5starsstocks.com income stocks: 2025 Expert Guide

Why Income Stocks Matter for Building Wealth

5starsstocks.com income stocks represent a specific category of dividend-paying investments that aim to provide regular cash flow to investors. These stocks come from companies that consistently distribute a portion of their profits to shareholders through quarterly or annual dividend payments.

Quick Answer: What You Need to Know About 5starsstocks.com Income Stocks

- Definition: Stocks selected by 5starsstocks.com that pay regular dividends

- Target Yield Range: Typically 2-6% annual dividend yield

- Key Sectors: Utilities, healthcare, consumer staples, REITs

- Selection Method: AI-powered analysis with five-star rating system

- Main Benefit: Steady passive income with lower volatility than growth stocks

- Caution: Independent testing shows mixed results (35% vs claimed 70% accuracy)

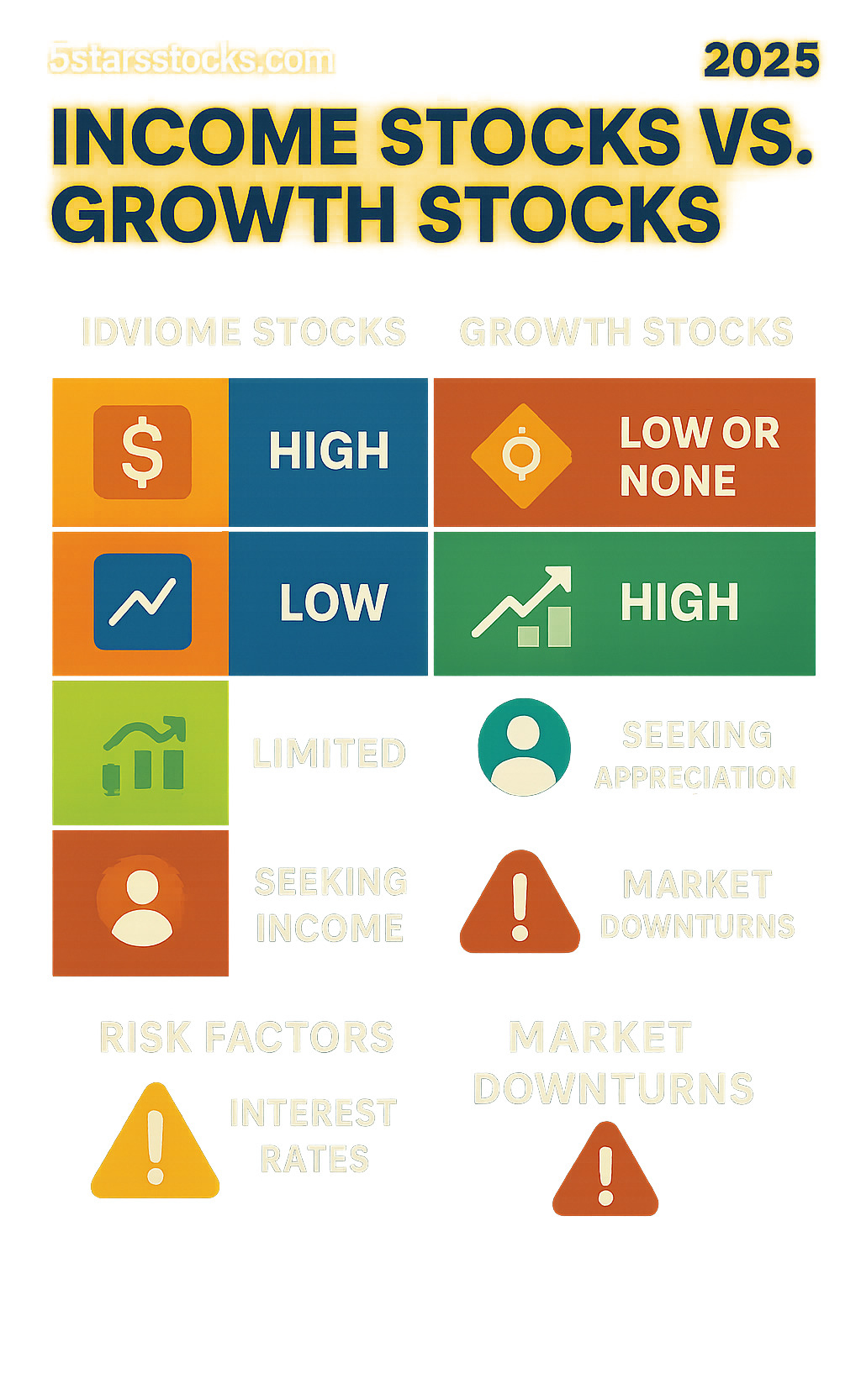

Income stocks differ significantly from growth stocks in their approach to shareholder returns. While growth companies reinvest most profits back into expansion, income-focused companies prioritize returning cash directly to investors. This makes them particularly attractive for retirees, conservative investors, and anyone seeking to supplement their primary income.

