5starsstocks.com dividend stocks: #1 Essential

Why 5starsstocks.com Dividend Stocks Matter for Your Investment Strategy

5starsstocks.com dividend stocks offer investors a pathway to building steady passive income through carefully selected dividend-paying companies. The platform uses AI-driven analysis and stock screening tools to identify companies that regularly distribute a portion of their earnings to shareholders.

Here’s what you need to know about 5starsstocks.com dividend stocks:

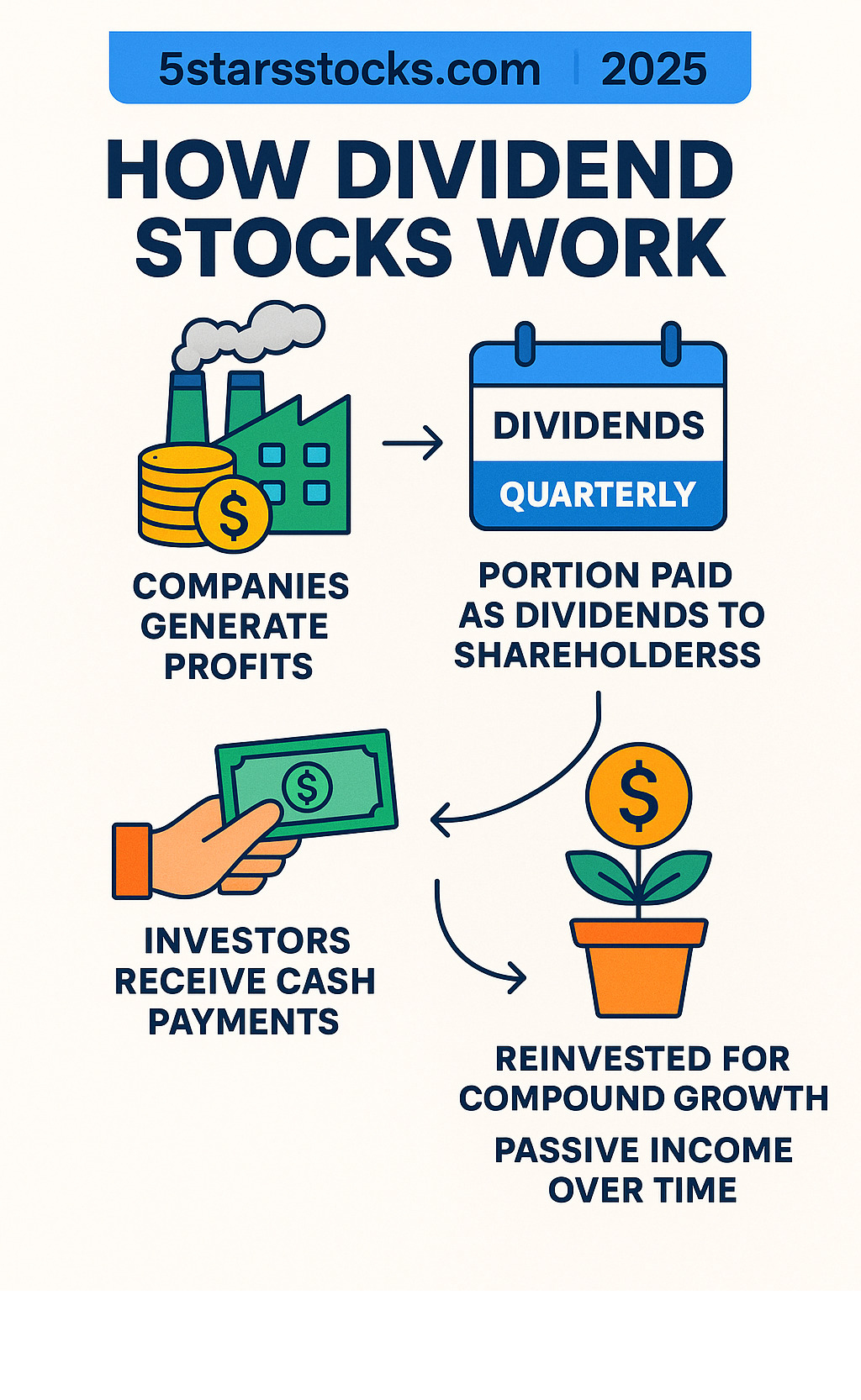

- Regular Income: Dividend stocks provide quarterly or monthly cash payments

- Growth Potential: Many dividend companies also offer capital appreciation

- Platform Tools: Stock screeners, market analysis, and portfolio tracking features

