fintechzoom.com markets: Master 90-Day Profits

Why FintechZoom Markets is Revolutionizing How We Trade and Invest

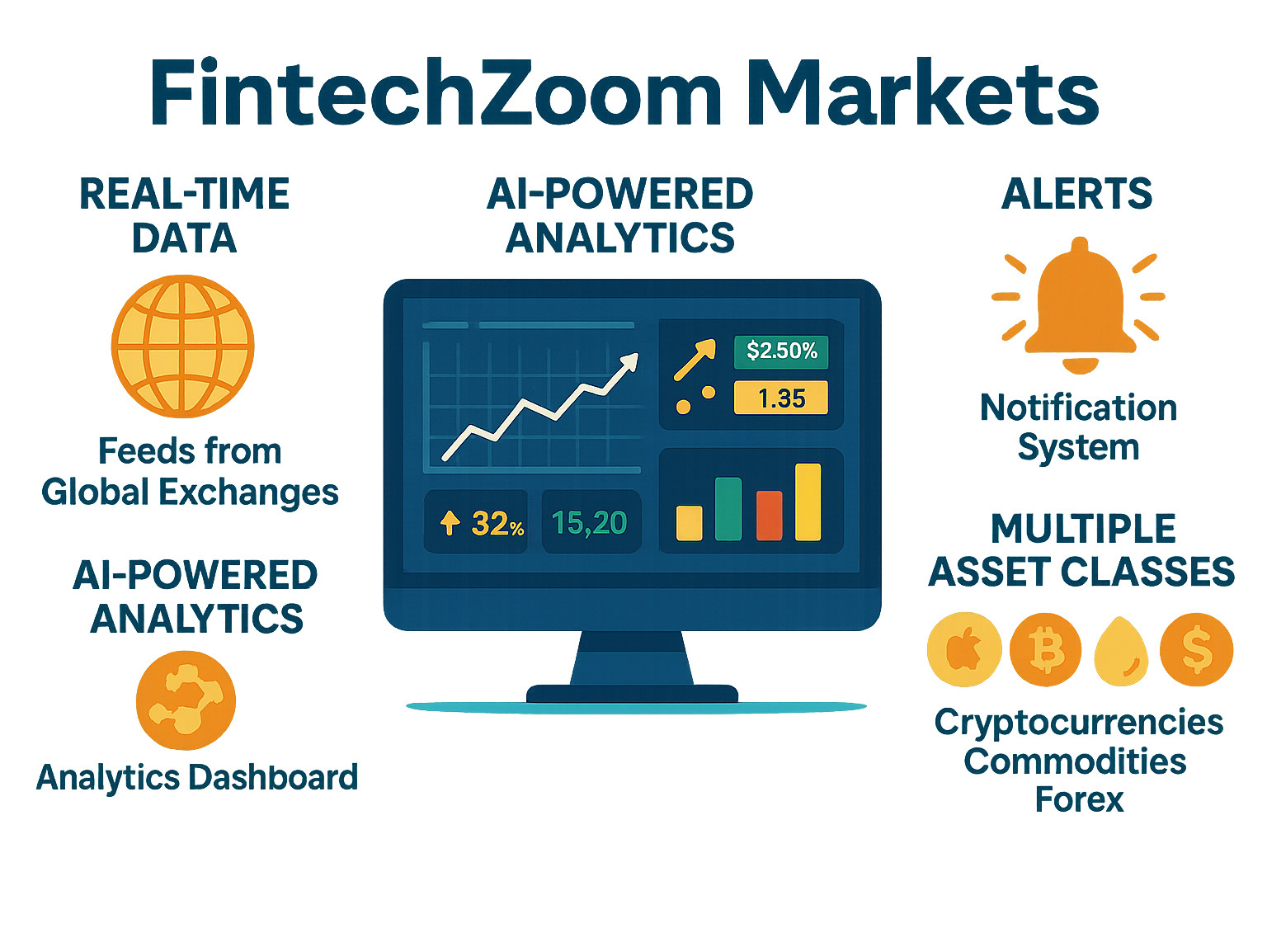

FintechZoom.com markets represents a comprehensive financial technology platform that provides real-time market data, trading tools, and investment insights across stocks, cryptocurrencies, commodities, and forex markets. Here’s what you need to know:

