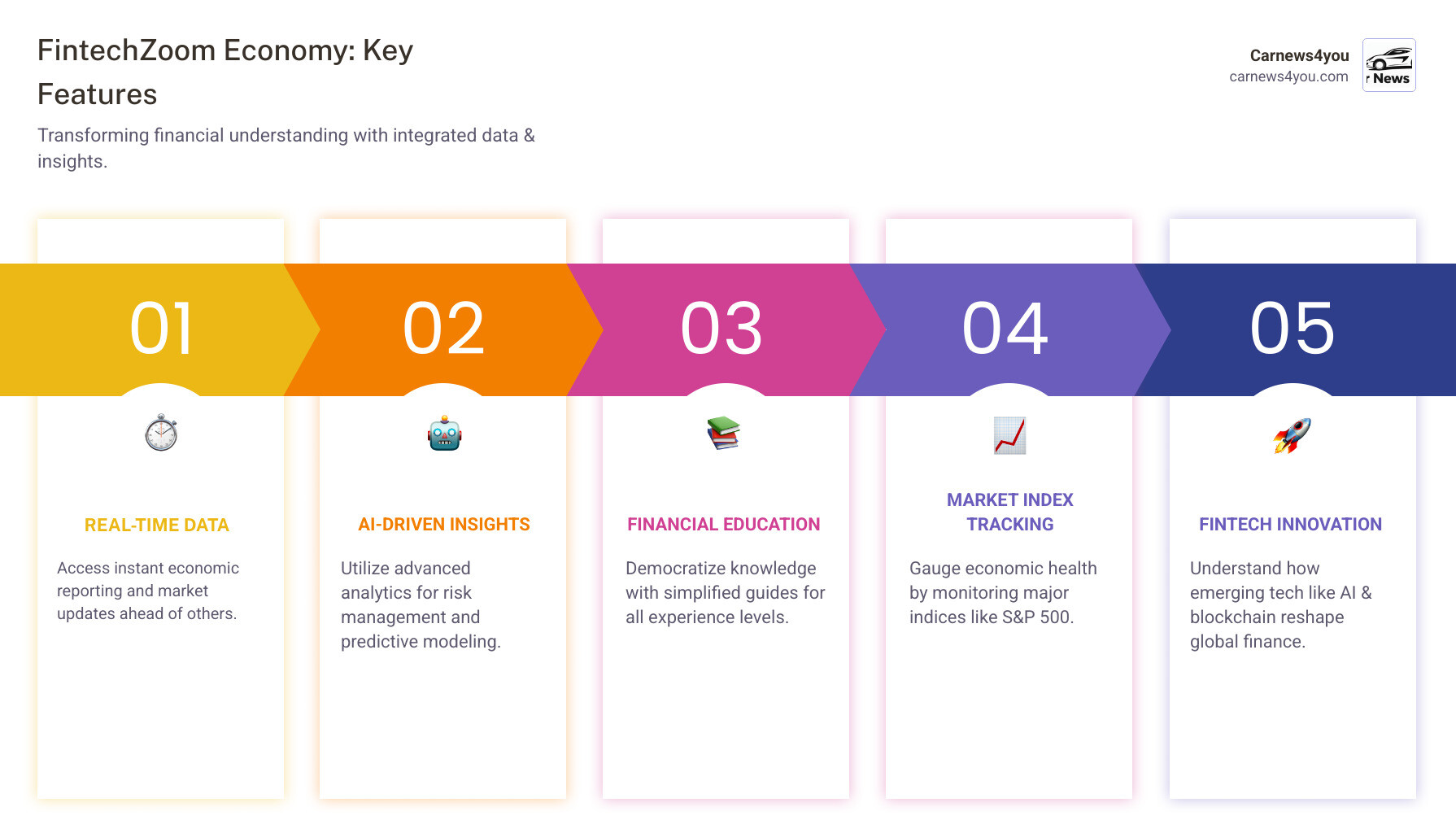

FintechZoom.com economy content represents a comprehensive approach to financial technology news and economic analysis aimed at changing how people understand modern markets. This platform combines real-time market data, fintech innovations, and economic insights into digestible content for both beginners and professionals.