- Risk Considerations: Independent testing shows mixed results with only 35% profitability

- Best Use: Ideal for idea generation rather than final investment decisions

Dividend investing has become a cornerstone strategy for building long-term wealth. As one investor shared in the research, focusing on dividend stocks helped build “a comfortable nest egg” with reinvested dividends growing a portfolio by 300% over 20 years.

5starsstocks.com positions itself as a comprehensive investment platform that cuts through market complexity. The site offers curated watchlists, in-depth stock analyses, and educational resources focused on dividend-paying companies across sectors like utilities, healthcare, and consumer staples.

However, independent analysis reveals important limitations. While the platform claims a 70% accuracy rate for its predictions, third-party testing found that barely one-third of recommendations were profitable. This makes the platform better suited for initial research and idea generation rather than as your sole investment guide.

The platform’s strength lies in its user-friendly approach to dividend investing education and its focus on established companies with sustainable dividend histories.

5starsstocks.com dividend stocks definitions:

How 5StarsStocks.com Supports Dividend Investors

Let’s be honest – diving into dividend investing can feel overwhelming at first. That’s where platforms like 5starsstocks.com step in, promising to make your journey smoother and more profitable. At Carnews4you.com, we’ve taken a close look at how this platform actually supports dividend investors, and here’s what we found.

The platform built its foundation on some solid principles. Their rigorous research approach involves a team of financial analysts and data scientists who dig deep into market trends, company fundamentals, and future potential. They claim to offer independent insights free from conflicts of interest, focusing purely on providing unbiased information that you can actually use.

What makes 5starsstocks.com interesting is their commitment to turning complex financial jargon into actionable data. Instead of drowning you in numbers, they translate everything into clear insights that help you make informed decisions. They also emphasize transparency in their methodology, though some aspects remain proprietary.

The platform offers a comprehensive suite of tools designed specifically for dividend investors. Their stock screening tools help you filter through thousands of options, while their market analysis features provide the context you need to understand broader trends. The portfolio tracking capabilities let you monitor your investments all in one place.

Understanding the Platform’s Tools

When you’re exploring 5starsstocks.com dividend stocks, getting familiar with their tools can make all the difference. Their stock screener is the heart of the platform, letting you slice and dice the market based on what matters most to you.

The dividend yield filter shows you the annual dividend income relative to the stock’s price – basically, how much bang you’re getting for your buck. The payout ratio filters help you identify companies that can actually sustain their dividend payments without going broke. Nobody wants to invest in a company that’s paying out more than it’s earning.

You can narrow your search by sector performance, focusing on areas known for reliable dividends like utilities, healthcare, and consumer staples. The platform provides real-time market data, so you’re not making decisions based on yesterday’s news.

Their expert recommendations offer curated lists that can spark ideas for your own research. The Smart Alerts System keeps you in the loop about significant changes without requiring you to constantly monitor the markets. Meanwhile, their Stock Heat Map gives you a visual snapshot of which sectors are hot and which are not.

The Importance of Research and User Trust

Here’s where things get interesting – and where we need to have an honest conversation. While 5starsstocks.com positions itself as your investment ally, our research uncovered some important gaps between their claims and reality.

The platform boasts a 70% accuracy rate for their AI predictions. Sounds impressive, right? However, independent testing tells a different story. Only about 35% of their recommendations actually proved profitable over a four-month period. Even more concerning, test portfolios using their recommendations underperformed the S&P 500 by a notable margin.

ScamAdviser gives the platform a trust score of 66 out of 100, which puts it in the “moderate risk” category rather than high confidence territory.