Key Features:

- Real-time data from 200+ global exchanges with sub-millisecond latency

- AI-powered alerts that surface news 4-6 hours before mainstream media

- Advanced analytics processing 2.8 million data points per second

- Multiple asset classes including stocks, crypto, commodities, and forex

- Educational resources for investors at all skill levels

Pricing Tiers:

- Free Plan: $0 (basic features)

- Premium Plan: $19.99/month (improved tools)

- Pro Plan: $39.99/month (full access)

In today’s fast-moving financial markets, having the right information at the right time can mean the difference between profit and loss. FintechZoom launched in 2018 with a simple mission: democratize access to professional-grade market intelligence for everyday investors.

The platform has already proven its worth with impressive user results. According to platform data, users report win rate improvements from 52% to 68% and average loss reductions of 31% after implementing FintechZoom’s insights.

Whether you’re a tech-savvy professional looking to optimize your investment strategy or someone just starting their financial journey, FintechZoom bridges the gap between complex market data and actionable insights. The platform covers 47 global markets and processes everything from traditional stocks to emerging cryptocurrencies.

What sets FintechZoom apart is its speed advantage. During major market events like the SVB collapse, the platform’s algorithms surfaced critical information hours before traditional financial media, potentially saving users thousands of dollars in avoided losses.

Simple guide to fintechzoom.com markets terms:

Introduction: What is FintechZoom and Why It Matters for Modern Investors

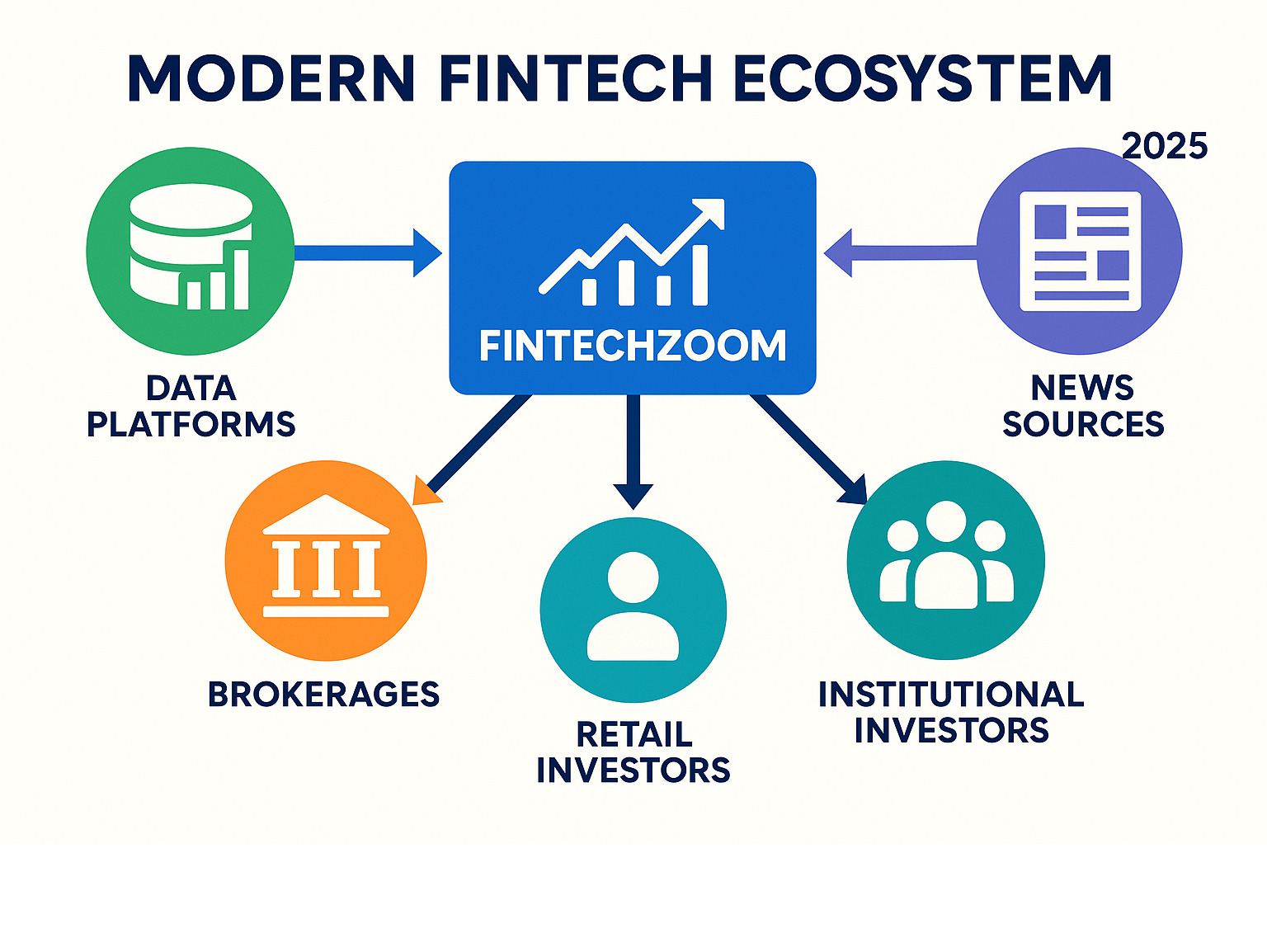

FintechZoom represents a fundamental shift in how we access and process financial information. Born in 2018 during a period of rapid technological advancement in finance, the platform emerged with a clear vision: make sophisticated market intelligence accessible to everyone, not just Wall Street professionals.

Think of FintechZoom as your personal financial intelligence network. While traditional financial media operates on news cycles measured in hours, FintechZoom.com markets operates in real-time, processing information as it happens across global exchanges. This isn’t just about speed – it’s about giving individual investors the same informational advantages that institutional traders have enjoyed for decades.

The platform serves a diverse audience, from beginners taking their first steps into investing to experienced traders looking for an edge. What makes it particularly valuable is its ability to translate complex market data into actionable insights. Instead of drowning users in overwhelming financial jargon, FintechZoom presents information in a clear, digestible format.

The democratization of financial tools has never been more important. According to research data, over 68% of retail investors now rely on digital platforms for research and market news. This shift reflects a broader trend where technology is breaking down barriers that once separated professional and retail investors.

For modern investors, the challenge isn’t finding information – it’s finding the right information at the right time. FintechZoom addresses this by combining speed, accuracy, and user-friendly design. Whether you’re tracking Tesla’s latest earnings report or monitoring Bitcoin’s price movements, the platform ensures you’re never behind the curve.

A Deep Dive into FintechZoom.com Markets: Coverage and Core Features

When you first explore FintechZoom.com markets, you’ll quickly find it’s not your typical financial news site. This platform transforms how we access and process market information, turning overwhelming data streams into clear, actionable insights that actually make sense.

The platform’s data processing capabilities are genuinely impressive. We’re talking about 2.8 million data points per second flowing through sophisticated algorithms that can spot patterns and opportunities in real-time. This isn’t just about speed – it’s about giving you the same level of market intelligence that Wall Street professionals have relied on for years.

What makes FintechZoom particularly valuable is how it covers multiple asset classes under one roof. Whether you’re tracking traditional stocks, diving into cryptocurrency markets, or exploring commodities like gold and oil, everything is integrated seamlessly. This comprehensive approach means you can spot connections between different markets that might otherwise go unnoticed.

Unparalleled Market Coverage

The breadth of FintechZoom.com markets coverage is where things get really interesting. This platform doesn’t just focus on the obvious choices – it provides access to 47 global markets that would have been nearly impossible for individual investors to monitor effectively just a few years ago.