Quick Answer – What FintechZoom.com Economy Offers:

- Real-time economic reporting with market updates and analysis

- Global economic trends covering GDP, inflation, and central bank decisions

- Fintech-specific insights on AI, blockchain, and digital banking impact

- Educational content that simplifies complex financial concepts

- Advanced tools for market tracking and investment analysis

- S&P 500 coverage as a key economic health indicator

The platform is noted for its goal of delivering critical information, in some cases reportedly 4-6 hours ahead of conventional sources during major market events. The service claims that users have reported significant improvements in their trading outcomes, with some metrics showing win rates jumping from 52% to 68% after using its tools.

What makes this platform’s approach unique is its focus on the intersection of technology and finance. Rather than just reporting economic news, it explains how emerging technologies like artificial intelligence and blockchain are reshaping the global economy.

The content serves everyone from finance students seeking educational resources to business owners tracking market trends that affect their operations. By breaking down complex topics into plain language, the platform aims to make financial knowledge more accessible in an increasingly digital world.

Glossary for fintechzoom.com economy:

1. Explore the Dedicated ‘Economy’ Section for Macro Insights

The fintechzoom.com economy section is designed to function as a source for economic analysis presented in accessible language. Instead of focusing on confusing financial jargon, this section breaks down global economic trends into bite-sized pieces.

What sets this platform’s approach apart is how it bridges the gap between complex financial concepts and real-world understanding. The goal is to clarify complicated topics for a broader audience.

The platform’s content is structured to align with Google’s EEAT guidelines, indicating a focus on expert-written content that is both timely and well-sourced. In a financial environment where 76% of fintech professionals seek reliable analysis platforms, such features are significant.

The platform provides real-time economic reporting to help users understand the reasons behind sudden market movements. When the Federal Reserve announces rate hikes or when global inflation data drops, the platform offers immediate analysis of the implications.

What the FintechZoom.com Economy Section Covers

Let’s peek behind the curtain and see what treasures await in the economy section.

GDP growth gets the spotlight it deserves here. You’ll find clear explanations of how different countries are performing economically. For example, when Japan’s real GDP dropped 0.5% in the first quarter of 2024, or when China’s Q2 GDP growth hit 0.7% quarter-on-quarter, FintechZoom breaks down what these numbers actually mean for the global economy.

Inflation reports become surprisingly digestible when presented through FintechZoom’s lens. Instead of just throwing numbers at you, the platform explains how inflation impacts your purchasing power and investment strategies. When Japanese inflation stayed at 2.8% in June, or when the Eurozone CPI was forecast to ease to 2.4% year-over-year, you get the full story behind these figures.

Employment data receives thorough coverage because job reports serve as crystal balls for economic stability. The platform monitors labor market trends and explains their broader implications. When tech companies announce layoffs or when monthly job reports come out, you’ll understand exactly how these developments ripple through the economy.

Central bank decisions get special attention because they create waves across global markets. Whether it’s the Federal Reserve, European Central Bank, or Bank of England making moves, FintechZoom provides regular analysis of monetary policy changes. When the Bank of Canada cuts its policy rate by 25 basis points to 4.50%, or when the People’s Bank of China reduces its seven-day reverse repo rate, you’ll grasp why these decisions matter.

International trade analysis rounds out the coverage by showing how different economies dance together on the global stage. FintechZoom digs into trade dynamics, offering comprehensive views that help you see the bigger picture of how various sectors influence each other.

This comprehensive approach ensures you’re never left wondering what’s driving the global economy. It’s like having a knowledgeable friend who can explain complex economic movements in terms that actually make sense.

More info about FintechZoom Economy Content

2. Analyze the Impact of Emerging Financial Technology

The fintechzoom.com economy section also focuses on how technology is impacting finance. It dives deep into how cutting-edge technology is changing the way people think about money. This is a significant shift where artificial intelligence, blockchain, and digital banking are reshaping the entire economic landscape.

A key feature of the platform is its explanation of these complex technological shifts and their real-world impact. Instead of using technical jargon, the platform shows the real-world impact of these innovations. When users read about AI-driven trading platforms or new mobile banking apps, they get insights into tools that are actively changing how millions of people manage their finances.

The platform covers everything from digital innovation in traditional banking to the rise of green finance initiatives. Readers get detailed breakdowns of cryptocurrency movements, regulatory changes, and how blockchain technology is creating more secure financial systems. The platform doesn’t just state what’s happening; it explains why these changes matter for personal finance and the future.

Take Australia’s PayTo payment network, for example. FintechZoom explains how this real-time system isn’t just faster – it’s creating a more customer-focused economy where people have better control over their money. These aren’t just tech upgrades; they’re fundamental shifts in economic power.