What does this mean for you? Think of 5starsstocks.com as a helpful starting point rather than your final answer. It’s excellent for idea generation and initial research, but you shouldn’t base your buy or sell decisions solely on their recommendations.

The platform works best when you use it as one tool in your research toolkit. Cross-reference their insights with other established sources, verify the information through SEC filings, and always do your own due diligence.

True trust in any investment platform comes from consistent, verifiable performance – not just marketing claims. Use 5starsstocks.com to find potential opportunities, but make sure you’re the one making the final investment decisions based on your own thorough research.

A Deep Dive into 5starsstocks.com Dividend Stocks

Ready to get into the nitty-gritty? Let’s roll up our sleeves and explore what makes 5starsstocks.com dividend stocks tick. Think of this as your financial detective work – we’re going to examine the clues that separate the dividend champions from the pretenders.

Evaluating 5starsstocks.com Dividend Stocks with Key Metrics

When you’re sizing up 5starsstocks.com dividend stocks, it’s like buying a used car – you need to look under the hood, not just admire the shiny exterior. The dividend yield might catch your eye first, but smart investors dig deeper.

Dividend yield is your starting point. If a company pays $2 per share annually and the stock costs $40, you’re looking at a 5% yield. Sounds great, right? But here’s the catch – sometimes a super high yield is like a “too good to be true” deal. It might mean the company is struggling and the stock price has tanked.

The payout ratio tells the real story. This shows what percentage of a company’s earnings gets paid out as dividends. Picture a company earning $100 million and paying out $60 million in dividends – that’s a 60% payout ratio. We like to see this number below 60% because it means the company keeps enough cash for growth and tough times. When it climbs above 80%, that’s your yellow warning light flashing.

Financial health is where things get interesting. You’re basically giving the company a financial physical exam. The debt-to-equity ratio shows if the company is drowning in debt. Earnings per share growth reveals whether the business is actually growing or just treading water. A solid return on equity (ideally above 15%) means management is doing a good job with shareholders’ money.

But here’s what really matters: cash flow. A company might look profitable on paper, but if cash isn’t flowing in consistently, those dividend payments become shaky. Strong, steady cash flow is like a reliable paycheck – it keeps the dividend lights on.

The golden rule? Look for companies that don’t just pay dividends, but grow them year after year. These businesses have proven they can weather storms and still reward their shareholders. Investment decisions should be based on your individual circumstances, so use these metrics as your compass, not your final destination.

Types of Dividend Stocks Highlighted by the Platform

5starsstocks.com dividend stocks come in different flavors, each serving different investor appetites. Think of it like choosing between different types of investments at a financial buffet – each has its own appeal and purpose.

High-dividend stocks are the attention-grabbers. They offer yields that make your eyes widen, often well above what you’d get from bonds or savings accounts. These can be fantastic for investors who need income now. But remember, sometimes high yields exist because the stock price has fallen – it’s not always a bargain.

Dividend growth stocks are the marathon runners of the dividend world. Companies like PepsiCo and Medtronic might not offer the highest yields today, but they’ve been raising their dividends for decades. These “Dividend Aristocrats” have increased payouts for 25+ consecutive years. ExxonMobil and Air Products and Chemicals also join this elite club. They’re like that reliable friend who always shows up – maybe not flashy, but dependable when it counts.

Real Estate Investment Trusts (REITs) operate under special rules. By law, they must pay out at least 90% of their taxable income as dividends. It’s like having a legal obligation to share the wealth. This makes them popular with income-focused investors, though they do ride the waves of the real estate market.

The platform also looks at growth stocks and value stocks through a dividend lens. Value stocks trading below their true worth can offer both income and the potential for price appreciation – like finding a diamond in the rough. Growth stocks typically reinvest more earnings back into the business, so they might pay smaller dividends but offer bigger capital gains potential.