In stocks, you’ll find comprehensive coverage of major indices like the NASDAQ and Dow Jones, but FintechZoom goes much deeper. The platform tracks international markets including the STOXX 600 in Europe and the Russell 2000 for small-cap exposure. This global perspective is crucial in today’s interconnected economy, where events in one market can quickly ripple across the world.

The cryptocurrency coverage reflects FintechZoom’s forward-thinking approach to modern investing. Bitcoin and Ethereum receive thorough analysis, but the platform also tracks hundreds of altcoins and provides insights into regulatory developments that could impact crypto markets. Given that cryptocurrency adoption has exploded in recent years, this coverage addresses a massive and growing segment of the investment landscape.

Commodities trading has gained renewed attention, especially with recent global economic uncertainty. FintechZoom provides robust coverage of gold, oil, silver, and agricultural products. The platform’s commodity analysis includes sophisticated forecasting tools that were once reserved for institutional investors.

Forex markets operate around the clock, and FintechZoom’s global coverage ensures you can track currency movements across all major pairs. Whether you’re interested in USD/EUR movements or more exotic currency pairs, the platform provides the data and analysis needed to make informed decisions.

According to Ernst and Young’s Global FinTech Adoption Index data, fintech adoption has surged dramatically from 16% in 2015 to 64% in 2019, demonstrating the growing demand for comprehensive digital financial services like what FintechZoom provides.

The Powerhouse Toolkit: Features That Give You an Edge

Here’s where FintechZoom.com markets really shines – its sophisticated toolkit transforms raw market data into intelligence you can actually use. The platform’s ability to process those 2.8 million data points per second creates a comprehensive picture of market conditions that updates in real-time.

Real-Time AI Alerts represent perhaps the most valuable feature for anyone serious about investing. These aren’t simple price notifications – they’re intelligent alerts that consider multiple factors including volume, sentiment, and technical indicators. The AI system learns from market patterns and can identify unusual activity that might signal significant price movements before they become obvious to everyone else.

The AI-Based Charting tools include essential technical indicators like RSI and MACD, along with Bollinger Bands and moving averages. These tools help identify trends, momentum, and potential reversal points. What sets FintechZoom apart is how these indicators integrate with real-time news and sentiment data, giving you a more complete picture.

Sentiment Analysis has become increasingly important in modern markets, where social media discussions can drive significant price movements. FintechZoom tracks mentions across platforms like Reddit and Discord, providing early warning of potential viral movements. The platform’s Discord tracking capabilities help identify emerging trends before they hit mainstream attention.

Custom Alerts allow you to set specific parameters for the assets you’re tracking. You can create alerts for price thresholds, volume spikes, news events, or technical indicator signals. This customization ensures you’re notified about developments that matter most to your investment strategy.

The Squawk Box Audio feature provides real-time audio updates on market-moving events, allowing you to stay informed even when you can’t actively monitor your screen. This feature is particularly valuable for busy professionals who need to stay connected to markets throughout the day.

Understanding the FintechZoom Pricing Structure

| Feature | Free Plan | Premium Plan | Pro Plan |

|---|---|---|---|

| Price | $0 | $19.99/month | $39.99/month |

| Real-time data | Basic | Improved | Full access |

| AI alerts | Limited | Standard | Advanced |

| Technical indicators | Basic set | Extended set | Complete toolkit |

| Sentiment analysis | Basic | Standard | Advanced |

| Custom alerts | 5 alerts | 25 alerts | Unlimited |

| Historical data | 30 days | 1 year | 5 years |

| Portfolio analytics | Basic | Standard | Advanced |

| Educational resources | Limited | Full access | Full access + webinars |

The pricing structure reflects FintechZoom’s commitment to making sophisticated market intelligence accessible to everyone. The free tier offers enough functionality for beginners to explore the platform and understand its value. Most users find the Premium plan at $19.99/month provides the right balance of features and cost, while the Pro plan at $39.99/month caters to active traders and investment professionals.

What’s particularly refreshing is that even the free version provides genuine value – you’re not just getting a watered-down teaser. The platform’s approach recognizes that building long-term relationships with users is more valuable than forcing immediate upgrades.