The challenge lies in evaluating which income stocks truly deliver on their promises. Not all dividend-paying stocks are created equal – some companies maintain unsustainable payout ratios or operate in declining industries that threaten future payments.

Platforms like 5starsstocks.com have emerged to help investors steer this complexity, using proprietary screening methods to identify promising opportunities. However, as one independent analysis revealed, “test portfolios using 5starsstocks.com recommendations underperformed the S&P 500 by 13.8% during a four-month study.”

This makes it crucial to understand both the potential benefits and limitations of any investment platform before making decisions with your money.

5starsstocks.com income stocks terms to remember:

Understanding the 5starsstocks.com Income Stocks Selection Process

Let’s be honest – picking the right income stocks can feel overwhelming. That’s where platforms like 5starsstocks.com come in, promising to make our lives easier with their AI-powered approach to stock analysis.

5starsstocks.com income stocks are chosen through what the platform calls a sophisticated selection process. Think of it as having a digital assistant that never sleeps, constantly analyzing thousands of companies to find those golden opportunities for steady dividend income.

The platform uses artificial intelligence to scan the market, focusing on companies that don’t just pay dividends today, but are likely to keep paying them tomorrow. Unlike growth stocks that reinvest everything back into expansion, these income-focused companies prioritize putting cash directly in your pocket through regular dividend payments.

What makes this interesting is their five-star rating system. Companies get rated based on multiple factors, and only the cream of the crop earns those coveted five stars. The platform claims a 70% accuracy rate in their predictions, though independent testing has shown mixed results – something we’ll explore more later.

5starsstocks.com doesn’t just stick to boring utility companies (though those are important too). They cover everything from healthcare and consumer staples to emerging sectors like defense, lithium, and cannabis. This broad approach means you’re not limited to traditional “grandpa stocks” when building your income portfolio.

You can dive deeper into their AI-driven insights at 5starsstocks.com AI, or explore specific opportunities in growing sectors like 5starsstocks.com Lithium.

The Platform’s Methodology

So how does this AI magic actually work? The platform’s methodology combines the number-crunching power of computers with the nuanced understanding that comes from looking beyond just the financials.

First up is the in-depth financial statement analysis. We’re talking about the kind of deep dive that would make your accountant proud. The AI examines revenue trends, profit margins, debt levels, and cash flow patterns to build a complete picture of each company’s financial health.

But here’s where it gets interesting – they don’t just look at today’s numbers. The platform puts major emphasis on dividend history screening. A company that’s been paying and increasing dividends for 10+ years? That’s music to an income investor’s ears. It shows management is committed to sharing profits with shareholders, even during tough times.

The real test comes with payout sustainability assessment. This is where the platform tries to answer the million-dollar question: “Can this company actually afford to keep paying these dividends?” They analyze earnings stability, future growth prospects, and competitive positioning to gauge whether those dividend checks will keep coming.

What sets their approach apart is the blend of quantitative and qualitative measures. While computers excel at crunching numbers, human judgment still matters when evaluating management quality, industry trends, and competitive advantages. The platform aims for analysis comparable to professional-level standards, similar to the rigorous analysis expected of certified financial analysts.

However, there’s a catch. The exact algorithms and weightings remain somewhat mysterious – a common trait of proprietary AI systems. This lack of transparency makes it harder to fully evaluate their methodology’s effectiveness.

Key Metrics for 5starsstocks.com Income Stocks

When 5starsstocks.com evaluates potential income stocks, they focus on specific financial metrics that separate the dividend champions from the dividend disasters.

Dividend Yield sits at the heart of their analysis. This tells you how much annual income you’ll receive relative to your investment. The sweet spot? Usually between 2% and 6%. If you see yields above 8%, that’s often a red flag – the stock price may have crashed for good reason, or the dividend might be unsustainable.

The Payout Ratio reveals how much of a company’s earnings go toward dividend payments. Companies paying out less than 60% of their earnings have room to maintain dividends during tough times. When this ratio climbs above 80% or goes negative, it’s time to worry about future payments.

Dividend Growth Rate matters if you want your income to grow over time. The best income stocks don’t just maintain their dividends – they increase them year after year. Companies with 5-10+ years of consistent dividend growth demonstrate both financial strength and shareholder-friendly management.