How FintechZoom Highlights New Tech’s Economic Role

Let’s break down how FintechZoom makes sense of this technological change for its audience.

AI in risk management gets special attention because of its role in how financial institutions protect money. The platform reports that users of its AI-driven predictive modeling have seen portfolio volatility drop by 15% during major market corrections. That represents a tangible reduction in market turbulence.

When it comes to digital security in transactions, FintechZoom covers the challenges involved. With more financial life happening online, cybersecurity has become crucial. The platform explains how blockchain technology is making transactions more secure and how advanced technological infrastructure protects trading activities.

Digital lending models represent another area where the platform connects the dots. Traditional lending is undergoing a major makeover, and the platform shows how technology helps lenders make faster, smarter decisions about who gets credit. This is especially important during economic downturns when access to funding can be critical for businesses and families.

The coverage of automated advisory platforms – also known as robo-advisors – is particularly detailed. FintechZoom breaks down how these AI-powered systems can provide sophisticated financial advice without the hefty fees of traditional financial advisors, making financial expertise more accessible.

Perhaps most importantly, FintechZoom tracks the impact on modern banking with clarity. Traditional banks are scrambling to keep up with nimble fintech startups. The platform explains how neobanks are challenging old-school institutions and how established banks are fighting back by adopting fintech solutions.

The result is a resource for understanding how these technological advances affect daily financial lives. Whether it’s faster payments, smarter investment advice, or more secure transactions, the fintechzoom.com economy coverage helps users steer this new world of digital finance.

3. Use Key Market Indices to Gauge Economic Health

Think of market indices as the economy’s vital signs – they tell us so much about what’s happening beneath the surface. When we want to understand how the economy is really doing, especially here in the US, these indices become our best friends. The fintechzoom.com economy coverage aims to make this whole process less intimidating and more accessible.

The S&P 500 is like the gold standard when it comes to checking America’s economic pulse. It tracks 500 of the biggest companies across different industries, so it gives us a pretty solid picture of how things are going overall. A key feature of FintechZoom is that it doesn’t just present numbers – it breaks everything down with clear charts and helpful tools.

Whether you’re just starting to learn about investing or you’ve been at this for years, the platform is designed to meet you where you are. It is a resource that does not assume all users have finance degrees.

What sets FintechZoom’s approach apart is how it goes beyond the basics. Users can track how the market is moving, but they also get insights into different sectors like technology, energy, or healthcare. They even cover the VIX Index – that’s the one they call the “fear gauge” because it shows how nervous or confident investors are feeling. It provides a snapshot of the mood of the entire market.

Understanding the FintechZoom.com Economy via Market Indices

Here’s where the analysis gets interesting. FintechZoom doesn’t just show the numbers – it helps users understand what they actually mean for their finances and future.

The company breakdowns are a helpful feature. Instead of just seeing that the S&P 500 went up or down, users can dig into which specific companies drove those changes. Maybe tech stocks had a great day, or perhaps banking stocks took a hit. This kind of detail helps in spotting trends before they become obvious to everyone else.

Sector performance tracking is another key tool. Users can watch how different parts of the economy are doing in real-time. For example, when European shares gained recently thanks to strong oil sector performance, FintechZoom was there explaining why it mattered and what it could mean going forward.

The platform also excels at reading market sentiment – basically, how investors are feeling about things. Are people optimistic and buying, or are they nervous and selling? FintechZoom’s algorithms even create “conviction scores” that help users understand the confidence level for different trading opportunities.

Another smart feature is how macro-economic statistics are woven right into the market analysis. Interest rates, job reports, GDP numbers – all of these big-picture economic factors get connected to what’s happening with individual stocks and indices. It’s like connecting the dots between headlines and personal portfolios.

For those managing their own investments, the portfolio comparison tools are useful. Users can see how their personal holdings stack up against major benchmarks like the S&P 500. Are they doing better or worse than the overall market? FintechZoom’s risk assessment tools help figure out if an investor is taking on too much risk or maybe being too conservative.

The benefit of all this is that FintechZoom transforms what can be confusing financial data into information that can be used. It’s like having a knowledgeable resource that’s good with numbers, ready to explain what’s happening in terms that make sense.

4. Leverage Advanced Tools for Real-Time Data and Analytics

In today’s lightning-fast financial world, having access to real-time data isn’t just nice to have – it’s absolutely essential. Think of it like trying to steer rush hour traffic without GPS; you might eventually get where you’re going, but you’ll probably miss some important turns along the way. That’s where fintechzoom.com economy offers tools that transform mountains of complex market information into clear, actionable insights.

