5starsstocks AI 2025: Risky Verdict

AI’s New Frontier in Stock Investing

5starsstocks ai is an artificial intelligence-powered stock analysis platform that claims to help investors identify profitable stock picks using advanced algorithms and machine learning. The platform uses a five-star rating system to rank stocks based on factors like fundamentals, growth potential, and market sentiment.

Quick Answer for 5starsstocks ai searchers:

- What it is: AI-driven stock analysis platform with proprietary rating system

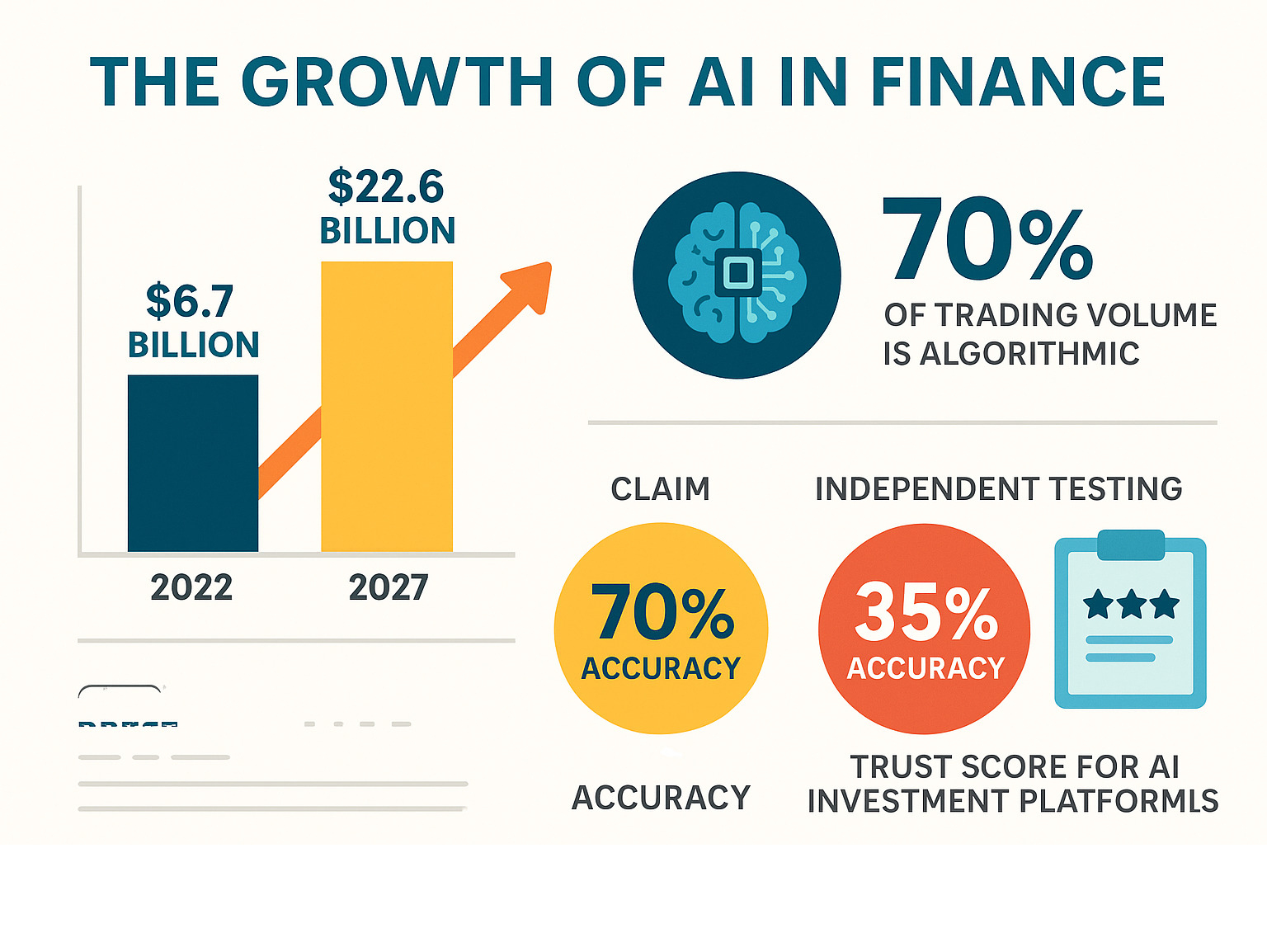

- Claimed accuracy: 70% success rate on stock predictions

- Independent testing: Only 35% of recommendations were actually profitable

- Performance: Test portfolios underperformed S&P 500 by 13.8%

- Trust score: 66/100 from ScamAdviser (moderate risk)