Traditional valuation metrics like P/E Ratio still matter for income stocks. An extremely high ratio might mean you’re overpaying, while an unusually low one could signal underlying problems that threaten future dividends.

The Debt-to-equity ratio shows how much debt a company carries relative to shareholder equity. Lower debt levels mean less financial stress and more reliable dividend payments. High leverage can force companies to cut dividends when times get tough.

Finally, Free cash flow represents the actual cash available after covering operational needs and capital investments. Strong, consistent free cash flow is the foundation of sustainable dividend payments. Without it, companies might be borrowing money or selling assets just to pay dividends – never a good sign.

For more insights on how these metrics apply to dividend investing strategies, check out 5starsstocks.com Dividend Stocks.

A Framework for Evaluating Any Income Stock

Finding great income stocks is like being a detective – you need to follow the clues carefully to separate the winners from the potential disasters. While platforms like 5starsstocks.com can help point us in the right direction, understanding how to evaluate these investments ourselves is what truly empowers us to build wealth over time.

The beauty of having your own evaluation framework is that you’re never completely dependent on someone else’s judgment. You can double-check recommendations, spot red flags early, and make confident decisions about your financial future.

Assessing Dividend Sustainability and Growth

The dividend is the star of the show when it comes to income investing. But not all dividends are created equal – some are rock-solid, while others might disappear faster than a mirage in the desert.

When evaluating 5starsstocks.com income stocks or any dividend-paying investment, we start by looking at the company’s consistent dividend history. Companies that have paid dividends through thick and thin – recessions, market crashes, industry upheavals – show they’re serious about taking care of their shareholders. We’re talking about businesses that treated their dividend payments like a sacred promise, even when times got tough.

But paying dividends isn’t enough. We want to see dividend growth over time. Companies that regularly increase their payouts demonstrate financial strength and confidence in their future. It’s like getting a raise every year from your investments! Some companies have increased their dividends for 25+ years straight – these “Dividend Kings” are the gold standard of income investing.

The payout ratio tells us whether these dividend payments are sustainable. Think of it as checking whether someone can actually afford the generous tips they’re giving out. A healthy payout ratio below 60% means the company is only using about half its profits for dividends, leaving plenty of room for business reinvestment and unexpected challenges.

Company earnings stability is the foundation everything else rests on. Dividends come from profits, so if earnings bounce around like a ping-pong ball, the dividend is probably at risk. We prefer companies with steady, predictable earnings – they might not be exciting, but they’re reliable.

Here’s where the magic really happens: reinvesting those dividends back into more shares. This turns your income stream into a wealth-building machine through the power of compounding. The power of reinvestment can transform modest dividend payments into substantial portfolio growth over decades.

Evaluating Company Financial Health

A company’s financial health is like checking the foundation before buying a house. Everything might look pretty on the surface, but if the underlying structure is shaky, you’re in for trouble down the road.

Strong balance sheets are non-negotiable for reliable income stocks. We want companies with plenty of cash in the bank and manageable debt levels. Low debt-to-equity ratios signal that the company isn’t drowning in obligations and can weather economic storms without cutting the dividend to stay afloat.

While these aren’t growth stocks, we still need to see some revenue and earnings growth. Companies that are slowly shrinking or completely stagnant often struggle to maintain their dividend payments over time. We’re looking for steady, predictable growth – not fireworks, just consistent progress year after year.

The best income stocks have what Warren Buffett calls an economic “moat” – a competitive advantage that protects their business from rivals. This might be a beloved brand, exclusive technology, or a dominant market position that’s hard to challenge. These moats protect the earnings that fund those precious dividend checks.

Finally, management track record matters enormously. We want leaders who have proven they can allocate capital wisely, make smart strategic decisions, and prioritize shareholders. A management team with a history of disciplined financial practices gives us confidence they’ll protect and grow the dividend over time.

If you’re curious about how these principles apply to the broader universe of quality investments, you might find it helpful to explore 5starsstocks.com Best Stocks to see how income considerations fit into overall stock selection.

[TABLE] comparing Key Features of an Ideal Income Stock vs. Red Flags

Sometimes it helps to see the contrast clearly. Here’s what separates the income stock champions from the pretenders:

| Feature | Ideal Income Stock | Potential Red Flag |

|---|---|---|

| Dividend Yield | Sustainable (2-6%) | Extremely high (>8%) |

| Payout Ratio | Below 60% | Over 80% or negative |

| Dividend History | 5-10+ years of growth | Inconsistent or recent cuts |

| Debt | Low debt-to-equity | High leverage |

| Industry | Stable, mature (e.g., utilities) | Highly cyclical or volatile |

If something looks too good to be true in the income investing world, it usually is. That 12% dividend yield might seem irresistible, but it could signal a company in serious trouble whose stock price has crashed for good reason.