The platform states that it can deliver critical information 4-6 hours ahead of conventional sources. During the SVB collapse in March 2023, its algorithm was reportedly alerting users while other platforms were still processing the news. This kind of early warning system can be the difference between protecting investments and taking an unexpected hit.

The platform processes an incredible 2.8 million data points every second during market hours. This includes traditional market data, social sentiment analysis, options flow data, and even satellite imagery all working together. It functions like a financial analysis tool powered by technology.

Users can use customizable technical indicators to spot potential entry and exit points, and the system sends alerts when pre-defined conditions are met. This means users don’t have to be glued to their screens all day – the platform does the monitoring and provides notifications when something important happens.

Quantifying the FintechZoom Advantage

Let’s talk numbers, because that’s where the fintechzoom.com economy tools are said to demonstrate their value. The platform’s faster information delivery translates into competitive advantages that can be measured.

Improved win rates are a key reported benefit. The platform claims that users have seen success rates jump from 52% to 68% after incorporating its tools into their trading strategy. That’s a significant improvement that can transform an approach to investing.

Reduced portfolio volatility is another reported advantage. The platform’s data suggests that users employing its AI-driven predictive modeling saw an average 15% reduction in portfolio swings compared to those sticking with traditional analysis methods. This can mean more confidence in a long-term strategy.

Lowered trade losses represent a tangible reported benefit. Average losses per trade reportedly dropped by 31% thanks to the platform’s risk management capabilities. When a trade is wrong, being wrong by a smaller amount preserves more capital for future opportunities.

The platform’s data-driven decisions feature generates “conviction scores” for trading opportunities by weighing various data inputs. Instead of relying on gut feelings or incomplete information, users get clear numerical guidance on which opportunities deserve attention.

5. Tap into Educational Content for Financial Literacy

One of the key aspects of fintechzoom.com economy is how it makes the intimidating world of finance more understandable. Financial jargon often feels like it’s designed to be exclusive, but FintechZoom.com attempts to change that by acting as a financial translator.

What defines this platform’s educational content is its user-centric approach. Instead of using dense technical terms, it uses everyday language to explain complex concepts. Whether a user is trying to understand how inflation affects grocery bills or why the stock market moves the way it does, FintechZoom.com breaks it down into bite-sized pieces.

The platform offers an impressive range of educational resources that cater to different learning styles. Users can dive into detailed explainer articles that unpack topics like Decentralized Finance (DeFi) using simple analogies. There are opinion columns from experts who share their insights, market watch tools to track performance in real-time, and global coverage of financial trends.

This comprehensive approach means users aren’t just passively reading – they are actively building financial literacy that can be applied to their own lives. It provides a resource for understanding money matters.

Why the FintechZoom.com Economy Content is Great for Beginners

For those just starting their financial journey, the fintechzoom.com economy content can serve as a useful starting point. Here’s what makes it beginner-friendly:

The platform’s explainer articles are a core feature for newcomers. These pieces tackle everything from basic inflation concepts to blockchain technology, using clear examples. They start from the ground up and build understanding step by step.

When users are ready to take action, the step-by-step tutorials can serve as a roadmap. These practical guides walk through real-world scenarios – like buying Bitcoin for the first time or understanding different trading strategies. They are written with the beginner in mind, which helps avoid gaps in knowledge.

The unbiased platform reviews are a helpful feature when choosing between different financial services. FintechZoom.com evaluates everything from trading volume to security protocols and customer support quality. This can help users avoid costly mistakes with their first financial platform choices.

Perhaps most importantly, all this educational content works together to help build investment confidence. For new users, the platform simplifies complex topics like financial markets, crypto trading, and AI-driven tools, making it an ideal starting point for learning about finance and trading. The community section even lets users join discussions and share thoughts, creating a supportive environment for asking questions.

The content consistently uses accessible language and avoids unnecessary complexity. The easy-to-use interface and thoughtful design make the learning journey smooth and enjoyable. Whether users are complete beginners or have some experience, they can find content that meets them where they are.

Frequently Asked Questions about FintechZoom

Here are answers to some of the most common questions about fintechzoom.com economy content.

Is FintechZoom.com a reliable source for economic news?

FintechZoom.com is positioned as a trustworthy financial resource. Its credibility is built on several key factors.