- Best use: Idea generation tool, not primary investment decision maker

- Red flags: Anonymous leadership, no regulatory oversight, unverified claims

The world of stock investing is changing fast. Algorithmic trading now accounts for 70% of U.S. stock market volume, and the AI-powered trading platform market was valued at $15.55 billion in 2021. It’s expected to grow at 12.2% annually through 2030.

But here’s the reality check: while AI can process massive amounts of data quickly, not all AI stock platforms deliver on their promises.

5starsstocks ai represents both the potential and the pitfalls of this new technology. The platform combines machine learning, natural language processing, and big data analytics to analyze everything from earnings calls to social media sentiment.

However, independent analysis tells a different story than the marketing claims. When researchers tested the platform’s recommendations over four months, they found significant gaps between promised and actual performance.

Simple guide to 5starsstocks ai terms:

What is 5StarsStocks AI and How Does It Work?

Picture this: you’re sitting at your computer, overwhelmed by endless financial data, company reports, and market news. Now imagine having a tireless digital assistant that can read through all of that information in seconds and point you toward potentially profitable stocks. That’s the basic idea behind 5starsstocks ai.

This investment platform harnesses artificial intelligence to analyze massive amounts of market data and identify stock opportunities that might be worth your attention. Think of it as having a research team that never takes coffee breaks, constantly scanning the financial landscape for interesting patterns and trends.

The magic happens through three key technologies working together. Machine learning acts as the platform’s brain, continuously learning from historical market data to spot patterns that humans might miss. It’s like having a student who studies every market movement from the past and gets smarter with each lesson.

Natural Language Processing gives the platform the ability to “read” and understand human language. This means it can digest news articles, social media posts, earnings call transcripts, and company reports to gauge how people feel about different stocks. If everyone’s buzzing about a company’s new product launch, the AI picks up on that sentiment.

Big Data analytics ties everything together, processing information from financial statements, social media sentiment, news trends, and even satellite data about weather patterns that might affect agricultural stocks. It’s like having access to every relevant piece of information in the financial world, all organized and analyzed in real-time.

The Core Features and Functionalities

When you actually use 5starsstocks ai, you’ll find several tools designed to make stock research less intimidating and more actionable.

The AI-powered analytics come through customizable watchlists where you can track your favorite stocks and sectors. Instead of jumping between multiple websites, everything you need sits in one dashboard that you can personalize to match your investing style.

Real-time alerts keep you informed without overwhelming you. Whether it’s a price target being hit, an earnings report dropping, or major news affecting your stocks, you’ll get notifications custom to what matters to your portfolio. No more missing important developments because you were away from your computer.

The portfolio tracking feature helps you monitor how your investments are performing, while advanced charting tools let you dive deeper into technical analysis if that’s your thing. You can examine trends, spot potential entry points, and understand price movements through various indicators.

What’s particularly helpful for newcomers are the educational resources built into the platform. These materials help you understand not just what the AI is recommending, but why those recommendations make sense. There’s also coverage of ETF market insights for those interested in diversified investment options.

Decoding the Five-Star Rating System

The heart of 5starsstocks ai is its proprietary algorithm that assigns star ratings to stocks, with five stars being the highest recommendation. This isn’t just a random number generator – there’s a specific methodology behind each rating.

The system evaluates stocks based on fundamentals, diving deep into company financial statements to assess revenue, earnings, and overall financial health. A company with strong, consistent earnings and solid balance sheets scores better than one struggling with debt or declining revenues.