Pros and Cons of Using 5starsstocks.com for Research

When we’re hunting for reliable 5starsstocks.com income stocks, it’s natural to consider specialized platforms that promise to make our lives easier. 5starsstocks.com certainly presents an appealing package with its AI-driven approach and sleek interface. But here’s the thing – every investment tool has its bright spots and its shadows.

Think of it like test-driving a car. It might look great in the showroom, but how does it actually perform on the road? Let’s take an honest look at what 5starsstocks.com brings to the table, and more importantly, what we need to watch out for.

Advantages of the Platform

There’s definitely some appeal to what 5starsstocks.com offers, especially if you’re feeling overwhelmed by the sheer volume of investment options out there.

The platform excels at idea generation – sometimes that’s exactly what we need. When you’re staring at thousands of potential stocks, having someone (or in this case, an AI system) point you toward interesting possibilities can be incredibly valuable. It’s like having a friend who’s done some of the legwork for you.

What really stands out is the user-friendly interface. Let’s be honest – many financial platforms look like they were designed by engineers for other engineers. 5starsstocks.com actually feels approachable, which matters more than you might think. When you can easily steer and understand what you’re looking at, you’re more likely to make thoughtful decisions rather than getting frustrated and clicking randomly.

The platform also shines in its coverage of specialized sectors. While other services might stick to boring blue-chip stocks, 5starsstocks.com ventures into more interesting territory. We’re talking defense stocks, cannabis companies, and emerging markets that many traditional platforms barely touch. This specialized focus can uncover opportunities that might otherwise fly under your radar.

For newcomers to investing, the educational resources are genuinely helpful. The platform doesn’t just throw stock picks at you and wish you luck. Instead, it provides learning materials and clear explanations that help beginners understand why certain stocks might be worth considering. This educational approach builds confidence and knowledge simultaneously.

Potential Risks and Considerations of 5starsstocks.com Income Stocks

Now, here’s where we need to put on our skeptical hats. While 5starsstocks.com has its merits, there are some serious concerns that we simply can’t ignore when our money is on the line.

The biggest red flag is the transparency issue. We’ve looked high and low, but finding concrete information about who actually runs this platform is surprisingly difficult. When you’re trusting someone with investment advice, wouldn’t you want to know their qualifications? The lack of clear information about their team and exact methodologies feels like trying to hire a contractor who won’t tell you their name.

Even more concerning are the performance claims versus reality. The platform boldly claims their AI is 70% accurate, but independent testing tells a very different story. One thorough analysis found that only 35% of their picks were actually profitable. Even worse, test portfolios following their recommendations underperformed the S&P 500 by nearly 14% over a four-month period. That’s not just missing the mark – that’s missing it by a mile.

User feedback varies dramatically, which should give us pause. While some people appreciate the educational content and easy interface, others report significant losses on stocks that were labeled as “strong buys.” This inconsistency suggests that the platform’s success might have more to do with luck than skill.

The marketing language can be pretty aggressive too. Phrases like “making smart investors rich” sound exciting, but they also set unrealistic expectations. Stock prices fluctuate, and no platform can guarantee profits, no matter how sophisticated their AI claims to be.

Finally, there’s the issue of track record. Since 5starsstocks.com only launched in 2023, we simply don’t have enough data to judge how their recommendations perform across different market conditions. Income stocks are supposed to be about stability and long-term reliability – but how can we assess that with such a short history?

The bottom line? 5starsstocks.com might be useful for generating ideas and getting started with research, but treating it as your sole source of investment guidance could be risky. Think of it as one voice in a conversation, not the final word on where to put your money.

Frequently Asked Questions about Income Stock Evaluation

As we steer 5starsstocks.com income stocks and income investing in general, we find ourselves asking the same questions over and over. It’s completely natural – after all, we want to make sure we’re making smart decisions with our money! Let’s tackle some of the most common questions that come up when evaluating income stocks.

How do income stocks fit into a passive investment strategy?

Think of income stocks as the steady, reliable friend in your investment circle. While growth stocks are out there trying to hit home runs, income stocks are consistently getting on base, quarter after quarter.

Income stocks form the backbone of most successful passive investment strategies because they do exactly what we want from a hands-off approach – they work for us while we sleep. These companies send us dividend checks regularly, often every three months, without us having to sell anything or make any trading decisions.

This steady cash flow is perfect for investors who don’t want to constantly monitor their portfolios or worry about timing the market. Whether you’re planning for retirement or just want to supplement your regular income, these stocks provide that predictable stream of money that can help you sleep better at night.