The expert-written content comes from professionals with backgrounds in finance and technology. These are knowledgeable analysts who understand the complexities of modern markets.

What the platform is known for is its commitment to timely updates. During key market moments when every minute counts, FintechZoom delivers fresh information multiple times throughout the day. For example, during the SVB collapse, it was reportedly providing information 4-6 hours before many traditional news sources.

The platform also provides well-sourced information, with solid data and verifiable references that let you dig deeper if you want to double-check anything.

Finally, FintechZoom aligns its content strategy with Google’s EEAT guidelines (Experience, Expertise, Authoritativeness, Trustworthiness). This means the platform aims to meet strict standards for quality content that can be relied on when making financial decisions.

How does FintechZoom.com differ from traditional financial news sources?

The fintechzoom.com economy approach differs from what you’ll find in traditional financial media in several ways.

The speed of information is a primary differentiator. While traditional sources are fact-checking and going through editorial processes, FintechZoom aims to deliver critical insights to users more quickly. During major market events, this head start can be a significant advantage.

But speed isn’t everything if the content isn’t accessible. Traditional financial news often contains a lot of jargon and assumes prior knowledge. FintechZoom takes a different approach, focusing on accessibility for beginners without simplifying the content excessively. It explains complex concepts in plain English.

The platform’s focus on fintech’s impact is another standout feature. Instead of treating technology as a side note, FintechZoom puts it front and center. It explores how AI, blockchain, and digital banking aren’t just innovations – they’re fundamental forces reshaping how money works.

Finally, the platform offers integrated data tools. Traditional news tells you what happened; FintechZoom gives you the tools to analyze it yourself. Real-time charts, AI-driven analytics, and portfolio comparison features turn passive news consumption into active financial learning.

How often is the economic content on FintechZoom.com updated?

If you’re wondering whether you’ll get stale information, FintechZoom keeps things fresh with impressive consistency.

The platform provides multiple daily updates throughout regular business hours. This isn’t just a once-in-the-morning news dump; it’s a continuous stream of relevant information as economic events unfold.

During active trading hours, you’re looking at essentially real-time coverage during market hours. When markets are moving, FintechZoom moves with them, providing live updates that help you understand what’s happening as it happens.

The real test comes during breaking news situations, and this is where the platform aims to shine with immediate analysis of breaking news. When the Federal Reserve announces rate changes, when inflation reports drop, or when unexpected economic events occur, the platform doesn’t just report the news – it provides instant analysis of what it means for different markets and investment strategies.

This constant flow of updated information means you’re not working with yesterday’s news when making today’s financial decisions. When markets can shift dramatically in minutes, that kind of responsiveness is invaluable.

Conclusion

As we wrap up our journey through fintechzoom.com economy, it’s clear this is a significant platform. It’s a dynamic resource that is genuinely changing how we understand money, markets, and the digital revolution happening right before our eyes.

What makes FintechZoom.com’s approach notable is how it makes financial knowledge accessible. Gone are the days when understanding economics meant deciphering complex jargon. Instead, users get clear, actionable insights that help make sense of everything from inflation reports to cryptocurrency trends. It’s like having a smart resource that can explain complicated stuff without making users feel foolish for asking questions.

The platform’s reported metrics speak for themselves. When a service claims users see their win rates jump from 52% to 68%, or that portfolio volatility drops by 15%, we’re talking about real results. That reported 4-6 hour head start during major market events? That’s the kind of advantage that can impact investment decisions.

Navigating the 2025 economy feels less daunting with tools that work for users rather than against them. FintechZoom.com bridges that gap between cutting-edge technology and everyday understanding. Whether tracking GDP growth, analyzing central bank decisions, or trying to figure out how AI is reshaping banking, the platform keeps users informed without overwhelming them.

For us at Carnews4you, analyzing such platforms is part of the broader conversation about how technology is changing every aspect of our lives. Just as we help you steer automotive trends and lifestyle choices, it is relevant to examine the tools that help people steer the increasingly complex world of digital finance.

The platform is designed for versatility. New investors may find the educational content approachable and confidence-building. Seasoned professionals might appreciate the advanced analytics and real-time data feeds. Everyone can benefit from the clear explanations of how emerging technologies are reshaping our economic landscape.

As we look ahead, having a valuable resource for investors becomes even more critical. The financial world isn’t slowing down, and neither should our understanding of it. A platform like FintechZoom.com can position users to stay ahead of the curve, making informed decisions in an era where information truly is power.