The FintechZoom Advantage: How It Outpaces the Competition

Speed and Accuracy: Getting News Before It’s News

In financial markets, timing isn’t just important – it’s everything. FintechZoom.com markets has built its reputation on delivering critical information 4-6 hours before mainstream financial media outlets. This speed advantage isn’t just about bragging rights; it translates directly into better investment outcomes for users.

The platform’s architecture includes proprietary fiber-optic connections that deliver sub-millisecond latency for premium subscribers. Compare this to competitors who typically operate with 15-30 second delays, and you begin to understand the magnitude of FintechZoom’s technological advantage. This infrastructure processes data from over 200 global exchanges simultaneously, creating a comprehensive real-time picture of global market conditions.

A perfect example of this speed advantage occurred during the SVB collapse. While traditional media was still reporting on “banking sector concerns,” FintechZoom’s algorithms had already identified the specific risks and alerted users to potential portfolio impacts. One user reported saving approximately $15,000 in avoided losses by acting on FintechZoom’s early warnings.

The platform’s fundamental scanner processes SEC filings within minutes of submission, automatically analyzing the content for material changes that could impact stock prices. This capability means users learn about important corporate developments almost immediately, rather than waiting for analyst reports or news coverage.

The evolution of Financial Technology has enabled platforms like FintechZoom to democratize access to institutional-grade market intelligence, fundamentally changing how individual investors can compete in modern markets.

From Data to Profit: Real User Success Stories

The true measure of any financial platform is its impact on user results, and FintechZoom.com markets delivers impressive performance improvements. Users consistently report significant improvements in both win rates and risk management after implementing the platform’s insights.

The most compelling statistic is the win rate improvement from 52% to 68% that users experience after implementing FintechZoom’s behavioral analytics suggestions. This 16 percentage point improvement represents a fundamental shift in trading success that can dramatically impact long-term returns.

Equally important is the 31% reduction in average losses per trade. This improvement in risk management often proves more valuable than increasing win rates, as it helps preserve capital during inevitable losing streaks.

Real-world examples demonstrate these improvements in action. During GameStop’s resurgence in May 2024, FintechZoom’s social sentiment tracking detected the 340% increase in mentions across Reddit and Discord before the stock began its significant move. One user who acted on this intelligence reported a profit of $2,460 on their GME position.

In the cryptocurrency space, FintechZoom’s short-term prediction models achieve 71% accuracy for 3-7 day price movements. While longer-term predictions (30+ days) show lower accuracy at 43%, the short-term precision provides valuable opportunities for active traders.

Another success story involves an AI ETF shorting opportunity in July 2024. FintechZoom’s institutional flow data revealed unusual selling pressure, leading to a user capturing a 28% gain over two weeks by shorting the ETF based on this intelligence.

Unique AI-Powered Behavioral and Portfolio Analytics for FintechZoom.com Markets

What truly sets FintechZoom.com markets apart is its sophisticated behavioral analytics that help users identify and correct trading mistakes. The platform doesn’t just provide data – it analyzes how users interact with that data and suggests improvements.

The behavioral analytics system tracks user decision-making patterns and identifies common mistakes that reduce profitability. By implementing the fixes suggested by these analytics, users typically see their win rate lift by 16 percentage points, moving from the average 52% to a more profitable 68%.

Portfolio analytics go beyond simple performance tracking to provide sophisticated risk management insights. The platform’s analysis helps users understand their portfolio’s volatility profile and suggests specific hedging strategies. Adding simple hedges like SPY puts, gold positions, or increased cash allocation can reduce portfolio volatility (sigma) by approximately 15% according to user surveys.

The AI system also provides confluence analysis, identifying situations where multiple indicators align to suggest high-probability trading opportunities. One user applied FintechZoom’s Confluence Strategy to Tesla stock, resulting in a 12% gain over the following week as the various signals proved accurate.

These analytics capabilities transform FintechZoom from a simple data provider into a comprehensive trading coach that helps users develop better decision-making skills over time.