Sector-wise, certain industries have earned reputations as dividend darlings. Utilities companies are like the steady heartbeat of dividend investing – people always need electricity and water. Healthcare companies provide essential services regardless of economic conditions. Consumer staples sell things people buy no matter what – think toothpaste and groceries. Financials like banks can be generous dividend payers, though they’re more sensitive to economic ups and downs.

| Feature | High-Yield Stocks | Dividend Growth Stocks | REITs |

|---|---|---|---|

| Yield | Often highest | Moderate to high | Generally high |

| Risk | Potentially higher (unsustainable) | Lower (stable companies) | Moderate (real estate market exposure) |

| Growth Potential | Capital appreciation less focus | Strong capital appreciation potential | Moderate capital appreciation |

| Typical Investor | Income-focused, higher risk tolerance | Long-term growth & income, conservative | Income-focused, real estate exposure |

| Example | Companies under financial pressure | Dividend Aristocrats like PepsiCo | Realty Income (O) |

The beauty of this variety is that you can mix and match based on your goals. Need income now? High-yield stocks and REITs might fit. Planning for retirement in 20 years? Dividend growth stocks could be your best friends. The key is understanding what each type brings to your financial table.

Strategies for Building a Dividend Portfolio

Building a successful dividend portfolio isn’t just about picking the highest-yielding stocks you can find. It’s about creating a thoughtful strategy that grows with you over time. 5starsstocks.com dividend stocks can be part of this journey, but the real magic happens when you understand how to put the pieces together.