The lower volatility compared to growth stocks means fewer stomach-churning moments when you check your account balance. Plus, those dividend payments can be automatically reinvested to buy more shares, creating a powerful compounding effect over time.

What is considered a good dividend yield?

Here’s where things get interesting – and where many new investors make their first mistake. A good dividend yield typically falls between 2% and 6%, but higher isn’t always better.

We know it’s tempting to chase that stock offering an 8% or 10% yield. It feels like free money, right? But here’s the thing – extremely high yields above 8-10% often signal trouble. The company might be struggling financially, or the stock price has crashed because investors are worried about the business.

Think of it like this: if a deal seems too good to be true, it probably is. Companies offering sustainable dividends usually fall in that sweet spot of 2-6% because they’re balancing returning money to shareholders with reinvesting in their business for future growth.

Always check why a yield is high. Is it because the company consistently pays great dividends, or because the stock price has fallen off a cliff? That makes all the difference between a great investment and a potential disaster.

How important is diversification when investing in income stocks?

Absolutely crucial – and we can’t stress this enough! Putting all your income eggs in one basket is like depending on a single friend to always be there for you. What happens when they’re not available?

Diversification across various sectors – think healthcare, utilities, consumer staples, and REITs – creates a safety net for your income stream. When one industry hits a rough patch, others might be thriving, keeping your overall dividend payments steady.

Let’s say you only invested in energy companies for their high dividends. When oil prices crashed, your entire income stream would be at risk. But if you had also owned utility companies, healthcare stocks, and consumer staple businesses, those other sectors could have kept your dividends flowing while energy recovered.

This approach helps us build a more resilient and reliable income stream that can weather different economic storms. It’s like having multiple income sources in your regular life – if one dries up, you’ve got others to fall back on.

The beauty of diversification is that it doesn’t just protect you from losses; it also helps smooth out the ups and downs, giving you more predictable returns over time.

Conclusion: Making Informed Investment Decisions

As we wrap up our exploration of 5starsstocks.com income stocks and the fascinating world of income investing, it’s clear that this path offers real potential for generating passive income and building lasting wealth. We’ve journeyed through the methodologies that platforms like 5starsstocks.com employ, examined the crucial metrics that separate winners from losers, and built a solid framework for evaluating income stocks on our own terms.

The most important lesson from our journey? While sophisticated tools and AI-powered platforms can provide valuable insights and spark great investment ideas, the buck stops with us. We’re the ones who need to roll up our sleeves, dig into the details, and make sure every investment aligns with our personal financial goals and risk tolerance.

Think of it this way: platforms like 5starsstocks.com are like having a knowledgeable friend who’s done some homework for you. They can point you toward interesting opportunities and simplify complex financial data. But just like you wouldn’t buy a car without taking it for a test drive, you shouldn’t invest based solely on someone else’s recommendation – even if it comes with fancy AI backing.

Our analysis revealed both the promising aspects of 5starsstocks.com – their user-friendly interface, coverage of specialized sectors, and educational resources – alongside some genuine concerns about transparency and performance claims. The gap between their claimed 70% accuracy and the independently verified 35% success rate serves as a powerful reminder that due diligence isn’t optional.

The evaluation framework we’ve outlined gives you the tools to assess any income stock confidently. Remember to look for consistent dividend history, sustainable payout ratios below 60%, and strong company financials. Watch out for those red flags like extremely high yields above 8% or companies with shaky balance sheets.

At Car News 4 You, we believe knowledge is your best investment tool. By understanding how to assess dividend sustainability, evaluate financial health, and spot potential problems before they hurt your portfolio, you’re building skills that will serve you for decades. Whether you’re planning for retirement, looking to supplement your current income, or simply working toward long-term financial security, a thoughtful approach to income investing can be your reliable companion.

The beauty of income stocks lies in their ability to provide that steady stream of cash flow while you sleep, work, or enjoy life. When you combine smart stock selection with the power of dividend reinvestment, you’re using one of the most reliable wealth-building strategies ever finded.

As the SEC wisely reminds us, Investment decisions should be based on your individual circumstances. What works for your neighbor or a financial influencer might not be right for your situation, timeline, or risk tolerance.

Ready to continue building your investment knowledge? We’ve got you covered with comprehensive guides that dive deeper into every aspect of smart investing. Explore our complete resource guides for investors and find the strategies that can help you achieve your financial dreams.

Successful investing isn’t about getting rich quick – it’s about getting rich slowly, steadily, and sustainably. Here’s to your journey toward financial independence!