Getting Started and Maximizing Your Returns with FintechZoom

Your First 90 Days: A Roadmap to Success

Think of your first three months with FintechZoom.com markets like learning to drive a high-performance sports car. You wouldn’t jump behind the wheel of a Ferrari and immediately hit the racetrack, right? The same principle applies here – taking a structured approach will help you open up the platform’s full potential without overwhelming yourself.

The good news is that FintechZoom users typically see win rate improvements of 10-15% within their first 90 days. That’s not just a number – it represents real money staying in your pocket and growing your wealth faster.

Start by defining your goals clearly. Are you someone who wants to build long-term wealth through solid investments, or do you prefer the excitement of active trading? Maybe you’re somewhere in between. Your answer will shape how you use every feature on the platform. A buy-and-hold investor will focus on fundamental analysis tools, while an active trader might prioritize real-time alerts and technical indicators.

Customizing your dashboard comes next, and this is where many new users make their first mistake. They try to monitor everything at once, creating information overload. Instead, start with what you know. If you’re passionate about technology stocks, focus your dashboard on NASDAQ components and tech sector news. If you’re interested in commodities, prioritize gold and oil data. You can always expand later.

Setting strategic alerts requires the same focused approach. Begin with just 5-10 carefully chosen alerts for your core holdings or watchlist. Think quality over quantity here. It’s better to have five highly relevant alerts that you act on than fifty notifications that you ignore because they’re overwhelming.

Leveraging educational resources might seem boring, but it’s where the real magic happens. FintechZoom’s learning center covers everything from basic investing principles to advanced technical analysis. Spend 15-20 minutes each day during your first few weeks exploring these resources. You’ll be amazed how much more sense the platform’s insights make once you understand the fundamentals.

Paper trading with insights is your safety net. Before risking real money, practice using FintechZoom’s signals in a simulated environment. This approach helps you understand how the platform’s recommendations translate into actual trading decisions without the stress of potential losses.

The secret ingredient to success is consistency. Users who engage with the platform regularly and gradually implement its insights see the most dramatic improvements in their investment outcomes. Think of it as building a muscle – the more you use it, the stronger it gets.

Common Myths and Limitations of FintechZoom.com Markets

Let’s clear the air about what FintechZoom.com markets actually does, because there’s quite a bit of confusion floating around online.

The biggest myth is that FintechZoom is just another news aggregator. It aggregates news, but calling it “just” a news aggregator is like calling a Tesla “just” a car. The real value lies in the proprietary AI analysis and predictive capabilities working behind the scenes. The platform processes information through sophisticated algorithms that spot patterns and connections that even experienced analysts might miss.

Another common misconception is that the platform is only for experienced traders. This couldn’t be further from the truth. FintechZoom is designed to be accessible whether you’re making your first investment or you’ve been trading for decades. The platform includes extensive educational resources and presents complex information in formats that actually make sense. Many beginners find it easier to understand than traditional financial news sources that seem designed to confuse rather than inform.

Information overload is a real limitation, but it’s completely manageable. The solution is using custom watchlists and carefully configured alerts to focus on information relevant to your strategy. Start narrow and gradually expand as you become more comfortable. Think of it like learning to drive – you don’t start on the highway during rush hour.

FintechZoom is not a brokerage, and that’s actually a strength, not a weakness. The platform focuses on providing superior market intelligence rather than trying to be everything to everyone. You’ll use these insights to make better decisions on your chosen brokerage platform. It’s like having a brilliant research assistant who never sleeps and processes millions of data points every second.

The platform works best when you understand it’s a tool for enhancing your decision-making process, not replacing careful analysis and risk management. It’s designed to give you the same informational advantages that institutional traders have enjoyed for decades, but you still need to make smart decisions with that information.

Frequently Asked Questions about FintechZoom Markets

Can I trade stocks or crypto directly on FintechZoom?

This is probably the most common question new users ask, and the answer is no – but that’s actually a good thing! FintechZoom.com markets is designed as a powerful informational and analytical platform that provides you with market intelligence. Think of it as your research assistant rather than your broker.