Building Your Portfolio with 5starsstocks.com Dividend Stocks

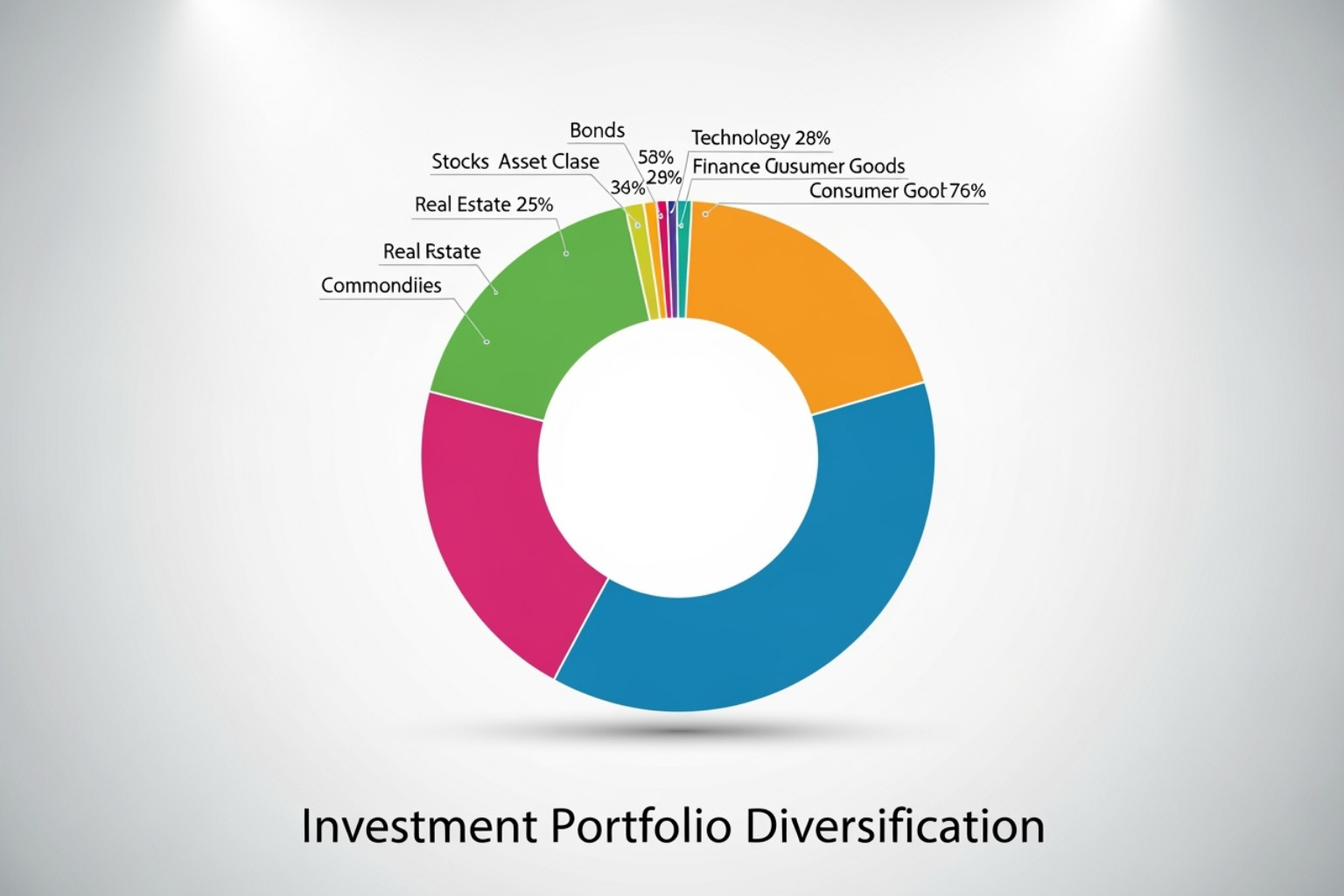

Think of building your dividend portfolio like planning a balanced meal – you want variety to get all the nutrients you need. The same principle applies to investing, where diversification across sectors becomes your financial vitamins.

Utilities are like the bread and butter of dividend investing. Companies that provide electricity, gas, and water have customers who need their services no matter what’s happening in the economy. These stocks tend to be steady performers that won’t keep you up at night worrying.

Consumer staples represent another reliable food group for your portfolio. People still need toothpaste, groceries, and household products during tough times. Companies like those featured in 5starsstocks.com dividend stocks often include these everyday heroes that quietly pay dividends year after year.

Healthcare stocks add growth potential to your mix. As populations age and medical technology advances, these companies often combine steady dividend payments with long-term growth prospects. It’s like getting both stability and excitement in one package.

Financials round out your diversification strategy, though they require a bit more attention. Banks and insurance companies can offer attractive dividends, but their fortunes tend to rise and fall with the broader economy.

The key is balancing risk and reward in a way that feels right for you. Maybe you’re comfortable with some higher-yielding stocks that carry more risk, balanced by rock-solid dividend growers that might pay less now but increase their payments over time.

Before you start picking individual stocks, take a moment to set clear income goals. Are you looking to supplement your current income, or are you building a foundation for retirement that’s still decades away? Your timeline and needs will guide which types of dividend stocks deserve the biggest slice of your portfolio pie.

Long-Term Wealth Accumulation and Reinvestment

Here’s where dividend investing gets really exciting – the power of Dividend Reinvestment Plans (DRIPs). Instead of taking your dividend payments as cash, you automatically use them to buy more shares of the same company. It might not sound glamorous, but this simple strategy can transform modest investments into substantial wealth over time.

Think of reinvestment like planting seeds. Each dividend payment buys you more shares, which then generate their own dividends, which buy even more shares. This creates what we call the power of compounding – your money starts working harder because it’s not just your original investment earning returns, but all the dividends you’ve reinvested along the way.

DRIPs also give you the benefit of dollar-cost averaging without even trying. When stock prices are low, your dividend buys more shares. When prices are high, it buys fewer. Over time, this smooths out the bumps and reduces the impact of market volatility on your portfolio.

For retirement planning, dividend stocks offer something special that growth stocks don’t – they train you to think about income generation rather than just hoping for price appreciation. A portfolio of quality dividend-paying companies can eventually provide the steady income stream you’ll need when you’re no longer working.

The ultimate goal for many investors is creating true passive income generation. Imagine reaching a point where your dividend payments cover your monthly expenses, giving you financial freedom to pursue what really matters to you. While it takes time and patience, combining the research capabilities of platforms like 5starsstocks.com dividend stocks with a disciplined reinvestment strategy can help you get there.

Building wealth through dividends isn’t about getting rich quick – it’s about getting rich slowly and surely, one dividend payment at a time.

Potential Benefits and Risks of Dividend Investing

Like any investment strategy, investing in 5starsstocks.com dividend stocks comes with its own set of potential benefits and risks. Think of it as a coin with two sides – both equally important to understand before you make your move.