Growth potential looks forward rather than backward, analyzing market positioning, industry trends, and expansion opportunities. A tech company launching innovative products in a growing market might score higher than a traditional manufacturer in a declining industry.

Valuation determines whether a stock is fairly priced, overvalued, or potentially undervalued compared to similar companies. Even a great company might get a lower rating if its stock price has run up too far ahead of its actual value.

Market sentiment uses that Natural Language Processing technology to gauge how investors, analysts, and the general public feel about a stock. Positive buzz and optimistic analyst coverage can boost a rating, while negative sentiment might lower it.

Finally, risk assessment evaluates factors like stock price volatility, company debt levels, and potential regulatory challenges. A stable utility company typically carries less risk than a volatile cryptocurrency stock, and the ratings reflect this difference.

By combining these five criteria, the platform aims to give you a quick snapshot of each stock’s potential. While the exact weighting of each factor remains proprietary, the goal is to provide transparency in how recommendations are generated – what they call a “glass engine” approach to AI insights.

Performance vs. Reality: Analyzing the Claims of 5starsstocks ai

Let’s talk about what really matters when you’re putting your hard-earned money on the line: does 5starsstocks ai actually deliver on its promises?

The platform makes some pretty impressive claims. They boast a 70% accuracy rate for their AI predictions, with some promotional materials pushing that number even higher – claiming 73% accuracy on top-rated signals over 12 months, or 78% success on swing trades. They suggest users can expect annual returns between 15% to 30%.

Those numbers would make any investor’s heart skip a beat. But here’s where things get interesting – and not in a good way.

Independent analysis tells a completely different story. When researchers actually tested the platform’s recommendations over four months, they finded that only 35% of the picks were profitable. That’s not just disappointing – it’s less than half of what was promised.

The reality gets even more sobering when you look at actual portfolio performance. A test portfolio following 5starsstocks ai‘s top recommendations lost 5.6% during a period when the S&P 500 index gained 8.2%. That means the platform’s AI-powered picks underperformed the market by a whopping 13.8%.

Now, to be fair, performance isn’t uniform across all sectors. The platform has shown some bright spots in defense stocks, with recommendations averaging around 18% gains in recent periods. Their picks in lithium and EV stocks have also performed reasonably well, averaging about 12% returns as demand for electric vehicles continues to surge.

But then there are the misses. Cannabis stocks recommended by the platform have been particularly brutal, with some users reporting losses exceeding 30%. This highlights a key issue: even sophisticated AI can struggle with highly volatile sectors affected by regulatory uncertainty and market oversupply.

User Reviews and Independent Audits

When you dig into what actual users are saying about 5starsstocks ai, the picture becomes even murkier. ScamAdviser, a well-respected platform that evaluates online services, gives the platform a trust score of 66/100. That’s not terrible, but it’s certainly not a ringing endorsement either.

The user feedback is, predictably, all over the map. Some folks share positive testimonials, claiming they’ve made profitable trades or avoided significant losses thanks to the platform’s insights. These success stories often appear prominently on the website and in marketing materials.

But dig a little deeper, and you’ll find users who’ve had very different experiences. Some report difficulties with the refund process, describing it as time-consuming and requiring multiple emails or even dispute filings to get their money back.

Here’s what’s really concerning though: there’s a notable lack of verifiable audits for the platform’s performance claims. Unlike established financial analysis services that often publish independently audited track records, 5starsstocks ai‘s impressive accuracy rates and return percentages appear to be largely self-reported.

This creates what experts call the “black box” problem. We can see the output – the stock recommendations – but we can’t independently verify how accurate or reliable the underlying AI system truly is. While research from Investopedia suggests AI-driven platforms have improved trade execution efficiency by up to 30%, that doesn’t automatically translate to profitable stock picks.

The bottom line? Understanding earnings reports and doing your own research remains crucial, regardless of what any AI platform tells you.

Is 5starsstocks ai a Legitimate Tool for Investors?

This is the question that keeps coming up, and honestly, the answer isn’t black and white. 5starsstocks ai probably isn’t an outright scam in the traditional sense, but it operates in what we’d call a significant “gray area” that should make any serious investor think twice.