You’ll use FintechZoom’s insights to make smarter decisions, then execute those trades on your preferred brokerage platform. This separation actually works in your favor because it allows FintechZoom to focus entirely on what they do best – providing top-notch market analysis.

When platforms try to be both information providers and brokers, conflicts of interest can arise. FintechZoom avoids this by staying laser-focused on giving you the best possible market intelligence without any hidden agendas.

How accurate are FintechZoom’s predictions and alerts?

FintechZoom.com markets has shown impressive accuracy rates, particularly for short-term movements. Their crypto predictions hit 71% accuracy for 3-7 day forecasts, which is quite remarkable in the volatile crypto space.

But here’s the thing – FintechZoom isn’t trying to be a crystal ball, and neither should you expect it to be one. The platform’s real superpower lies in surfacing critical data hours before it becomes common knowledge. This timing advantage is often more valuable than perfect predictions.

The accuracy varies depending on what you’re looking at. Short-term predictions tend to be much more reliable than long-term forecasts, which is why many users focus on FintechZoom’s real-time intelligence rather than relying solely on predictive models.

Even the best tools are just that – tools. They’re meant to augment your strategy and help you make better-informed decisions, not replace your own judgment and risk management.

Is FintechZoom suitable for beginners?

Absolutely! One of the best things about FintechZoom.com markets is how it makes complex financial information accessible to everyone, regardless of experience level.

The platform offers a clean, intuitive interface that doesn’t overwhelm you with unnecessary complexity. You can start with the free tier to explore core features without any financial commitment. This lets you get comfortable with the platform before deciding whether to upgrade.

The wealth of educational resources is particularly valuable for beginners. You’ll find everything from basic investing principles to advanced technical analysis, allowing you to grow your knowledge alongside your experience with the platform.

Many beginners actually find FintechZoom’s approach to presenting complex information more accessible than traditional financial news sources. Instead of drowning you in jargon, the platform translates market data into clear, actionable insights.

The key is to start simple and gradually expand your use of the platform’s features as you become more comfortable. FintechZoom is designed to help new investors build confidence and make data-driven decisions from day one – which is exactly what you need when you’re starting your investment journey.

Conclusion: The Future of Trading and Achieving Your Financial Goals

As we look toward the future of investing, FintechZoom.com markets stands as a guide of what’s possible when technology meets financial markets. This isn’t just another platform competing for your attention – it’s a fundamental shift in how everyday investors can access and use market intelligence.

The numbers tell a compelling story. When users see their win rates jump from 52% to 68% and their average losses drop by 31%, we’re talking about real money and real results. These improvements compound over time, creating a meaningful difference in your journey toward financial independence.

But the true power of FintechZoom lies in its high-speed advantage. Getting critical information 4-6 hours before mainstream media isn’t just impressive – it’s game-changing. Whether it’s spotting the early signs of a market shift or catching wind of a regulatory change that could impact your crypto holdings, being first to know can make all the difference.

The platform’s AI-driven insights continue to evolve, becoming more sophisticated with each passing month. The ability to process 2.8 million data points per second and translate that into actionable intelligence represents the cutting edge of financial technology. This comprehensive coverage across 47 global markets ensures you’re never missing opportunities, whether they’re in traditional stocks or emerging crypto markets.

What excites us most about FintechZoom’s future are the upcoming developments. The improved mobile app will make it even easier to stay connected to markets while you’re on the go. The expanded global coverage means more opportunities to diversify and find value in international markets.

At Car News 4 You, we know that building wealth is often about more than just the numbers – it’s about creating the freedom to pursue your passions. Whether you’re dreaming of that vintage Ferrari or planning to experience the VIP luxury experiences that come with financial success, having the right tools makes all the difference.

Mastering the markets with a platform like FintechZoom can be your stepping stone to financial freedom. The same attention to detail that goes into crafting a perfect luxury vehicle goes into building a successful investment portfolio. Both require the right tools, the right information, and the patience to let excellence compound over time.

The future belongs to investors who can adapt, learn, and leverage technology to their advantage. FintechZoom provides exactly that opportunity – turning the complex world of global markets into something accessible, understandable, and profitable for investors at every level.