The Upside: Stability and Income

There’s something deeply satisfying about receiving regular dividend payments. It’s like having a part-time job that pays you without requiring you to show up! The benefits of dividend investing are compelling and well-documented.

Steady income streams are perhaps the biggest draw. Most dividend-paying companies send out checks quarterly, creating a predictable flow of cash into your account. Whether you use this money to pay bills, fund a vacation, or reinvest for growth, that reliability can be incredibly valuable.

Lower volatility is another major advantage. Dividend-paying companies tend to be well-established businesses with proven track records. They’re like the reliable friend who’s always there when you need them. These companies usually experience less dramatic price swings than their growth-focused counterparts, making for smoother sailing during market storms.

The hedge against inflation aspect shouldn’t be overlooked either. While it’s not perfect protection, companies that regularly increase their dividends can help your purchasing power keep pace with rising costs. It’s like having a built-in cost-of-living adjustment.

Predictable returns offer peace of mind that’s hard to find elsewhere in investing. While your stock’s price might bounce around, that dividend payment tends to arrive like clockwork. This predictability makes financial planning much easier.

For long-term wealth accumulation, dividend investing truly shines. When you reinvest those payments, compound growth works its magic. Small, consistent additions can snowball into substantial wealth over decades.

Remember though, stock prices fluctuate, so even stable dividend stocks can see their values rise and fall with market conditions.

The Downside: Potential Pitfalls

Now for the less cheerful side of the story. Even the most carefully selected 5starsstocks.com dividend stocks carry risks that every investor needs to understand.

Market risk affects all stocks, including dividend darlings. During broad market downturns, even companies with stellar dividend histories can see their stock prices tumble. Your dividend payments might continue, but your overall investment value could still take a hit.

Dividend cuts represent every dividend investor’s nightmare scenario. Companies can and do reduce or eliminate their dividend payments when times get tough. It’s like having your part-time job suddenly cut your hours – painful and unexpected. This risk is especially high with companies sporting unsustainably high payout ratios.

High-yield traps are particularly sneaky. When you see a stock offering a dividend yield that seems too good to be true, it often is. These “traps” typically involve companies in financial distress whose stock prices have fallen so much that their dividend yields appear artificially high. The catch? Those dividends are usually unsustainable and likely to be cut.

Interest rate sensitivity can make dividend stocks less attractive during certain economic periods. When bond yields rise, the fixed income from dividends suddenly doesn’t look as appealing compared to safer government bonds. It’s basic competition – investors gravitate toward the better deal.

Tax implications add another layer of complexity. Dividend income is generally taxable, and the rates can vary depending on whether your dividends qualify for special treatment and what tax bracket you’re in. This can eat into your returns more than you might expect.

The importance of independent research cannot be overstated. While platforms like 5starsstocks.com provide valuable insights, they shouldn’t be your only source of information. Cross-referencing recommendations with multiple sources and diving into company financial statements is essential. For authoritative guidance on investing safely, the U.S. Securities and Exchange Commission (SEC) offers invaluable resources for protecting yourself as an investor.

Understanding both the bright and dark sides of dividend investing helps you make smarter decisions and set realistic expectations for your investment journey.

Frequently Asked Questions about 5starsstocks.com

We get a lot of questions about investment platforms, and honestly, it makes sense. When your hard-earned money is on the line, you want to know exactly what you’re getting into. Let’s tackle the most common questions we hear about 5starsstocks.com dividend stocks.

Are 5starsstocks.com stock recommendations reliable?

This is probably the most important question you can ask, and we’re going to give you the straight answer based on our research.

5starsstocks.com claims their AI predictions hit the mark 70% of the time. Sounds pretty impressive, right? But here’s where things get interesting. When independent observers actually tested their recommendations over four months, they found something quite different. Only about one-third (35%) of the picks actually turned a profit.

Even more telling? Test portfolios that followed their recommendations underperformed the S&P 500 by a significant margin during that same period. ScamAdviser gives the platform a trust score of 66 out of 100, which puts it in the “moderate risk” category rather than the green zone.