The biggest red flag? Anonymous leadership. The website doesn’t reveal who owns it, who runs it, or who developed the AI system. In the financial world, trust is built on accountability. When you can’t verify the credentials or track record of the people behind a platform, you’re essentially flying blind.

Then there’s the regulatory oversight issue – or rather, the complete lack of it. 5starsstocks ai isn’t a registered financial advisory service or brokerage firm. Real financial advisors and brokerage firms are regulated by authorities like the SEC or FINRA. This platform operates outside that protective framework entirely.

The performance gap we discussed earlier is another major concern. When there’s such a significant difference between claimed accuracy and independently tested results, it raises serious questions about the reliability of all their marketing claims.

Some users also report aggressive marketing tactics, including persistent emails and high-pressure sales pitches to upgrade to premium tiers. This kind of approach often prioritizes getting people to sign up over actually helping them succeed.

Finally, there’s the “black box” AI problem we mentioned. While the platform claims to use sophisticated artificial intelligence, there are no technical details or independent audits available to verify how effective – or biased – their system actually is.

5starsstocks ai might have some useful features for generating investment ideas, but the combination of anonymity, lack of regulation, unverified claims, and disappointing independent test results suggests it’s a platform that requires extreme caution. Your money deserves better transparency than what’s currently on offer.

Weighing the Pros and Cons

Let’s be honest – 5starsstocks ai isn’t all doom and gloom, but it’s not the golden ticket to wealth either. After diving deep into user experiences and independent testing, we’ve found a platform that sits firmly in the “proceed with caution” category. Think of it like a fancy sports car with a beautiful exterior but some serious engine problems under the hood.

| Advantages | Disadvantages |

|---|---|

| User-friendly interface perfect for beginners | Performance discrepancy between claims and reality |

| Excellent idea generation for stock research | Lack of transparency in methodology and leadership |

| Comprehensive niche sector coverage | Anonymous team with no verifiable credentials |

| Real-time data access and market insights | No regulatory oversight from SEC or FINRA |

| Educational resources for learning | Potential for algorithmic bias in recommendations |

| General economy insights and market health tracking | Data security questions and privacy concerns |

Main Advantages

The platform genuinely shines in several areas that make it appealing, especially for newcomers to the investing world. The user-friendly interface feels intuitive – you won’t need a computer science degree to steer the dashboard or understand the basic features. For beginners who feel overwhelmed by traditional financial platforms, this accessibility is genuinely valuable.

What 5starsstocks ai does particularly well is idea generation. Rather than relying on it for final investment decisions, many successful users treat it as a starting point for their research. The platform excels at surfacing stocks you might not have considered, especially in niche sector coverage like lithium mining, defense contractors, or emerging biotech companies.

The real-time data access keeps you connected to market movements without constantly refreshing multiple websites. Combined with their general economy insights, you get a decent overview of broader market conditions that can inform your investment timing.

Disadvantages and Red Flags

However, the disadvantages are more concerning than mere inconveniences – they’re fundamental trust issues. The most glaring problem is the performance discrepancy we discussed earlier. When independent testing shows only 35% profitability versus claimed 70% accuracy, that’s not a small gap – it’s a credibility chasm.

The lack of transparency extends beyond just performance metrics. The anonymous team behind the platform raises serious questions about accountability. In the financial world, reputation and track records matter enormously. When you can’t verify who’s making the recommendations or their qualifications, you’re essentially flying blind.

Perhaps most troubling is the no regulatory oversight situation. Unlike legitimate financial advisors who must register with the SEC or brokers regulated by FINRA, 5starsstocks ai operates in an unregulated space. This means no official body is watching out for your interests or ensuring fair practices.

The potential for algorithmic bias is another technical concern. Without transparency into how their AI makes decisions, we can’t know if it has built-in biases toward certain sectors, company sizes, or market conditions. Finally, data security questions linger around how they protect your personal and financial information, especially given the anonymous leadership structure.

The bottom line? 5starsstocks ai might serve as a useful research starting point, but treating it as your primary investment guide could be a costly mistake.