What does this mean for you? Think of 5starsstocks.com as that friend who’s really enthusiastic about stocks and has some interesting ideas, but you wouldn’t hand them your entire paycheck to invest. Their platform works best for idea generation and initial research, not as your final word on what to buy or sell.

Always cross-reference their suggestions with your own research. Check SEC filings, look at company fundamentals, and verify the information through multiple sources. The platform can point you toward interesting 5starsstocks.com dividend stocks, but the heavy lifting of due diligence is still on you.

Is 5starsstocks.com suitable for beginner investors?

Absolutely, but with some important guardrails in place. The platform shines when it comes to user-friendly design and educational content. If you’re just starting out, their interface won’t overwhelm you with jargon or complicated charts you can’t understand.

The educational resources they provide can help you learn the basics of dividend investing, from understanding payout ratios to recognizing what makes a sustainable dividend. This kind of structured learning is invaluable when you’re building your foundation.

However, and this is crucial, don’t make it your only source of information. Think of 5starsstocks.com as one teacher in your investing education, not the entire curriculum. Supplement what you learn there with established financial education resources and independent analysis.

As a beginner, you’re in a great position to develop good research habits from the start. Use the platform to identify potential opportunities, then dig deeper with your own research before making any investment decisions.

How should I use the platform’s analysis in my strategy?

Here’s how we recommend approaching 5starsstocks.com to get the most value while protecting yourself from potential pitfalls.

Start with idea generation and initial research. The platform’s screening tools and curated lists can introduce you to dividend stocks you might never have finded on your own. Their market analysis can also help you understand current trends and sectors worth exploring.

But that’s just the beginning. Once you’ve identified a promising 5starsstocks.com dividend stock, the real work starts. Cross-reference everything with other reputable sources. Check the company’s actual financial statements, read recent SEC filings, and see what other analysts are saying about the stock.

Risk management should be built into every decision you make. This means diversifying across different sectors and companies, not putting all your eggs in one basket. Consider using stop-loss orders to limit potential losses, especially with more volatile positions.

Make regular portfolio reviews part of your routine. Even the most stable dividend stocks can face changes in their business environment or financial health. Set aside time quarterly or semi-annually to reassess your holdings and make sure they still align with your goals.

The key is treating 5starsstocks.com as a powerful research assistant, not as an investment oracle. Use their tools to streamline your research process, but always remember that the final decision and responsibility rest with you. This balanced approach lets you benefit from their insights while maintaining the critical thinking that successful investing requires.

Conclusion

Building wealth through dividend investing doesn’t have to feel overwhelming. Throughout this guide, we’ve walked through how 5starsstocks.com dividend stocks can become part of your investment toolkit, offering you paths to steady income and long-term financial growth.

The beauty of dividend investing lies in its dual benefits: you get regular cash payments while your investments potentially grow in value over time. When you reinvest those dividends, the compounding effect can transform modest investments into substantial wealth over decades. It’s like planting seeds that not only bear fruit but also plant more seeds automatically.

5starsstocks.com serves as a helpful research companion in this journey. The platform’s AI-driven analysis and stock screening tools can point you toward interesting dividend opportunities you might have missed otherwise. Its user-friendly design makes complex financial concepts more digestible, especially if you’re just starting out.

But here’s the key insight from our research: treat any platform as a starting point, not the final word. While 5starsstocks.com claims impressive accuracy rates, independent testing shows mixed results. This doesn’t make it worthless – it makes it exactly what it should be: one tool among many in your investment research process.

The most successful dividend investors we’ve studied share common traits. They diversify across sectors, they research thoroughly, and they maintain a long-term perspective even when markets get bumpy. They understand that sustainable dividends come from companies with strong fundamentals, not just attractive headlines.

At Carnews4you.com, we believe financial education empowers better decisions. Whether you’re dreaming of early retirement, building passive income streams, or simply growing your wealth steadily, dividend investing offers a time-tested path forward. The key is combining platform insights with your own due diligence and sound risk management.

Your financial future is in your hands. Start small, stay consistent, and let the power of compounding work its magic over time. Every dividend payment is a step closer to your financial goals.

Explore our guides on adventure vehicles and continue building your knowledge across all areas of finance and technology.